What is DeFi Yield Protocol (DYP) | What is DYP token

Why is DeFi Yield Protocol Unique? DeFi Yield Protocol: Your New On-The-Go DeFi

DeFi Yield Protocol (DYP) will provide a solution to the risk Yield Farming brought in. How? – The DYP is developing a platform that allows anyone to provide liquidity and to be rewarded for the first time with Ethereum. At the same time, the platform maintains both token price stability as well as secure and simplified DeFi for end users by integrating a DYP anti-manipulation feature.

How will this work?

DeFi Yield protocol (DYP) is changing the way you earn through liquidity on Ethereum smart contract. The argument against DeFi is that whales have the power to control the network. DeFi Yield protocol (DYP) prevents the whale advantage in DeFi. DYP anti-manipulation feature ensures that all pool (DYP/ETH, DYP/USDC, DYP/USDT, and DYP/WBTC POOL) rewards are automatically converted from DYP to ETH at 00:00 UTC, and the system automatically distributes the rewards to the liquidity providers. This feature is excellent because the network’s liquidity will be fair to all participants; no whale will be able to manipulate the price of DYP to their advantage.

Every day at 00:00 UTC, the smart contract will automatically try to convert the DYP rewards to ETH. If the DYP price is affected by more than -2.5%, then the maximum DYP amount that does not affect the price will be swapped to ETH, with the remaining amount distributed in the next day’s rewards. After seven days, if there are still undistributed DYP rewards, the DeFi Yield protocol (DYP) governance will vote on whether the remaining DYP will be distributed to the token holders or burned (all burned tokens are removed from circulation).

Smart contracts are the engine room of any DeFi project. The advantage of smart contracts is that the community writes the rules; they can work without human interaction. Unlike the centralized world in which a set of rules are interpreted by a few experts who make decisions. Cool feature, Right. Not really. There is a significant disadvantage of smart contract risk, which happens when there is a bug in a smart contract. YAM finance is the greatest example of a smart contract risk. The team discovered a bug that prevented a vote from being executed. Yam tokens were dumped by users causing the tokens to plunge overnight. DYP prevents smart contract risk by ensuring that all their smart contracts are audited, and the codes are secured from participants who try to take advantage of the system.

DYP Staking Pools Tutorial

Deposit your liquidity provider tokens to receive Ethereum rewards

In order to lower the risk of DYP price volatility, all pool rewards are automatically converted from DYP to ETH by the smart contract at 00:00 UTC, and WETH (Wrapped Ethereum) is distributed as a reward to the liquidity providers.

Maintaining token price stability — every day at 00:00 UTC, the smart contract will automatically try to convert the DYP rewards to ETH. If the DYP price is affected by more than -2.5%, then the maximum DYP amount that does not affect the price will be swapped to ETH, with the remaining amount distributed in the next day’s rewards. After seven days, if we still have undistributed DYP rewards, the DeFi Yield protocol governance will vote on whether the remaining DYP will be distributed to the token holders (with appropriate slippage tolerance of -2.5%) or burned (all burned tokens are removed from circulation).

