What is Trinity Protocol (TRI) | What is TRI token

What Is Trinity?

In short, Trinity is a novel protocol that combines the unique mechanisms of several recently successful DeFi projects:

- Auto liquidity generation

- Frictionless yield generation

- Automated buybacks and token burns

Not only do these mechanisms work synergistically to automatically build liquidity, transactional volume, and yield, they provide the TRI token a real-world use case as a “liquidity bridge” for fledgling DeFi projects.

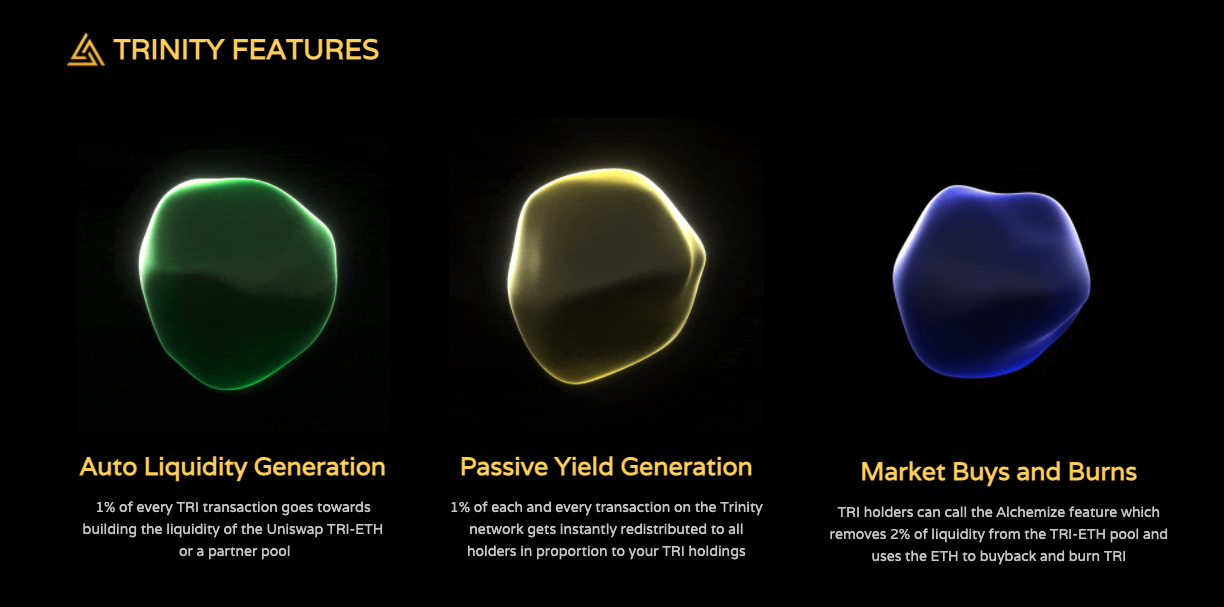

Trinity’s 3 Core Features

1. Proof of Liquidity (PoL) — Perpetual Liquidity Generation For Any TRI Pairing

Trinity’s Proof of Liquidity (PoL) mechanism automatically uses 1% of every transaction involving TRI to automatically build liquidity in its native TRI-ETH pool, or any whitelisted pool paired with TRI.

This ensures an ever-growing liquidity pool that’s attractive to traders, investors and arbitrageurs.

Specifically, the Trinity Proof of Liquidity mechanism:

- Stores 1% of every TRI transaction inside of the contract (Note: this number can be adjusted up to 5%)

- Once the stored TRI reaches X tokens (this threshold can be modified), a portion of the stored TRI will be market-sold and UNIV2 liquidity tokens will be generated and locked inside the contract

- A portion of these TRI will go towards the initiator of the transaction since this “auto liquidity add” function consumes a high amount of gas

Although automatically generating liquidity is not a novel feature, Trinity’s innovation is the** ability to auto-generate liquidity on ANY Uniswap token pair with TRI**, not just TRI-ETH.

