What is PieDAO DEFI++ (DEFI++) | What is DEFI++ token

DEFI++ is an industry first, an index of DEFI indices containing 13 industry-disrupting assets.

DEFI++ is a 70 / 30 weighted balance of DEFI+L and DEFI+S, our large and small market cap DEFI indices.

Just like DEFI+L and DEFI+S, DEFI++ automatically rebalances, has zero streaming fee, and can be staked in our liquidity pool for 20k DOUGH of weekly incentives!

You can get hold of DEFI++ directly through our web interface with Eth, with an option to mint your own pie (which sources the underlying assets through Uniswap and other providers), or buy directly from the market.

Putting DEFI++ to the Test

To celebrate the announcement we were curious to examine how our community’s flagship product would have performed in the recent DEFI downturn.

The results were impressive.

Tl;dr: Over the last 30 days our upcoming DeFi++ would have significantly outperformed indices from our competitors (Set’s DPI and Synthetix’s sDEFI)

Indices Outperform

You might have noticed that indices are everywhere in traditional finance.

There’s a reason for this. Put simply, they outperform most other investing strategies.

Indices avoid over-exposure to one individual asset, with diversification offsetting risk. But that isn’t the full story. While markets do move in synchronization, discrepancies in price movements provide a continual flow of opportunities.

As prices move automatically rebalancing indices takes profits from a performing asset and move into an asset that has not performed as well, available at a relative discount. Over time these micro moves cumulatively add up to significant gains, and this is especially noticeable in highly volatile cryptocurrency markets. It’s also important to note that indices on average outperform in both bear and bull markets.

Until recently indices were a missing piece of the DeFi puzzle, especially noticeable when contrasting with traditional finance.

PieDAO is a community with experience in this sector. By leveraging Balancer pools we’ve been able to make non-custodial, permissionless index investing a possibility for anyone, anywhere in the world.

Others in the ecosystem have also started to target this vital market need, most noticeably Set’s DeFi Pulse Index DPI and Synthetix’s sDEFI.

Today we’re going to compare how our pies performed against not just the individual assets themselves, but against these two main competitors.

This is the first part in a series of pieces examining the advantages of index investing, so be sure to subscribe for more.

Backtesting

To illustrate the advantages of an index investment strategy we backtested our pies against recent historical market data.

Our analysis compares DEFI index performance over the last 30 days, first examining our indices vs their constituent parts, and then vs competing DEFI indices.

The results are compelling.

Before diving in let’s take a second to look at PieDAO’s index offerings.

The DAO community has developed a range of indices, including pies providing safe exposure to tokenised USD and BTC.

Today however we’re going to focus our analysis specifically on our DEFI indices, which rebalance using Balancer pools and can also be staked to receive the DAO’s governance token DOUGH.

All of our pies also currently have zero streaming fee, a feature unheard of in traditional finance.