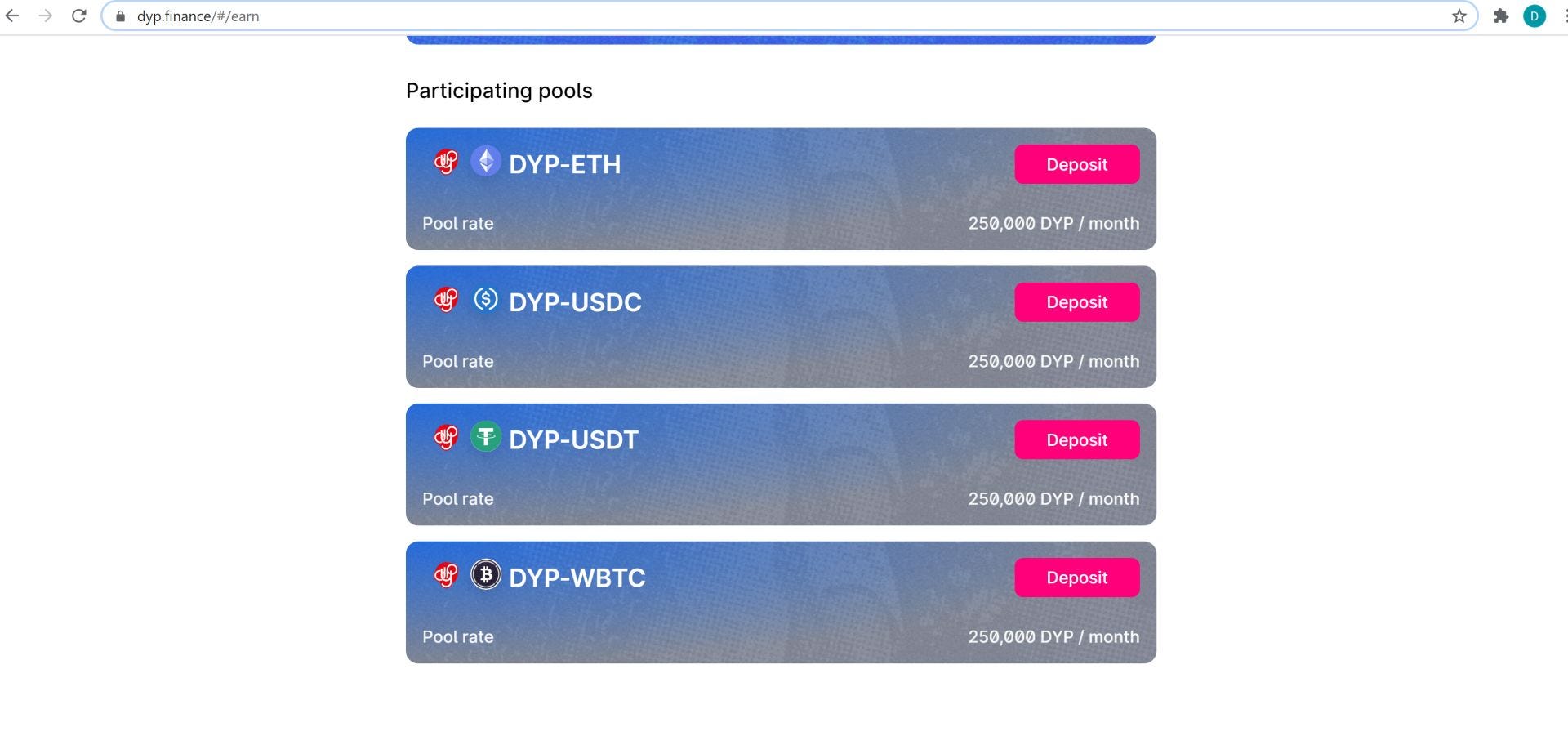

To start providing liquidity and earning ETH rewards, you must deposit your liquidity provider tokens (Uniswap LP tokens) into the corresponding initial list of pools: DYP-ETH, DYP-WBTC, DYP-USDC, and DYP-USDT.

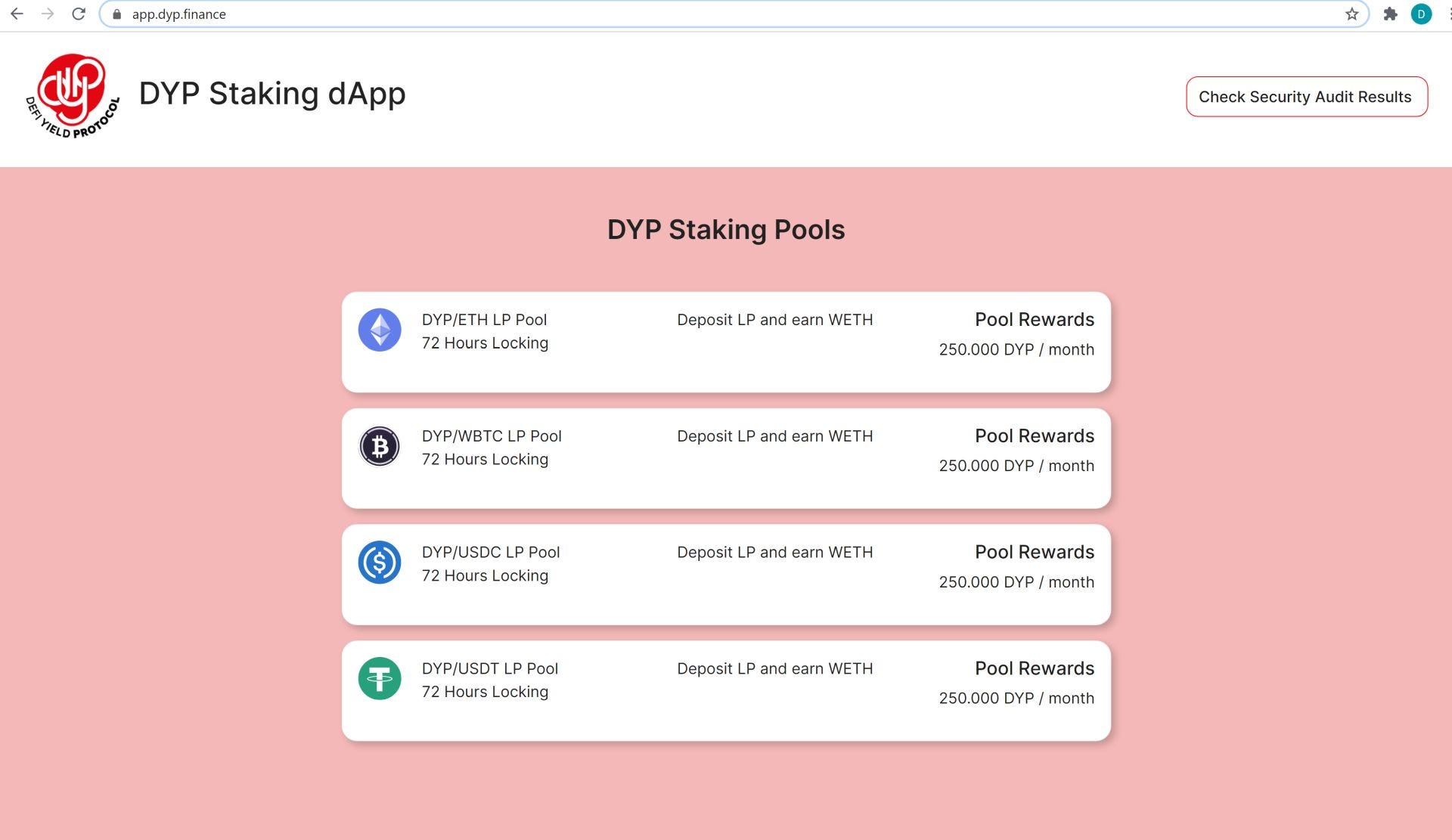

Each pool will have four different staking options, with rewards starting from 30.000 DYP up to 100.000 DYP each month, depending on the lock time from a minimum of three days up to 90 days.

