What is DAOventures (DVG) | What is DAOventures token | What is DVG token

About DAOventures

DAOventures is a DeFi robo-advisor and automated money manager platform. Imagine “Robinhood for DeFi”. It is our mission to make DeFi simpler, accessible & inclusive. We believe in creating a simpler, more accessible, and more open world that is permissionless, inclusive and guided by our DNA of continuous learning, integrity and transparency.

Introducing DAOventures, Automated DeFi Money Manager

Simple & Easy to Use | Expert Curated | Prioritizing Risk with Reward

We all are aware of DeFi — the new area of growth for crypto investments that has seen 1000% growth in recent times! Many of us are now believing it is the future of finance.

Successful traders and investors are thinking DeFi is a once in a decade investment opportunity

In our series-1, we have discussed this revolutionary new financial system and showed that the crypto world has been taken by DeFi because it is helping to receive yield using DeFi lending protocols!

The DeFi environment is still in its infancy and young due to its poor user experience, anonymous founders, inexperienced team, and some random technical issues. You can understand more about the existing problems in DeFi asset management in our series-2****.

After understanding the problems in this explosive growing technology, we wanted to tackle the industry’s pain-point heads on.

Introducing DAOventures, your DeFi robo-advisor, and automated asset manager for Decentralized Finance (DeFi). Because we know, it’s never been simpler to explore and evaluate various DeFi assets on the market!

DAOventures is a decentralized organization (DAO) that helps Liquidity Provider’s (LP) to invest in decentralized finance (DeFi) products as a pooled asset manager. With smart contracts and automated robo-traders, DAOventures invest in the best performing DeFi assets for the most optimized return.

DAOventures works like a “typical VC”; sourcing deals and investment opportunities to generate optimized returns for the “LP”. We build technology and tools in-house; arbitrage bot, token swap, liquidity miner, automated balancer, and etc.

- DeFi Products in a Dashboard: You can simply explore, and evaluate various DeFi assets on the market by browsing curated products, checking historical returns, and more.

- Non-custody and Self-approval: DAOventures do not hold the user’s capital. DeFi enables self-custody for everyone. So, you can interact & approve ‘smart contract’ individually. You own your money.

- Performance and Optimization: Your investments are transparent on the blockchain and you would be able to monitor your capital 24/7 by reviewing and optimizing your portfolio.

Unique Value Proposition

DAOventures aims to build the simplest and best tool to invest and manage your DeFi portfolio. Our core team researched, analyzed, and backtested the latest DeFi protocols to filter the best from the rest, and our main value proposition is focused on user experience to deliver seamless experience and usability with the best performing strategies.

- Simplicity: Browse recommended investment strategies. Select, approve & invest automatically.

- Secure: Security audit, code-review, open-source review, pen-test, and 3rd party firm audited.

- Trusted: Transparent, professional fintech & cryptocurrency team, and

- verified smart contracts.

- Save Gas: With ‘pooled investment fund’ and better gas fees calculation,

- investors save gas up to a particular percentage.

Why should you choose DAOventures?

- Deep Expertise in the Crypto Market: DAOventures technology provides recommendations and capital deployment on behalf of LP into DeFi investment.

- Cash Flow from Digital Assets: All investors are able to generate yield/returns from their existing digital assets and get yield by

- participating in DeFi investments.

- Community Participation with Governance Token: The governance token model enables LP to cast votes for changes to the rules in the protocol.

- Reduce Counterparty Risk: Through the non-custodial processes,

- counterparty risk is reduced. The funds stay with LP’s wallet.

- DAOventures do not hold the user’s fund.

- Reputable Technology Team: DAOventures technology team architects

- build and execute the DAO’s proposal to the protocol. The core team

- previously built predictive data analytics on the crypto market.

- Compliance and Security: Audited all processes and smart contracts will be reviewed and audited before deployed into the mainnet!

How does this work?

Robo-advisor allocates pooled crypto funds based on “Ethereum smart-

contract” that automatically invests into deFi protocols and generates a return for LP. Regular crypto investors struggle with the difficulty and complexity to interact with DeFi protocols.

Best strategies require constant monitoring of performance, multiple protocols composability, managing risk vs reward ratio, and auditing smart contract security.

