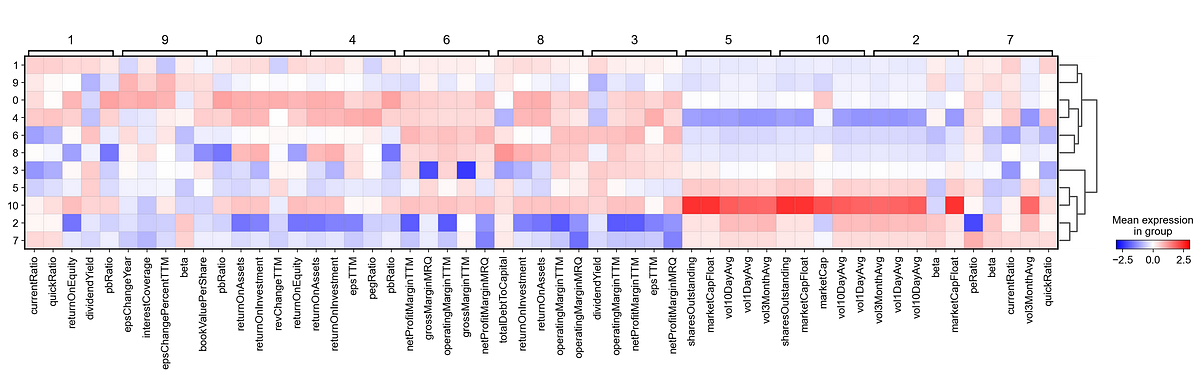

In 2020 August, the author started out as a demonstration to adopt the Single-Cell Genomic Analyses (SCGA) in the business and finance world. The SCGA has a high number of features (Up to 56k genes/features) and also frequently known to have low signals in high backgrounds. Here, the author sought to characterise S&P 500 companies during covid19 period, based on fundamental financial metrics.

We know that the Standard & Poor’s 500, or simply the S&P 500, is a stock market index that measures the **stock performance of 500 large companies **listed on stock exchanges in the United States. It is one of the most commonly followed equity indices, and many consider it to be one of the best representations of the U.S. stock market. It also makes a reasonable good and sufficient stocks universe to pick some good companies to form an investment portfolio based on an Alpha that we defined.

#finance #machine-learning #data-science #fundamentals #covid19