What is APYSwap (APYS) | What is APYSwap token | What is APYS token

Decentralized finance (DeFi) has shifted the way that cryptocurrency users interact with the protocol, introduced variety of new features and, most importantly, gave back the asset ownership to users rather than intermediaries. However, as the DeFi ecosystem develops, it faces a number of issues, one of which is complexity. An average user is now required to have a specific and up-to-date knowledge of how to interact with pools, deposit liquidity and mitigate impermanent loss.

In addition, many may find it hard to differentiate between various DeFi projects and evaluate their potential risks and rewards. Portfolios are in constant need of attention if you are looking to maximize profits, which may be difficult to keep track of. Finally, Ethereum transaction fees have grown significantly, making it more expensive for regular users to interact with yield farming opportunities and other dApps.

APYSwap offers a unique solution to these problems. APYSwap is a protocol for decentralized cross-chain exchange of shares of Tokenized Vaults. It implements a delegation function for user assets and provides a marketplace for financial assets trading. APYSwap allows users on multiple blockchains (initially Ethereum, Polkadot and Binance Smart Chain) to create and control their native blockchain vaults and transfer the ownership to third parties. Users may also benefit from passive income without actively managing their portfolio. Alpha version is already available with beta and Polkadot’s parachain version still in development

About APYSwap:

APYSwap is a protocol for decentralized cross-chain exchange of shares of Tokenized Vaults. Leveraging Layer-2 blockchain technology, APYSwap enables the trustless trading of tokenized yields across multiple Layer-1 blockchains. APYSwap can now support the most popular DeFi protocols on Ethereum, Polkadot, Binance Smart Chain, and Huobi ECO Chain. In addition, APYSwap platform will offer supplementary functionalities to its current features, further exploring innovative benefits for end-users and DeFi portfolio managers.

Product and features:

APYSwap consists of three layers: the protocol and smart contracts, the layer 2 aggregation marketplace as well as the user wallet on the top layer. APYSwap Vault is the underlying layer. It is a smart contract managing access to its funds and functionality to other blockchain agents depending on their share ownership of the vault. It can interact with any trustless service on the Ethereum, Polkadot and Binance Smart Chain networks.

Ownership of the vault is split between multiple agents by tokenization. This allows portfolio managers to create specific combinations of Liquidity Providers, Yield Farming and other tokens and enables the transfer of divisible shares of these portfolios to third parties. Therefore, instead of unlocking the assets for trading, users can instead trade APYSwap Vault shares. This provides liquidity to the previously illiquid assets without losing the rewards tied to assets remaining locked.

Polkadot, Binance Smart Chain or Chromia blockchain can be used as Layer 2 networks to transfer or trade shares in APYSwap vaults, while the assets remain anchored to the Ethereum network. This also allows for the Uniswap-style exchange, where the users can exchange tokens on Chromia layer 2 without the high gas fees and Ethereum transaction times.

Portfolios and APYSwap Vault shares are available at APYSwap Marketplace. Marketplace transaction will be signed via APY Mask, a Metamask-style web wallet. This wallet may also be used to manage the APYSwap Vaults, transfer their ownership, etc. Users can login via APY Mask and vote with their APY token balance for the addition of new services or whitelist/blacklist certain DeFi projects.

Current share prices of the APYSwap Vault as well as the asset’s pool is determined by oracles. Fees in APY tokens are used to reward oracles’ honest reporting and tokens can be staked to vote for honest oracle selection. Share prices will be settled naturally by the market, since it is up to a buyer to decline or accept the price, offered by the seller. An oracle price assessment will also be implemented, where buyer/seller would be able to pay delegated oracles with APYSwap tokens in exchange for their services.

Users may choose to delegate control of their shares to the rebalancing contract via the on-chain or hybrid solution, select the rebalancing strategy and their portfolio will be automatically managed on their behalf.

