Are Banks Afraid of P2P Lending?

While banks have traditionally acted as the main provider of loans, the needs of smaller businesses are evolving and now come with more concerns.

2020 has brought along spikes in operating costs and increasing fluctuations in demand.

These are some of the extreme challenges SMEs face when it comes to raising capital — a crucial element of their growth. Banks often overlook these, and as a result,** this has opened up the door for the P2P Lending Market to grow.**

This is why we are going to create a data-driven investment strategy for Prosper Marketplace, a P2P lending firm, that will take a holistic overview from processing the raw data to inferring business outcomes.

Overall, our predictive model will act as a **prescriptive tool **that directly portrays the impact on the investor & business.

Investor’s Decision Making

Two fundamental steps are required for an investor to gain a better understanding of which loan to invest in:

- Prosper’s investors will have to decide on how much money to invest (considering potential return) and allocate to other options for investment.

- Prosper’s investors will need to decide on picking “good” loans (i.e.: loans which will end up being fully paid off) in which to invest their money, and this is what our loan classification model will focus on.

However, it is important to note that there is no one ideal investment, as it is highly contingent on the risk appetite of the investor.

Dataset

The datasets to be utilized in this analysis are publicly available online for download using a registered Prosper account.

Predictors

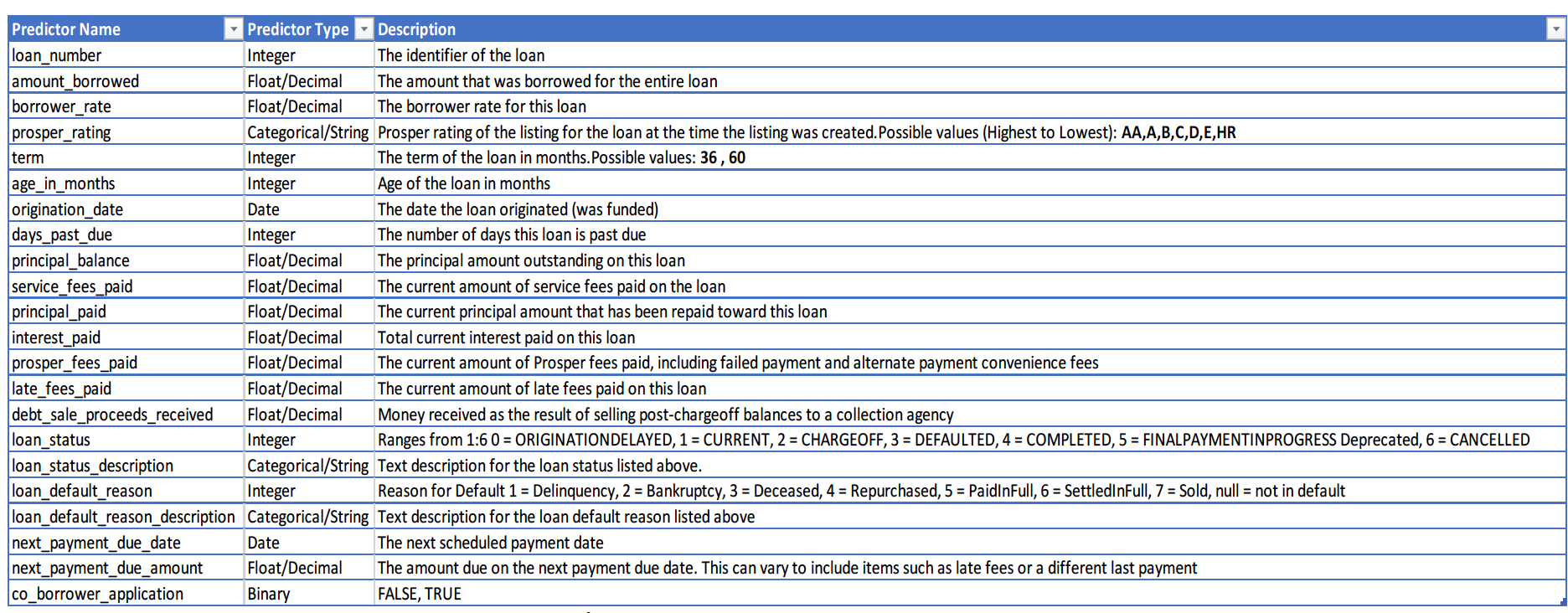

The dataset contains comprehensive information on all loans posted annually and a set of 22 variables that cover the different attributes of an individual loan.

Prosper Dataset Description (22 variables)

These include but are not limited to the** loan amount, the amount of interest & fees paid, loan duration, a Prosper credit rating score, and loan status** with reason if completed or defaulted.

Completed vs. Defaulted Loan: 0s vs 1s

There are 4 outcomes for a loan in Prosper’s data:

- Completed (A)

- Charged Off (B)

- Current ©

- Defaulted (D)

To simplify our Prosper data analysis, we decided to assign a value of **0 to completed loans (A) **and 1 to the remaining 3 types of loan statuses **(B, C, & D) **that refer to loans that have not been completed.

How Can We Identify a “Good” Loan?

In order to acquire an intuition of identifying good loans, it is important to realize the correlation & interaction amongst all the variables.

However, the **definition of a good loan **is still quite ambiguous so it is vital that the prediction should be based on one of these goals: whether a loan will default, paid back early, time of default, or time taken to pay back if paid back early.

#investing #business #machine-learning #finance #artificial-intelligence #deep learning