These are some of the products and solutions on DAOventures protocol:

1/ Yield Farming

Generate yield simply by choosing a portfolio. Choose from a range of

different yield farming strategies from low-risk, low reward to high-risk,

high reward.

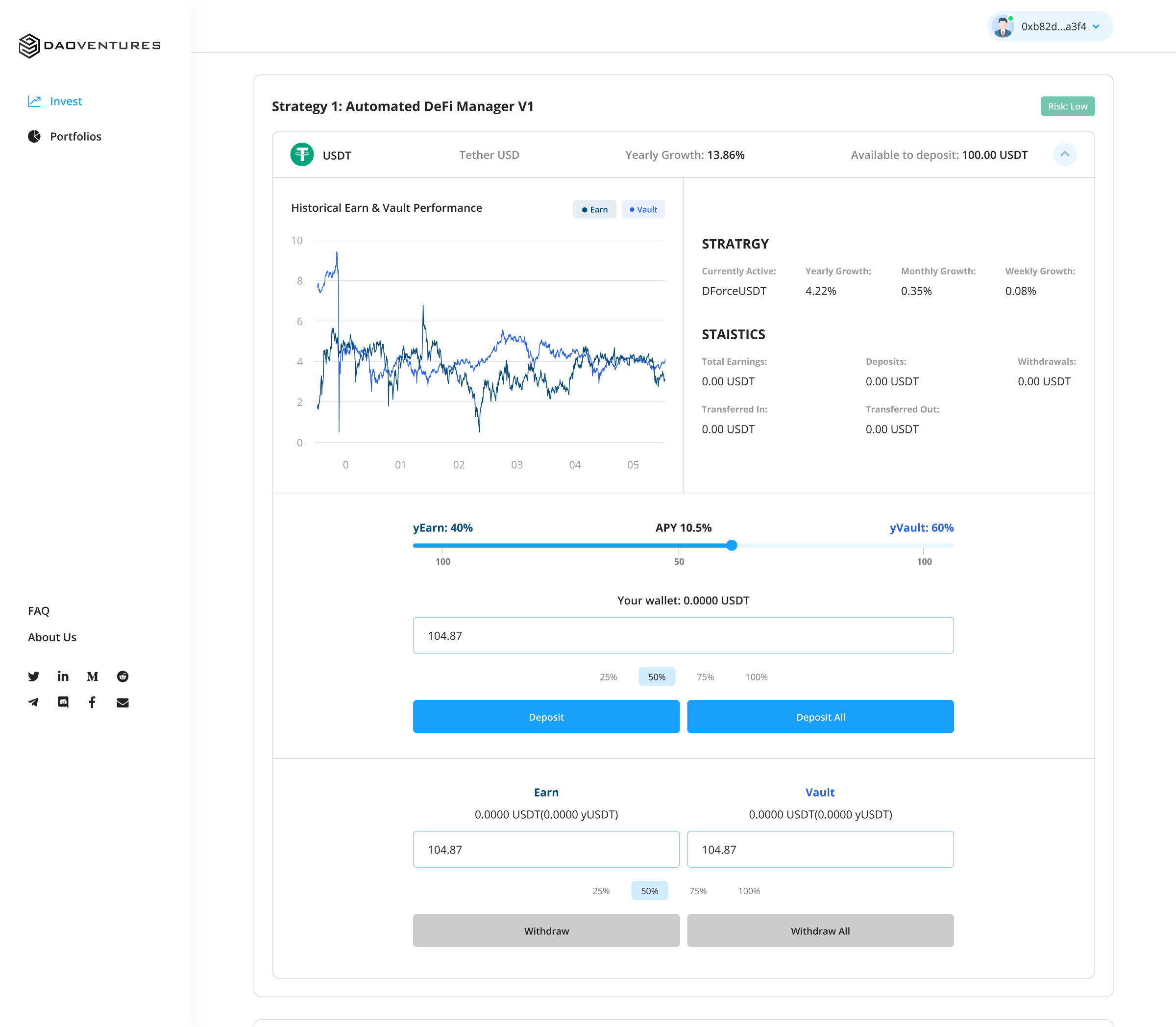

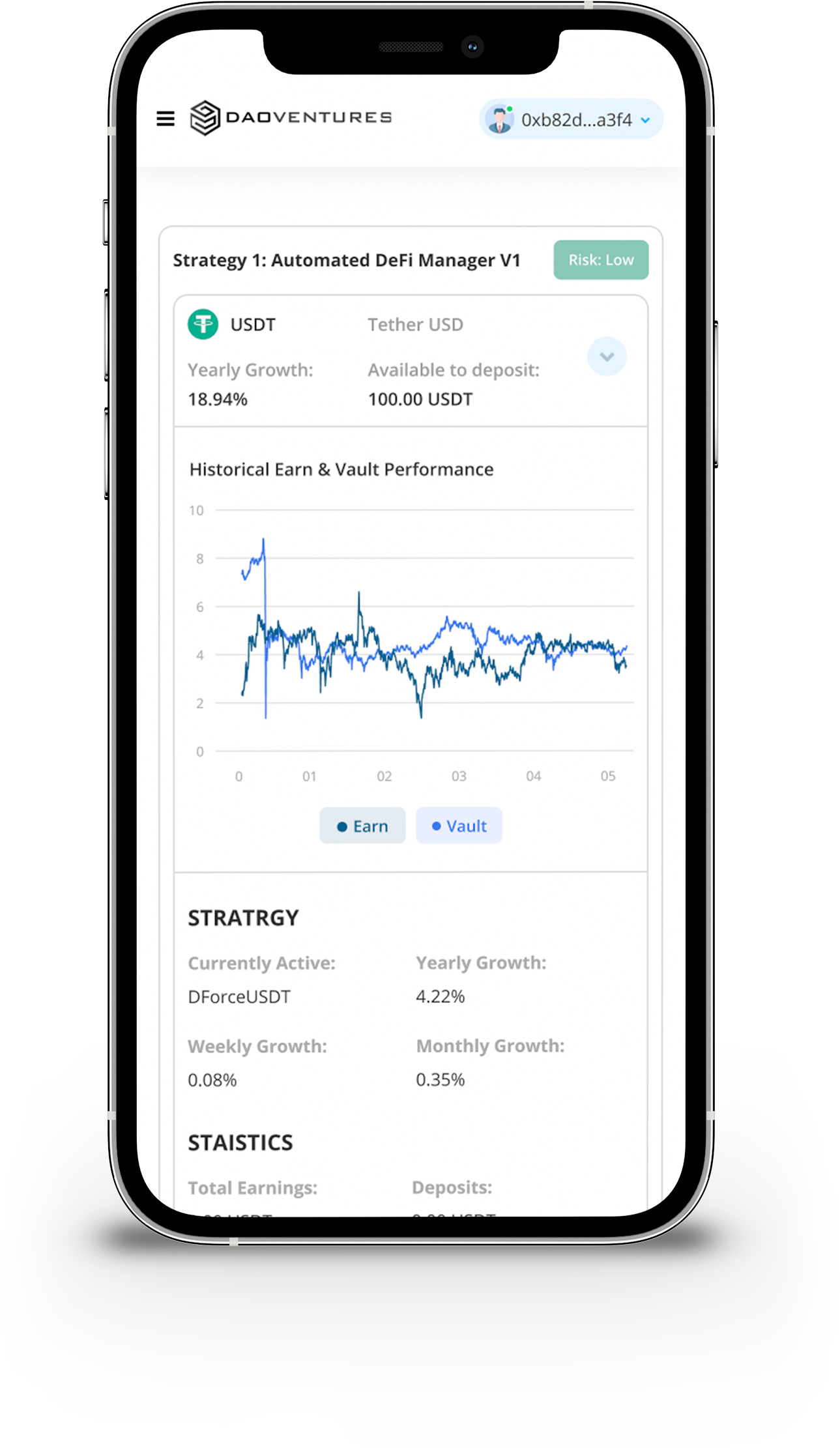

2/ Automated DeFi Manager

Automated DeFi Manager is a simple-basic algo strategy that deploys user’s cryptocurrency to the best yield aggregator through stablecoins like USDT, DAI, USDC, TUSD, etc. These strategies for lending platforms that rebalances for the highest yield during contract interaction.

