Why is it necessary to change?

According to 2018 statistics, £4.1 billion was stolen as a result of credit card fraud in the UK last year. 1 out of 5 people has been defrauded via their credit cards in the last year, highlighting the rising levels of credit card cyber risk in the UK.

As more and more people choose to shop online, our money is made increasingly vulnerable to sophisticated cyber criminals.

So to protect people from card frauds it was important to change the way we made payment and how did we do this? Let’s see.

How did we do it?

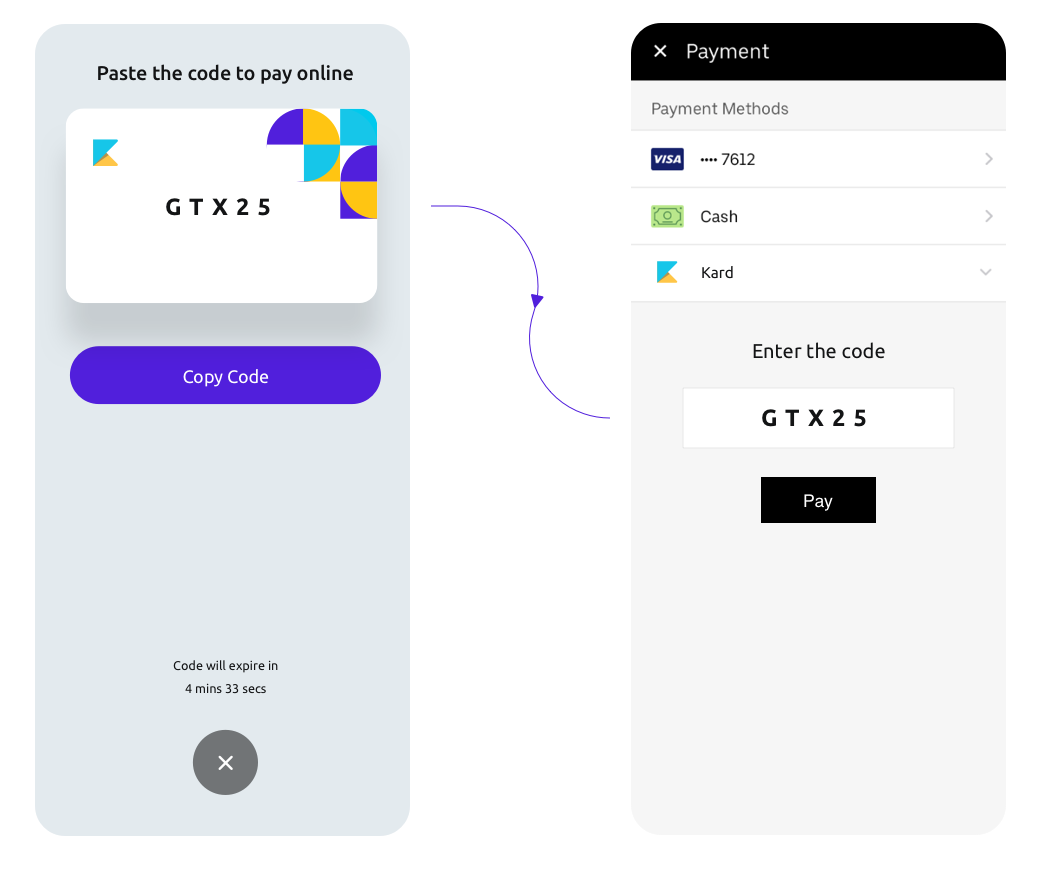

I got on a call with the client and his team to find a solution to this, we were discussing how cybercriminals use credit/debit card details to make payments from someone else account and we figured that — If the cybercriminals don’t have credit card details they won’t be able to conduct these frauds.

So to protect ourselves from cybercriminals we won’t share our card details while shopping online, we would instead select a card on the app and generate a 5 digit code on the app which has to be entered on the payment gateway online which is then verified at the merchant side.

Scope of work

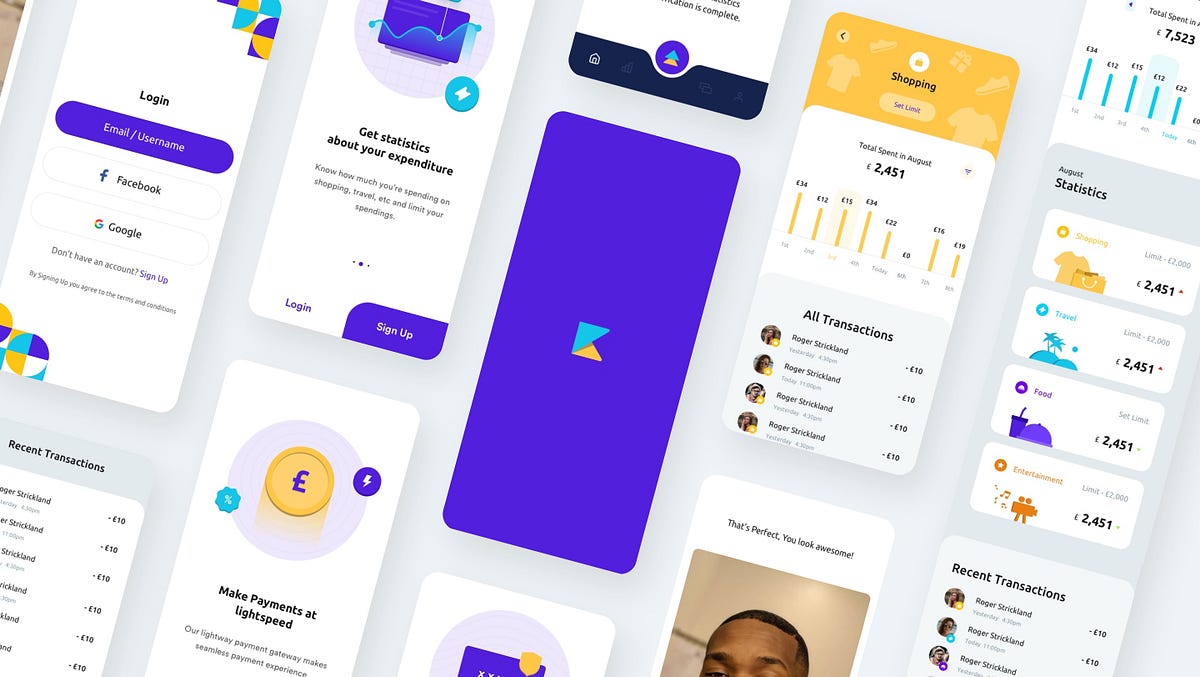

I designed the Product, Illustrations, Interactions, Iconography, and combined with the guidance of my client and his team I was able to find a sweet spot where business and customer goals meet and were able to deliver a robust digital product.

UX Design — Brainstorming with the client and his team to find a solution. Talking to customers about their online shopping experience. I then made the user flows to analyze the journey to make it more secure and faster.

UI Design — Designing for trust, safety, and guarantee. From branding and illustrations, I designed the app keeping in mind our target customers — millennials.

#startup #product-design #fintech #case-study #ui