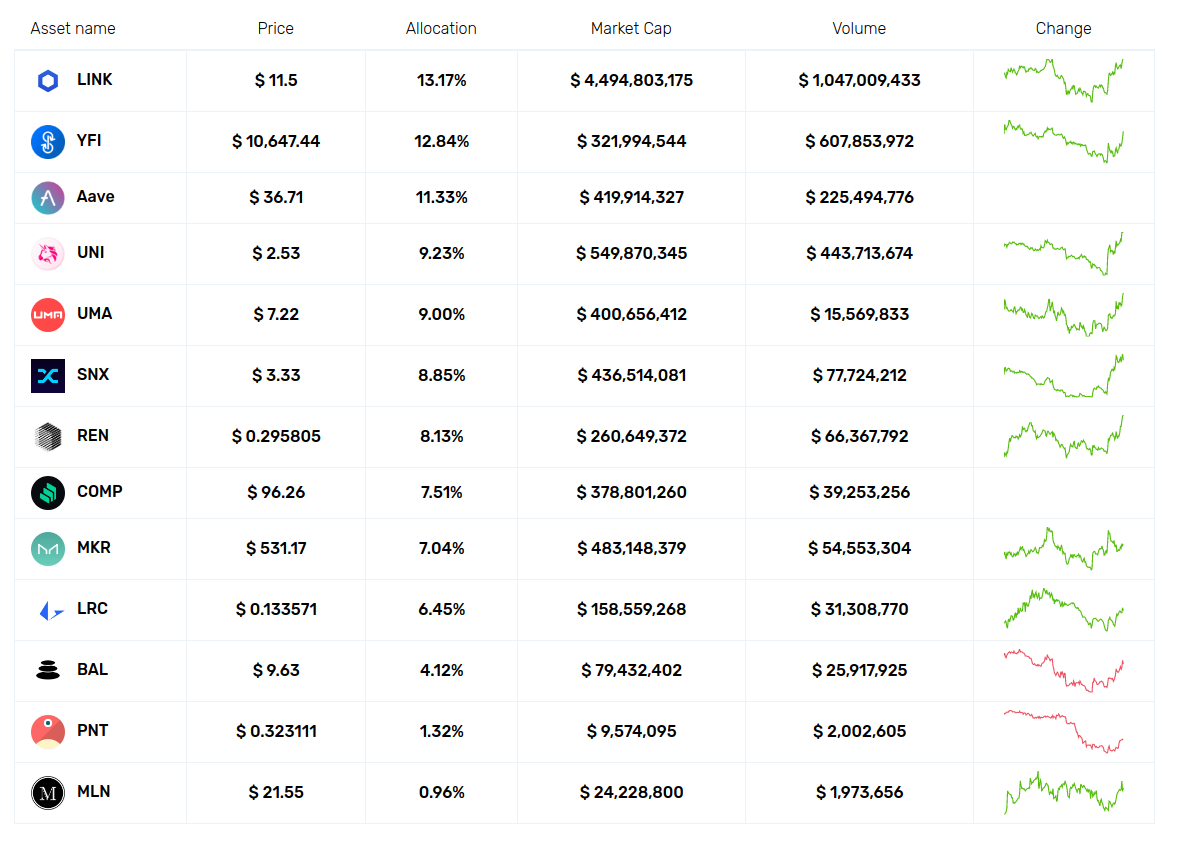

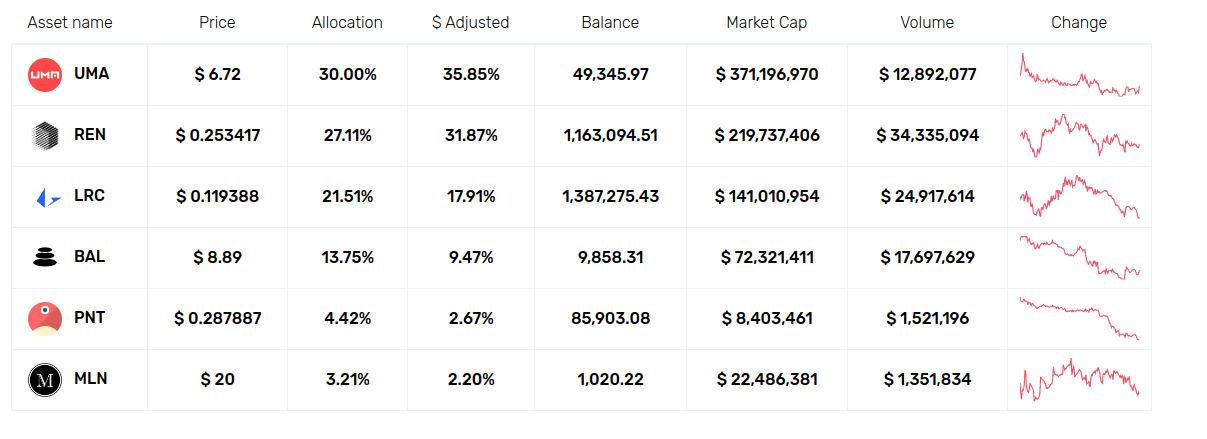

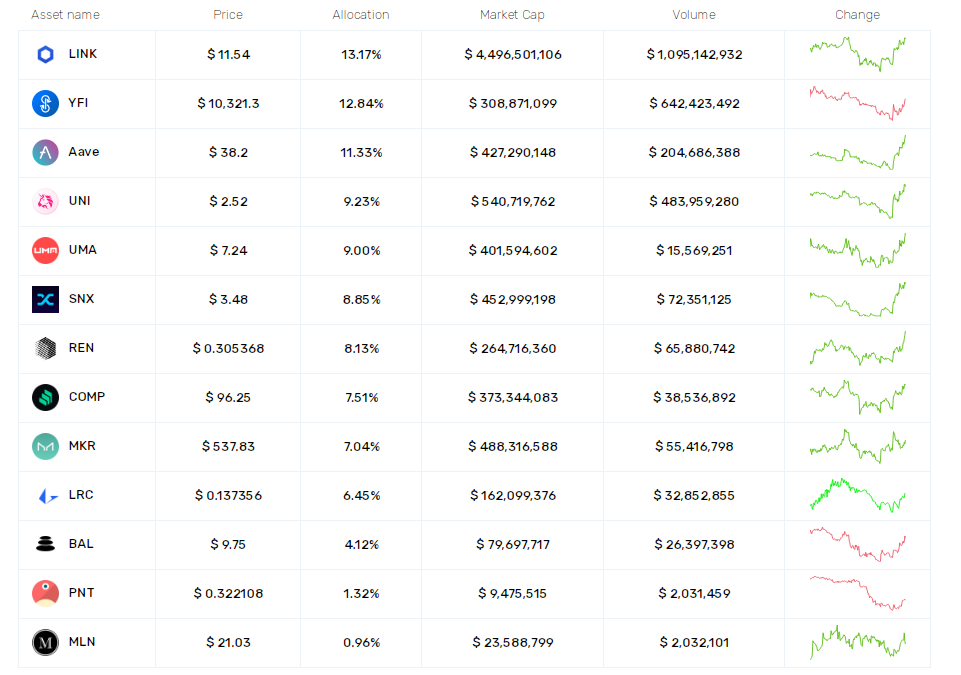

DEFI+S

Our small market Cap pie, containing DEFI projects that have immense potential for future growth.

They are: $BAL $LRC $UMA $MLN $REN $PNT

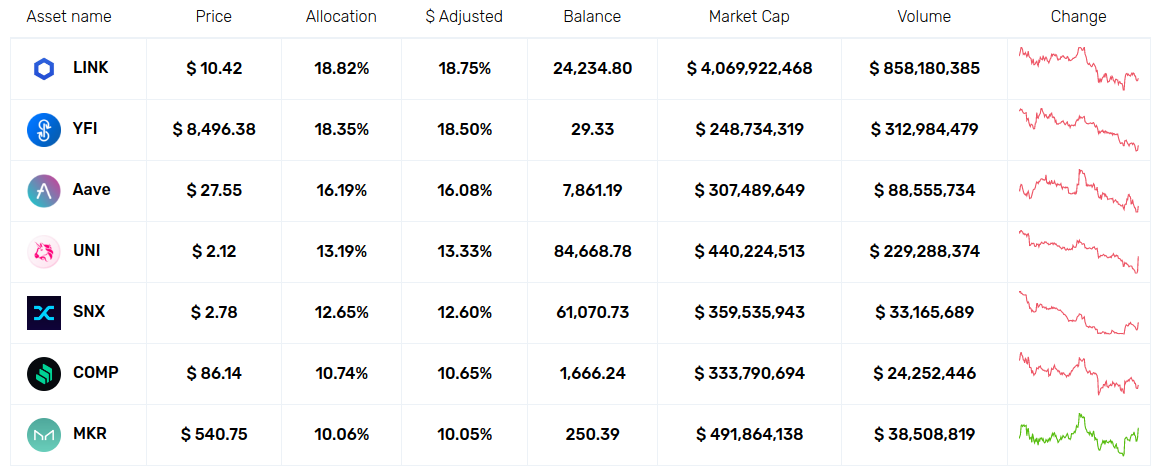

DEFI+L

Our Large market Cap pie, containing DEFI’s juggernauts. These projects have broken through the market, demonstrating significant value already.

They are: $COMP, $AAVE, $UNI, $LINK, $MKR, $SNX, $YFI

DEFI++

A market first, DeFi++ is our index of DeFi indices. It contains both DeFi+L and DeFi+S with a 70 / 30 weighting.

