What is XUSD Stable | What is XUSD token | What is XUSD Coin | What is XUSD Share

$XUSD: A Fair Launched Innovative Decentralized Stablecoin Protocol

TL;DR_ $XUSD is a Fair Launched Partial-Collatetalized Stabecoin._

What is XUSD

XUSD is a partial-collateralized stablecoin with a novel stability mechanism, and unlike other over-collateralized or fully algorithmic stablecoins, XUSD employs a partial-collateralized model, which means parts of XUSD supply is backed by collateral and parts of the supply is algorithm controlled, this makes XUSD capital efficient and truly stable:

- Capital Efficient: No over-collateralization

- Stable: Partially backed by the assets in collateral pools, less reflexivity, avoid “death spiral”

How Does XUSD Work

XUSD protocol is a two token system: the stablecoin XUSD and the share token XUS. The system works as follows:

1. Dynamic target collateral ratio according to XUSD price

- When XUSD price is over the threshold (1+δ), the system decreases the target collateral ratio

- When XUSD price is below the threshold (1- δ), the system increases the target collateral ratio

- Collateral ratio starts at 100% and updates every hour at a step of 0.25%

2. Mint & Redeem

- Users mint XUSD with collateral token and XUS, the ratio between the collateral token and XUS is determined by current target collateral ratio, e.g. Current collateral ratio is 80%, to mint 100XUSD, Alice has to put $80 worth of DAI and $20 worth of XUS into the DAI collateral pool, XUS is burned during the minting process.

- Users can also redeem their XUSD, its the opposite process of minting, during redemption, you burn your XUSD and get back the collateral and XUS.

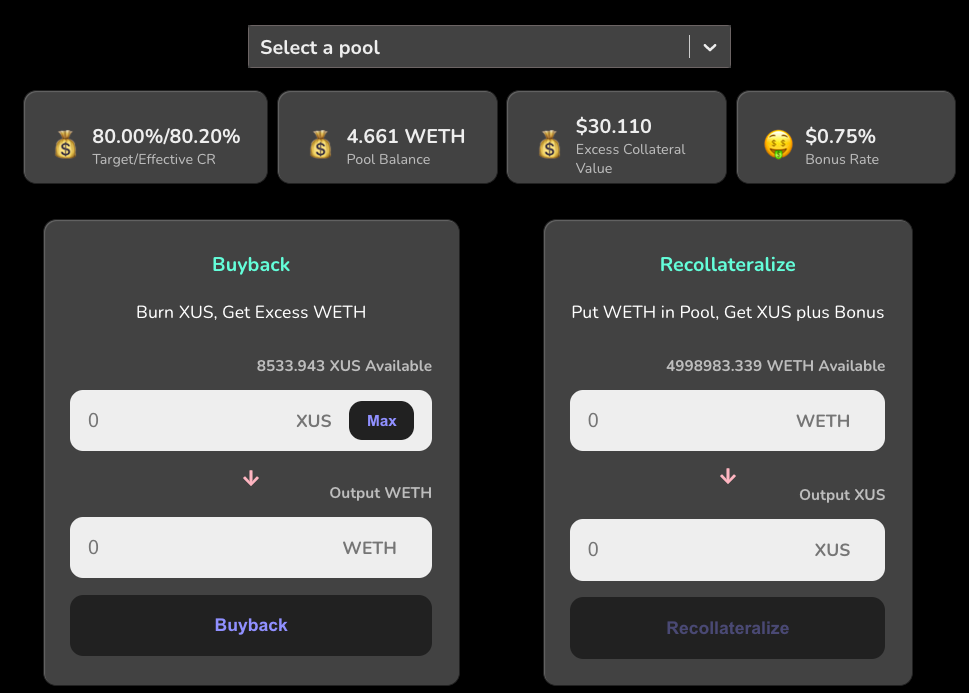

3. Buyback & Recollateralize

- Buyback: When the effective collateral ratio is above the target collateral ratio, users can burn their XUS and get the excess collateral in the pool.

