What is Rai Reflex Index (RAI) | What is Rai Reflex Index token | What is RAI token

RAI is a non pegged, ETH backed stable asset. It is useful as more “stable” collateral for other DeFi protocols (compared to ETH or BTC) or as a stable asset with an embedded interest rate.

What is Reflexer?

Reflexer is a platform where anyone can use their crypto collateral to issue reflex indexes. Reflex indexes are stable assets that are not pegged to anything, very similar to how the US Dollar is not pegged and it is still considered stable.

Reflex indexes dampen the volatility of their underlying collateral. They are useful as more “stable” collateral for other DeFi protocols (compared to ETH or BTC) or as stable assets with embedded interest rates that supercharge other DeFi protocols.

What is RAI?

RAI is an ETH backed reflex index with a managed float regime. The RAIUSD exchange rate is determined by supply and demand while the protocol that issues RAI tries to stabilize its price by constantly de or revaluing it.

The supply and demand mechanic plays out between two parties: SAFE users (those who generate RAI with their ETH) and RAI holders (those who hold, speculate on or use RAI in other protocols and apps).

Compared to protocols that try to defend a fixed exchange rate between their native stable asset and fiat (DAI/USD, sUSD/USD etc), RAI’s monetary policy offers a couple of advantages:

- Flexibility: the protocol can devalue or revalue RAI in response to changes in RAI’s market price. This process transfers value between SAFE users and RAI holders and incentivizes both parties to bring the market price back to a target chosen by the protocol. The mechanism is similar to countries devaluing or revaluing their currencies in order to combat a trade imbalance. The “trade imbalance” in RAI’s case happens between RAI and SAFE users

- Discretion: the protocol itself is free to change the target exchange rate to its own advantage. It can attract or repel capital whenever it wants.

How does RAI work?

The long term price trajectory of RAI is determined by the demand for ETH leverage. RAI tends to appreciate if SAFE users deleverage and/or RAI users long and it depreciates in case SAFE users leverage and/or RAI users short.

To better understand how RAI behaves, we need to analyze its monetary policy which is made out of four elements:

- Redemption price: this is the price that the protocol wants RAI to have on the secondary market (e.g on Uniswap). The redemption price is used by SAFE users to mint RAI against ETH and it is also used during Global Settlement in order to allow both SAFE and RAI users to redeem collateral from the system. The redemption price almost always floats and it does not target any specific peg

- Market price: this is the price that RAI is traded at on the secondary market (on exchanges)

- Redemption rate: this is the rate at which RAI is being devalued or revalued. The process of devaluing/revaluing RAI consists in the redemption rate changing the redemption price

- Global Settlement: settlement consists in shutting down the protocol and allowing both SAFE and RAI users to redeem collateral from the system. Settlement uses the redemption (and not the market) price to calculate how much collateral can be redeemed by each user

Let’s walk through an example of how RAI is revalued in case of ETH capital inflow (aka people are bullish on ETH):

- At time T1: ETH price is $500, RAI’s market and redemption prices are both $5

- At time T2: ETH price surges to $1000. RAI SAFE users suddenly have more borrowing power and generate more RAI against their collateral. SAFE users sell RAI on the secondary market (Uniswap), causing RAI’s market price to crash to $4

- At time T3: ETH remains at $1000 and RAI’s market price is still $4. The system wants the market price to get close to the redemption price. In order to eliminate the imbalance between the market/redemption prices, the system starts to revalue RAI. Revaluing consists in setting a positive redemption rate which makes the redemption price grow every second

- At time T4: ETH remains at $1000. RAI’s redemption price is now $5.1. SAFE users are starting to realize that they can now borrow less RAI per one ETH, they can redeem less ETH during Settlement (because RAI is now more expensive) and that it will be more expensive to close their SAFE once the market price follows the redemption price. At the same time, RAI holders are starting to realize that they can redeem more and more ETH during settlement and they can also “earn yield” by holding RAI and assuming that the market price will (at some point) surge toward the redemption

- At time T5: ETH remains at $1000. RAI’s redemption price is now $5.2. RAI’s market price surged to $5.2 as a result of:

- SAFE users buying RAI in order to close their positions as soon as possible instead of later on when RAI is more expensive

- RAI holders incrementally buying more RAI in order to “earn” more yield as a result of the eventual market price surge

- When RAI is devalued (in case of ETH capital outflow), the opposite thing happens:

- SAFE users realize that they can mint more RAI against their ETH and that they will be able to buy cheap RAI once the market price tanks

- Token holders realize that they can redeem less ETH during Settlement and, in order to earn money, they need to short RAI

Is RAI a stablecoin?