Competitors

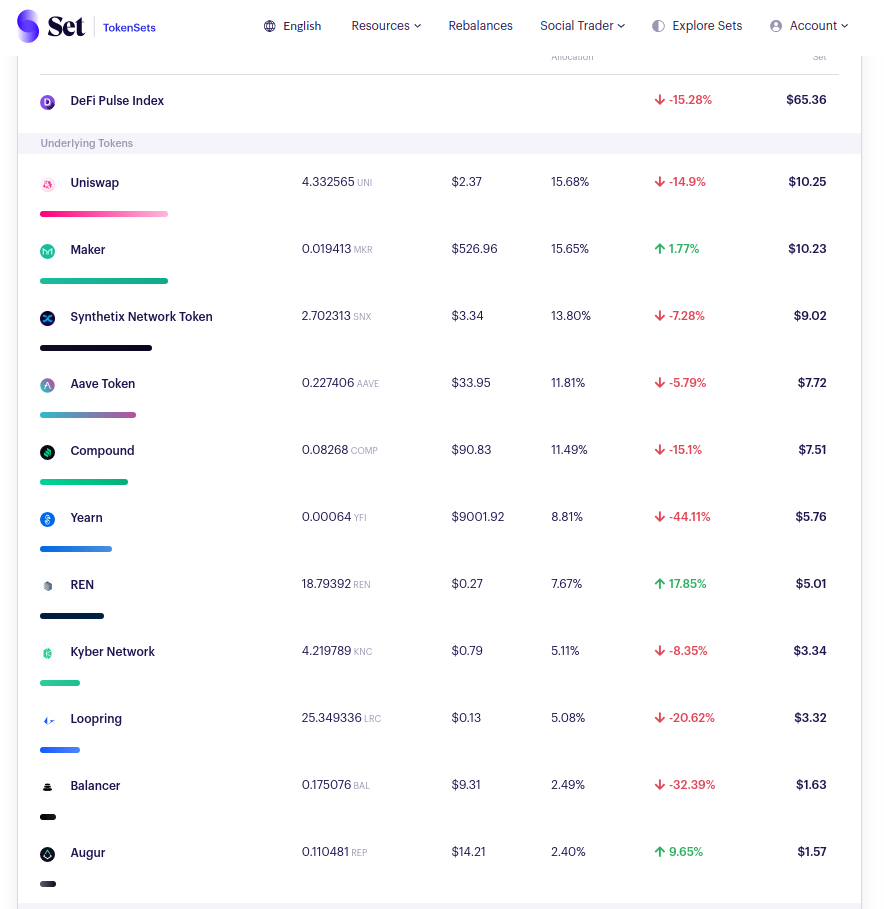

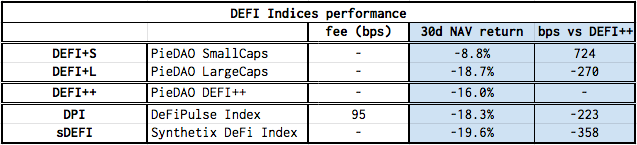

**DPI **is Set’s DEFI index, comparable with DEFIi++.

It charges investors a 0.95% streaming fee.

