What is Jarvis Network (JRT) | What is Jarvis Network token | What is JRT token

Decentralized finance?

Decentralized finance (or DeFi) is a financial system whose infrastructure is based on a Blockchain, and is therefore open, transparent, and fully programmable.

- As such, it allows recreating existing financial services and products ( insurance, trading, derivatives, loans, rental properties, etc.) on a Blockchain;

- but it also allows to innovate with products previously synonymous with science fiction ( lotteries or donations without loss of money, assets that self-generate interest, etc.);

- these products inherit Blockchain features and are therefore auditable, and can be automated and become entirely autonomous;

- eventually, it gives everyone access to all these investment products and solutions that were prior reserved for institutional investors ( liquidity provision, hedge funding, etc.).

The Jarvis Network

Visit https://jarvis.network

Jarvis network is a set of protocols on Ethereum for universalizing and uberizing finance and more particularly — financial products and markets. It is owned by a DAO.

Jarvis “Blockchainizes” traditional financial markets to make them open, transparent, interoperable and programmable, and eventually disintermediate them.

These protocols allow users to gain exposure to the prices of any financial instrument via margin trading and/or synthetic assets (for convenience, we will say that users trade, invest, open positions in these instruments) and/or provide the liquidity required for these protocols to run smoothly.

Margin Protocol

A trust-minimized off-chain trading protocol

This protocol allows users to open leveraged positions on different markets such as Forex, indices, stocks or cryptocurrencies, collateralized by Dai.

**They trade against liquidity pools supplied by liquidity providers **(LP) who set their rules (spread, commissions, leverage, supported markets, price source, etc.), effectively uberizing brokerage. LPs can run “No Dealing Desk” or “Dealing Desk” node to hedge their exposure or run a sophisticated market making strategy with their brokers, exchanges or other institutional partners.

Synthetic protocol (Synthereum)

An on-chain trading protocol

Leveraging from the UMA platform, this protocol allows users to create tokens that track the price of any traditional or digital asset. They can be converted directly with the smart contract, without a counterparty, spread, or slippage: instead of an exchange taking place between a buyer and a seller, the user burns a token (1 synthetic EUR) and atomically mint another one of the same value (0.8 synthetic GBP).

They deposit their collateral in liquidity pools supplied by LPs who are responsible for ensuring the over-collateralisation of the assets minted. This obligation poses a financial risk to LPs that they can hedge via the Margin protocol.

Jarvis Reward Token (JRT)

The JRT is a utility token for securing and governing the protocols, respectively through **staking **and through a DAO, and aims at rewarding the agents who would bring value to the ecosystem.

- the DAO vote on multiple settings and on propositions to improve the network

- the DAO manage a 100M Reward Funds to distribute JRT across various reward program, to incentivize those who bring value to the ecosystem;

- the DAO collect all the fees and decide how to best allocate them to serve the interest of the network and the JRT holders;

- JRT is staked by validators and relayers to align their interests with those of the protocols.

The Apps

dApps integrating one of the protocols have the possibility to add a fee to generate revenue, in which case part of it will be used to automatically buy back JRTs from the markets and burn them.

Even though anyone can develop an application on the top of the protocols, we have opened different companies in different jurisdictions to be the first to do so and to provide seamless decentralized applications (dApps) to end-users to interact with the protocols: Jarvis market and Jarvis wallet.

Jarvis market

Jarvis market allows interacting with the Margin and Synthetic protocols. It is a trading platform for active investors which provides spot and margin trading.

The Spot trading mode aggregates liquidity across several Cex and Dex to allow users to trade any ERC20 tokens (and therefore synthetic assets) at the best prices.

Eventually, the platform will offer social features by integrating 3box and Set Protocol for example.

Jarvis market uses Jarvis trader, a standalone proprietary trading platform that allows traders to connect to several traditional exchanges and brokers.

Jarvis wallet

Built on Gnosis Safe and Unilogin, Jarvis wallet is a smart contract wallet closer to Revolut than to Trust wallet: no private key, no cryptic address, no gas and … no “crypto”. Leveraging from the Synthetic protocol, the base currency of the wallet is not Ether or Dai, but synthetic Euros, Swiss francs or any of the 30 synthetic fiat currencies that the protocol will support.

Thanks to open banking and our partner Ramp.network, Jarvis users can seamlessly connect their bank and instantly buy Dai which will automatically be converted into jEUR, jCHF or jGBP, free of charge and without KYC.

Users then access a dashboard presenting several natively integrated financial services: savings and credit account (Compound, Aave etc.), portfolio management (stocks, cryptos, metals, etc.), real estate (realT, etc.) insurance, lottery, art, games etc. Savvy users will be able to use their wallet to connect to decentralized applications effectively accessing more services, thanks to Unilogin or WalletConnect.

Token distribution

This article will help you understand how the $JRT token supply will evolve in the next 10 years. We will start with the DAO and team token distribution before diving into the token sales one.

