What is Sovryn (SOV) | What is Sovryn token | What is SOV token

Sovryn is a decentralized protocol for Bitcoin lending and margin trading. The protocol can be easily integrated into new and existing exchanges, or accessed simply through a web3 portal.

Components:

Sovryn will provide decentralized alternatives of all the most popular centralised Bitcoin finance tools.

Current Features

Spot-Exchange — a low cost, low-slippage, AMM allowing instant trades between tokens.

Margin Trading — Creates up to 5X long/short trades, allowing users to borrow leverage from the lending pool.

Lending Pool — Allows HODLers to earn interest by lending tokens to margin traders and borrowers.

Smart BTC Relay — Allows use of Bitcoin almost instantly with smart contracts and decentralized products, from any Bitcoin wallet.

Bitcoin-backed Stablecoin — users can use a USD-pegged token, backed by overcollaterilzed Bitcoin.

Future Features

Borrowing — Allows users and smart contracts to borrow tokens from the lending pool. All lending is over-collateralized.

Perpetual Swap — BTC backed perpetual swaps allowing trades with up to 20X leverage.

Benefits to Bitcoin and Bitcoiners

Sovyrn benefits the entire Bitcoin ecosystem by providing easy-to-use, decentralized finance alternatives.

Privacy — as a decentralized service, Sovryn does not require user accounts, KYC or user tracking. Your privacy and pseudonymity are protected.

Self-Custody — Don’t risk giving up your keys to centralized services that can be compromised or censored.

Bitcoin-Native — No need to use other tokens or rely on the security of other chains, such as Ethereum. All fees are paid in Bitcoin. All transactions are merged with Bitcoin PoW.

Increase Bitcoin Defense-in-Depth — Trusted third parties are security holes. The more the Bitcoin economy falls under the sway of centralized services, the more vulnerable the economy and it’s participants become to censorship and other attacks. Increase Bitcoin’s security envelope by increasing the depth of decentralization in the Bitcoin economy.

Hyperbitcoinization — Increase the usefulness of Bitcoin and its ability to grow. Adopt the best innovations of other tech stacks and accelerate innovation in the Bitcoin ecosystem.

Use Cases

Stacking Sats and HyperHODLing

Alice, a hodler, wants to put her BTC stack to work by lending them to a margin trade.

Bob, a trader, is so bullish, he isn’t satisfied just to HODL. He wants to HyperHODL. He opens a long position on BTC, borrowing the funds from Alice.

Alice and Bob do not want to move their BTC onto a centralized service and give up control of their keys. Using Sovryn, Alice issues a peer to peer loan straight from her wallet and Bob trades straight from his. Alice is now stacking sats, and Bob is HyperHodling without compromising their privacy, control or ideals.

LegoLand

Carol is building a centralized exchange. David is building a decentralized hedging dapp. Both can integrate permissionlessly with the trading, lending and liquidity of Sovryn. In doing so, they gain instant access to more liquidity, more features and can provide greater functionality for both their users and those of Sovryn.

Roadmap

Decentralized Governance

Decentralization is the key to user Sovereignty. By denying central points of control, it shifts the balance of power from centralized authorities, back to the users. Sovryn is being built with the goal of maximal decentralization, while still being able to provide ease-of-use and the ability to constantly improve. Sovryn will never have the same level of decentralization of Bitcoin but it’s also not trying to be the next global reserve currency.

We expect to continue engineering greater assurances of decentralization, as Sovryn evolves. In the early days, Sovryn will be decentralized by the following means:

Governance Token — The SOV token will be a form of decentralized equity, “Dequity”. It’s holders will have the ability to manage the protocol by staking and voting. In doing so, they will earn the right to the revenue the protocol generates.

Staking — By staking SOV, holders will be able to actively participate in management of the protocol, changes to features and distribution of revenues and rewards.

Distributed Smart Contract Keys — A central point of control that afflicts almost all dapps is control of the smart contract keys. If one party controls those keys, that can make almost any change to the protocol, including stealing users funds. However, some degree of control is necessary, to allow for system and feature upgrades.

Sovryn will distribute control of smart contract keys and place them under the control of the SOV holders. No one party will be in control.

How to Earn and Leverage Bitcoin with Sovryn?

DeFi is still a growing industry with new products and innovations. Sovryn is decentralizing trading and lending for Bitcoin, with a Bitcoin-native DeFi platform. Sovryn aims to enable decentralized applications for Bitcoin, a truly decentralized cryptocurrency in a way that is as native to the Bitcoin blockchain as possible.

In this explainer, you will learn how to perform leveraged trades in BTC permissionlessly and without selling your soul aka custody of your coins to a centralized middleman.

So you have found your NFT allowing you entry to Sovryn’s test phase and enabled the RSK Mainnet on your Web3 wallet. Now it’s time to try out the Sovryn trading platform. Make sure that you acquire some rBTC via an exchange or through our Fast BTC Relay. What this does is allow you to onboard your BTC to the RSK Mainnet.

Sovryn Leveraged Trading Interface

You will arrive at the following UI. Take note, while it looks very solid thus far, we have many interface improvements underway. Kudos to the team for their hard work.

How to perform a Long/Short leveraged trade

Select between Long and Short. Long is for trades that win when the price of BTC goes up, and Short is for trades that win when the price of BTC goes down. According to the level of leverage you take, the Liquidation Price will adjust. If for example you wished to Long BTC at 2x leverage, your Liquidation Price will be further from the current price of BTC than it would if you were to do 5x leverage. It works similarly for leveraging Short, but in the opposite direction.