In this tutorial, I will use a DYP/ETH pool to add liquidity and start earning Wrapped Ethereum (WETH) rewards:

- You should click the following link: https://dyp.finance/#/earn or directly visit the staking app https://app.dyp.finance/

2. Now, you should click ‘’CONNECT WALLET’’ and log into your MetaMask wallet.

3. Now you can see the staking pools, I will choose DYP/ETH LP pool.

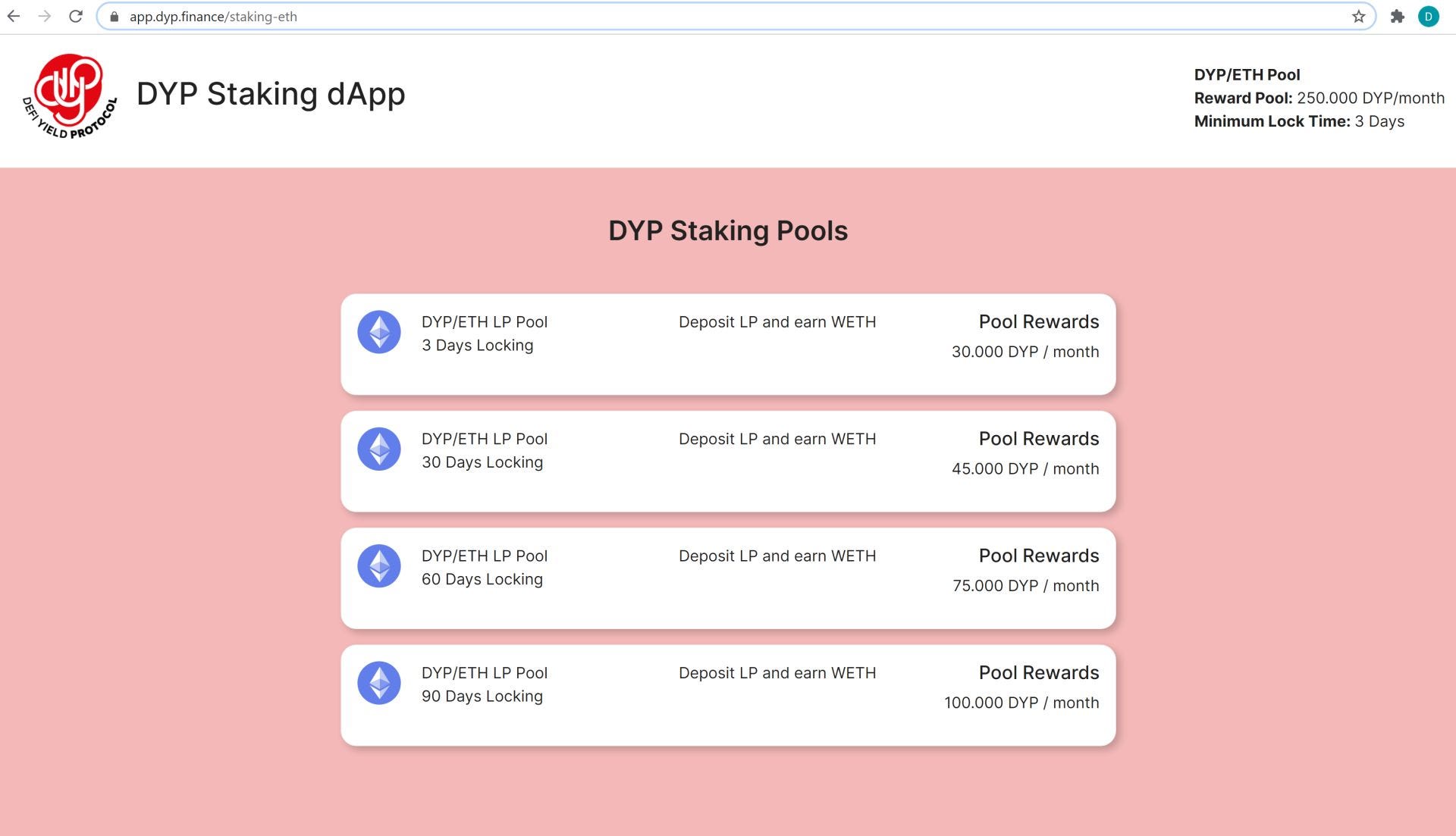

4. You will have the following four options:

-

DYP/ETH pool with three days Locking and Pool Rewards of 30.000 DYP/month

-

DYP/ETH pool with 30 days Locking and Pool Rewards of 45.000 DYP/month

-

DYP/ETH pool with 60 days Locking and Pool Rewards of 75.000 DYP/month

-

DYP/ETH Pool with 90 days Locking and Pool Rewards of 100.000 DYP/month.

