What is Modefi (MOD) | What is Modefi token | What is MOD token

Modefi’s main objective is developing Oracle blockchain solutions that empower true decentralization of data on-chain for integration via Smart Contracts. Modefi’s suite of Oracle solutions will provide higher level transparency, precise data, and a fully trustless ecosystem.

Oracle manipulation has been one of the biggest culprits when it comes to contracts and DeFi hacks. Protocols are exposing their users to potentially massive risks when relying on centralized or single data point oracles within their eco-systems.

Modefi’s Oracle Solution Suite will allow DeFi protocols to reduce the potential of putting their users’ hard earned capital at risk due to unforeseen circumstances.

On-Demand Oracle Solution

Leveraging Modefi’s by design decentralized model, the platform introduces the ability for developers and end users to obtain one-time and uncommon data requests to meet the demands of their custom smart contracts that are reliant on outside data sources that may not have API’s.

What is an Oracle?

A data oracle provides the transfer of real world data to smart contracts on the blockchain.

Why are Oracles needed?

Blockchains and smart contracts don’t have direct access to off-chain (real world) data. However, for many smart contracts, it is important to have relevant information from the outside world to function as intended.

This is where oracles are necessary, as they provide a connection between off-chain and on-chain executions. Oracles are extremely important to the blockchain ecosystem since they open a gateway of possibilities to smart contract uses.

The Problem

Finding a Oracle data provider is proven to be difficult for small one-off or uncommon data requirements. Typically most trusted Oracles stick with the common data outputs. E.g. The price of a popular cryptocurrency. This currently works for a large portion of data requirements on-chain at the moment, but with adoption of smart contracts in other sectors like insurance, gambling, or voting, the need for all types of data on-chain will grow exponentially.

The Modefi Solution

At Modefi we understand the importance of off-chain data requests regardless if the requirements are ongoing or one-off tasks.

The On-Demand data oracle comprises a P2P network built around smart contracts and EOA’s. It’s designed to be easy to use and integrate by end users, developers and data validators.

Data reporters (validators) may be subject to Governance, and other means of social verification. Prior to being eligible to report data, the validator bonds collateral (if required by client) and will be rewarded upon successful consensus of the data they provide. Providing incorrect or manipulated data will result in the validator being disqualified from future requests and at risk of losing their stake.

With the use of Modefi’s P2P On-Demand data oracle it opens up the possibility for small data requests ranging from a friendly wager on who will win the next presidential campaign, or a multi-million dollar decentralized sports betting platform needing the score for tonight’s big game.

What can this data be used for?

- E-Sports

- Sporting Events

- Elections

- Voting

- Weather conditions in a location at a specific time

- Prediction Markets

- P2P wagers

- Insurance Payouts

How it works

Bob and Alice decide to create a friendly wager smart contract to bet on who will win the next Presidential Election. The smart contract allows both parties to submit their pick and deposit the wager amount. The wager smart contract is programmed to only accept the winning result from a custom oracle contract deployed on the Modefi network.

The oracle contract is deployed automatically after Bob and Alice fill out all the relative information on the Modefi oracle dApp.

This information includes but is not limited to

- Brief description of the data requested

- Where the result data should be sourced from

- List of potential outcomes

- Event timer

- Required number of validators for consensus

- Required value of tokens staked by validator

- Minimum reputation

- Validator Incentive

Once the oracle contract is deployed and the required timer has expired, eligible validators can start submitting their results. After the minimum number of validators have submitted data, the contract will reach consensus and the results will be available on-chain for the wager contract to react accordingly. The wager contract will then allow the winner to withdraw their funds.

Decentralized Aggregated Oracle Solution

There is a big problem with today’s oracle providers, which is currently inhibiting them from reaching their potential value and use cases. Oracles at present are not fully trustless, transparent or decentralized. When oracles can overcome this problem, adoption will scale to an entirely new level and into the mainstream with it bringing an influx of money into the Decentralized Finance markets.

What is an Oracle?

A data oracle (such as Chainlink, Tellor, Band etc.) provides the transfer of real world data to smart contracts on the blockchain.

Why are Oracles needed?

Blockchains and smart contracts don’t have direct access to off-chain (real world) data. However, for many smart contracts, it is important to have relevant information from the outside world to function as intended.

This is where oracles are necessary, as they provide a connection between off-chain and on-chain data. Oracles are extremely important to the blockchain ecosystem because they open a gateway of possibilities to smart contract uses.

The Oracle Problem

Since smart contracts execute decisions based on data provided by oracles, they are key to a healthy blockchain ecosystem. The main challenge with designing oracles is that if the oracle is compromised, the smart contract relying on it is also affected. This is often referred to as The Oracle Problem.

Since oracles are not part of the main blockchain consensus, they are unfortunately not part of the security mechanisms that public blockchains can provide. The trust conflict between third-party oracles and the trustless execution of smart contracts remains a mostly unsolved issue.

Man-in-the-middle attacks can also be a threat, where a malicious actor gains access to the data flow between the oracles and the contract and modifies or falsifies the data.

