What is Dynamic Set Dollar (DSD) | What is DSD token

Stable coins have long played a pivotal role in the crypto ecosystem. Tether made it possible for centralized crypto exchanges to interoperate, stabilizing the frequent disparities in across exchange prices. Now, a variety of stablecoins provide a solid foundation for the growth in the nascent DeFi space. It is arguable that without stablecoins as a safe, non-volatile asset, the massive price action in DeFi would have scared away many market participants, limiting the adoption rate that DeFi has experienced. However, to this day, we have yet to emerge on a stablecoin that fulfills the needed functionality for the DeFi space while reliably maintaining its peg.

Dynamic Set Dollar

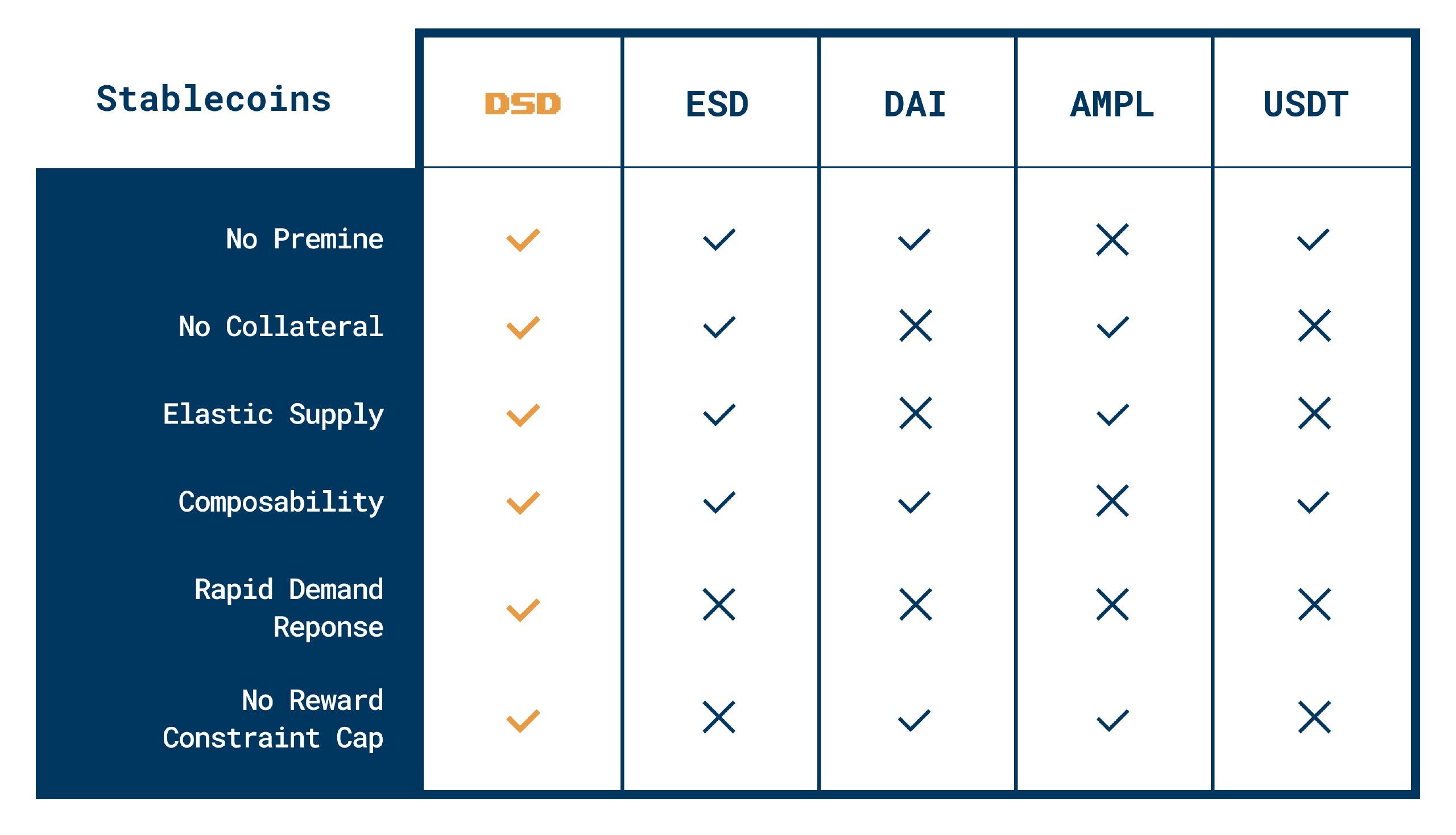

DSD builds upon successful primitives from existing stablecoin projects — particularly ESD -, replacing suboptimal functionality to achieve what we believe is the perfect stablecoin model. In this article, we showcase some of the challenges experienced by other projects, and how DSD overcomes them. As an introduction, the following chart provides a simplistic overview of the major differences between DSD and other stablecoins:

A New Approach

Lately, the concept of elastic supply as a mechanism for achieving stability is advancing in the world of decentralized finance. Elastic supply in this context simply refers to a protocol where the token price is coaxed towards a defined peg (typically 1USD) by using price oracles in conjunction with token supply controls. Elastic supply protocols dynamically expand or contract the token supply through a mechanism called a rebase. An oracle samples the token price at specified intervals so it can decide if the total token supply should decrease or increase. Limiting the token supply makes the token more scarce, which increases the value of each token, so it can adjust to the 1 USD peg. If the price is above the peg, the total token supply is increased, making the token more common, and decreasing the value of each token. Almost all rebase tokens increase and decrease the token supply by directly adjusting the amount of tokens in every token holder’s wallet.

Rebasing is a clever mechanism to adjust the price of a token, however directly increasing or decreasing the total token supply has two significant problems, one technical and one psychological. From a technical standpoint, this form of rebasing does not strictly adhere to ERC-20 standards, making interoperability with the rest of the DeFi ecosystem difficult. The ability to inherently interoperate is called **composability. **Projects that lack composability will naturally be passed over for projects that require no extra effort to integrate.