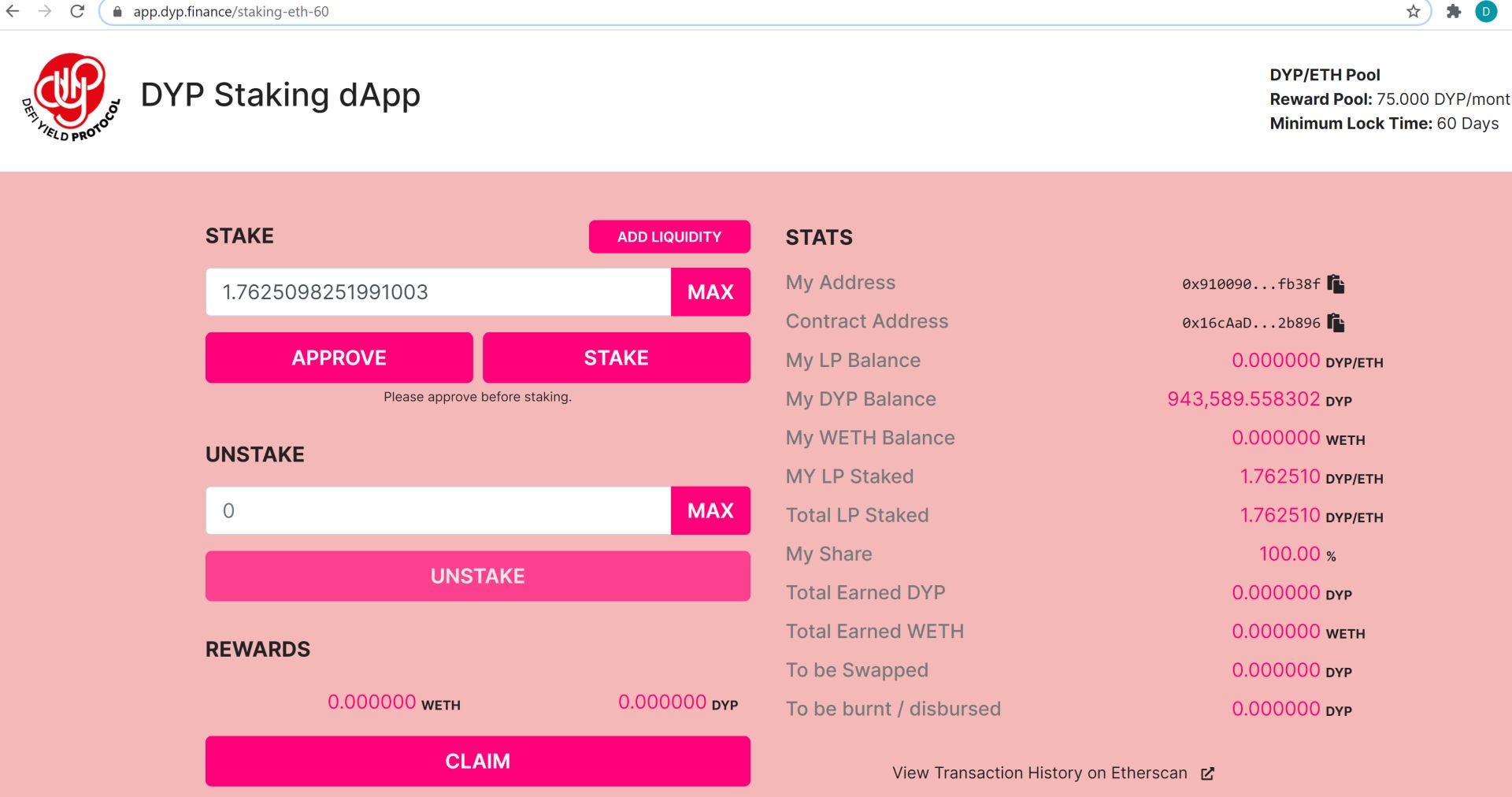

5. I will choose DYP/ETH pool with 60 Days Locking and Pool Rewards of 75.000 DYP/month

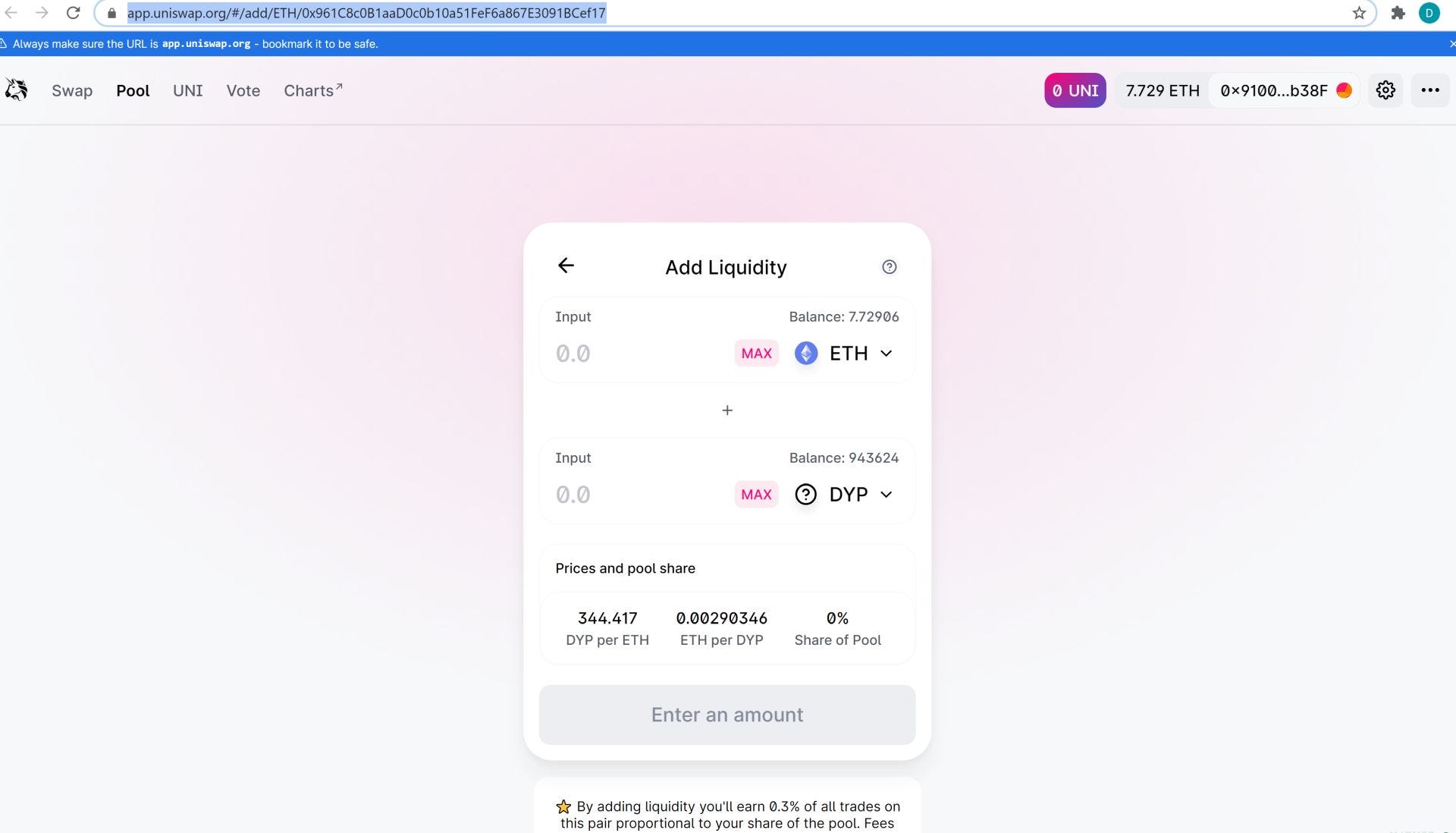

6. Now, I need to add liquidity on Uniswap to the DYP/ETH pair. I need to click ADD LIQUIDITY, and it will direct me to the following Uniswap page: https://app.uniswap.org/#/add/ETH/0x961C8c0B1aaD0c0b10a51FeF6a867E3091BCef17

