So, a couple of days ago, I got into a little squabble with my dad about what to do with some cash that I had lying around in my bank. I wanted to invest the money to generate a better interest rate than the pathetic ~0.5% offered by most banks. My dad leaned more toward just parking my money with a random advisor and trusting them to invest it while I was more inclined toward managing the money on my own. Unable to come to a conclusion, we decided that an experiment was in an order and decided to split the money in a 2:1 ratio, parking 2/3 of the money with this new, popular investment firm and leaving 1/3 of the money for me to invest with.

However, when I started to look into the firm, I got a little wary — especially since they kept promoting themselves as a “data-driven” firm and had all these cool graphics. Here’s the article outline (and tl;dr)

tl;dr

- The firm: Singapore finance company, boasting data driven solutions and proprietary systems

- Problems:

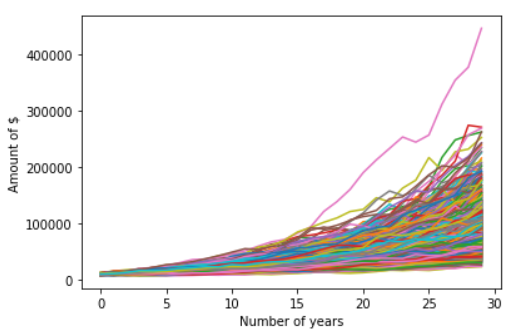

- a. Inaccuracy/Unreliability of simulations: The accuracy of simulations/models are contingent on the accuracy of their input. Running a model 1,000 or 1,000,000 times does not increase its forecasting accuracy if the inputs are flawed to begin with. Hence, their 1,000 simulation forecasts aren’t that impressive.

- b. Historical Returns + Fees: Historical returns (which is used by the company for projection) are never indicative or provide certainty about future returns. Also, fees affect return rates.

- Conclusion: Nothing wrong with investment companies doing such projections but we, as consumers, must be mindful that they aren’t always the most accurate thing

The Company

The firm bills itself as a “Singapore-based financial technology company that empowers people to take control of their financial future”. I’ve highlighted the “financial technology company” part because that’s where this company really sells themselves highly, contrasting this ‘advanced’ technological approach to traditional financial advisors. Their mission statement goes on to explain that they use a “proprietary system [to] provide data-driven wealth advice in constructing personalised solutions.” Wow — to the ordinary folk, this all sounds really cool and (to use a Singapore colloquialism) cheem. Data-driven advice? Proprietary system? Sign me up BABY.

#monte-carlo-simulation #python-pandas #investing #data-science #financial-services