Insurance claims forecasting for extreme weather events that result in large scale destruction such as hurricanes, wildfires, floods, etc. is an important planning activity for insurance firms and any process improvements that can enhance the accuracy and quality of the forecasts should be welcome. This article provides an introduction to the forecasting methodology for insurance claims payouts and then discuss potential use of machine learning techniques to enhance the forecasting process.

I. Introduction

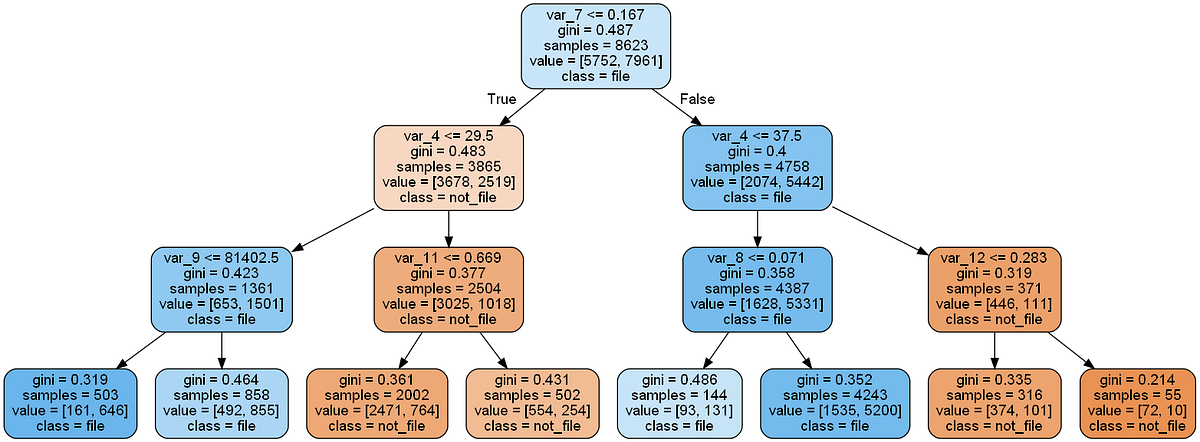

This article provides an introduction to forecasting insurance claims payouts. We focus specifically on the claims arising from weather events (events) that result in large scale destruction such as hurricanes, wildfires, floods, etc. We first provide a general overview of the traditional methodology and then discuss potential use of machine learning (ML) techniques to enhance the forecasting process.

While the examples and website references provided in this article are US-centric, the ideas presented herein are general and can be applied to all locations. In other regions and countries, the analyst will need to substitute the appropriate data sources for event data.

The remainder of the document is organized as follows. In the next section, we provide an overview of the general model structure and the elements that need to be considered within the modeling framework. In section III, we focus on where ML techniques are most appropriate to use. In the final section, we discuss our conclusions.

Note that all the data used for illustrative figures in this article is simulated and does not reflect any actual event except where otherwise indicated.

#insurance-claim #claims #machine-learning #forecasting-models #insurance