3/ Lending or Borrowing & AMM

Riding with the rise of the DeFi market, Uniswap trading volume has

constantly exceeded some of the top centralized exchanges globally;

ie. Coinbase. We will be tapping into these protocols in the near future.

DAOventures purpose is to focus on creating simple and easy to use solutions

to generate optimized risk-adjusted returns for depositors of various

cryptocurrency via best-in-class lending protocols, liquidity pools, and specialized strategies for an unfair advantage, today.

DAOventures is being built on one of the world’s leading blockchains, Polkadot!

DAOventures plans to make the power of decentralized finance available to the mainstream investing markets, with a suite of tools that will enable anyone to grow and manage their investment portfolios easier than ever before. We are looking to lower the barriers for mainstream investors and in order to do this we need to build on a blockchain that best suits the mechanisms and requirements of DeFi protocols.

In the DAOventures engineering roadmap, we will be prioritizing cross-chain integration with other public blockchain networks such as Polkadot. Polkadot offers a powerful array of features that DeFi projects can take advantage of. Speed, scalability and interoperability are just a few of the benefits that come alongside building on Polkadot and below we highlight how building on Polkadot’s substrate will enable DAOventures to offer a scalable, permissionless and interoperable DeFi platform to the world.

Interoperability

Interoperability is what sets Polkadot apart from Ethereum and other blockchains and Polkadot supports multiple blockchains through a mechanism called “sharding” or parachains. This allows transactions to be processed efficiently and in parallel.

As an open-source multichain, Polkadot facilitates interoperability between other blockchains and enables cross-chain transfers of tokens and data, which is essential if the DeFi space is to evolve in coming months.

Scalability:

The Polkadot blockchain connects private and public blockchains and networks through parachains that allow other blockchains to connect as sidechains. With its parachains, Polkadot can support an infinite number of blockchains and allow them to connect together.

With most transactions considered final in under a minute, Polkadot can currently handle more than 1,000 transactions per second (tps), compared to just ~25 tps for Ethereum at its peak.

Speed:

Ethereum is currently the most leveraged DeFi network, and the blockchain’s limited throughput has created issues with DeFi applications in recent months, namely high fees. The Ethereum blockchain can process roughly 10–14 transactions per second (tps) at full load, or just over 30 transactions if blocks are fully optimized.

For decentralized exchange (DEX) platforms and other DeFi protocols that rely on fast transaction times this is a promising alternative, and one that DAOventures plans to take advantage of.

Cost

The sudden explosion of DeFi protocols on Ethereum has also pushed Gas fees for transactions sky-high in recent months and has made swaps, yield farming and liquidity mining borderline inaccessible to the everyday user due to increased prices. Building on Polkadot offers an alternative at least until ETH 2.0 can address these issues.

“We are currently building on Ethereum and understand its limitations; scalability and gas fees. Our technical team brainstormed based on other available public blockchain networks and decided we will be building on Polkadot to scale. This is planned in the roadmap and we are looking to implement this in Q2-Q3 in 2021.” — Victor Lee, DAOventures Co-Founder

Victor Lee, DAOventures Co-Founder

As DAOventures will be built on Ethereum initially, we plan to use Moonbeam to integrate into the Polkadot ecosystem. Over the coming months, we’ll also be exploring bringing DVG to other blockchains based on speed, scalability and developer activity on the network.

$DVG — The DAOventures Governance Token

It is no doubt an exciting time to invest in DeFi projects, with well-established players and high-street financial institutions continually seeking ways to participate in this exciting new technology.

However, despite the tremendous popularity of Defi and the increasing interest in DAOventures, we still feel obligated to ensure that all of our token holders have a complete understanding of our token utility and the tokenomics surrounding our ever-popular DVG token.

You have the power to make a difference!

The DVG token has much to offer, but at its core, it is a governance token for the DAOventures protocol. For some of our newer, more novice community members, let us confirm what a Governance token is, exactly.

Coinmarketcap describes a Governance token as a token that helps shape the future of a protocol — and that’s exactly what we are offering our loyal DVG token holders. Together you will influence decisions concerning our project and use your tokens to vote on any future changes to the protocol.

What does the DVG Token offer?

