Note from Towards Data Science’s editors:_ While we allow independent authors to publish articles in accordance with our rules and guidelines, we do not endorse each author’s contribution. You should not rely on an author’s works without seeking professional advice. See our Reader Terms for details._

Why the jump?

Discontinuous functions are a common occurrence in financial instruments. For instance, the graph below shows the price of a typical five-year fixed rate bond with a semi-annual coupon. We have set the coupon rate higher than the discount rate, so the value of the bond stays above its Par Value of $100. If you are not familiar with bond pricing, a good primer is available here.

(Image by Author)

The important things to notice for our purposes are the jumps that occur at each coupon payment date. This happens simply because money cannot be made out of thin air. The “wealth” of the security owner remains the same immediately before and after the coupon. As such, we have:

value before coupon = value after coupon + coupon cash.

Similar jumps occur in the values of more complicated path-dependent financial derivatives on exercise dates. A classic example here is a Bermudan swaption, a popular instrument used to manage mortgage prepayment risk. Bermudan-style options can be exercised on a predetermined schedule of dates where the value may jump.

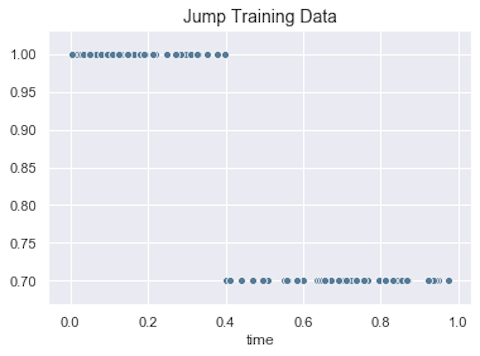

(Image by Author)

To keep things concrete, we will focus on the sub-problem of learning a piece-wise constant function with a single downward jump. We generate the training data as shown in the graph above. The reader is invited to follow along with our code in this Jupyter notebook.

#finance #neural-networks #modeling #deep-learning #mathematics