No. Stablecoins are pegged or oscillating around a specific value (usually pegged to fiat coins such as USD, EUR etc).

RAI, on the other hand, is not pegged to anything. The system behind RAI only cares about the market price getting as close as possible to the redemption price. The redemption price will almost always float (thus, it won’t be pegged) in order to compel system participants to bring the market price toward it.

Is RAI a rebase token?

No. The protocol doesn’t change the amount of tokens you have. Rather, it changes the target (or redemption) price that the protocol wants RAI to have on the secondary market (on exchanges).

Will I be charged fees?

The Reflexer app is free to use. However, you will need to pay transaction fees when you interact with the protocol’s smart contracts and, depending on the features you use, fees associated with RAI itself such as the Stability Fee and/or the Redemption Rate.

What is the redemption rate?

The redemption rate is similar, but not identical, to an interest rate. Its role is to devalue or revalue RAI in response to market forces.

What is the borrow rate/stability fee?

The stability fee is an interest rate charged to users who deposit collateral and mint RAI. The fee is used to incentivize external parties to maintain the protocol as well as build a surplus buffer meant to settle bad debt.

What are your plans to governance minimize RAI?

RAI will be governance minimized over three stages. We have a dedicated guide with more details about the governance minimization process. The Reflexer team will keep the community up to date with the exact timeline of each stage.

Why would I hold RAI when the system devalues the token?

This is exactly what the system wants you to ask yourself when it charges a negative redemption rate. The system is trying to incentivize RAI holders to sell and bring the market price down and close to the redemption price.

Can you summarize what users should do so they can take advantage of the PID?

- When the redemption rate is positive, SAFE users should repay their debt, RAI users should buy more RAI

- When the redemption rate is negative, SAFE users should mint more debt, RAI users should sell/short RAI

Can you summarize the behaviour of the RAI redemption rate?

- When RAI’s market price > redemption price for a sustained period of time, the redemption rate will become negative

- When RAI’s market price < redemption price for a sustained period of time, the redemption rate will become positive

- When RAI’s market price = redemption price for a sustained period of time, the redemption rate will become zero

Why would I want to hold something that is not pegged and yet does not behave like ETH or BTC?

We often get this question from people who are used to holding assets such as DAI or USDC which seem more “stable” because they try to target a specific peg.

While it is true that the mechanism behind RAI may cause more uncertainty vs pegged coins because of the floating redemption price, it also comes with its own perks:

- RAI is trader friendly. A trader can, for example, analyze the market sentiment as well as look at the current redemption rate in order to decide on whether they should long or short RAI

- RAI holders (longs) can benefit from exposure to a positive redemption rate (revaluation)

- Shorts may also benefit from RAI devaluation

It is also worth considering that only some fiat currencies are pegged, while others float and they are still considered “stable”. The most well known example of a stable currency with no peg is the US Dollar. Check out this classification of exchange rate arrangements which shows the full spectrum of stability.

Why would I want to mint RAI?

We have both short and long term plans meant to attract borrowers and improve the experience of interacting with the protocol:

- Getting paid for opening and managing SAFEs: when RAI is devalued, SAFE users are “paid” because the value of their debt shrinks compared to the value of their collateral

- Capped borrow rate: in the long run, RAI will have a capped (and small) borrow rate which makes the cost of maintaining a SAFE more predictable. Governance can, in theory, set the borrow rate to 0% although this prevents the system from accruing surplus that’s used to update core components such as oracles and the PID. A 0% borrow rate would also prevent the protocol from building a surplus buffer meant to settle bad debt that couldn’t be covered by collateral auctions

- Insurance for SAFEs: in the long run we can allow SAFE users to attach a wide variety of insurance contracts meant to protect their positions against liquidation

- No exposure to assets with counterparty risk: RAI will only be backed by ETH. Borrowers are not exposed to riskier crypto assets or real world collateral

- Superior collateral factors: as we improve the efficiency of our and add insurance contracts for SAFEs, we can lower the collateral requirements for borrowing RAI

What are RAI’s use-cases?