Token utility:

APYSwap tokens are used to safeguard and govern the APYSwap’s ecosystem. They ensure that only the reputable DeFi projects are available on the marketplace. Their role is to provide an insurance utility. Projects, interested in listing at the APYSwap’s marketplace, will have to purchase APY tokens and lock them.

If the project has proven to be untrustworthy, tokens will be unlocked and distributed as a compensation. A time limited yield farming opportunity will be launched in exchange for locking funds in the vault.

Token owners will be able to vote for new portfolio projects. At first, APY team and early adopters will provide portfolios and tokenized vaults. In the long term, the platform will shift towards the complete decentralization with community acting as decision makers.

Portfolio managers will be incentivized to purchase the APY tokens, since they can attract more users by offering unique projects in their portfolio. However, they will need tokens to vote for the addition of said projects into the APY’s whitelist. Therefore, portfolio managers will contribute to APY token’s market value.

Composing financial instruments with APYSwap

we will take a detailed look at the delegation procedure within the APYSwap. APYSwap has implemented a delegation function to increase the composability of users’ assets. Users are able to create and control vaults on their native blockchain and transfer vault’s ownership to the third parties. This enables them to enjoy various DeFi services without sacrificing the ownership of their assets. Now, let’s dive into the inner workings of the delegation procedure.

Working with Delegates

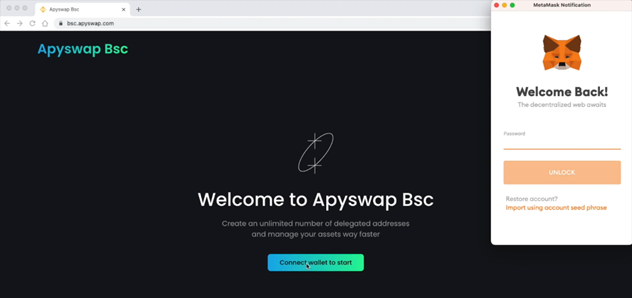

Delegate is an address that you own but its ownership can be transferred from one user to another. Transfer can be full or partial and it is a completely trustless system. To transfer the ownership, visit APYSwap’s website and select the desired chain. Connect your wallet and enter your APYMask (our version of MetaMask) password to unlock the delegates.

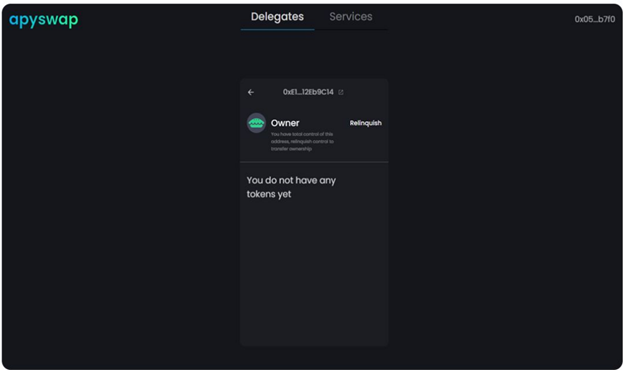

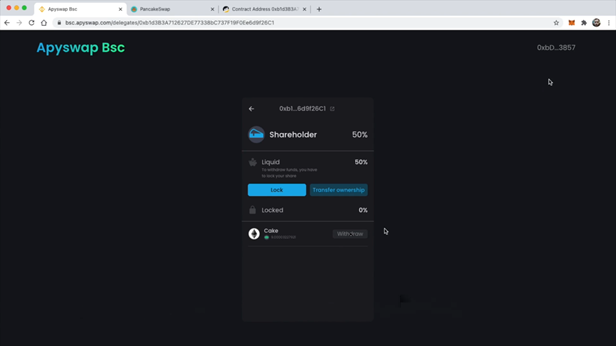

You will be transferred to the delegates management menu.