This improvement makes it attractive for other projects to partner with Trinity because this PoL mechanism will market-buy the partner project tokens when creating liquidity on the pair.

Eventually, multiple partner pairings will create a multi-token “liquidity web” which opens up profitable trading and arbitrage opportunities that then serve to generate yields for all TRI holders (see next core feature).

2. Passive Yield Generation — Perpetual Rewards Without Staking

Trinity improves upon RFI’s passive yield generation mechanism which distributes instant rewards to every single token holder on each transaction.

Here’s how this mechanism works:

To start, 1% of every TRI transaction is automatically and instantly distributed to all holders in proportion to their TRI holdings.

This allows every single holder to benefit from transactions on the TRI network, without the need for staking or transferring tokens. This allows for more secure, passive and gas-efficient yield generation.

This feature is particularly attractive to liquidity providers because you will receive additional TRI tokens on top of the default 0.3% Uniswap fee. These rewards can act as a hedge against impermanent loss.

The percentage of each transaction that is distributed to holders can be adjusted from 1–5% and will be governed by the Trinity DAO (see roadmap below).

Additionally, TRI has a special Liquidity Treasury that generates interest from this mechanism and sends these TRI rewards periodically to liquidity providers as added incentives.

3. Liquidity Alchemy — Perpetual Price Appreciation Through Market Buybacks and Burns

Trinity’s first two features work best when there’s high transactional volume on the network, which will be organically achieved and sustained through multiple partner pools.