From a psychological standpoint, it can be scary to see the number of your tokens decrease and an autonomously changing token balance does not promote confidence. Lowered confidence might provoke unnecessary volatility, which is an undesirable behavior for a stablecoin.

DSD incentivizes market participants to voluntarily increase or decrease the token supply, to provide liquidity to DSD trading pairs, and to positively contribute to the long-term success and adoption of the asset. Further, the protocol leverages a variety of mechanisms to incentivize token holders in a game-theoretic battle that is carefully designed to drive the token price to trade at or near its peg.

Voluntary Elastic Supply

To meet the optimal market demand, DSD’s total supply can either expand or contract. These mechanisms are mandatory in order to counteract the scenarios of having DSD trading above or below 1$.

DSD trading <1$

If the token price is below the peg, token holders must be incentivized to contract the token supply as doing so will help to get the spot price back towards the peg. To do so, the DAO issues so-called Coupons (debt). To purchase Coupons, users burn their DSD, thereby reducing circulating supply. This is incentivized as you always purchase Coupons with an added discount which depends on the debt ratio (Debt/Circulating supply) in the system. Once there is a positive rebase event, the DAO mints a programmatically sufficient amount of new DSD. In this case, an equal amount of Coupons will be redeemable for DSD. Important to note is that Coupons face an expiry of 360 epochs after purchase.

The debt ratio in DSD is capped at 35% which implies a max. premium of ≈46%.

DSD trading >1$

We must also consider what happens when the price of DSD goes above its $1 peg. As the token price moves above the peg, the token supply needs to expand in order to push it back down. In a positive rebase event, the DAO mints an appropriate amount of new DSD. In this case, the equal amount of Coupons will be redeemable for DSD and the remaining Coupons (debt) will automatically be cleared. If any DSD remains after all existing Coupons have been redeemed, the bonded DSD holders and liquidity providers (LPs) will be rewarded. After all existing Coupons have been cleared, the entire supply extension will go towards bonded DSD holders and LPs.