A new delegate can be created by simply pressing the “Create delegate” button. Notification will pop up, asking you to pay the required fee. After confirming it, a new delegate will be added to the list with an empty balance.

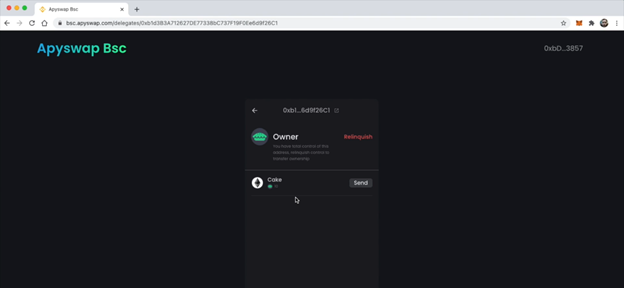

You can top the new delegate’s balance by copying its address directly to clipboard and sending tokens via the APYMask’s prompt. As soon as they are transferred, they will be displayed in the delegates menu.

Working with DeFi services

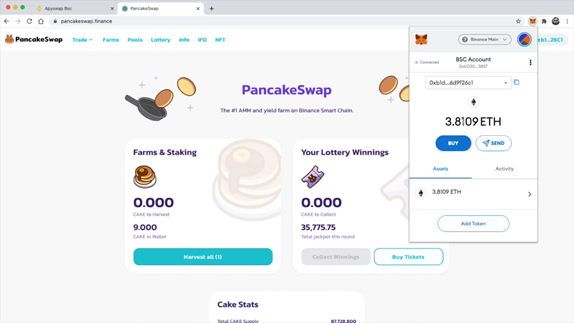

Now we will explain how ApyMask can be used to interact with DeFi services, by using PancakeSwap as an example. Select the delegate of your choice in APYMask. Your current balance will change accordingly, depending on which delegate you have chosen.

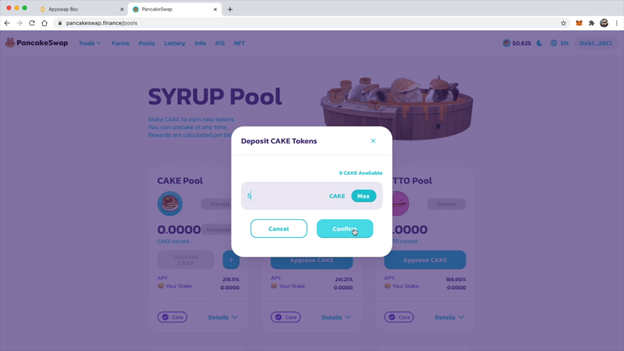

Go to PancakeSwap’s Pool. Here you can create a new transaction by pressing the “Approve CAKE” and confirming it. The owner will sign the transaction, however the delegate will be the one used to transfer it. After the confirmation, transaction will be recognized by the service.

You can stake your delegate assets by clicking the “plus” icon and selecting the amount you wish to deposit. Your assets will be displayed in the pool. Press the “Unstake CAKE” and confirm it to unstake the assets.

