What is ARMOR token

Introduction

We are on the verge of an unprecedented financial revolution built upon the key features of DeFi: composability and permissionless access.

Insurers are financial first-responders

Traditional financial institutions and investors are taking note of DeFi.

However, DeFi protocols are largely open source, making them an easy target for hackers. Repeated large-scale hacks could prevent DeFi from achieving mainstream adoption.

Insurance makes sense to buy for those who might not recover from losses potentially incurred by smart contract risks.

Armor is a DeFi coverage aggregator to secure and scale adoption.

Armor is a smart insurance aggregator for DeFi, built on trustless and decentralized financial infrastructure.

Armor’s V1 Product Suite provides _Pay as You Go and Only Pay What You Owe _coverage for user funds across various protocols.

Users may cover their assets against smart contract risks across popular protocols such as Uniswap, Sushiswap, AAVE, Maker, Compound, Curve, Synthetix, Yearn, RenVM, Balancer and more. Soon custodial and centralized exchange asset coverage will be made available too.

Armor tracks exact amounts of user funds as they dynamically move across various protocols, keeping up with the rapid pace and movement of the modern DeFi investor, and bills by the second using a streamed payment system. The result is minimized costs and maximized flexibility.

Armor’s coverage is underwritten by Nexus Mutual’s blockchain-based insurance alternative, with added features:

- Permissionless access without sign-up requirements

- Pay as you go coverage across various protocols

- Flexible amount / duration coverage, only pay what you owe

Collaboration Over Competition

Other Blue-Chip DeFi protocols such as Uniswap, Sushiswap, Compound, Aave, Curve, Synthetix achieve their goals through the creation of permissionless pooled resource markets powered with decentralized governance.

Insurance products in DeFi usually seek to create coverage capacity in their own unique ways.

Armor recognizes asset coverage as a complex problem which requires a dynamic, adaptable approach to connect coverage capacity with user demand. This is why Armor’s product suite includes the ability to aggregate coverage providers should an option become suitably competitive.

Armor will aggregate and bring to market pooled and permissionless solutions powered with a simple and easy user experience which abstracts the complexity under the hood to fill unmet demand.

Armor ensures — in the easiest manner to date — that funds a user held on vulnerable platforms will be protected.

In a similar manner to Chainlink which provides oracle services from anywhere to anyone on chain and has been systemically important to the adoption of DeFi with developers…

We envision Armor will become just as important to the mass adoption of DeFi both with institutions and individuals.

At launch, Armor coverage will be underwritten by Nexus Mutual (similar to how re-insurers work in traditional finance).

Armor also introduces arNXM, which is the yield bearing token for the arNXM vault. arNXM can be traded freely with incentivized liquid markets, as a complete replacement for wNXM which also accrues staking rewards realized by a steady increase in value of arNXM through its swap rate with the vault.

Where one day, 1 arNXM may be swapped for 1 wNXM, through the activities of the vault, on a later date 1 arNXM may be swapped for 1.5 wNXM, 2 wNXM or more. This steadily increase in value may be realized by the token holder in a completely passive manner.

The best use of the NXM token is to productively deploy it to generate yield and returns for the owner through provision of coverage capacity to Nexus Mutual.

Armor’s arNXM vault achieves this goal by abstracting the responsibilities of staking, risk and yield management to Armor’s governance and multisig product leaders.

More information on the arNXM token and vault may be reviewed here.

Hybrid Decentralization

The $ARMOR token officially ensures the ArmorDAO is sufficiently decentralized within the first token distribution launch event.

The Armor protocol will require continuous updates and tweaks to maintain a competitive edge. To maintain future compatibility and ensure the accommodation of interface changes, it is necessary to launch the contracts with proxies.

The proxies are controlled with a new hybrid system.

There is a timelock owned contract which controls everything with two owners: a team multisig and a full DAO (functional and accessible at launch through direct contract interactions, user-friendly interface provided at a later date).

Each can delete proposals from the other. This allows us to launch with and maintain full agility while ensuring token holders can influence and control the protocol from day one.