Differences with ESD

There are similarities between DSD and Empty Set Dollar. As explained in the ESD white paper, “[i]nstead of reinventing the wheel, we aim to construct [ESD] using already existing primitives where possible. This allows for minimal implementation with few unknown unknowns.” Just as ESD uses Basis, 0x Staking, and Rho, we use ESD to be a strong foundation from which to construct DSD.

There are crucial differences between ESD and DSD:

- Epoch Duration

- Rebase Amount

- Supply / Reward Mechanism

- Extended Coupon Expiry

1. Epoch Duration

ESD allows for 3 daily epochs (1 Epoch every 8hrs), while DSD changes this to 12 potential supply extension or contraction events per day (1 Epoch every 2 hours). This not only allows a faster response to price discrepancies, it allows DSD a more granular response to other matters. Smaller, incremental changes smooth transitions between rebase events unlike with only three rebase events per 24 hours. A small price difference should not trigger an outsized rebase reaction.

2. Rebase Amount

ESD features a maximum change to the token supply of 3% in one epoch. DSD removes the maximum percent limit since the token price difference can only ever move by 1/12 % every epoch. Scaling the price this way also prevents exploitation from attempts to manipulate the 2-hour epoch length.

In this context, DSD and ESD also differ in the way bonded token holders and LPs are rewarded. ESD rewards 80% to bonded holders and 20% to liquidity providers. It is our contention that liquidity providers are not rewarded enough for the risk they take, while bonded holders are comparably rewarded too much considering their low risk and capital efficiency. To incentives a deep liquidity pool that is more resilient against volatility, DSD rewards 60% to bonded holders and 40% to liquidity providers.

3. Supply / Reward Mechanism

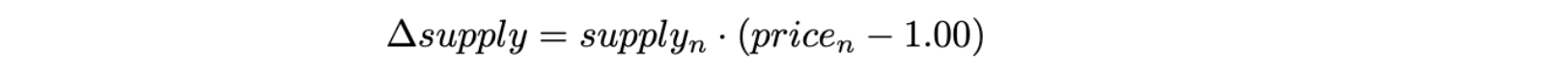

Supply Elasticity in DSD is formulated in a slightly different way to ESD. The change in the supply of ESD is given as:

The amount of supply to change is determined by two main terms, the total supply multiplied by the price deviation from 1. If the price is lower than 1, then the supply difference will be negative, thus that amount of tokens must be subtracted from the total supply.

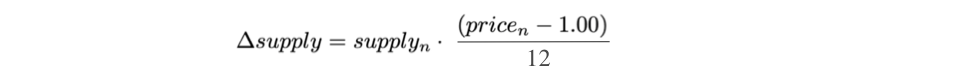

DSD modifies the change in demand formula to:

A positive number indicates supply should be increased by that amount. If the supply is 100 and the current token price is 1.20, then the supply difference will be:

1.67% of the total token supply is added to the total supply in order to devalue the high price.

This change will dampen the extension or contraction amount by a factor of 12. Since there are 4 times more epochs in DSD, it is not necessary to have a large token supply change in one event. Again, more frequent smaller changes help to reduce the likelihood of triggering token dumps. Due to these mechanics, we expect the price to stabilize as shown in the graph below.

4. Extended Coupon Expiry

Users that purchase Coupons play a fundamental role in the DSD ecosystem. By burning DSD for Coupons these users are willing to buy-off and reduce the underlying debt in the system.

In ESD, (Coupons in ESD = Coupons in DSD) coupons have to be redeemed within 90 epochs which bears significant risk as coupons remain worthless as they expire after 90 epochs without redemption.

To increase the chance of Coupon redemption, users can redeem them within the next 360 Epochs after their purchase.

Conclusion

Digital assets like ETH experience significant price volatility, necessitating high over-collateralization. This is capital inefficient and still subjects the user to non-trivial liquidation risks. The advantage of ETH is that it has equity-like characteristics. As DeFi grows, so too does the importance/value of ETH. ETH locked up as collateral cannot be used for other productive purposes, but it still creates a return.