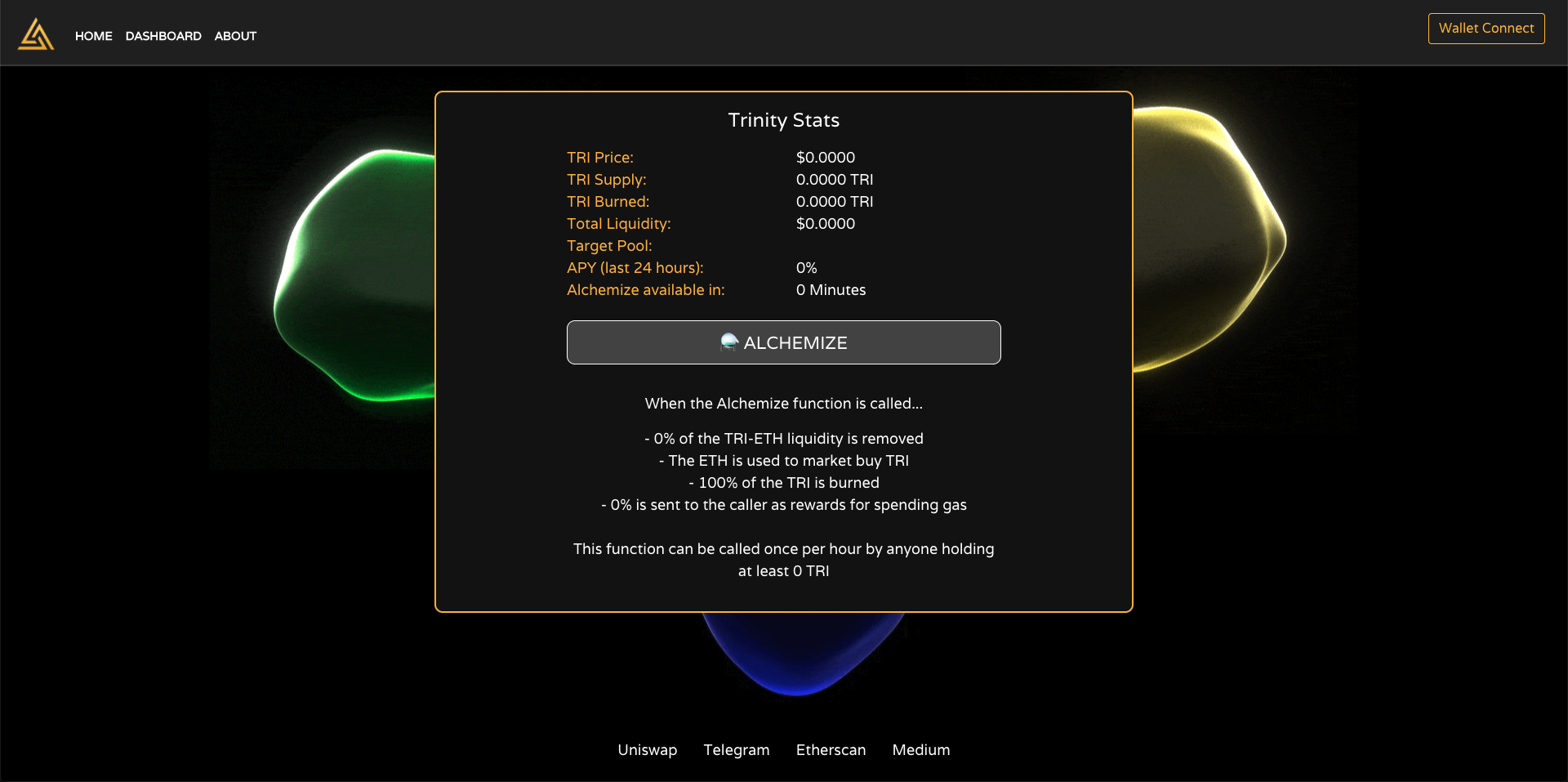

Yet as an additional driver for transaction volume, TRI has an “Alchemize” function that transforms 2% of it’s native liquidity pool into ETH which is then used to market-buy and burn TRI.

This mechanism was inspired by ITS and helps create consistent buy pressure and price appreciation for Trinity, while keeping the supply deflationary.

Here’s what happens when the Alchemize function is called:

- 2% of the liquidity from the TRI-ETH pool is removed and split into ETH and TRI

- The ETH is used to market buy TRI

- 95% of the TRI is burned

- 5% of the TRI is sent to the function caller (to incentivize user spending gas)

This function may be called once per hour by holders with at least 1,000 TRI tokens. Users can access the Alchemize function via the Trinity dashboard.

Trinity’s Use Case As A Liquidity Connector

While Trinity’s core features have all been validated as they were directly inspired from a few recently successful DeFi projects, the protocol’s true value comes from having a real-world use case in the overall DeFi ecosystem.

Trinity leverages its liquidity generation and passive staking features through partnerships with other DeFi projects, many of which are in early stages and in need of more liquidity and trading volume.

The Trinity protocol can easily re-route it’s auto-liquidity generation mechanism to target partner pools (TRI-PARTNER).

Besides generating more attention for TRI through cross-community promotions, these synergistic partnerships allow for more transaction volume on the Trinity network, which in turn generates yields for all holders and liquidity providers.

Here’s what a typical partnership would look like:

- Project A is looking for more buyers and liquidity providers for their token, ATOKEN

- Project A market buys TRI and creates a Uniswap TRI-ATOKEN pool

- This partner pool is whitelisted and, 1% of all transactions on the TRI network will go towards generating liquidity for the TRI-ATOKEN pool via Trinity’s PoL mechanism

- Additionally, all TRI-ATOKEN liquidity providers will receive additional rewards generated by the TRI’s passive yield mechanism and the Liquidity Treasury (more info below)

- Once the partner liquidity-generation period ends, TRI can partner with a new project or switch the liquidity-generation target back to its own ETH pool

One thing to note is partnerships create additional buy pressure for the TRI token because partners have to market buy TRI with ETH in order to access Trinity’s liquidity building features and treasury rewards, as well as gain exposure to Trinity’s community of DeFi investors and traders.

Trinity’s Liquidity Treasury

Trinity’s Liquidity Treasury will be funded with 500,000 TRI at the time of initial deployment. This principle amount can never be transferred or removed.