This enables shared community ownership for Armor as publicly-owned and self-sustainable infrastructure with a flexible and agile governance system.

Initial governance parameters

- 0.1% of ARMOR total supply to submit a governance proposal

- 4% of ARMOR supply required to vote ’yes’ to reach quorum

- 7 day voting period

- 2 day timelock delay on execution

ARMOR Allocation

1 billion ARMOR have been minted at genesis and will become accessible over the course of 2 years. The initial two year allocation is as follows:

65.00% to Armor community members 650,000,000 ARMOR

- 36.5% Community DAO Treasury with 2-year vesting

- 14.25% reserved for participants in the 24-week launch distribution event

- 14.25% reserved for strategic backers to enhance the position and longevity of Armor protocol within the Ethereum ecosystem with 2-year vesting

35.00% to Armor team members with 2-year vesting 350,000,000 ARMOR

- 16.266% to future team and contributors

- 18.044% to seed team

- 0.69% to advisors

Specific details with respect to tokenomics may be reviewed here.

The 2-year vesting is based on Aave’s model and will look something like this:

- 80% of ARMOR is locked at launch

- 60% of ARMOR is locked after 6 months from launch

- 40% of ARMOR is locked after 12 months from launch

- 20% of ARMOR is locked after 18 months from launch

- 0% of ARMOR is locked after 24 months from launch

All vested tokens, whether for DAO treasury, strategic backers or team members will have tokens locked up on an identical schedule.

Note: There is no pre-mine. Team will NOT farm ARMOR as the goal is to sufficiently decentralize the protocol and give the community full reward opportunities.

Community Treasury

36.5% will be reserved for the DAO treasury which can be used by the community to support the long-term development of the ecosystem, for further product growth programs and to ensure the Armor protocol grows sustainably long term. A community-managed treasury opens up many exciting opportunities which will ideally foster a spirit of experimentation. Hence, solid governance principles will be critical in ensuring the most optimal distribution of this treasury. The following allocations are suggested at launch:

- 1% — bug bounties

- 6% — educational programs

- 12% — development grants

After 30 days from Sunday 24 Jan 2021, governance will reach its vesting cliff and Armor governance will control all ARMOR vested to the Armor treasury. At this point, governance can vote to allocate ARMOR towards grants, strategic partnerships, governance initiatives, additional reward pools, and other programs.

ARMOR holders may also vote to add more pools with the upcoming Snapshot.page off-chain token governance system.

Bootstrapped Growth Program

Of the 65% of the ARMOR genesis supply allocated to Armor community members, 14.25% of the total supply (142,500,000 ARMOR) has already been allocated for distribution in a 24–week Liquidity and Utilization Rewards Program.

The 24 week token distribution event will enable the ArmorDAO to release the V1 Product Suite over a 4 week phased rollout period, and also release the V2 Product Suite in 2–3 months allowing also for a 4 week phased rollout period.

This will allow for a variety of tests to be conducted which would enable the complex Armor product suite to scale user acquisition self-sustainably without token subsidization during or following the conclusion of the 24 week token distribution event.

Liquidity and Usage Token Rewards

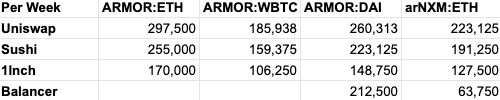

To start, users may earn ARMOR rewards by LPing for ARMOR pairs and for arNXM pairs (arNXM detailed below) on Uniswap, Sushiswap, 1inch, Balancer and Bancor, as well as staking NFTs and also from buying coverage in the smart system or shield vaults.

The rewards program will begin Sunday 24 Jan 2021, continuing for 24 weeks.

Armor V1 Suite Launch Schedule

- DEX pools will be seeded using 1% of the ARMOR token supply, this supply will not be used to earn ARMOR rewards and will be returned to the DAO treasury when appropriate.

- Phase 1 (24 Jan) will see a release of the arNXM yield vault for NXM and wNXM swaps to the new arNXM token. In addition, a number of reward pools will begin distribution to incentivize liquid markets for the arNXM and ARMOR tokens.