Digital assets like USDT experience very little price volatility, but if you collateralize them they will not generate a return. Users suffer opportunity costs compounded by the necessity of moderate over-collateralization. The advantage is that there is a low possibility of liquidation.

DSD has the advantages of both while mitigating the disadvantages. DSD is a non-volatile digital asset pegged to the dollar, so the risk of liquidation through volatile price action is low. DSD can also have equity-like characteristics. If DSD becomes an important stablecoin in DeFi, then demand for DSD will increase. Bonded DSD will grow in value as the supply-demand for DSD increases. At the same time, sophisticated traders can profit from incentives that force the price of DSD towards its peg in a cleverly designed game-theoretical battle. It is as exciting as it sounds. A decentralized stable coin that grows more valuable in correlation with DeFi.

How is DSD different from other stablecoins?

For a more comprehensive overview of the differences between DSD and other stablecoins, please refer to this article.

DSD is a fully decentralized stablecoin that unlike centralized coins, e.g. USDT, has no 1:1 backing through a centralized USD treasury. To be highly capital efficient it does not use any collateral, like the main competitors DAI or sUSD. The voluntary elastic supply mechanic is different from Ampleforth (AMPL) and Based (BASED). It is inspired by Empty Set Dollar (ESD), yet responds faster to market demand through more frequent epochs, extended supply caps, and a modified supply extension/contraction formula.

If DSD is a stablecoin, is it always worth 1 USD?

The goal of a stablecoin is not to always be worth 1 USD, but to always be almost worth 1 USD. Even centralized stablecoins such as Tether experience price volatility. Decentralized stablecoins such as DAI can experience even greater price amplitudes. Different stablecoins employ different mechanics to return to the USD peg. DSD is built to become more stable over time. Due to its self-stabilizing mechanism DSD is expected to experience elevated volatility in the initial stages. At maturity, DSD aims to vacillate close to 1 USD.

How does DSD’s supply grow?

DSD uses an elastic supply mechanic. As market demand for DSD increases, the price of DSD increases above the 1 USD peg, which causes new DSD to be minted. This increases the supply of DSD, returning the price of DSD to the peg. There are several ways newly minted DSD are distributed. In the event of supply extension, 60% of the newly minted DSD will return to DSD holders that have bondedtheir DSD inside the DAO, while the remaining 40% return to Uniswap Liquidity Providers/Oracle. Lastly, DSD features a built-in debt market that handles supply contraction phases (DSD price < $1). Once debt has been created, DSD token holders can burn their DSD to acquire Coupons. Coupons will be redeemable for newly minted DSD during a supply expansion event. When burning DSD for Coupons, there is always a discount applied depending on the debt ratio.

Important to note is that the supply of DSD changes through voluntary actions of users. Your wallet balance will never increase or decrease without your volition.

Will DSD become a sustainable, useful token?

This is our mission. DSD combines the strengths of different stablecoin projects that came before it. By utilizing the knowledge and experiences of former stablecoin designs, DSD precedes to improve various factors, e.g. capital efficiency, stabilizing requirements and governance. For DSD to become a sustainable and useful stablecoin, we aim for integrations with all sorts of DeFi applications, most importantly lending and borrowing platforms and exchanges.

I want to help, what can I do?

DSD becoming a widely used stablecoin across DeFi can only be achieved in a collaborative manner with the community. It is crucial to fully understand how DSD works in order to contribute to its success. By actively participating in all sorts of discussions around DSD and actively voting on governance proposals, you help to pave the way for DSD as an adopted stablecoin.

Advocating DSD to be added to your favorite DeFi platforms will accelerate the mission we strive for.

Token Mechanics

What is an epoch?

An epoch defines a period within the DSD ecosystem in which the total supply of DSD is being adjusted. 1 epoch equals 2 hours, 12x daily. Within the epoch, the token price will be measured in order to decide if a supply extension or supply contraction is necessary. It also allows governance proposals to be raised and voted on by token participants.

What are a Coupons?

