What is Peanut (NUX) | What is NUX token

From humble beginnings, decentralized exchanges (DEXs) have emerged to capture a sizable chunk of the cryptocurrency market, seizing market share from centralized exchanges (CEXs). In the process, DEXs have pioneered new ways of market making and liquidity provision, while incentivizing token-holders to put their assets to work and earn yield.

DEXs now capture around 13% of the total crypto trading market and the leading automated market maker (AMM), Uniswap, records more volume than many of the leading CEXs including Kraken. On busy days, it’s even surpassed that of the largest US exchange, Coinbase.

The Trouble With DEXs

Uniswap liquidity providers (LPs), who pool paired assets, such as an equal weighting of ETH and USDT, earn a portion of all fees for token swaps. At present, the commission paid to LPs stands at 0.3%. LP’ing may sound like an easy way to make money, but it comes with certain risks attached.

Every time a trader swaps between tokens using an AMM, the price of the tokens in the pool changes. This affects the value of the pooled holdings of all LPs. When one of the tokens in the pool spikes or crashes in price, as can frequently happen, LPs suffer what’s known as impermanent loss (IL). As a result, when they go to withdraw their assets from the pool, the value of their holdings has diminished.

The threat of IL makes trading in all but the most liquid pools for the largest cryptocurrencies a hazardous business. It’s all too easy for the 0.3% profit that LPs make off each swap to be exceeded by losses through IL. Moreover, because each DEX trade impacts the price of the pooled assets, it places DEX prices briefly out of sync with those on centralized exchanges and other DEXs. This results in arbitrage, with savvy traders rushing to profit from these price discrepancies.

Onchain “arbers” front-run large DEX orders by paying a higher fee to have their tx included in the first block. This is great for these sophisticated traders who know how to profit from such opportunities, but it doesn’t do ordinary users or liquidity providers any favors. Until these problems are solved, the value proposition of decentralized exchanges is seriously impaired.

“The presence of slippage is a huge inconvenience, and can sometimes carry significant risks for DEXs. Peanut provides a great solution to this problem. By using only 10% of user funds in a centralized manner (cross-exchange arbitrage), Peanut manages to achieve significantly higher efficiency of the mechanics and returns for users,” commented Michael Egorov, the founder and CEO of Curve.

What the crypto market needs is a DEX framework that can support trustless trading and incentivize liquidity pooling without exposing participants to pricing risk and the potential for losses. Solving this problem, however, has proven elusive up until now.

Introducing Peanut, an Advanced Price Balancer

To address the problems inherent to DEXs, we’ve developed Peanut, an advanced price balancer tool. Peanut was developed by Remme, one of the most accomplished and experienced teams in the crypto space, with a pedigree that stretches back years.

Peanut is a set of smart contracts that automatically balance prices after each trade to help LPs earn more and reduce slippage with no manual effort. Benefits include:

- Increases passive income

- Lower risk of impermanent loss

- Reduced slippage

- Reward with governance tokens

- No manual effort: Peanut does everything automatically

How It Works

The current Uniswap model requires LPs to supply 100% of the assets they wish to pool in a single transaction, with a 50/50 weighting of each token based on a respective market value of each asset. Once the LP has supplied these assets to a Uniswap liquidity pool, they are at the mercy of IL, and are particularly prone to large buy and sell orders that will move the market price.

