Chief Scientist, Managing Partner at Invector Labs. CTO at IntoTheBlock. Angel Investor, Writer, Boa

The crypto market might seem incredibly boring to traders these days with Bitcoin and Ethereum behaving like stablecoins 😉. However, a handful number of crypto-assets are showing an atypical momentum non-correlated with the rest the space. Among those crypto-assets, none is capturing the imagination of crypto-speculators like ChainLink. In the last few days, ChainLink has been regularly hitting all-time highs despite challenging the lack of momentum of the top crypto-assets.

The ChainLink protocol is tackling one of the hardest problems in the blockchain ecosystem by enabling the integration of off-chain data sources into smart contracts. However, the recent momentum of the LINK has little to do with the merits of the protocol and has been fueled by trading speculation. Let’s look at some revealing metrics.

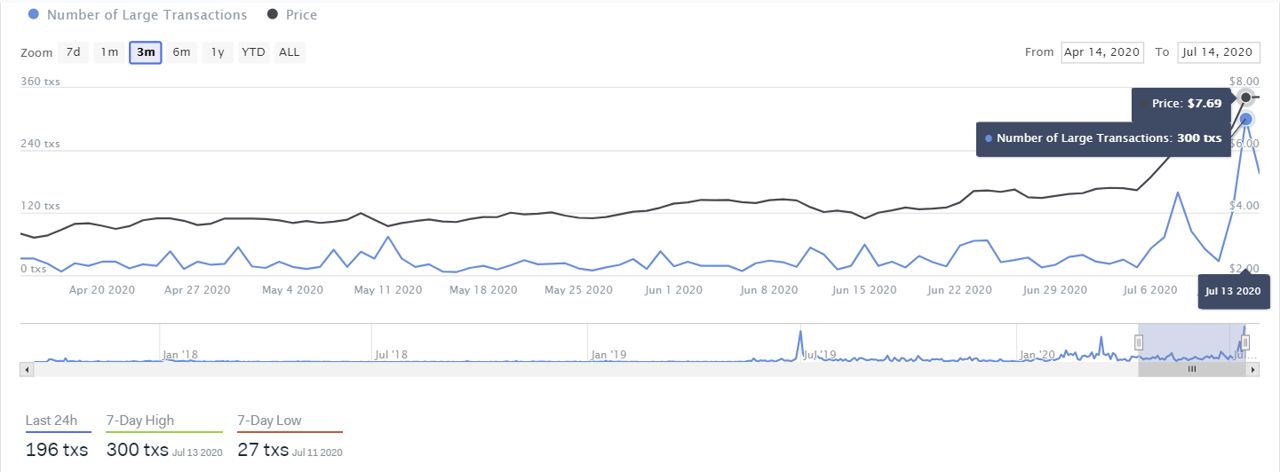

1) The number of transactions over $100,000 in ChainLink has increased 15x in 3 months

Large transaction used to be an exception in LINK. IntoTheBlock’s large transaction analysis shows that there were only 22 LINK transactions over $100,000 in mid-April. Well, that number skyrocketed to over 300 in July 13rd. How is that for a measure of speculation.

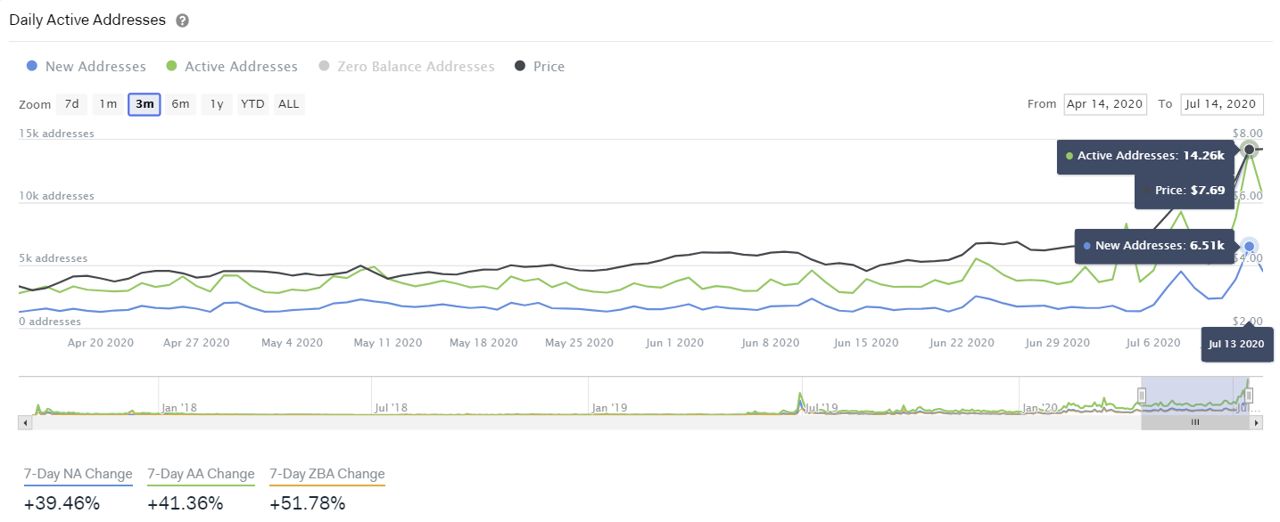

2) New and active addresses in ChainLink has sky rocketed

The ChainLink network is growing at a healthy clip. Yes, the number of addresses is increasing but, more importantly, those addresses are active which shows a strong momentum in the network. This is shown by IntoTheBlock’s daily active addresses indicator.

#chainlink #cryptocurrency #blockchain #data #data-centric #data-centric-perspective #crypto-assets #to-the-moon