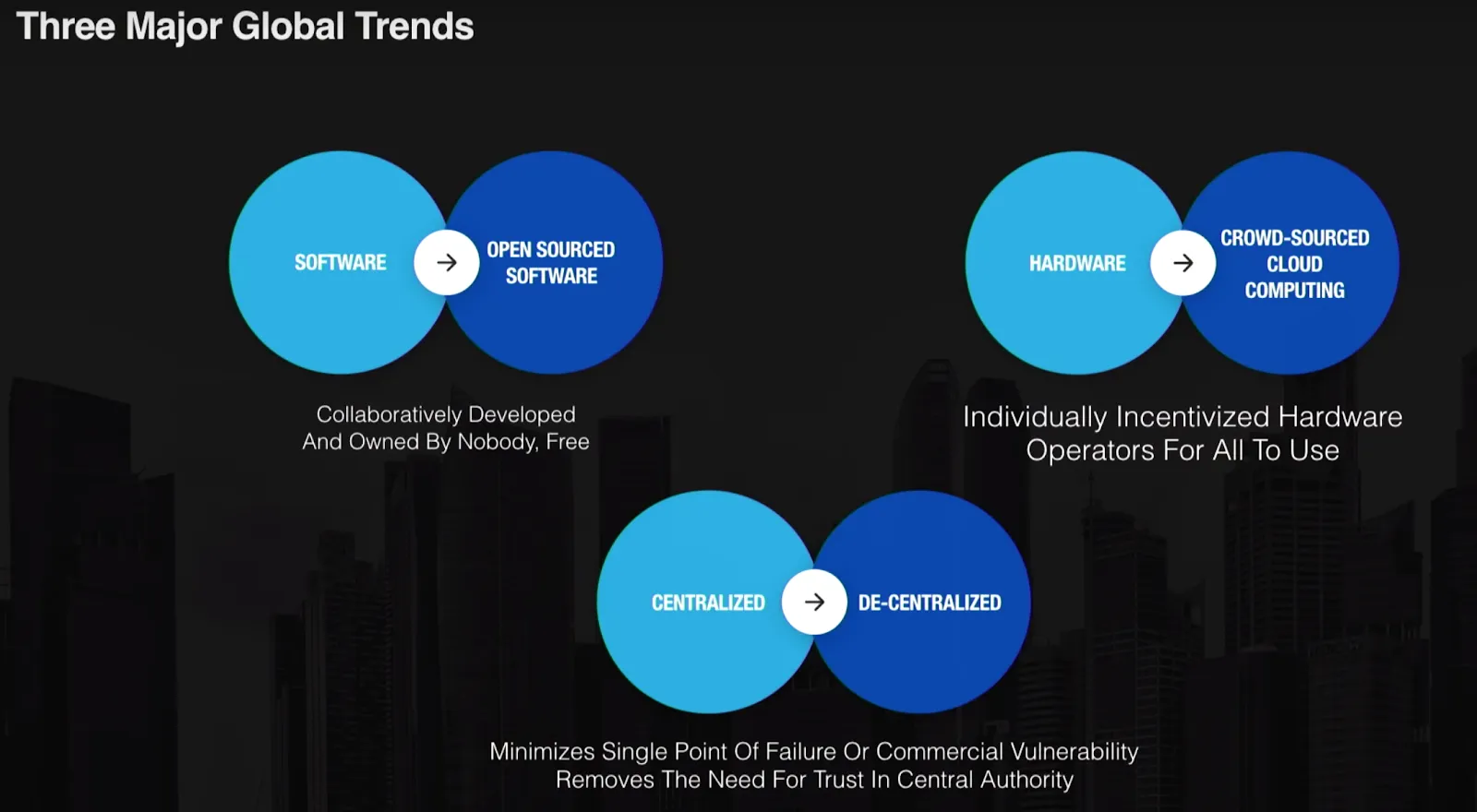

Long before the invention of Bitcoin, the computerized world has become dependent on open source developers. Some pieces of code such as Internet browsers, operating systems, and code libraries have become so essential that it is unanimously agreed upon that they should not be controlled by a single company, who might charge exorbitant fees for their usage, withhold the software from certain users for any reason, or do other nefarious things with the code.

With the advent of cryptocurrencies and decentralized finance (DeFi), open source development has become more important than ever. However, there is a noticeable lack of professional developers in DeFi. As a result, many emerging DeFi platforms go live as largely untested garage enterprises. Oftentimes, new DeFi smart contracts can attract millions of dollars in locked value, although there has been next to no auditing.

For example, the DeFi platform YAM encountered a small but critical bug in their code, which led to massive loss of funds only a few days after the platform was launched. The platform was rushed and it’s smart contracts were never audited. While DeFi’s approach to breakneck innovation is certainly a good thing, developers lack the right tools to avoid critical mistakes and monetary incentives are a big part of this equation.

The nature of non-profit open source development has it that the initiators of DeFi projects often cannot expect their inventions to generate significant revenue. It is thus very difficult to find professional developers and auditors. While volunteer work is an absolute must-have in a world that is becoming more and more dependent on code, there is a lot of money at stake in DeFi.

Sadly, developers are seeing very little from this money. As an investor, would you entrust a DeFi platform with your money, knowing that it was hacked together in a few days by developers who have no monetary incentive for the platform to succeed?

Current Revenue Streams

For individual open source developers, there currently is little money to be made in DeFi. Most blockchain projects are either funded by various high-dollar development funds run by the big blockchain platforms, or through venture capital. While venture capitalists typically require their funded projects to be profit-oriented, blockchain development funds are often not optimal for DeFi projects.

These funds usually incentivize development on a specific blockchain as part of their ecosystem building. This leads to DeFi projects often becoming mere copy-cats of existing DApps on Ethereum, with no real innovation. Also, this incentivizes only the development of complete user-facing DApps.

What is needed is a more granular revenue stream that is oriented towards individuals. A single developer who can solve a difficult problem in an elegant way can often generate more value to a blockchain ecosystem than a full-fledged DeFi DApp, but oftentimes, coders who develop these building blocks either don’t have the connections that allow them to turn them into a complete DApp, or they simply do not have an interest in doing so.

#blockchain #defi #radix #blockchain-developer #blockchain-top-story #what-is-dlt #defi-top-story #open-source-incentivization