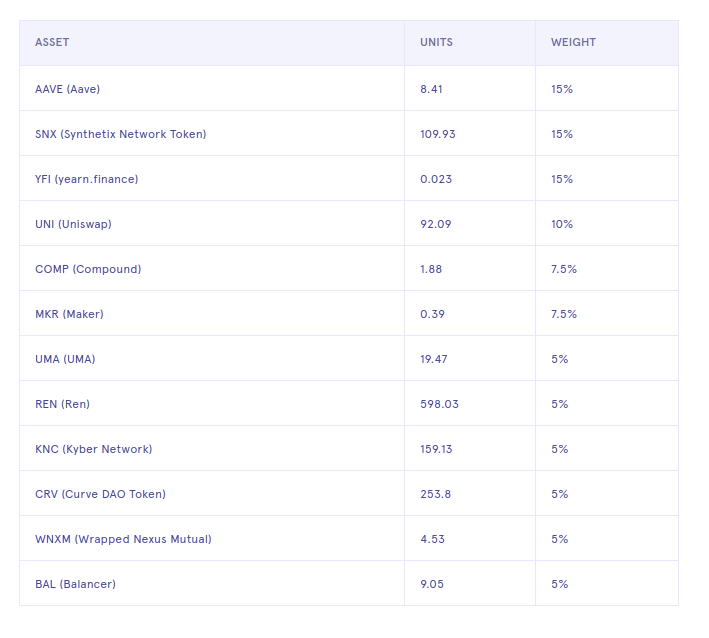

**sDEFI **is Synthetix’s DEFI index, which is also comparable with DEFI++.

Performance

- Diversification for the win

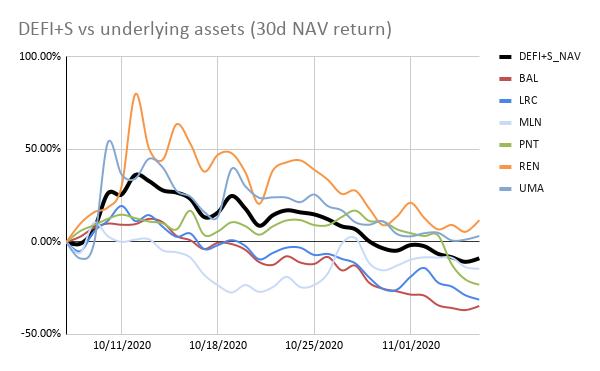

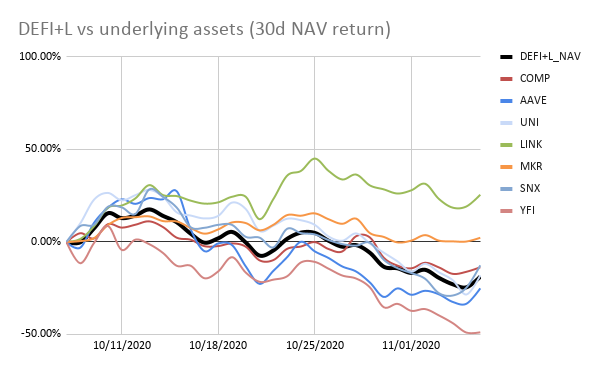

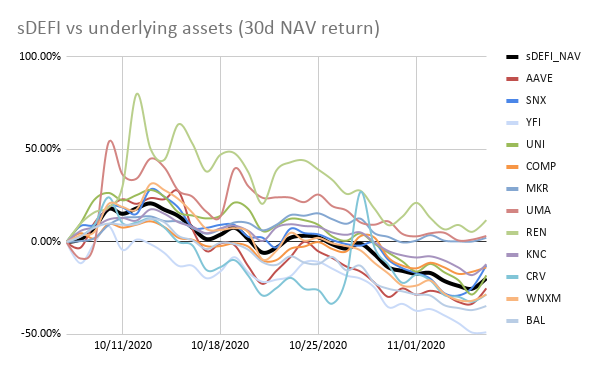

Let’s first examine how our DEFI indices performed against the individual assets they comprise, starting with DEFI+S.

As you can see in the graph above, it has been quite a rough 30 days for DEFI investors. The good news is that while DEFI+S fell 6.8% in price (feed Coingecko) and 8.8% in NAV (Net Asset Value), it outperformed all other DEFI indices, and thus the market overall.

LRC fell -31.10%, BAL -34.58%, and MLN fell -14.41%, but investors were protected from this through their balanced exposure to well-performing assets such as REN (+11.84%) and UMA (+3.26%).

It was a similar story for DEFI+L. Over the past 30 days, our Large Cap index fell by -18.7% in NAV, still hedging investors from their exposure to YFI (-48.79%) and AAVE (-25.04%), among others with negative performance.