- Recollateralize: When the effective collateral ratio is below the target collateral ratio, users can put collateral into the pool and get XUS plus a 0.75% bonus.

4. Mint/Redeem Fees

- 0.7% minting & 0.3% redemption fee at launch, decrease to zero gradually

- Gathered to contract XUSDFeePool

- Fees will be used to buyback XUS or distributed to XUS holders

5. Initial Collateral Pools:

- WETH pool

- DAI pool

- More to come: BAC, MIC, AMPL, etc.

To fully understand how XUSD works, please refer to our documentation: https://docs.xusd.money

Fair Token Distribution

All share tokens (XUS) are minted as a reward of the liquidity program, there is no private sale, no pre-mining, only **4% **of the reward is sent to the team address for continuous development and marketing.

Fair Distribution

- 10 million total supply

- No private sale & No pre-mining

- All XUS is minted as a reward for liquidity farming

- 4% staking rewards to dev address for development and marketing

- Only 500 XUS & 500 XUSD minted at genesis to bootstrap liquidity

XUS Staking Rewards

- 500k total supply

- Reward rate halves every month, first-month reward: min. 100k, max. 300k

- Collateral ratio(CR) boost

- — No boost when global CR is 100%

- — 3x boost when global CR is 0%

- — 3*(1-CR) boost when global CR is between 0% and 100%

Initial staking pool weights:

