The Dash cryptocurrency network invented the masternode concept in 2014, and has recently come to an interesting conclusion: that masternodes heavily influence the coin’s market cap — both for better and for worse.

The past six years have seen Dash’s dramatic rise to the number three spot in market cap rankings, followed by its meteoric fall to the 25th spot where it currently resides.

And now, after more than nine months of research, debate, and surveys, the Dash network thinks they know why this happened. And what’s more, they have a plan to do something about it.

A Flattening of the (Expected) Curve

Once the Dash network deployed masternodes into its architecture in 2014, the network began gradually shifting block reward payments away from miners until they reached an even split: half the block reward went to miners, and half went to masternodes.

At some points in these early days, the annual return-on-investment (ROI) of running a masternode was as high as 20%. This understandably attracted many new investors to the Dash ecosystem, and the coin sat comfortably in the top-10 by market cap for nearly four years.

But then in late 2018, something started to change: the expected rate at which new master nodes were being created began to fall (see chart below). For the entire history of the Dash network, the curve of master node creation had always stayed in line with the curve of new coin creation. But now the master node creation rate started to lag behind the overall inflation rate.

Image via Dash Masternode Information

“Circulating” Coins vs. Collateralized Coins

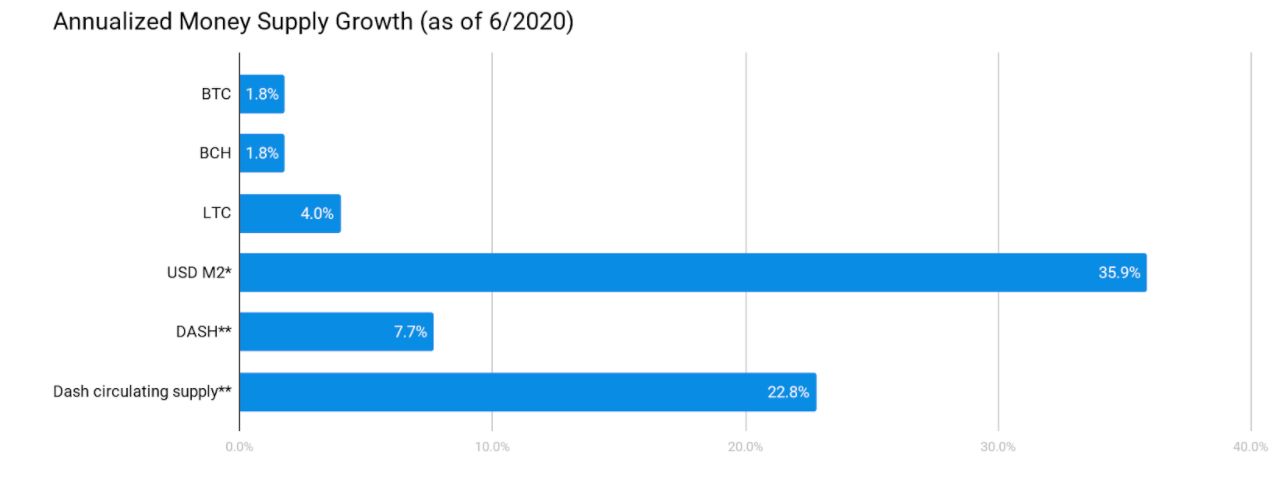

In late 2019, Dash’s continuing fall in market cap rankings led Ryan Taylor, CEO of Dash Core Group, to start digging into potential reasons. He first compared Dash’s annual inflation rate with that of other coins like Bitcoin and Bitcoin Cash (below).

Image via Dash Core Group presentation on Dash Economics

Image via Dash Core Group presentation on Dash Economics

While Dash’s annual inflation of 7.7% is significantly larger than its competitors that hover around 2%, Taylor found something much more compelling: that the slow sell-off of master nodes that started in late 2018 had, over time, dramatically increased the “circulating” supply of Dash (that is, the coins not collateralized in master nodes) to the tune of 22% per annum as of this year.

“It’s really hard for Dash to maintain price parity against assets like Bitcoin and Bitcoin Cash if the circulating supply is growing as fast as it is,” Taylor said during a Dash Economics AMA on YouTube recently. “I think that it behooves the network to take a close look at this and see if we can get closer to parity with some of these other coins, and then allow our [technical & adoption-related] advantages to accrue to the network.”

#dash-network #dash #blockchain #masternodes #staking #staking-rewards #staking-economy #hackernoon-top-story