What is Fire Protocol (FIRE) | What is FIRE token

Hey there, you all know Binance… their smart chain and all the development happening there? Actually, I can barely recall any Binance-exclusive project developing there? Most adapted or added support for it out of the Ethereum ecosystem. We have a different approach. We believe the Huobi Eco Chain has incredible properties to serious challenge Ethereums’ prime stance in the DEFI space.

A couple of words about this incredible opportuniy….

The market for Decentralized Finance(DeFi) has been growing at an exponential rate since 2019. We have seen more than $14 billion total value locked within smart contracts with an annual growth rate of 1785.53%. With the growth of Uniswap DEX protocol, Compound Lending protocol, traditional financial instruments have been brought to Blockchain, innovative, disruptive, emerging to sophisticated ecosystems for everyone to use.

Huobi consistently ranks as one of the world’s top ten largest exchanges by trade volume. Huobi Eco Chain has opt to be as a better alternative to Ethereum or Binance Smart Chain. There is zero gas fee on Huobi Eco Chain, in turn incentivizing more users to transact on the chain. Furthermore, it is also EMV-compatible for developers to easy enter and applications to move to Huobi Eco Chain.

Introducing Fire Protocol….

Fireswap Protocol is the first infrastructure to Huobi Eco Chain, which helps onboard non-Huobi Chain assets via our cross-chain solutions, an integrated trading and money market with lending and borrowing services. FireSwap is committed to bridge the gap between centralized and decentralized finance by providing a one-stop financial solution exclusively on the Huobi Ecosystem: a protocol combination of UniSwap and Compound. This entails Basic functionalities such as of cross-chain asset wrapping, flash swap, liquidity mining, lending/borrowing pools, interest derivatives.

The DEX and the Lending platform works in conjunction, such as all tokens that are being traded or facilitated as liquidity provision, can also be used as collateral on the lending platform. With these collaterals, users can borrow other assets for trading, which in turn increase the trading volume. With the integrated DEX, the liquidation issue of lending / borrowing platform can also be solved, as we will automate the liquidation via selling the collateral on the AMM DEX directly (limited by the amount of liquidity available on the DEX), and in turn this will be a factor to consider for the collateralization ratio. FIRE token serve for incentive plans and governance voting to maintain the user ecosystem.

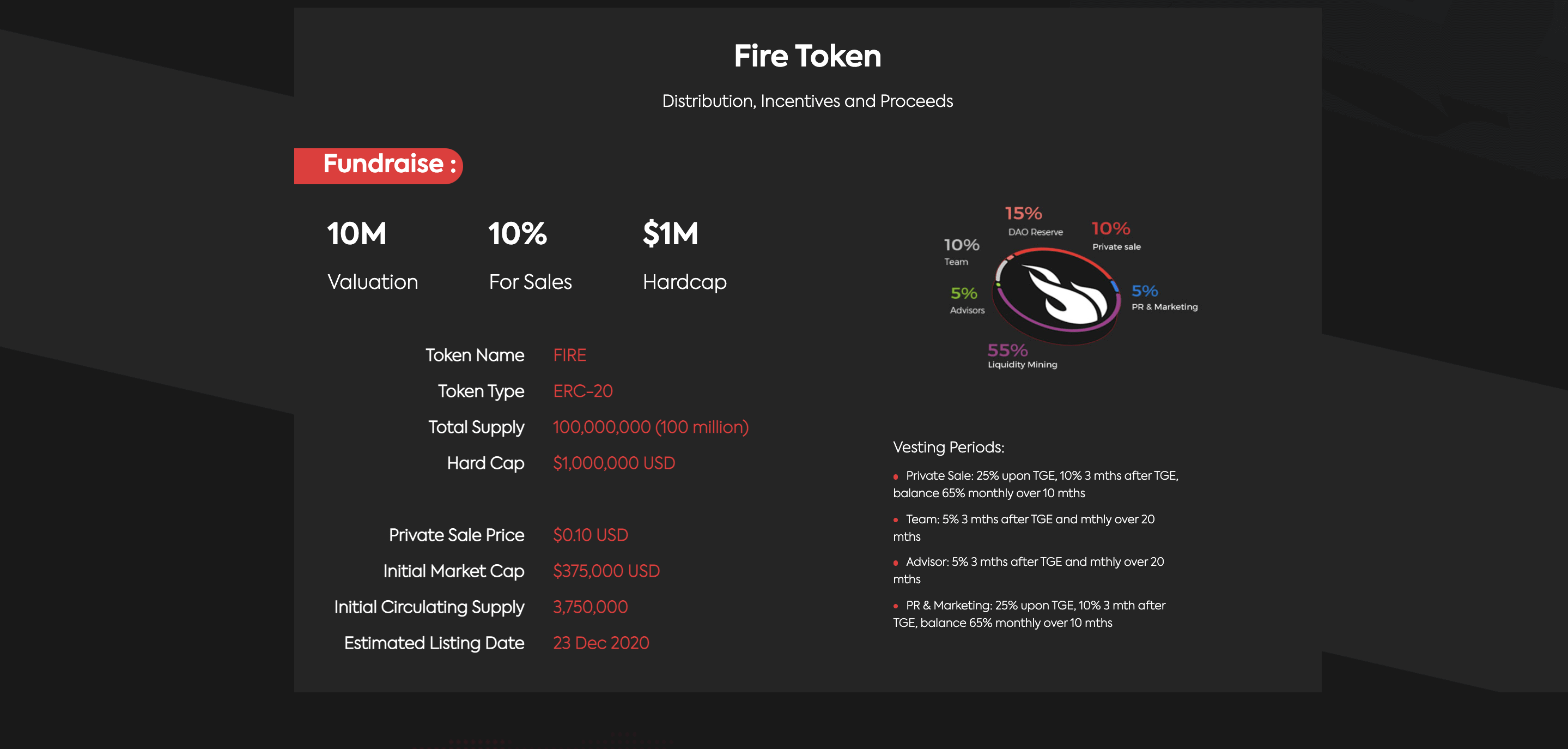

Fire Token

Distribution, Incentives and Proceeds

Fundraise : 10M

Valuation: 10%

For Sales: $1M

Hardcap

- Token Name: FIRE

- Token Type: ERC-20

- Total Supply: 100,000,000 (100 million)

- Hard Cap: $1,000,000 USD

- Private Sale Price: $0.10 USD

- Initial Market Cap: $375,000 USD

- Initial Circulating Supply: 3,750,000

- Estimated Listing Date: 23 Dec 2020

Vesting Periods:

- Private Sale: 25% upon TGE, 10% 3 mths after TGE, balance 65% monthly over 10 mths

- Team: 5% 3 mths after TGE and mthly over 20 mths

- Advisor: 5% 3 mths after TGE and mthly over 20 mths

- PR & Marketing: 25% upon TGE, 10% 3 mth after TGE, balance 65% monthly over 10 mths

Would you like to earn many tokens and cryptocurrencies right now! ☞ CLICK HERE

Looking for more information…

☞ Website

☞ Whitepaper

☞ Social Channel

☞ Message Board

☞ Documentation

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#blockchain #bitcoin #fire protocol #fire