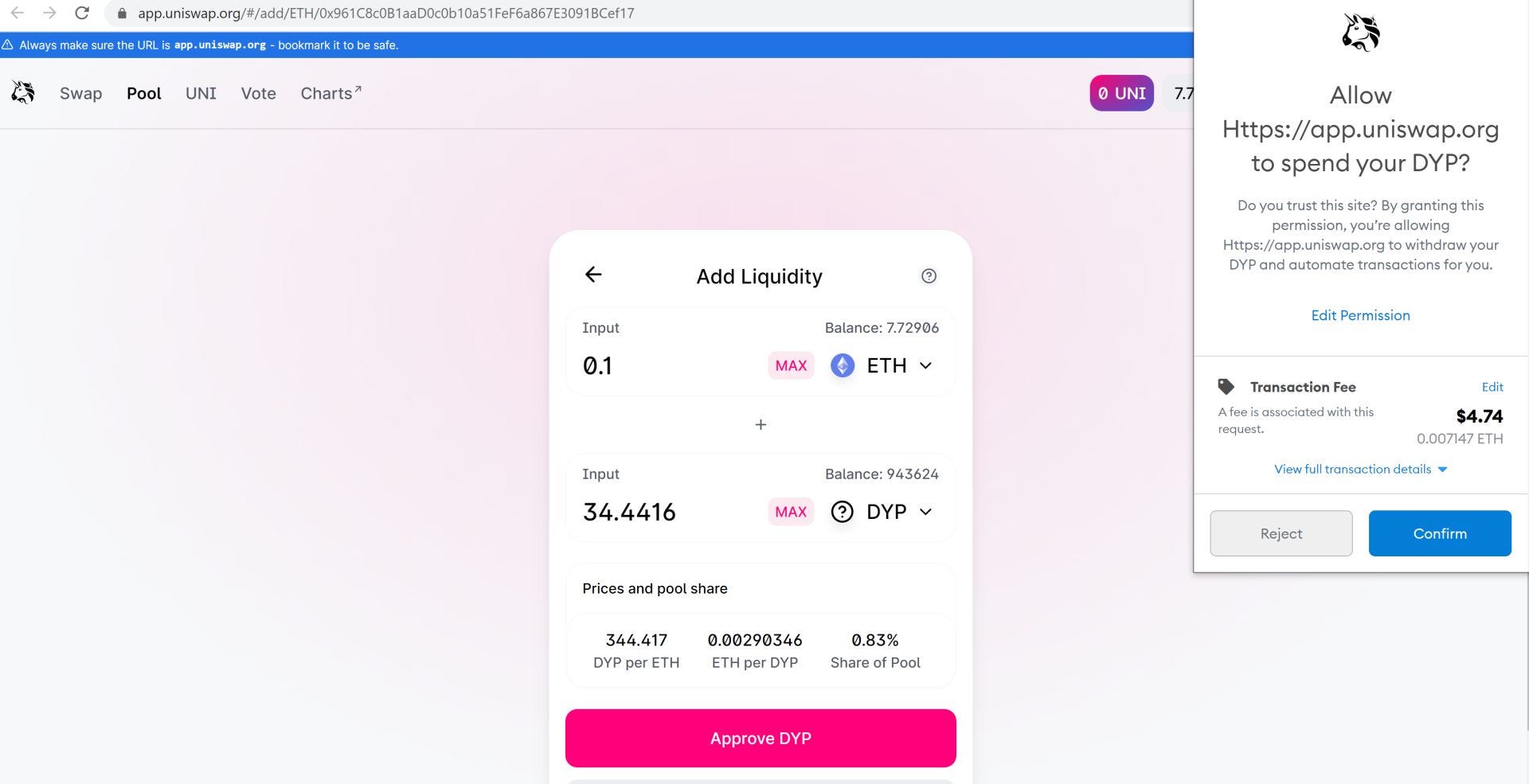

7. I will add 0.1 ETH and the same amount in DYP, at the current price, it will be 34.44 DYP for 0.1 ETH.

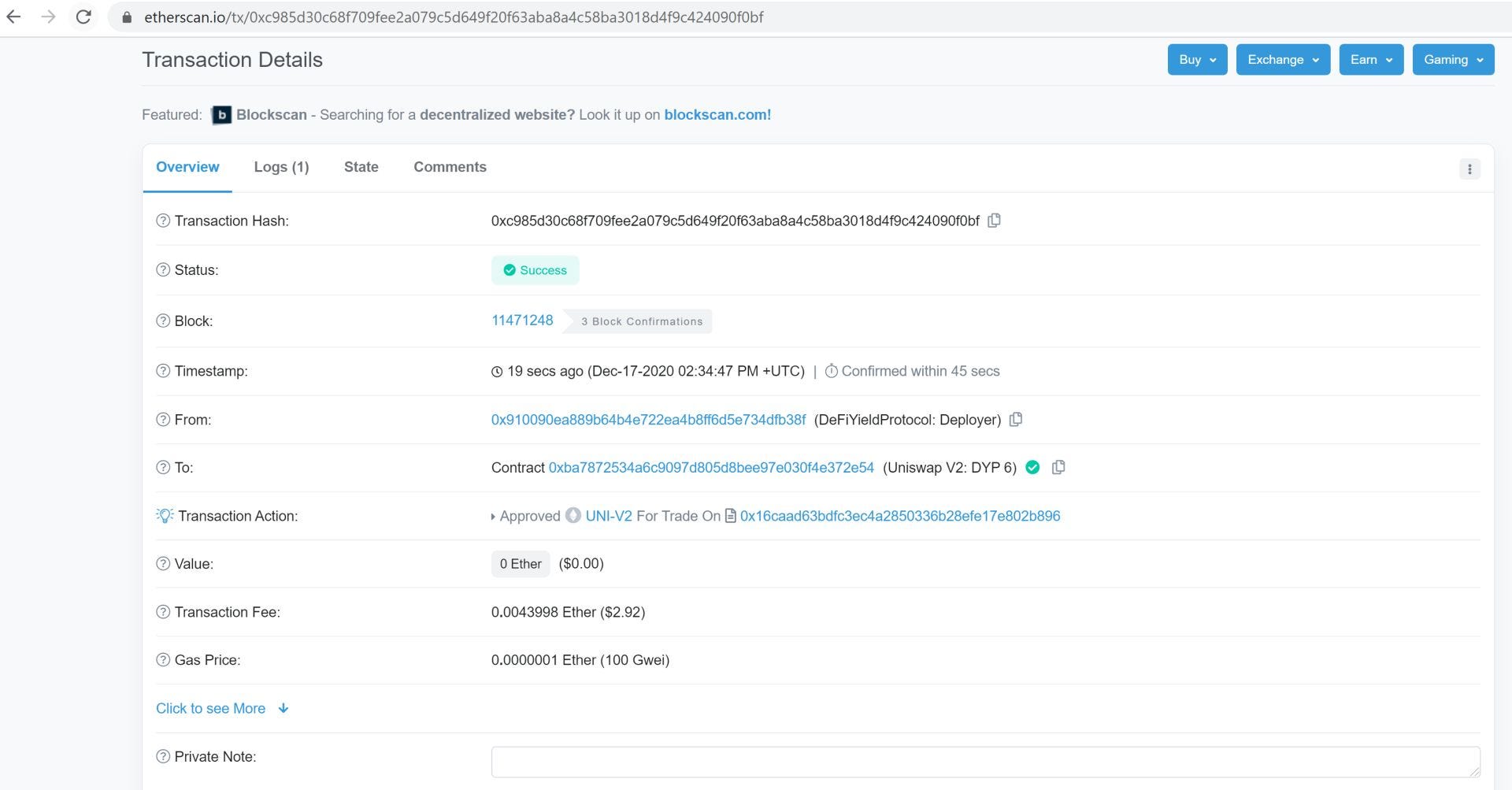

8. You should click Approve DYP and sign the transaction with MetaMask. I will click EDIT to set the Gas to FAST.

9. Once the transaction is confirmed, you must click Supply.

10. When the transaction is confirmed, you will receive the LP tokens in your wallet on the staking app.

