Statistical Arbitrage (Stat Arb) are trading strategies that typically take advantage of either mean reversion in share prices or opportunities created by market microstructure anomalies. It is a highly quantitative analytical approach involving a well-diversified portfolio of securities. However, to illustrate the concept I will take the example of pairs trading involving only two cointegrated securities.

Pairs trading is a market-neutral strategy where we use statistical techniques to identify two stocks that are historically highly correlated with each other. When there is a deviation in the price relationship of these stocks, we expect this to be mean reverting and buy the underperforming stock and simultaneously sell the outperforming one. If our mean-reversion assumption is valid then prices should converge to long term average and trade should benefit. However, if the price divergence is not temporary and it is due to structural reasons then there is a high risk of losing the money. You can find the Python Notebook and data used in this article on my Github page. The overall approach followed in this article is mentioned below:

- Stock Universe and Identification of Cointegrated Pairs of Stocks.

- Perform Stationary test for the Selected Pair.

- Generate Trading Signals using z-score.

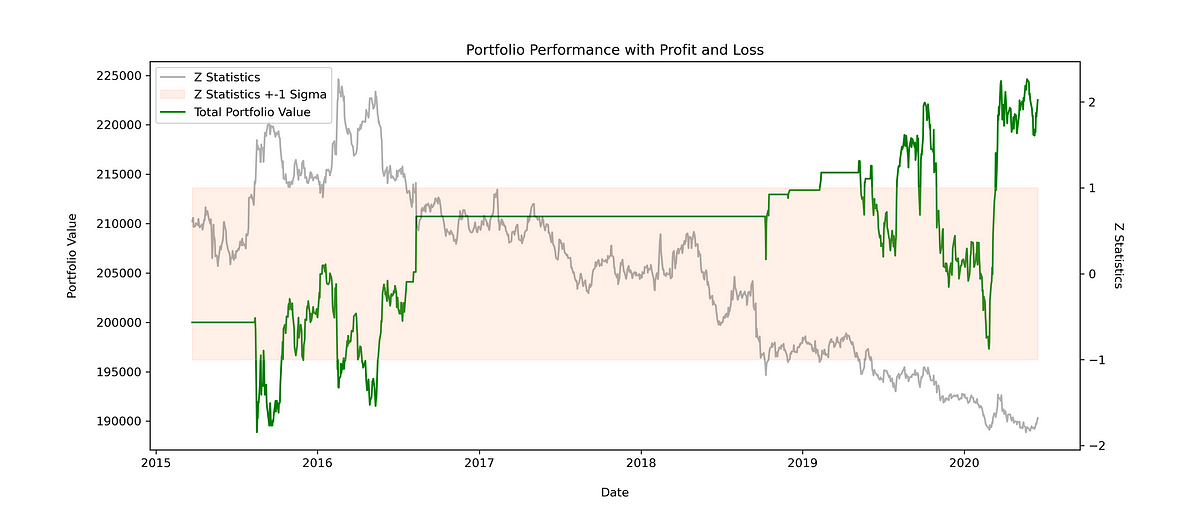

- Portfolio Profit and Loss Calculation.

Stock Universe and Identification of Cointegrated Pairs of Stocks

Our first step is to decide the stock universe and identify the pairs with high correlation. It is very important that this is based on economic relationships such as companies with similar businesses, else it might be spurious. I have taken all constituents of NSE-100 which are categorized as ‘FINANCIAL SERVICES’ companies. This gives us a list of 25 companies to start with. However, we filter out companies with less than 10 years of daily pricing data and are left with only the final 15 stocks. We take the daily closing price for these 15 stocks and split the dataframe into test and training sets. This is to ensure that our decision to select a cointegrated pair is based on the training dataset and backtesting is done using out of sample test dataset.

#trading #stock-market #investing #finance #machine-learning #deep learning