The DAOventures native DVG token has several appealing utilities. Working as an incentive mechanism to attract and stake liquidity, the DVG token invites market participation from the DAOventures community ensuring long term demand and price appreciation.

Every decision we’ve made, we have done so with our token holders and community in mind. This is further illustrated by the following points, which should be pleasing to all:

- Initial market cap. A very modest $516k initial market cap

- Deflationary model. Block rewards are reduced every 2 weeks for 4 years!

- Low inflation. Less than 100k daily

- Fair launch. NO pre-mine for team/advisors

- High Liquidity. Over 1% allocation for liquidity at AMM

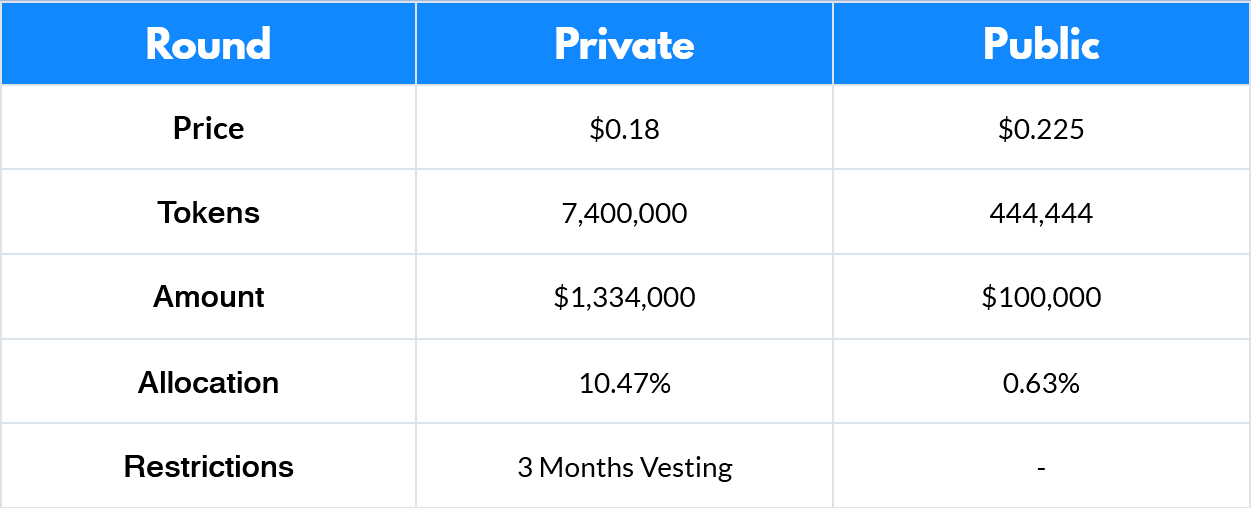

Private and Public Sale Details

As mentioned there is no pre-mine for the team or advisors, and this is done as a testament to the teams’ commitment to the project. There are only 7.8m DVG tokens minted for the private and public sale combined, this represents 11% of the total tokens.

- 7.4m of the 7.8m minted tokens are allocated to our private round.

- 444k of the 7.8m minted tokens will be sold to the public via our partner platforms.

It is important to us that all token holders are aware that each private round participant was extensively vetted. We want every token holder to be part of the community and contribute to the success of the project well after the launch date.

With an initial market cap of only $516k, DVG is a governance token with room for growth in the market in the coming months.