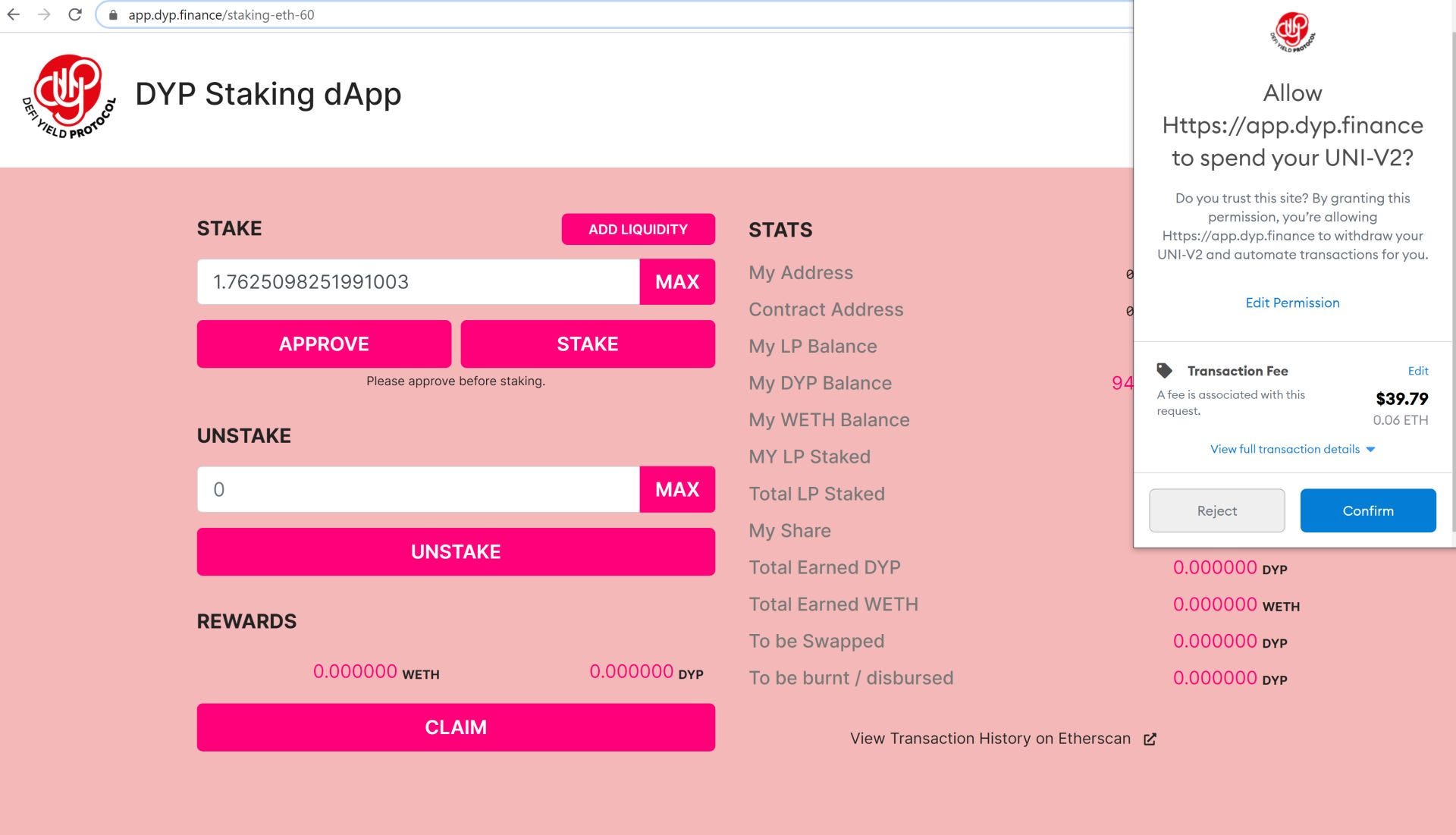

11. NOW, you should first click MAX, then APPROVE.

12. By default, the gas fee is set to 100 Gwei and 600,000 gas limit, so MetaMask will show you $39.76. However, it will not spend that amount. You can also click edit and change to slow, average, or fast. Again we recommend using Fast. In my case, it charged me only $2.92.

