“ As humans, we are attracted to the colorful leaves and sometimes pay little attention to the roots, the stem, and the branches that are essential to the tree’s life. This is comparable to doing a financial model where a novice Quant rushes to the modeling process without spending sufficient time exploring the intricate details of the data”.

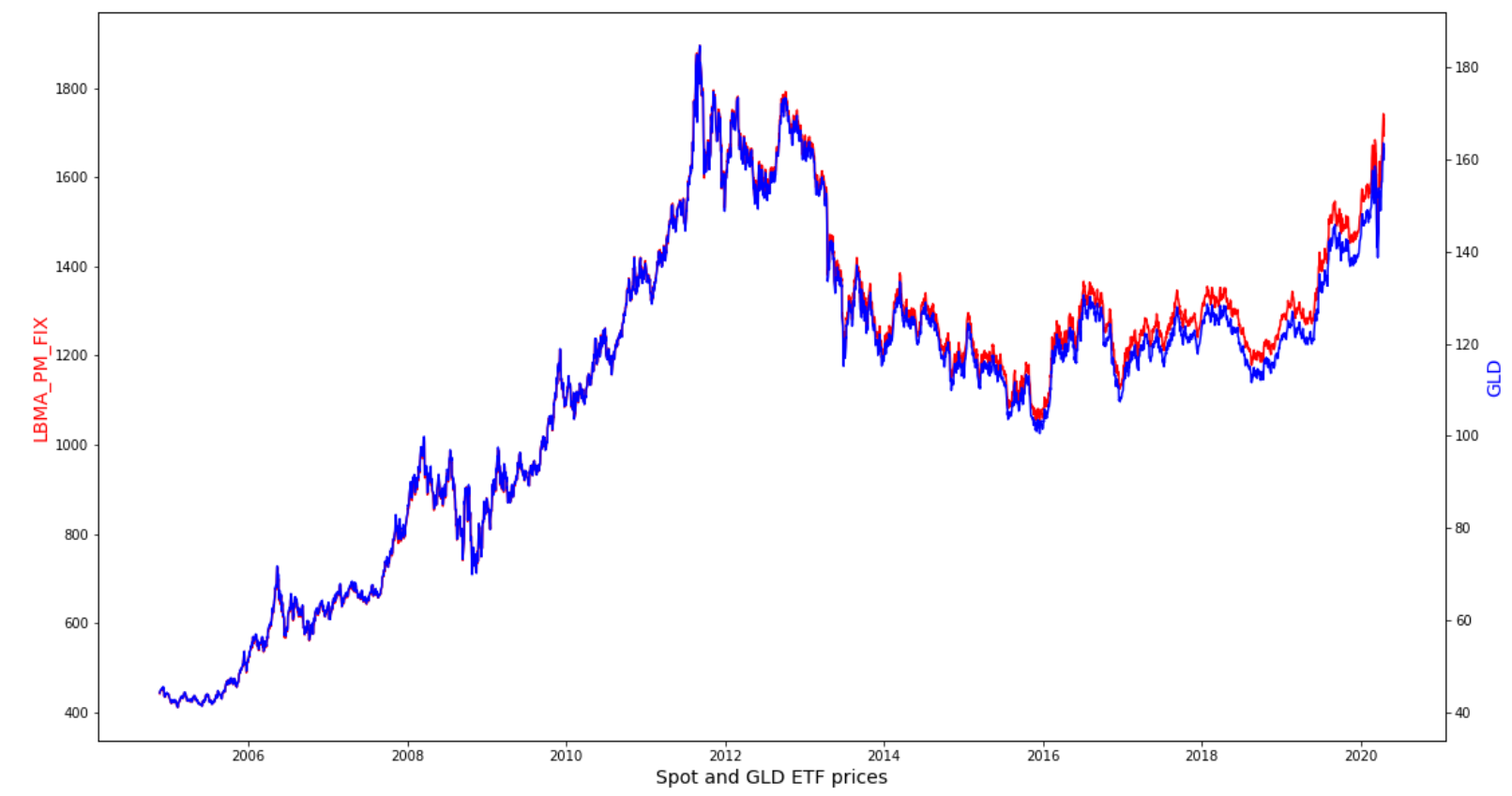

LBMA PM Fix & GLD ETF from Notebook

In this article, I will share my personal experience in doing a research project for Global Precious Metals. My firm is a niche player in the precious metals market, offering global end-to-end service from sales and trading to storing and delivering precious metals to prospective clients. Their goal was to ‘bring some quantitative practice to old school physical work’. I was to take part in this revolution and help the firm realize a systematic way to allocate money to gold. The firm might not be familiar with deriving the mathematical cost function of a regression model, but they know the mechanics of the gold industry. I was always astonished by the heavy flow of information and findings revolving this polarized asset, which kindled my exploration from the very first day.I told myself “forget about modeling, it’s time to learn about gold”.There is a plethora of benefits and caveats of using gold ETF as an alternative to gold spot prices for modeling. I will also allude to the notion of fund tracking errors and underlying factors that caused it. Tracking error exists in every fund that tracks a benchmark. Because it exists, one has to question whether or not the gold ETF would represent the genuine value of gold. It introduces caution to not only gold modelers but also investors. This article will not go through the deep mechanism of tracking errors, but it will guide you through my resolve to it.The article will address the following considerations before developing a model for gold:

- Common gold assets to based our model on and why ETFs are a feasible choice_Calculating/Visualizing tracking errors for different gold ETFs_Verifying factors that affect the tracking error of gold ETFsChoosing a gold ETF based on tracking error

A Little Detail on Gold Choices

So we want to create an investment model for gold. The first question is which gold asset do we model with. Some of the asset choices are:

- Physical gold: The London Bullion OTC market (LBMA) offers investors gold as a tangible asset. Holding gold this way can sustain long term wealth without any counter party risks. Even though LBMA is based in London, the market can be traded from across the globe. The LBMA website holds some useful information on setting prices and trading terms.Exchange futures contracts: Futures contract traders are composed of mainly hedgers and speculators. Hedgers would buy/sell the present contract price of gold they wish to hold (to be delivered in future) and hedge the risk of the price rising/falling before the expiry date. Speculators conduct trades in order to profit from their speculation of price movement, as their goal is not to hold physical gold itself.Gold Tracking Exchange Traded Fund (ETF): These type of ETFs track the returns of spot gold prices by holding physical gold and futures contracts. Investors would invest in the shares of the ETF. Futures speculators and ETF investors are similar because they trade gold without holding gold. There are other gold ETFs that does not gain exposure to the commodity directly, instead investing in companies that specializes in gold.

So which Gold to model?

Assume your objective is to invest and actually store the gold. Allocation to gold will be re-balanced weekly. We decided to use an ML model to predict the direction of one week returns using daily observations.

Using futures prices are out of the question because we are not hedging nor speculating on the futures price. We can base the model on the LBMA spot price, but this method conveys some issues when constructing our feature set.

#linear-regression #gold #error-tracking #data analysis