What is fyeth.finance (YETH) | What is YETH token

About

FYETH FINANCE is a wholly owned subsidiary of the global fintech group Investment Evolution, one of the licensed non-bank financial institutions in the United States - and operates in European countries. Platform that will allow users to borrow money in US dollars based on crypto assets. The three cryptocurrencies as collateral are BTC, ETH and yETH. The platform will operate 24/7 worldwide, Loans are available as soon as collateral is offered loan transactions and loan repayment will be paid through Blockchain. We that allows user to define their loan terms including an (LTV) ratio of 30 to 90%.Their balance sheet we “stronger than ever” and that its margins have expanded, hence it will increase deposit rates than traditional banks. We want to bring our traditional customers into the digital currency space, while targeting crypto holders in more than 200 countries and territories, who can borrow in difference multiple fiat currencies based on their digital assets. Now, with our loan products, Individual and institutional investors can transact like the big boys without selling the cryptocurrencies they have hoarded or leaving their wallets. They see us as a lever to maximize profits in cryptocurrency market transactions. We will become a global brand in digital currency loans and loans.

Why Choose yETH?

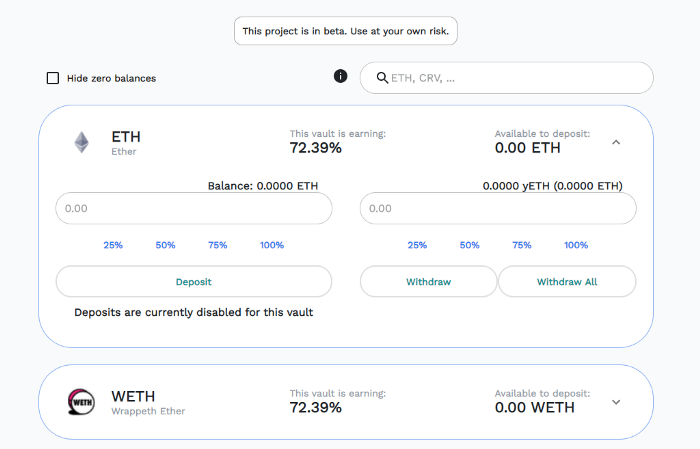

yETH vault are powerful financial primitives. yETH are tokens that constantly increase in value from earning interest, while tokens that represent short are leveraged positions. These yETH Tokens composed into novel financial products, used as collateral for loans, or listed on any exchanges to instantly enable margin lending and trading.

yETH vault is powerful financial primitives. yETH is tokens that constantly increase in value from earning interest, while tokens that represent short are leveraged positions. These yETH Tokens composed of novel financial products, used as collateral for loans, or listed on any exchanges to instantly enable margin lending and trading.

Quick primer on how the vaults work, as there seems to be quite a bit of misinformation currently going around.

Where does the yield come from;

- Lending, assets are lent out via lenders such as Aave, Compound, and dYdX

- Trading, assets provided to Uniswap, Balancer, and Curve earn trading fees.

- Liquidity incentives, protocols such as Compound, Balancer, and Curve provide liquidity incentives, they provide additional incentives for liquidity

What risks are associated with this;

- Lending, since it is a lender, assets might not be available all the time, but that’s why lenders use utilization ratio. How this works, the closer the pool is to empty (maximum amount borrowed out) the higher the interest paid for it. This allows new assets to be provided (or borrowed assets to be returned). But the window does exist where provided assets exceed available borrowed assets.

- Smart contract, as always there can be bugs, exploits, and other flaws.

- Lack of trading activity, which means reduced fees

- Liquidity incentive price fluctuations causing unstable APY

yETH vault explained;

- yETH vault provides ETH to Maker to mint DAI.

- DAI is provided to yDAI (the yearn.finance DAI vault).

yDAI vault explained;

- DAI is provided as LP for curve.fi/y

- curve.fi/y LP tokens are locked in the gauge to receive CRV

We have seen a lot of misinformation around the yETH vault and its minted DAI vs available DAI. This is no different than a lender/borrower utilization ratio.

If you supply 100 tokens to a lender, and someone borrows 50 tokens. You can not withdraw your 100 tokens, but you can withdraw 50 tokens. When you withdraw 50 tokens then the borrower pays an additional premium, so other lenders are incentivized to add tokens or the borrower to repay their debt.

This is the base premise for all vaults, and yETH is no exception. There is however one difference, since yETH uses yDAI, the “lender” is in fact curve.fi.

As DAI in the pool becomes low, arbitragers sell DAI for (USDC, USDT, or TUSD). This adds DAI to the pool. So as DAI is removed, this makes it more valuable to trade in DAI. This is the same mechanism as explained for lenders and borrowers utilization ratios.

The only core difference here, is that in a normal vault, there is no debt. With yaLINK and yETH there is debt, this does add additional risk, since you need to have enough available funds to cover debt. This is why we maintain a ~200% ratio, so there is a ~50% buffer in case of lender/liquidity shortages.

Most systems have a maximum borrow buffer. This means a certain amount of liquidity minimum must be available in the system. The general rule is around ~25% (so borrowers can’t borrow more than this). For this reason the yETH vault was capped at ~60m, as this buffer is around ~$16m, which even if y pool halved in capacity, would still be available.

FYETH FINANCE FAQ

Recently, we have been asked some of very popular questions for a multiple times. We would love to make this article, it will be well-explained a number of questions that most people ask.

How to buy the yETH?

Yes, please wait for the public sale rounds.

What is the total supply of the Fyeth finance ?

It has only 9.000.000 yETH

What is the initial circulating supply?

It has only 3.600.000 yETH.

How long is the vesting for the rest allocation?

It takes up to 6 years, the core team is only allocated for 900.000 yETH

When will the presale and public sale go live?

The presale round has ended. We are preparing for the public sale.

What are the allocations for the presale and public sale rounds?

For the presale: 540.000 yETH, for the public sale: 360.000 yETH

How does Fyeeth Finance the public sale rounds?

Round 1: 50,000 — price $3.00

Round 2: 100,000 — price $3.46

Round 3: 200.00 — price $3.96

The minimum is 100$, maximum is 5,000$.

What exchanges our yETH will be listed?

We will not disclose the names all here, but we will be listed in at least 3 Dex, and 3 centralized exchanges in Quarter 2, 2021

When can we sell our eYTH?

All YETH tokens are distributed during the pre-sale will be locked in a trading contract for a period of more than 12 months and during the public sale is 6 months.

Would you like to earn many tokens and cryptocurrencies right now! ☞ CLICK HERE

Looking for more information…

☞ Website

☞ Explorer

☞ Source Code

☞ Social Channel

☞ Message Board

☞ Documentation

☞ Coinmarketcap

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#blockchain #bitcoin #crypto #fyeth.finance #yeth