The following is a non-exhaustive list of use-cases we envision for RAI:

- Portfolio diversification: RAI offers dampened exposure to ETH’s price moves

- Source of yield: traders can earn “yield” when RAI’s market price follows the redemption price

- DeFi collateral: RAI can be used as an ETH supplement or alternative collateral in DeFi protocols due to the fact that it dampens ether’s price moves and gives users more time to react to market shifts

- DAO reserve asset: DAOs can keep RAI on their balance sheet and get exposure to ETH without being affected by its full market swings

What are the risks of using Reflexer and RAI?

There are several risks associated with using Reflexer and RAI, ranging from smart contract bugs to suboptimal parameters set in the protocol. You can check our dedicated risks page for more details as well as read more about each protocol module.

What are the assumptions behind RAI’s mechanism?

RAI’s success depends on three main factors:

- Narrative: similar to other protocols (ranging from Multi Collateral DAI to L1’s such as Bitcoin and Ethereum), people need to believe that a system works in order for it to actually work

- Liquidity: the more liquidity RAI has, the harder it is for malicious parties to manipulate its market price

- The presence of arbitrageurs: similar to other stable assets, there need to be traders who arb the difference between the asset’s market and redemption (or target) prices

It’s worth noting that the narrative attracts liquidity and arbitrageurs which in turn can further strengthen the narrative.

Introducing Proto RAI

A stepping stone in on-chain control theory

After months of research and building, we’re excited to unveil our first, full Ether backed asset called Proto RAI!

What is Proto RAI?

Proto RAI (PRAI) is an unaudited mainnet demo of our upcoming reflex index called RAI. PRAI is managed and repriced by a primitive version of our on-chain, autonomous PID controller. Check our whitepaper for a description of the controller and for the system as a whole.

The purpose of this demo is to test and improve our tooling and smart contracts, bootstrap an initial group of keepers that liquidate undercollateralized positions as well as gather live data which can help us update our market model and simulations. This is why in the first couple of weeks we will focus exclusively on developers. After we finish our initial audits we will invite more people to join.

If you would like to monitor the system, you can use this simple dashboard.

How Do I Create PRAI?

In order to create PRAI, you need to deposit Wrapped ETH into a smart contract and open a new position which we call a “Safe”.

At this stage we do not have a webapp to facilitate the creation of PRAI although we encourage developers to use our Typescript and Python libraries as well as our CLI in order to interact with the system. This video guide and our documentation walk you through using the Typescript library with proxy contracts in order to generate PRAI backed by (W)ETH.

We advise everyone to exercise caution and avoid using large amounts of Ether when they test the system. Do not risk more than you can afford to lose.

What Can I Do with PRAI?

Currently you can trade PRAI for ETH using this Uniswap V2 pool. Please be aware that the pool does not have a lot of liquidity.

Key System Parameters

There are several system parameters that everyone should be aware of:

- Debt ceiling: 10200 PRAI. This is the maximum amount of PRAI that can be issued at the moment using Safes

- Minimum collateralization ratio: 150%

- Initial PRAI redemption price: $2.015. We chose this number because it symbolizes the year when Ethereum launched (2015).

- Liquidation penalty: 11%. This is needed in order to avoid auction grinding attacks.

- Collateral auction fixed discount: 5%. This is the discount at which the system sells ETH (confiscated when liquidating a Safe) compared to Ether’s last recorded market price in the OSM. The discount is meant to incentivize keepers to participate in collateral auctions and recapitalize the system. You can read more about the collateral auction mechanism here.

- Minimum amount of PRAI that must be generated by a Safe: 85 PRAI. This ensures that the total amount of debt confiscated (in the case of a liquidation) is greater than the gas cost incurred for doing so and thus keepers have an incentive to liquidate Safes.

- Maximum amount of PRAI that can be generated by a Safe: 255 PRAI. This is a temporary limit meant to make it more expensive to hit the current (and small) debt ceiling in one transaction.