- Phase 2 (29 Jan 1800 UTC) will see a release of the Smart Cover System and arNFT staking pool along with reward emissions for usage and staking.

- Phase 3 (5 Feb 1800 UTC) will see a release of the Armored Shield Vaults for a number of token pairs selected for their high liquidity and trading volume for yield-based coverage.

- Phase 4+ Implementation of referral rewards system and begin processes for airdrop rewards.

Specific details on the launch schedule may be reviewed here.

DEX Liquidity mining (begins Sunday 24 Jan 2021)

These $ARMOR tokens are not subject to vesting or lock up. Tokens are loaded to reward contracts weekly and are open to change based on community feedback.

Uniswap

ARMOR:ETH | Info | Add Liquidity | Trade | Earn Rewards

ARMOR:WBTC | Info | Add Liquidity | Trade | Earn Rewards

ARMOR:DAI | Info | Add Liquidity | Trade | Earn Rewards

arNXM:ETH | Info | Add Liquidity | Trade | Earn Rewards

Sushiswap

ARMOR:ETH | Info | Add Liquidity | Trade | Earn Rewards

ARMOR:WBTC | Info | Add Liquidity | Trade | Earn Rewards

ARMOR:DAI | Info | Add Liquidity | Trade | Earn Rewards

arNXM:ETH | Info | Add Liquidity | Trade | Earn Rewards

1inch

ARMOR:ETH | Info | Add Liquidity | Trade | Earn Rewards

ARMOR:WBTC | Info | Add Liquidity | Trade | Earn Rewards

ARMOR:DAI | Info | Add Liquidity | Trade | Earn Rewards

arNXM:ETH | Info | Add Liquidity | Trade | Earn Rewards

Balancer (98:2 low IL)

ARMOR:DAI | Info | Add Liquidity | Trade | Earn Rewards

arNXM:ETH | Info | Add Liquidity | Trade | Earn Rewards

Next steps

- Users with NXM and wNXM tokens may swap their tokens for arNXM on https://armor.fi/arnxm-vault then provide liquidity on DEX pairs as described above. Once liquidity is added, the LP tokens must be staked on a rewards contract to begin earning ARMOR rewards.

- Users who want to buy arNFTs for staking rewards in phase 2 may mint them here https://armor.fi/mint (if cover is sold out, please try again within 24 hours. More staked NXM will expand coverage capacity.)

- Users who seek to earn ARMOR tokens through providing DEX liquidity may refer to the section above for details. Once liquidity is added, the LP tokens must be staked on a rewards contract to begin earning ARMOR rewards.

Contracts

Tokens

ARMOR Token:

0x1337def16f9b486faed0293eb623dc8395dfe46a

arNXM Token:

0x1337DEF18C680aF1f9f45cBcab6309562975b1dD

arNFT Token:

0x1337def1e9c7645352d93baf0b789d04562b4185

Misc

arNXMVault Master:

0x7eFf1f18644b84A391788923d53400e8fe455687

arNXMVault Proxy:

0x1337DEF1FC06783D4b03CB8C1Bf3EBf7D0593FC4

ReferralRewards Master:

0xefF1CDc3CC01afAB104b00a7D9cd09619B94ae8F

ReferralRewards Proxy:

0x1337DEF1C79053dA23921a3634aDbD12f3b748A5

FarmController Master:

0x0bdb7976c34ab05e5a9031f258b8956f68ee29cf

FarmController:

0x1337DEF159da6F97dB7c4D0E257dc689837b9E70

Multisig Admin:

0x1f28eD9D4792a567DaD779235c2b766Ab84D8E33

Timelock Owned:

0x1337def11d788e62a253fea846a505ee1b57623f

Looking for more information…

☞ Website ☞ Explorer ☞ Explorer 2 ☞ Whitepaper ☞ Social Channel ☞ Social Channel 2 ☞ Social Channel 3 ☞ Message Board ☞ Coinmarketcap

Would you like to earn ARMOR right now! ☞ CLICK HERE

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ Binance ☞ Bittrex ☞ Poloniex ☞ Bitfinex ☞ Huobi

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#blockchain #bitcoin #crypto #armor