Monte Carlo Simulations are an incredibly powerful tool in numerous contexts, including operations research, game theory, physics, business and finance, among others. It is a technique used to understand the impact of risk and uncertainty when making a decision. Simply put, a Monte Carlo simulation runs an enourmous amount of trials with different random numbers generated from an underlying distribution for the uncertain variables.

Here, we will dive into how to predict stock prices using a Monte Carlo simulation!

What do we need to understand before we start?

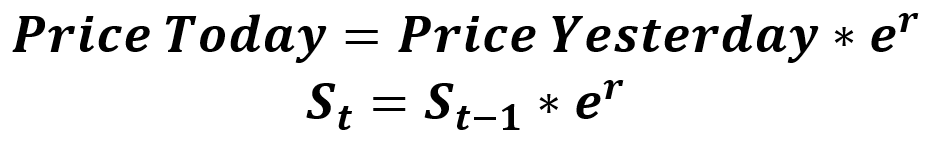

We want to predict the price of the stock today. We know the price of the stock yesterday. So, what’s missing? We obviously do not know the daily return that the stock is going to yield today. This is where Monte Carlo comes in! But first… how can we estimate the return?

How do we predict the daily return of the stock? Brownian Motion.

Brownian motion will be the main driver for estimating the return. It is a stochastic process used for modeling random behavior over time. Brownian motion has two main components:

- Drift — the direction that rates of returns have had in the past. That is, the expected return of the stock. You may ask yourself: why is the variance multiplied by 0.5? Becasue historical values are eroded in the future.

- Volatility — the historical volatility multiplied by a random, standard normal variable.

Together, these compute the brownian motion — ie the daily return of a stock!

This technique will be used for every day into the future you want to predict, and for however many trials the monte carlo simulation will run! Let’s get to coding!

#stock-market #forecasting #data-science #monte-carlo

![Monte Carlo Simulations for Predicting Stock Prices [Python]](https://miro.medium.com/max/1200/0*JcmXw-oXcwZEIzWk.jpg)