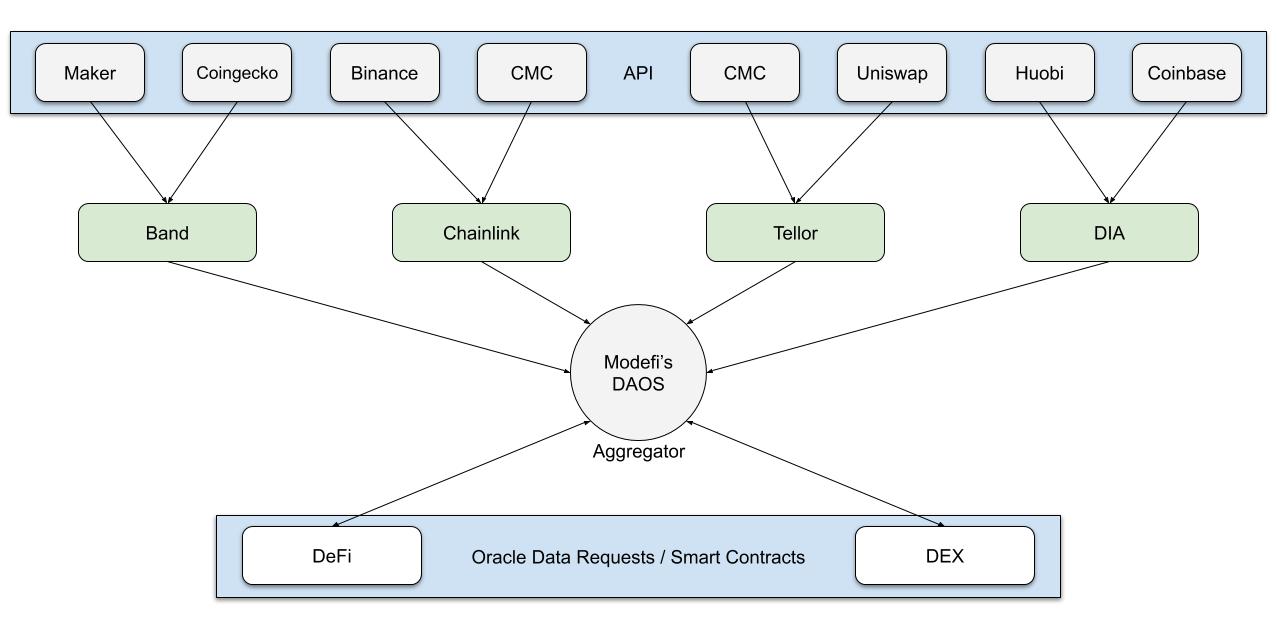

The Modefi DAOS Solution

Modefi integrates major oracle and data providers to use them as complementary entities instead of treating them as competition. Integrating multiple oracles into the platform gives clients using Modefi’s DAOS the ability to obtain trustless, transparent, secure, and decentralized data.

Aggregation of on-chain data

To maximize the security and precision behind the data provided by an Oracle, multiple Oracles across multiple networks must be used simultaneously. Outliers, malicious actors, and

corrupt data are removed autonomously with no outside interaction through the use of Smart Contracts and multiple transparent data sources.

Modefi’s DAOS is a game-changing solution for DeFi, and clients that require the utmost reliable and trustless oracle data. It’s time to put an end to one of the most extensive problems known to blockchain once and for all.

Modefi Sale Details / Tokenomics

Token Name: Modefi

Token Ticker: MOD

Token Type: ERC20

Max Total Supply: 22 Million

Circ. Supply on Listing: 2,860,000.00 MOD

Uniswap Listing Price: $0.24

Marketcap on Listing: $686,400.00

Venture — 3 M MOD tokens — $0.12 each

20% unlock on listing Vested for 90 Days

Strategic — 1.4 M MOD tokens — $0.18 each

15% unlock on listing Vested for 90 Days

Public — 7 M MOD tokens — $0.20 each

20% unlock on listing Vested for 60 Days

Token Distribution

Sale (Vesting 60–90 Days) — 11.4 Million MOD

Fully released after 90 Days

Team (Locked for 6 months, then 3 years vesting) — 1.5 Million MOD

Fully released after 3 years and 6 months

Foundation (Unlocked — Non circulating) — 4.5 Million MOD Marketing, Strategic Partners, Advisors, Infrastructure, Development and Exchanges

Core Partners (Locked for 6 months, then 3 years vesting) — 2 Million MOD Fully released after 3 years and 6 months

Validation / Staking Rewards / AD (No lock, 1 year vesting) — 1.95 Million MOD

Fully released after 1 year

Uniswap Tokens for Liquidity ~650,000 MOD

Looking for more information…

☞ Website ☞ Explorer ☞ Explorer 2 ☞ Whitepaper ☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Message Board ☞ Coinmarketcap

Would you like to earn MOD right now! ☞ CLICK HERE

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ Binance ☞ Bittrex ☞ Poloniex ☞ Bitfinex ☞ Huobi

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#cryptocurrency #bitcoin #modefi #mod