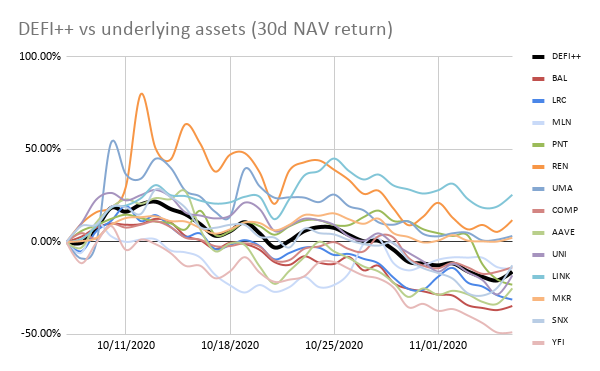

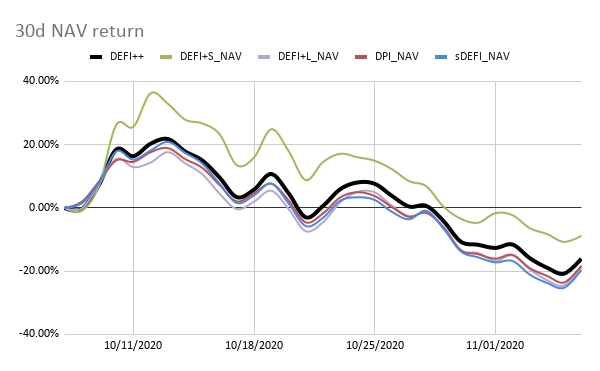

Back-testing the performance of our newcomer DEFI++ Index, relying on an allocation of 70% for DEFI+L & 30% for DEFI+S.

DEFI++ scored -16% over the past 30 days, from October 7th to November 6th, outperforming most other DeFi indices.

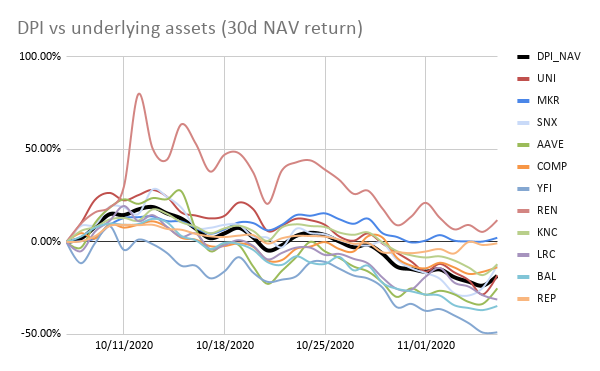

DEFI Pulse Index (DPI), over the past 30 days fell by -18.3% in NAV, still hedging investors from their exposure to YFI (-48.79%) and BAL (-34.58%), among others negative performances.

Similarly, backtesting the performance of Synthetix’ sDEFI Index according to their last allocation introduced as of October, over the past 30 days this fell by -19.6% in NAV, still hedging investors from the negative performance of YFI (-48.79%), BAL (-34.58%), Curve CRV (-28.31%) and the Wrapped Nexus Mutual WNXM (-28.32%), among others negative performers.

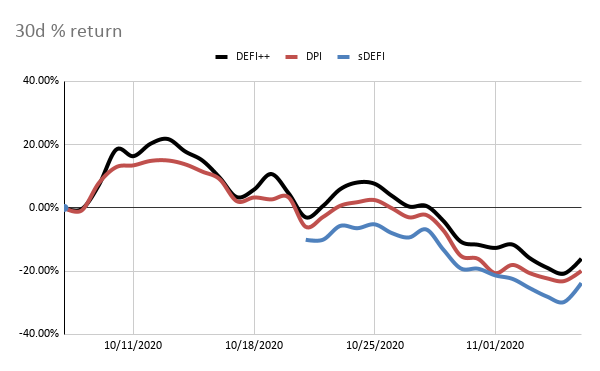

In short, DEFI++ outperformed both DPI and sDEFI from a NAV analysis, protecting investors 2.23% vs DPI and 3.58% vs sDEFI

Comparing DEFI Indices

This is where it really gets interesting.

As you can see from the graph, overall DEFI++ would have outperformed all other DeFi Indices, excluding PieDAO DeFi+S’ incredible+724 bps (basis points).

Specifically, DEFI++ would have outperformed both Synthetix’ sDEFI and DefiPulse’s DPI by -358 bps & -223 bps respectively (not including the additional -95 bps streaming fee nominally applied by the latter).