- (W)ETH annual stability fee/borrow rate: 1.5%

- Minimum & maximum 24H redemption rate: -/+20%

Bumpy Start

After we deployed the system, we discovered that we did not properly set authorized addresses inside the ERC20 PRAI contract. Because of this, we were not able to add new authed accounts or remove old ones.

We decided to disable the original CoinJoin contract which allows users to transfer PRAI between the core system and the ERC20 contract. Users (mostly bots that traded in the old Uniswap pool) who hold old PRAI tokens can now call the old CoinJoin in order to join() tokens inside the system. They can then use the latest CoinJoin and Coin contracts in order to get new PRAI tokens and trade using the new Uniswap PRAI/ETH pool.

We also had to disable the old treasury and abandon the initial Uniswap v2 PRAI oracle in favor of new versions that are integrated with the latest Coin/CoinJoin.

RAI is Live

Crypto native stability backed by ETH and available for all

After almost a year of testing, simulations and building, we’re thrilled to announce the launch of RAI! RAI is an ETH backed, non pegged stable asset whose monetary policy is managed by an on-chain, autonomous controller. You can start to mint RAI today using our dashboard. RAI was deployed at this address and the Uniswap v2 RAI/ETH market is here.

Prior to this launch, Proto RAI, our mainnet demo, ran smoothly for almost 3 months and was shut down on 25th of January. We’ve received great support from our community who put more than $612K worth of ETH in the demo and minted almost 52K PRAI.

Proto RAI also showed for the first time how a stable asset can lack a peg and instead have its redemption price float in response to market forces. PRAI’s redemption price started at $2.015 and then floated between $1.937 and $2.06. This happened with no professional market makers, almost no liquidity and a lack of arbitrageurs which would have made PRAI significantly more stable. Moreover, during the PRAI demo, ETH went from about $400 to $1400, a 350% increase, while PRAI’s redemption price fluctuated less than 4%.

To summarize PRAI’s behaviour, when its market price was consistently above the redemption price, redemption would start to go down. Similarly, if the market price was consistently below the redemption price, redemption would start to go up. You can read more about how the system behind P/RAI works in our FAQ.