When the total token supply contracts, the DAO incentivises users to voluntarily burn their DSD for Coupons at a discounted DSD rate depending on the debt ratio. In the event of supply extension, Coupon holders will be able to redeem their Coupons for DSD. Coupons expire after 360 epochs=30 days.

What is bonding?

Bonding_ enables you to participate in supply extension and allows voting on proposals concerning DSD’s DAO. Users can stage DSD into the DAO, which can then be bonded. Also, they can bond their Uniswap LP tokens and earn rewards by providing liquidity,_

This prevents manipulations and flash loan attacks during supply expansion and contraction events. Token holders with bonded DSD can vote on DAO governance proposals.

What do “frozen” and “fluid” states mean?

_Frozen means you are available to transact. Fluid means you are committed to only bonded or unbonded DSD tokens until the end of this epoch._Once you have deposited some funds into the DAO you have entered the available state. In the frozen state:

- You can withdraw DSD from the DAO or stage more DSD

- You can bond your DSD

By bonding your DSD you enter the fluid state. In the fluid state:

-You can bond or unbond your DSD.

-You cannot withdraw or stage DSD.

When your DSD is bonded but you wish to withdraw, you first have to unbond your DSD. You can’t withdraw in the fluid state. At the beginning of the next epoch, you will return to the available state, which lets you withdraw your DSD.

You can deposit and bond in the same epoch. Once you have bonded your DSD, you enter the fluid state and can no longer withdraw or deposit until the next epoch starts.

Frozen and fluid states appear on the wallet page and the Liquidity Pool Reward page of the DAO.

How do I advance an epoch?

Epochs advance every 2 hours. They are advanced manually by a user. This allows the DAO to apply state transformations like Coupon expiry and supply regulation on advancement. To incentivize this behavior, the DAO mints reward DSD tokens to the sender upon successful advancement. As a new user, it is unnecessary to concern yourself with this technical detail.

What does the governance page do and how should I engage with it?

DSD is governed by token holders. The governance page is used for token holders to propose changes and to vote on proposals. You need to own at least 1% of bonded DAO to make a new proposal.

Why do some epochs grant rewards and some do not?

Rewards can only be granted during token supply expansion events. If a supply contraction event occurs or no event takes place, then no rewards can be granted. Supply expansion events occur when the price of DSD rises above 1 USD, which causes the minting of enough new tokens to return the price back to the peg, as well as clearing all remaining debt. The newly minted DSD are used to redeem all Coupons held by users. Once the Coupons are redeemed and the debt is cleared, bonded token holders and Liquidity Providers will be rewarded with the newly minted DSD.

How do we know if any given epoch will have rewards and how much rewards?

The DAO determines the token price of DSD through Uniswap’s time-weighted average price (TWAP) algorithm. TWAP is measured and weighed over the course of 1 epoch, 2 hours. This means, if the price changes drastically in the final minute of the epoch, it won’t have an outsized impact on the TWAP since for the majority of the 2 hours the price remained steady.

You can estimate the chances of a supply extension event and the amount of rewards possible by doing the appropriate calculations. We encourage savvy, enthusiastic DSD community members to automate this process and share the information with the community.

Maintaining DSD’s price peg

How do I participate in maintaining the peg?

The easiest way to help maintain the peg is by bonding DSD, providing liquidity to the Uniswap Liquidity Pool, or doing both. Optionally, DSD holders can take part in the Coupon market.

How do I buy DSD?

Currently, the best place to buy DSD is from the Uniswap DSD-USDC pool. You can access the pool from the trade page of the DSD DAO site. This link will also take you to the DSD-USDC pool.

The prices you see may be over or under the peg by a non-trivial amount. Pay attention to the price you are paying when you buy it. DSD is a self-stabilizing system, which means initially there will be more volatility. Over time the price will fluctuate closer and closer to the 1 USD peg.

Do I gain rewards for buying DSD?

If you just buy DSD it has the same reward opportunities as USDT or USDC. You can buy DSD below the peg and sell it at or above the peg, gaining the difference. Passively holding DSD without bonding them in the DAO does not earn rewards.

How can I receive DSD rewards?