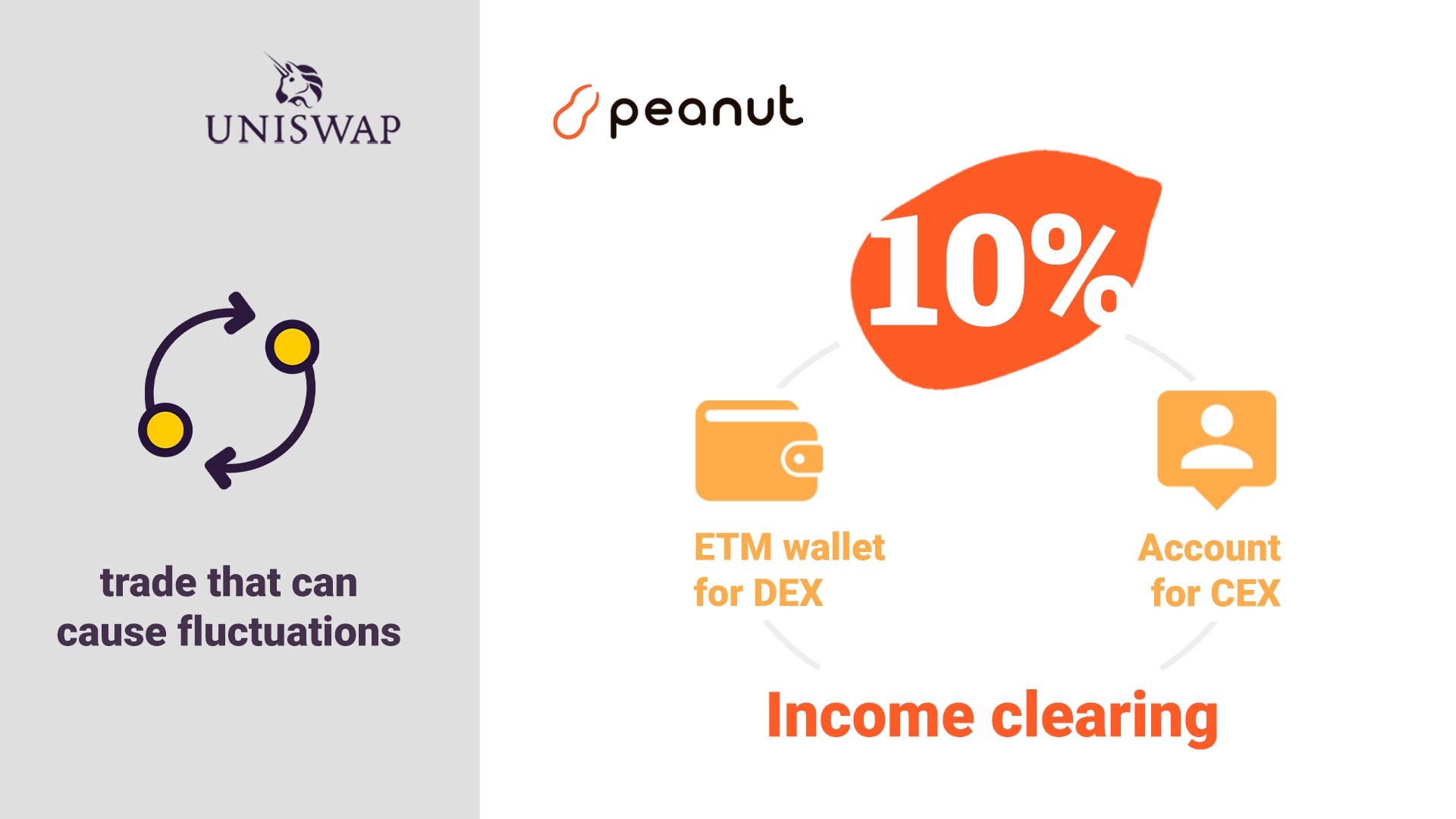

With Peanut, 90% of the LP liquidity goes directly into the Uniswap pool. The other 10% goes into the Peanut protocol, to serve as a price balancer. Just as a peanut bean consists of two edible parts (known as cotyledons, FYI), Peanut divides LP assets into two parts:

- 90% is used for providing liquidity on Uniswap or via another DEX (pull with paired tokens)

- 10% is used for automatic multi-level price balancing between Uniswap, other DEXs and CEXs.

The Part 2 pool is used on two levels to provide lightning-fast trading operations to keep the price balance:

- Level 1 — ETH account for onchain operations on DEXs

- Level 2 — account on CEXs where the token being bought or sold is tradable

When large buy/sell orders are placed, the Peanut pool automatically and simultaneously makes a corresponding trade on two levels i.e. on other DEXs and CEXs. After trading operations are completed, Peanut performs clearing for earned income.

This means that any potential price movement from large DEX trades can be immediately dampened by matching it on the CEX, protecting LPs from slippage.

Liquidity providers are free to withdraw their assets from Peanut’s two-part pool system at any time, just as they are with Uniswap. As a result, LPs can enjoy all of the upside from pooling tokens and earning 0.3% of fees, with the lower risk of impermanent loss.

Peanut is a breakthrough for AMMs, thanks to its hybrid system that harnesses the best elements of DEX and CEX. It enables trustless token swapping and revenue sharing while dramatically reducing the risk of impermanent loss and front-running.

Would you like to earn many tokens and cryptocurrencies right now! ☞ CLICK HERE

OKEN SALE: 22 DEC – 29 DEC

Ticker: NUX

Token type: ERC20

ICO Token Price: 1 NUX = 0.25 USD

Fundraising Goal: $1,500,000

Total Tokens: 40,000,000

Visit ICO Website ☞ CLICK HERE

Looking for more information…

☞ Website

☞ Social Channel

☞ Message Board

Create an Account and Trade Cryptocurrency NOW

☞ Binance

☞ Bittrex

☞ Poloniex

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#bockchain #bitcoin #crypto #peanut #nux