The interest generated by Trinity’s passive staking mechanism is automatically sent to liquidity pools as added incentives for liquidity providers.

TRI Roadmap

With how quickly things move and change in the DeFi space, teams need to be constantly iterating and pivoting to stay relevant in the space. That’s why we have a flexible roadmap with the high-level outcome of connecting to as many partner projects as possible while giving governance to the TRI holders.

- Develop tokenomics and features

- Develop contract, front end website and dAPP

- Audit contracts

- Secure initial partnership

- Launch TRI on Uniswap

- Set up social profiles and apply to CG

- Start influencer marketing campaign

- Community growth and bounty campaigns for partnerships

- Secure project partnerships 3–4

- Develop TRI App and stats dashboard

- Create TRI DAO for governance

- Transfer contract ownership to governance contract

A more detailed roadmap with timelines will be released during the launch week.

TRI Governence

The TRI protocol allows for adjustable fee and rewards rates, which allows it to be more dynamic than previous protocols with similar mechanisms. For example, RFI has a default 1% fee that can never be changed. Trinity allows this fee to be modified up to 5%, which allows for higher yields for holders.

Because the contract owners can change these parameters, we’ve also hardcoded limits to ensure the security of the protocol — that it can’t ever be “rugged”.

Still, you could argue the contract owner has too much control over the protocol which is why we are planning to release governance in the upcoming weeks, once the Trinity protocol is up and running.

This way, these rates and fees can be set via community voting rather than unanimously by the contract creator.

TRI Audit

Although Trinity has been thoroughly tested before deployment, it’s still an experimental project as it combines mechanisms from different protocols. That’s why we got an audit to make sure the contracts are free from bugs and vulnerabilities, as well as optimized for gas fees.

The audit was conducted by Swipe’s Chief Architect, Genji Sakamoto**. **All of the issues presented in the audit were fixed and tested before deployment.

Click here to view the audit report

Disclaimer: Despite being audited and bug tested, Trinity is still an experimental protocol to use at your own risk.

TRI Launch

Trinity will be fair-launched directly to Uniswap on December 14, 2020.

Although our dev team is experienced in the original protocols TRI draws inspiration from, our team understands the natural skepticism DeFi market participants have when it comes to investing in new projects from anonymous teams.

That’s why instead of raising a presale, we decided to bootstrap 40 ETH of initial liquidity ourselves and list directly to Uniswap.

In addition, we will lock 100% of the starting liquidity:

- 75% of the initial liquidity will be locked for over a year

- The remaining 25% will be locked a month

The plan is to take out only the initial liquidity float (40 ETH) after a month, relock the rest and re-invest this 40 ETH towards development, partnerships and marketing.

Again, this is a fair-launch project with no VC-backing. Our vision is to build a fully decentralized liquidity-connection protocol that will help the growth of the DeFi ecosystem. We hope to attract like-minded community members who can really help this project grow to new heights.

TRI Tokenomics

- **Total starting supply: **10,000,000 TRI

- **Liquidity Treasury (additional rewards for LPs): **5% (Note: These treasury tokens can never be moved or transferred so they are essentially out of circulation. The purpose of this treasury is to generate interest, which will serve as rewards for liquidity providers)

- DAO Treasury (for partnerships and growth): 5%

- Marketing: 7.5%

- **Team: **2.5%:(Locked for 4 weeks)

- Starting Liquidity: 8,000,000 TRI / 40 ETH

Would you like to earn many tokens and cryptocurrencies right now! ☞ CLICK HERE

Looking for more information…

☞ Website

☞ Explorer

☞ Source Code

☞ Social Channel

☞ Documentation

☞ Coinmarketcap

Create an Account and Trade Cryptocurrency NOW

☞ Binance

☞ Bittrex

☞ Poloniex

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#blockchain #bitcoin #crypto #trinity protocol #tri