Interest APR

Interest is paid upfront at the specified rate in 28-day periods when taking a position. Should you close your position earlier, the unspent amount will be refunded. If your position gets rolled over after 28 days, you’ll pay again the interest for the next period in advance.

To place a trade, simply input the amount of BTC you wish to execute the trade with and click Place Trade. Accept the transaction through your Web3 wallet, and your trade should be visible below.

Trading Activity

Reading your Trade Activity

Here you will see the current status of the trade you performed. Under Current Margin, the number equates to how much percentage above the liquidation price you are currently sitting at. The green number next to it in this example shows how the price has changed since I took my position.

Interest APR means this is what I am paying annually in BTC for taking this position. The Start Price pretty clearly serves as a record for the price of BTC at the very beginning of your position. Renewal Date means the date after 28 days where your position gets renewed and you paid a portion of the % APR.

You can choose to Top-Up your position by adding more BTC. Finally, if you are ready to exit your position, click Close. The Sovryn protocol takes a .15% fee for each leveraged trade.

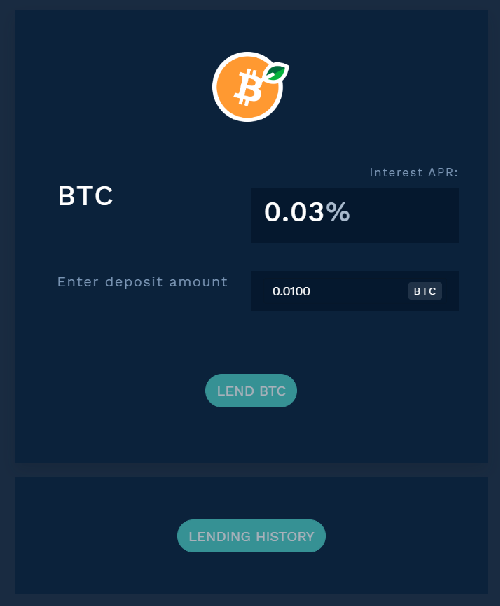

Two Ways to Lend Bitcoin

Stack sats lending BTC with Sovryn

In the Lend section of Sovryn’s trading platform, you can lend Bitcoin on the other side of these leveraged trades to passively stack sats. The Interest APR is the % you can expect to gain annually for lending your BTC. Keep in mind, this is entirely non-custodial and you are free to withdraw at any time. This is the most faithful platform for lending true Bitcoin and earning sats without having to entrust your holdings to a centralized custodian or a multi-sig that issues digital IOUs for your Bitcoin. The % APR will change according to the demand for borrowing BTC on the permissionless Sovryn platform.

Interest payments made by borrowers are distributed to lenders. The Sovryn Protocol collects 10% of interest for the insurance fund, which exists to protect lenders in the possible case of a loan defaulting.

The second way to earn on BTC is providing liquidity to Sovryn’s AMM. Pretty soon, users will be able to swap between the Dollars on Chain (DOC) stablecoins and Bitcoin. Liquidity providers will be able to earn from trading fees as well as earn yield from Sovryn’s future liquidity mining program. Unlike other AMMs that only accept a 50/50 ratio among a pair of cryptocurrencies, you would only need to deposit one in order to start earning swap fees. The fees will start at 0.1% per swap per coin for liquidity providers.

Configuring Metamask Wallet for Sovryn?

If you made it here, you’re likely a Metamask user intent on trying out Sovryn on mainnet. If you don’t wish to use Nifty wallet, that’s ok! In just a few minutes of your time, I’ll show you a quick and easy way to set your Metamask up to RSK and load up with Bitcoin on RSK through the Fast BTC relay.

Open up your Metamask and go to the network button at the top where it says “Main Ethereum Network”. Click “Custom RPC” and input the following:

Hit Save and make sure you are switched to the RSK network. Next step is adding WRBTC and DOC tokens. DOC (Dollars Onchain) is a stablecoin backed by BTC. In Nifty you only need to go to add tokens and search for “DOC”. In metamask to “Add Token”. Select “Custom Token” and add the following details:

DOC Token Contract Address:

0xe700691da7b9851f2f35f8b8182c69c53ccad9db

RSK-BTC Contract Address:

0x542fDA317318eBF1d3DEAf76E0b632741A7e677d

So your Metamask is set!

Transferring BTC to RSK Sidechain

Sovryn requires Bitcoin to be on the RSK sidechain in order to be utilized on its trading platform. If you would like to load up Bitcoin on RSK, go to the Fast BTC Relayer application. There will be an address to send BTC to, which then mints WRBTC on the other side (for a fee of 0.1%), allowing you to trade with Bitcoin on the Sovryn app.

Token info

Ticker: SOV

Platform: Blockchain

Token Type: Utility

Available for sale: 1,800,000 SOV (1.8%)

Total supply: 100,000,000 SOV

ICO Time: 24 Jan 2021 - 30 Jan 2021

Looking for more information…

☞ Website ☞ Source Code ☞ Social Channel ☞ Social Channel 2

Would you like to earn SOV right now! ☞ CLICK HERE

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ Binance ☞ Bittrex ☞ Poloniex ☞ Bitfinex ☞ Huobi

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#blockchain #bitcoin #sovryn #sov