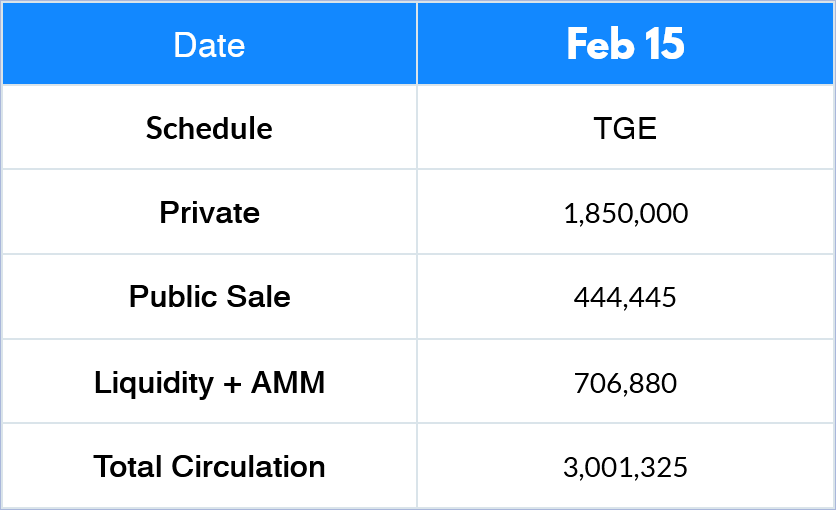

Private Sale Vesting Schedule

To reduce market selling pressure from speculators we have created an attractive and fair vesting period for the private round, with private tokens being fully distributed in 3 months.

**TGE **= 25%

**Week 5 **= 25%

Week 9 = 25%

Week 12 = 25%

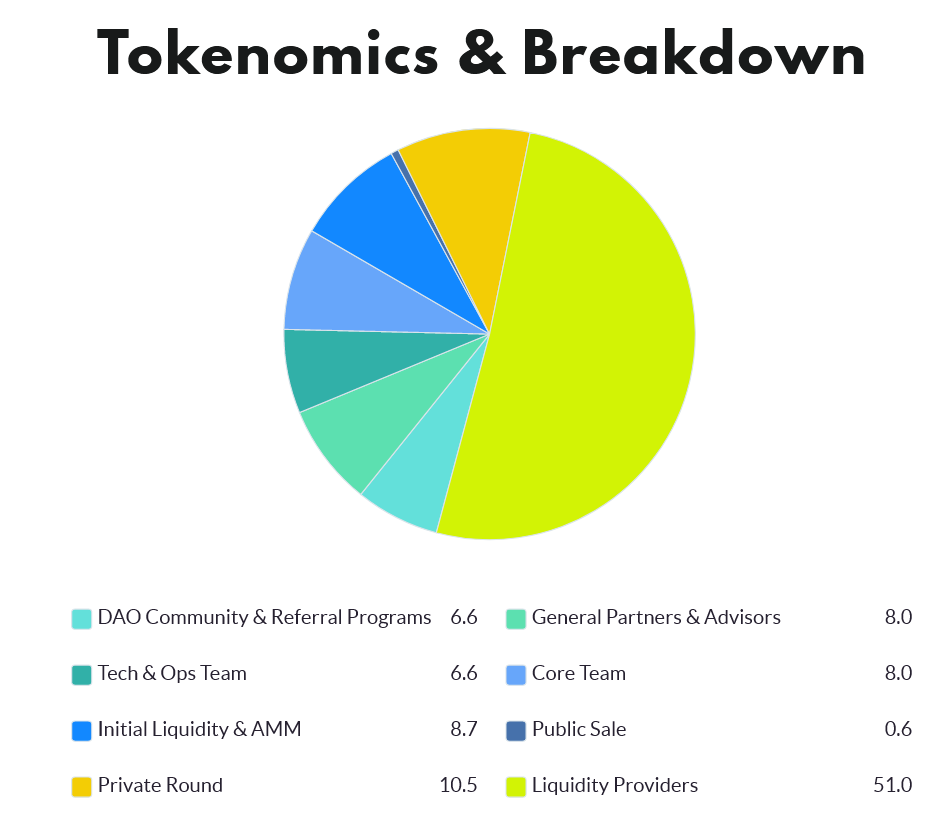

Further allocation breakdown

Below you’ll find a full token breakdown. We have structured it so that price discovery is prioritized and the spread of price is kept nominal.

The top exchanges for trading in DAOventures are currently Uniswap (V2) , Bilaxy , and 1inch Exchange

Looking for more information…

☞ Website ☞ Explorer ☞ Explorer 2 ☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Social Channel 3 ☞ Message Board ☞ Coinmarketcap

Would you like to earn many DVG right now! ☞ CLICK HERE

*Top exchanges for token-coin trading. Follow instructions and make unlimited money *

☞ Binance ☞ Bittrex ☞ Poloniex ☞ Bitfinex ☞ Huobi

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#blockchain #bitcoin #crypto #daoventures #dvg