DAO treasury

The DAO was seeded with 100M $JRT. Around 9M $JRT have been distributed through two incentives programs in 2020.

The 91M $JRT remaining would need to be distributed through incentives programs, trading competitions and grants for the next 10 years (the DAO will receive 10M $JRT per year).

The DAO will also have to manage a smart Balancer pool with JRT-USDC.

Team distribution

The Jarvis LTD company received 40M $JRT. A maximum of 3M $JRT will be shared every year for at least the next 10 years among the team members. 10M $JRT have been allocated to liquidity provision on Uniswap, Sushiswap, Balancer, Bitmax and Switcheo.

The participants to these first sales have quite unique features:

- unlike most of the ICOs, Jarvis’ happened among a french community of non-crypto people, mostly Forex traders, moved by the exciting idea of a Finance 3.0;

- some of them do not even have wallets yet, they just follow the project, waiting for the DAO to be launched;

- only a handful withdraw their initial investment, but most of them did not sell their JRT during the summer craze.

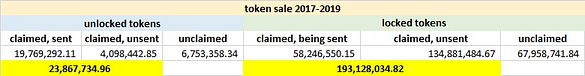

420 participants bought 291,707,869.96 $JRT

- 30,621,093.30 tokens were unlocked and claimable from December 2019

- 261,086,776.66 tokens are locked and will be gradually claimable for the next two years starting from January 2021

Token unlocked distribution

- 19.76M $JRT have been claimed by 197 participants (46.9%) and sent to them;

- 4.09M $JRT have been claimed by 39 participants (9.3%) who decided not to receive them; they expressed their will to wait for the launch of the DAO and to stake them there directly;

- 6.75M $JRT remain unclaimed by 184 participants (43.8%).

Token locked distribution:

Locked tokens were supposed to be locked within the DAO, and unlocked gradually every second for 2 years; since the DAO is not launched yet, we asked our community whether they would like to start receiving them every week until the DAO is launched, and then lock the leftovers within the latter, or to simply wait for the DAO launch; a large number of beneficiaries requested to lock their bonus tokens directly in the DAO.

- 58.24M $JRT have been claimed by 104 participants, who are now receiving 1/104e of that amount every week until the launch of the DAO; this amounts for 560k $JRT per week.

- 134M $JRT have been claimed by 74 participants, who requested to wait for the launch of the DAO to lock them directly in there;

- 67M $JRT remain unclaimed by 242 participants; if the tokens are not claimed by end of March 2021, they will either be burned or added to the DAO treasury.

Numbers show that 58 participants who claimed and received their unlocked tokens did not claim their unlocked token yet.

Distribution breakdown of the 2020 token sale

112 participants bought 98,452,086.58 $JRT

- 31,683,717.68 $JRT were unlocked after 90 days;

- 66,768,668.90 $JRT were unlocked after 180 days.

90 days locked tokens distribution

- 27.58M $JRT have been claimed by 85 participants, and were sent to them;

- 2.47M $JRT have been claimed by 14 participants, but they expressed their will to wait for the launch of the DAO to receive them, in order to stake them directly;

- 1.64M $JRT remain unclaimed by 7 participants.

180 days locked tokens distribution

- 17.31M $JRT have been claimed by 46 participants, and were sent to them;

- 45.93M $JRT have been claimed by 46 participants, but they expressed their will to wait for the launch of the DAO;

- 3.54M $JRT remain unclaimed by 20 participants.

Our first article about the token distribution had a pretty violent reaction ($JRT price went from 30c down to below 10c), as many recent buyers were afraid that investors will “dump on them” immediately after the release of the tokens. However, these numbers show that the large majority of $JRT holders are patient and have long-term commitment who asked to postpone the release; on-chain data shows that the vast majority of the ones who received their tokens did not sell them, and the number of holders has been growing.

Locked token within the DAO

Around 193M locked $JRT in the DAO will be gradually unlocked every second, until January 2023. Unlocked tokens can be claimed by the investors at any time, adding them into the circulation supply. The DAO will of course be able to prolong this period.

Participating in the governance will require staking $JRT within the DAO, and lock them for 1 to 3 months depending on the voting power the participants want to acquire. Participants will be able to vote with their unlocked and unclaimed $JRT, as well as with their JRT-ETH LP token (Uniswap, Sushiswap, Bancor, Balancer, etc.).

Looking for more information…

☞ Website ☞ Explorer ☞ Explorer 2 ☞ Whitepaper ☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Message Board ☞ Coinmarketcap

Would you like to earn JRT right now! ☞ [CLICK HERE](https://www.binance.com/en/register?ref=28551372 “CLICK HERE”)

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ Binance ☞ Bittrex ☞ Poloniex ☞ Bitfinex ☞ Huobi ☞ MXC

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#bitcoin #crypto #jarvis network #jrt