DSD provides three active methods to generate rewards to token holders. All require staging DSD into the DAO. Once your DSD is in the DAO you can:

- Bond your DSD

- Provide liquidity to the Uniswap Liquidity Pool, then bond the LP tokens

- Purchase Coupons on the DAO’s debt market and redeem them during a supply expansion event. Always remember that coupons expire after 30 days = 360 epochs.

What is better? Bonding, or providing liquidity?

The answer will depend on the particular market conditions of the current epoch. The relative reward to bonding on the DAO and providing liquidity in the Uniswap Liquidity Pool vary over time. In the case of supply extensions after successful Coupon redemptions, 60% of the newly minted tokens will reward token holders and 40% goes to the liquidity providers. Depending on the total amount of liquidity in the Uniswap Liquidity Pool, those rewards can strongly vary . Besides token rewards, Liquidity Providers will also earn 0.3% of all transactions that are facilitated through the Liquidity Pool.

It is possible to calculate the relative rewards for the current epoch. We encourage community members to do so and share with others.

How do I buy DSD from Uniswap?

- Go to the Wallet page on the DAO site here, and click on the “Trade” button.

Or go to the Uniswap page directly here.

- Connect to Uniswap and approve the tokens you wish to buy DSD with.

- Enter an amount of USDC into Uniswap, approve the transaction and buy DSD.

- Pay attention to the price and slippage as the market’s liquidity changes.

How do I bond my DSD to the DAO?

- Go to the DSD DAO wallet page here.

- Click “Unlock” to allow the DAO to interact with your DSD.

- Enter the amount of DSD into the Staging box (or click max), then click the “Staging” button and approve the transaction. Wait for the transaction to complete.

- After successfully staging, enter the amount of DSD into the Bonding box (or click max), then click the “Bonding” button and approve the transaction. Wait for the transaction to complete. When that transaction clears, your DSD will be bonded to the DAO.

How do I bond Uniswap LP tokens?

It is not advised to do this unless you already have some prior knowledge of how to contribute to Uniswap Liquidity Pools and know how to bond Uniswap LP tokens. If you are familiar with it, please proceed:

- Add liquidity to the DSD-USDC Uniswap Liquidity Pool

- Go to the Liquidity Page on DSD here.

- Enter the amount of Uniswap LP tokens into the Staging box (or click max), then click the “Staging” button and approve the transaction. Wait for the transaction to complete.

- After successfully staging, enter the amount of Uniswap LP tokens into the Bonding box (or click max), then click the “Bonding” button and approve the transaction. Wait for the transaction to complete. When that transaction clears, your LP tokens will be bonded.

What can I do with rewards from bonding to the DAO?

Rewards that you earn from your bonded DSD are automatically bonded. Your bonded rewards will continue to compound automatically.

If you wish to sell DSD, first unbond them, then unstage them. After 36 epochs you will return to the available state, where you can withdraw your DSD.

What can I do with rewards from bonding Uniswap LP tokens?

Your rewarded tokens from providing liquidity to the Uniswap Liquidity Pool will appear on the LP Reward Pool page of the DAO under the rewarded header. Unlike bonded rewards, LP rewards do not automatically generate any further rewards.

If you wish to add your rewards to the liquidity you are already providing in the Uniswap Liquidity Pool, you can do it easily with one click. On the bottom of the LP Reward Pool page, you see a “Provide” section. It will also display your USDC balance in your connected wallet. You can enter a number from your awarded tokens (or click Max) into the box, and if you have sufficient USDC to contribute the necessary proportion demanded by the pool at that time, you will trigger a transaction by clicking provide that will take your rewarded DSD, and the appropriate amount of USDC, add it to the Uniswap pool, and bond the Uniswap LP token you receive in return to the DAO.

Would you like to earn DSD right now! ☞ CLICK HERE

Looking for more information…

☞ Website

☞ Explorer

☞ Social Channel

☞ Message Board

☞ Documentation

☞ Coinmarketcap

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#blockchain #bitcoin #crypto #dynamic set dollar #dsd