In Banking and Financial Services, Reinforcement learning seems well suited to many activities in trading and investment management. We have explored potential applications of reinforcement learning in finance through research, development and analysis of published research. Some of the popular use-cases are discussed below.

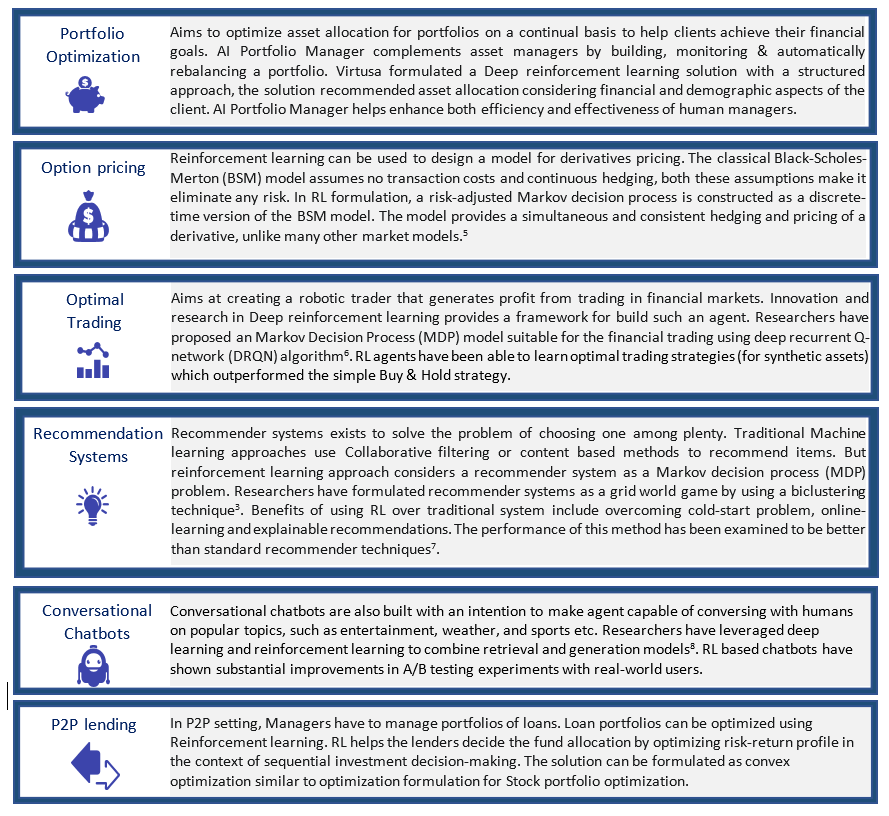

**Portfolio Optimization: **Aims to optimize asset allocation for portfolios on a continual basis to help clients achieve their financial goals. AI Portfolio Manager complements asset managers by building, monitoring & automatically re-balancing a portfolio. Virtusa formulated a Deep reinforcement learning solution with a structured approach, the solution recommended asset allocation considering financial and demographic aspects of the client. AI Portfolio Manager helps enhance both efficiency and effectiveness of human managers.

**Option pricing: **Reinforcement learning can be used to design a model for derivatives pricing. The classical Black-Scholes-Merton (BSM) model assumes no transaction costs and continuous hedging, both these assumptions make it eliminate any risk. In RL formulation, a risk-adjusted Markov decision process is constructed as a discrete-time version of the BSM model. The model provides a simultaneous and consistent hedging and pricing of a derivative, unlike many other market models.(Reference:1)

**Optimal Trading: **Aims at creating a robotic trader that generates profit from trading in financial markets. Innovation and research in Deep reinforcement learning provides a framework for build such an agent. Researchers have proposed an Markov Decision Process (MDP) model suitable for the financial trading using deep recurrent Q-network (DRQN) algorithm(2). RL agents have been able to learn optimal trading strategies (for synthetic assets) which outperformed the simple Buy & Hold strategy.

#banking-technology #data-science #reinforcement-learning #machine-learning #artificial-intelligence