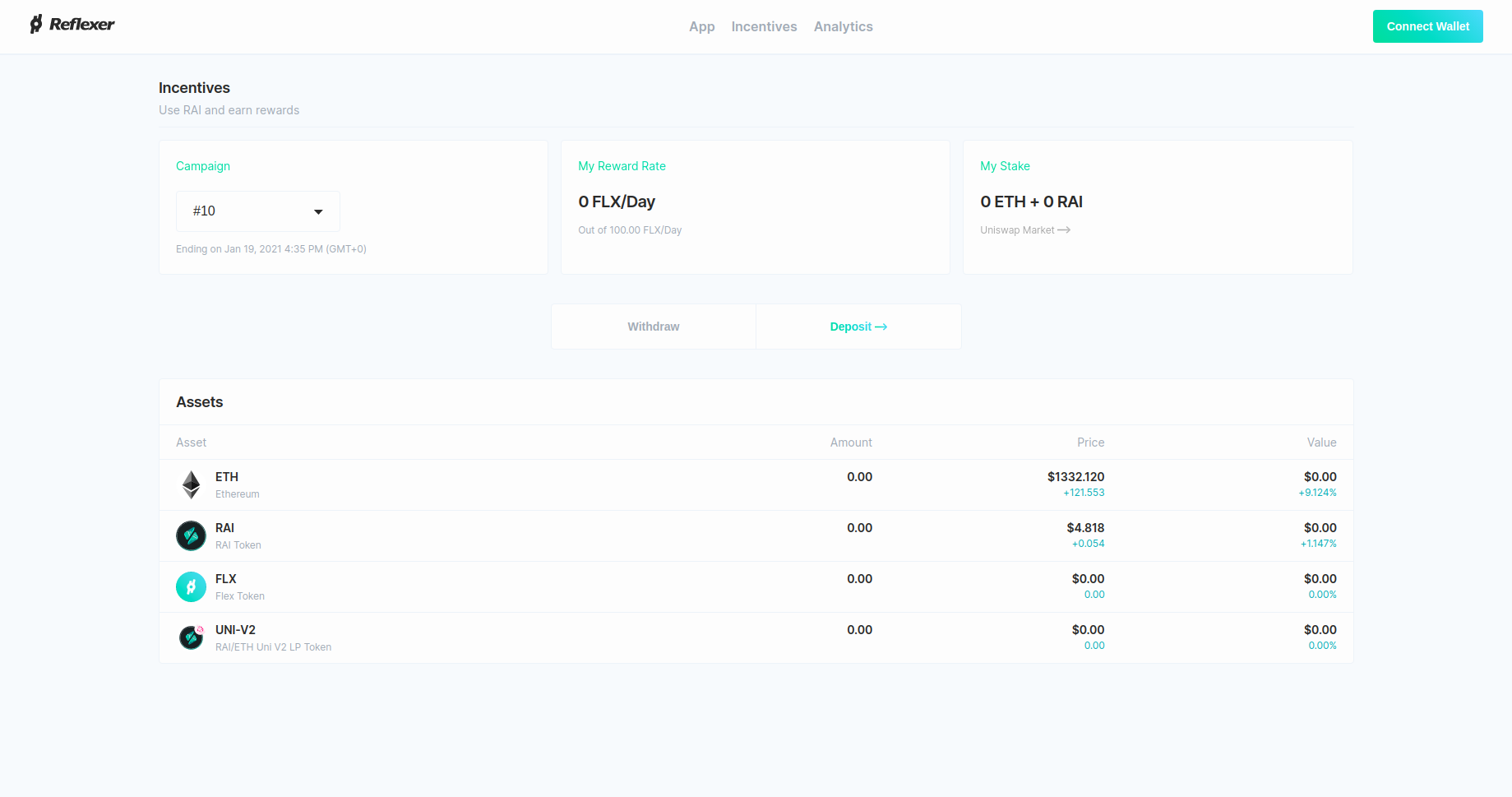

Liquidity Incentives

In the next couple of weeks we will announce our liquidity mining program for the RAI/ETH Uniswap v2 pool. At that point, we will also reveal the Reflexer ungovernance token, FLX.

In the meantime, we’re not saying that there will be retroactive mining rewards for the initial cohort of RAI/ETH LPs, but we’re also not saying there won’t be.

Before the liquidity mining announcement, you can test our Kovan liquidity mining dashboard.

Kovan Liquidity Mining Interface

Phased Controller Launch

For the time being and until RAI has enough liquidity on Uniswap v2, the controller will be weaker than usual. We will soon update the community with the minimum amount of liquidity that must be on exchanges so that the controller is not easy to manipulate. Until then, we encourage you to check our PID risks documentation before using RAI.

RAI Parameters

RAI was launched with a starting redemption price of $3.14. From this point on, RAI will continue to float while it is managed by the protocol’s on-chain controller.

In the foreseeable future, we plan to set an annual RAI borrow rate between 2–4%. We believe that a rate in this range will be able to provide the system with enough capital so it pays keepers to maintain oracles and the controller as well as fill the surplus buffer.

You can read more about the rest of the parameters in our docs.

Security

Proto RAI has been beta tested for almost 3 months on mainnet Ethereum. The core contracts were audited by OpenZeppelin and the helper contracts (oracles, PID etc) were audited by Quantstamp and Solidified. However, audits do not guarantee that smart contracts are bug free so we advise everyone to be cautious when using the protocol.

We have an open bug bounty program where you can earn up to $30K. We also wrote here in more detail about major risks associated with using RAI.

Resources

Whitepaper: https://github.com/reflexer-labs/whitepapers

Documentation: https://docs.reflexer.finance/

Video Guide on How to Create PRAI: https://www.youtube.com/watch?v=6rD7MjUaJUA

Stats Dashboard: https://stats.reflexer.finance/

Mainnet Subgraph: https://thegraph.com/explorer/subgraph/reflexer-labs/prai-mainnet

Uniswap PRAI/ETH Pool: https://info.uniswap.org/pair/0xEBdE9F61e34B7aC5aAE5A4170E964eA85988008C

Looking for more information…

☞ Website ☞ Explorer ☞ Explorer 2 ☞ Whitepaper ☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Message Board ☞ Coinmarketcap

Would you like to earn RAI right now! ☞ CLICK HERE

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ Binance ☞ Bittrex ☞ Poloniex ☞ Bitfinex ☞ Huobi

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#blockchain #bitcoin #rai reflex index #rai