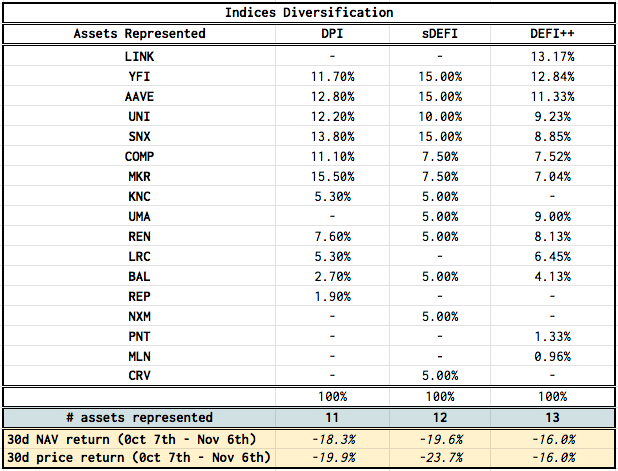

It’s also worth looking at the diversification offered by the above indices, shown below.

As we can see, DEFI++ currently offers a diversification of over 13 underlying assets, sDEFI over 12 assets (although not physically owned), and DPI over 11 assets. We hypothesised that greater diversification would see greater performance, and our backtesting has shown this to be the case.

A note on pie building: Allocation in DEFI ++ is computed for all underlying assets considering their average 30 days Market Capitalization (capped to 20% in DEFI+S & DEFI+L) and weighing this out for a 20% through a Market Sentiment score voted in by PieDAO’s community, assessing for each asset its Innovation, Functionality to the DeFi Ecosystem and its Growth Potential.

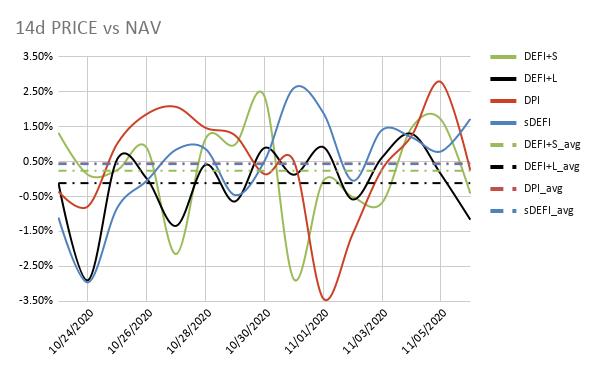

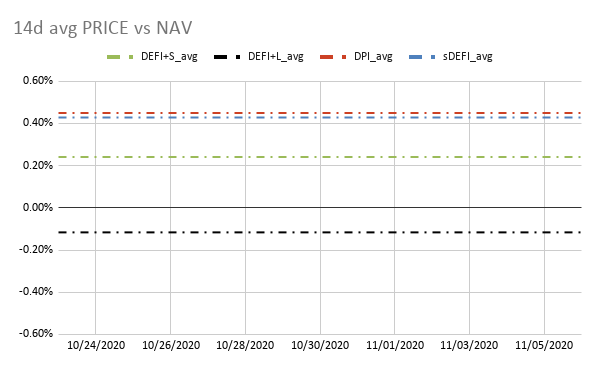

A final aspect covered with this analysis is the % difference between the trading Price and the Net Asset Value (NAV) of different indices. We here considered the past 14 days to allow a better price stabilization from the beginning of trading for many of these indices.

Considering the 14 days avg of this Price-NAV difference it seemed fairly clear how some indices are consistently trading at Premium vs NAV, specifically +0.45% for DPI, +0.43% for sDEFI, and +0.24% for DEFI+S, while DEFI+L has been trading on average at Discount (-0.12%) vs the NAV of its underlying assets, representing an opportunity for investors looking to buy it out from the open market.

Would you like to earn many cryptocurrencies right now! ☞ CLICK HERE

Looking for more information…

☞ Website

☞ Explorer

☞ Source Code

☞ Social Channel

☞ Message Board

☞ Coinmarketcap

Create an Account and Trade Cryptocurrency NOW

☞ Bittrex

☞ Poloniex

☞ Binance

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#cryptocurrency #bitcoin #blockchain #piedao defi++ #defi++