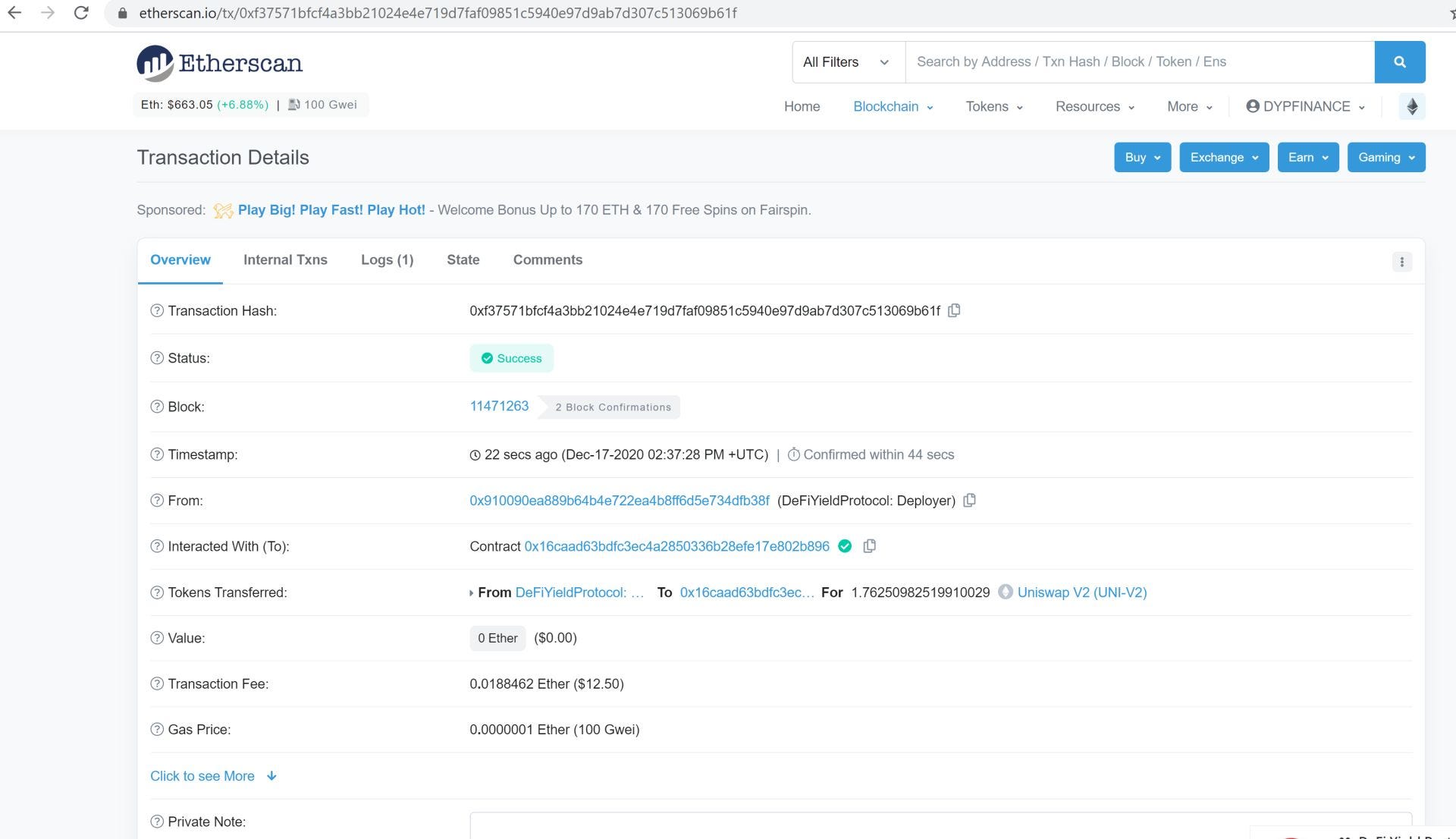

13. Now you need to click STAKE, MetaMask will show me again that it will charge me $39.02, but it spent $12.50.

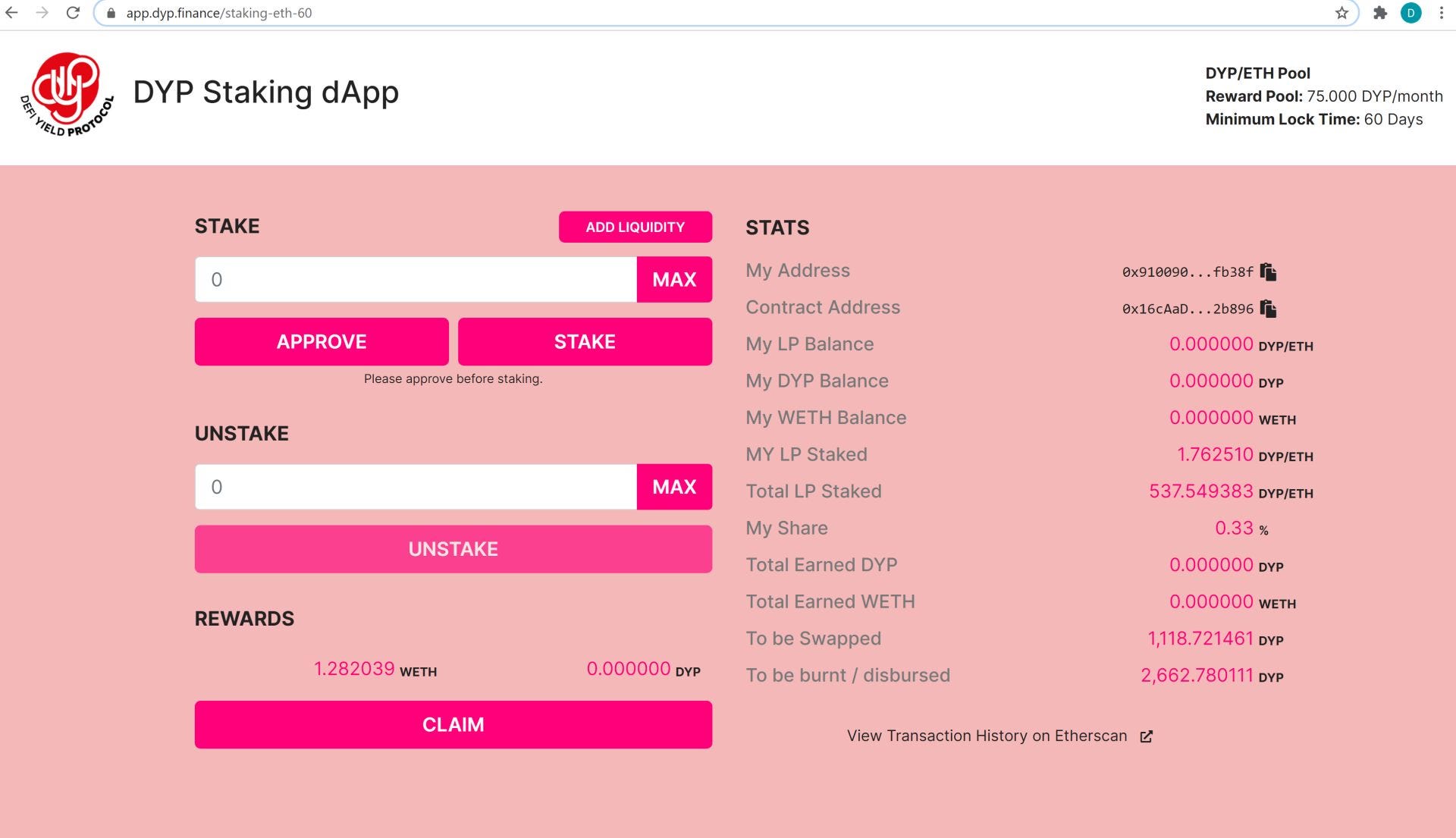

14. You can now see your LP Staked.

15. You will be able to CLAIM your Wrapped Ethereum (WETH) rewards every 24 hours.

16. The REWARDS are updated periodically when any liquidity provider clicks CLAIM.

17. Depending on the pool you have chosen, you will be able to UNSTAKE after 3, 30, 60, or 90 days.

Would you like to earn many tokens and cryptocurrencies right now! ☞ CLICK HERE

Looking for more information…

☞ Website

☞ Explorer

☞ Source Code

☞ Social Channel

☞ Message Board

☞ Coinmarketcap

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#blockchain #bitcoin #defi yield protocol #dyp