- XUSD/DAI LP pool: 20%, less risky, less weight

- XUS/XUSD LP pool: 40%, risky pool

- XUS/ETH LP pool: 40%, risky pool

A Step by Step Guide for XUSD User Mining

1. Mint

**Step 1: **Go to the Mintbase and select a collateral pool:

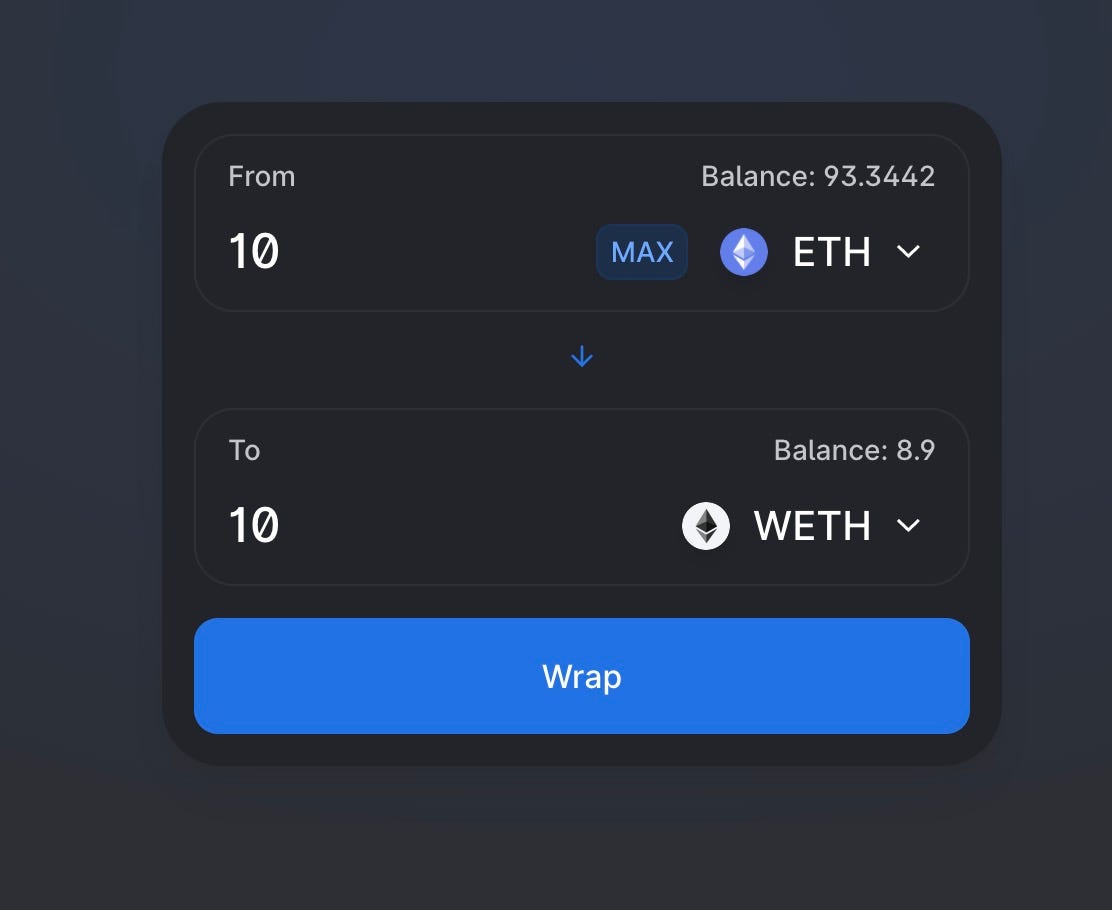

Note: When select WETH, users need to go to Uniswap DEX to wrap ETH to WETH by hand.

**Step 2: **Go to the Mint card, you have to approve both WETH and XUS

**Step 3: **After approve, fill WETH amount you want to use to mint XUSD, the XUS amount and output XUSD amount will be calculated automatically:

**Step 4: **Due to the price fluctuations of collateral and XUS, there may be slippage, so you have to set the slippage tolerance at the top bar:

Step 5: Hit Mint and wait for confirmations in Metamask.

2. Redeem

Step 1: Fill in the amount of XUSD you want to redeem, the output collateral amount and XUS amount will be auto-calculated:

**Step 2: **Hit Redeem and wait for confirmation in Metamask, then wait for the redeem transaction to complete.

**Step 3: **You have to wait for 1 block until you can claim the redemption output.

**Step 4: **Go to the Claim card, it displays the amount of collateral and XUS you can claim:

**Step 5: **Hit the Claim button and confirm the transaction in Metamask.

3. Buyback

When the effective collateral ratio(CR) is above the target collateral ratio, you can burn your XUS and get the excess collateral in the pool, this process is called Buyback.

Just input the amount of XUS you want to burn and hit the Buyback button.

4. Recollateralize

Same as above, when the effective collateral ratio is below the target collateral ratio, you can put collateral into the pool and get XUS with some extra bonus.

5. Liquidity Program

There are 4 staking pools on the bank page:

You can deposit XUSD or Uniswap ETH/XUSD LP token or XUS/XUSD LP token or BAC/XUSD LP to earn XUS reward, the pool weights are different, select the ones based on your own risk preference.

There are almost no XUS and XUSD circulating supply at launch, to bootstrap the protocol, we will hold the collateral ratio to 100% for a period of time, at this stage, minting of XUSD does not require XUS, users can mint XUSD with their WETH or DAI. After this stage, we will enable the collateral ratio refreshing function, users may need XUS tokens to mint XUSD at this stage.

Official Contracts Addresses Info

XUSD Stablecoin Token Contract Address: 0x1c9BA9144505aaBa12f4b126Fda9807150b88f80

XUS Share Token Contract Address:

0x875650dD46b60c592d5a69a6719e4e4187A3ca81

More contracts info could be found here: https://github.com/XUSDStable/xusd

Looking for more information…

Website: https://xusd.money

Github: https://github.com/XUSDStable/

Twitter: https://twitter.com/xusd_stable

Telegram: https://t.me/xusdstable

Discord: https://discord.gg/7A8zgWRtuM

Medium: https://medium.com/xusdstable

Would you like to earn XUSD right now! ☞ CLICK HERE

Thank you for reading!

#cryptocurrency #bitcoin #xusd