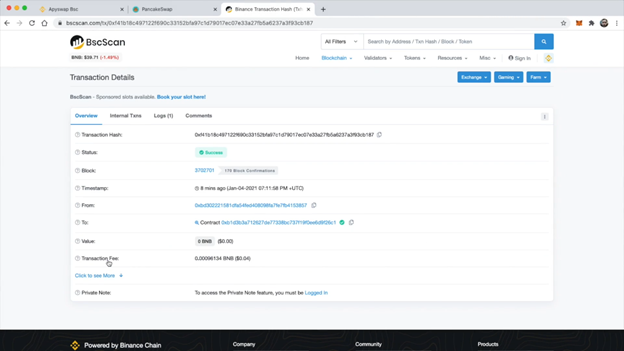

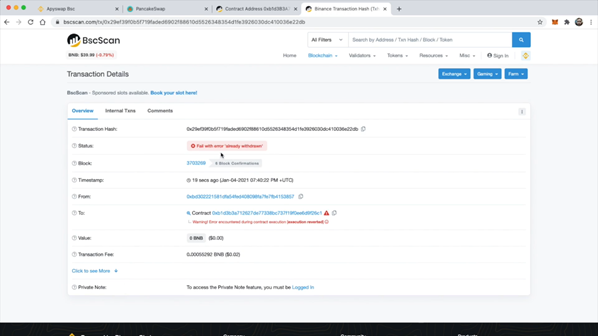

If you are interested in transaction’s details, you can view it on BscScan. A link to BscScan is imbedded in your wallet.

All transactions are from the owner to the Delegate, which calls smart contract on the owner’s behalf.

Ownership transfer and withdrawal of assets

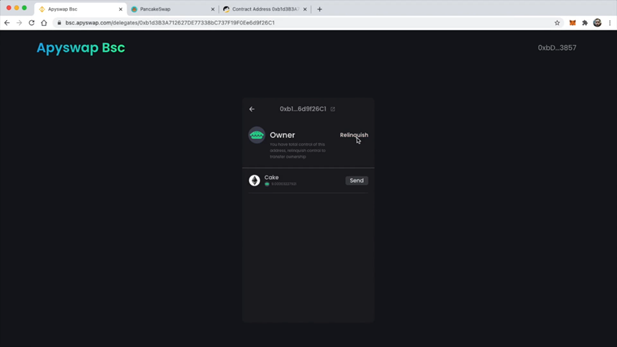

Asset’s ownership can be relinquished at any time by selecting the specific Delegate and paying an appropriate amount of fee.

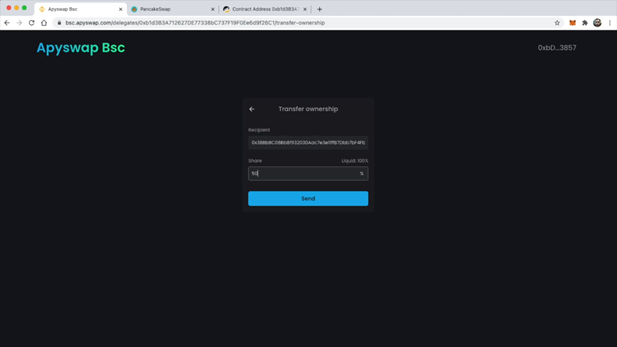

As soon as the ownership is relinquished, the interface will change, displaying your current share of the asset. However, you will not be able to withdraw it, unless your share is locked. Instead, you can transfer its ownership by selecting the appropriate button. Type in the recipient’s address as well as the size of the share you wish to transfer. Press “send” and the ownership transfer will be complete.

You will notice that the share percentages have changed. Lock in your ownership to withdraw the assets. You cannot select the specific amount; the entire sum will be withdrawn, should you choose it.

Assets can only be withdrawn once and any further withdrawal attempts will result in a failure.

Marketplace

It is important to note that users are able to shop for delegates at the APYSwap Marketplace. They can trade the shares of APYSwap Vaults, rather than selling the constituent assets within them. This enables the trading of the locked assets, thus bringing liquidity to the previously illiquid assets without suffering the penalties tied to the lock-up periods. Lastly, portfolio managers can use it to their advantage by leveraging the lending protocol, creating a dividends-generating DeFi index funds. This wraps up our explanation of the delegation procedure.

Looking for more information…

☞ Website ☞ Whitepaper ☞ Social Channel ☞ Message Board ☞ Documentation ☞ Coinmarketcap

Would you like to earn APYS right now! ☞ [CLICK HERE](https://www.binance.com/en/register?ref=28551372 “CLICK HERE”)

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ Binance ☞ Bittrex ☞ Poloniex ☞ Bitfinex ☞ Huobi ☞ MXC

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#blockchain #bitcoin #crypto #apyswap #apys