For any startup, finance is a key issue. Attracting financing is not an easy task due to the high risk factor and the complex process of launching startups. There is also another problem — finding the right way to work with investors interested in your project.

Knowing how investment rounds are divided and what requirements for startups should be met can help greatly. At each stage, money is attracted for clearly defined tasks, but there are also some limits to financing. Why else is funding divided into rounds? Because it gives investors a clear understanding of what stage a particular startup is at and what tasks it is currently solving.

In this article, we will talk about each of the rounds in detail, including its tasks, opportunities, and “pitfalls”. We will also give you answers to the following questions:

- How Does Funding Work?

- What Is Pre-Seed Funding?

- What Is Seed Funding?

- What is Series A Funding?

- What is Series B Funding?

- What is Series C Funding?

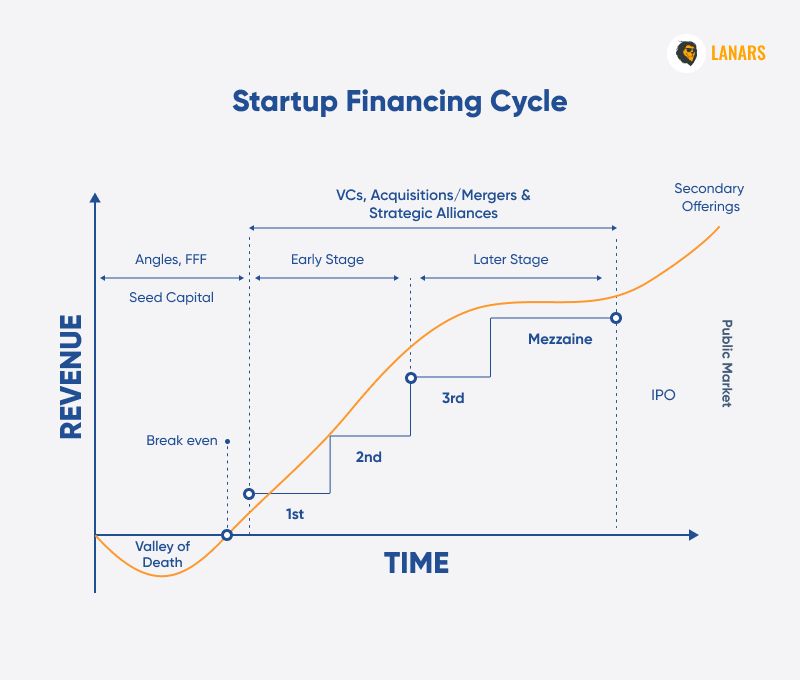

How Does Funding Work?

First, it is good to know what venture capital means. Venture capital is money from private investment funds or companies for the development of startups in their very early stages. A venture capitalist receives an equity stake in the company being funded. Venture fund holders often invest in startups at the idea level, if it looks promising to them, hoping for big profits in the future.

The distinguishing feature of venture capital investments is the high degree of risk. CB Insights has found that “70% of upstart tech companies fail — usually around 20 months after first raising financing (with around $1.3M in total funding closed).” However, the profit from one successful transaction can cover the losses of dozens of failures.

The main task of a venture investor is to find a company that can become the next new Facebook or Amazon in the future. A company that can grow into a large corporation from a small startup, with a $10K stake, can earn the investor $1 million as a result. That’s what makes venture investments the most profitable, but at the same time, the most risky.

As a rule, the period of venture investment is 7-10 years. After that, investors sell their shares in the company on exchanges or to strategic buyers. Most investment funds operate in the homeland of venture capital investments — the United States. About 1000 venture funds operate here, most of them are concentrated in Silicon Valley. The most famous are Andreessen Horowitz, Sequoia Capital, Accel Partners, Google Ventures, to name a few.

To understand how venture investment works, you need to know that each startup goes through certain development levels, with each development level associated with an investment stage. Conventionally, there are several defined stages: pre-seed, seed, Series A, B, and C. We’ll focus on each major stage in more detail below. However, some companies can go on to Series D and Series E funding rounds as well.

#pre-seed #seed #series-a #series-b #series-c #startups #funding