What is Flow Protocol (FLOW) | What is Flow Protocol token | What is FLOW token

Introducing Flow Protocol (FLOW)

Flow is a protocol that establishes an Ethereum based self-distributing token (FLOW). FLOW is designed to facilitate token distribution without dilution.

The protocol distributes inflation of FLOW tokens to all addresses holding it without the need for a single transaction. Inflation happens daily and does not require any action on the side of the FLOW token holder or any other parties. This method of inflation allows for the token to be applied to modern DeFi use cases without diluting the token holders.

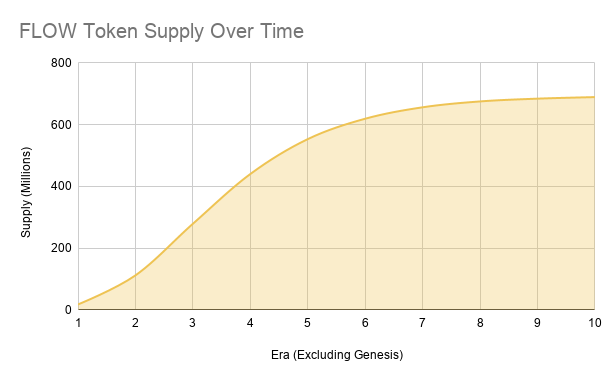

Over a period of 10 years, inflation is reduced and ends with a capped supply of FLOW tokens.

Why do we need Flow?

Until now, digital assets like Bitcoin have required participation in mining or staking in order to receive a portion of the inflating supply. This has several problems:

- When a digital asset is tied to a consensus mechanism, it disproportionately punishes holders as their share of the supply is continuously diluted during the inflation period.

- The long term value of these assets depends heavily on the ability of the protocol to continue to operate without inflation being paid to miners/stakers, which is a highly debated topic.

- Protocol coins (BTC, ETH, etc) are tied to the underlying network, which can cause their value to fluctuate wildly due delays in network upgrades, bugs, etc.

- Assets that require actions such as staking in order to receive a portion of inflation prevent them from being used easily in other applications (lending, collateral, etc.) without being diluted.

Flow solves these problems by applying the single-responsibility principle (SRP) from software engineering. The Flow protocol takes responsibility only for essential distribution functions, allowing the Ethereum network to manage everything outside that scope.

Designed for DeFI

As DeFi rapidly grows, so does the demand for collateral assets that fill specific roles. FLOW (Store of Value) can help diversify collateral by being combined with digital assets that fill other roles such as ETH (Protocol) and AMPL (Elastic Supply).

FLOW does not need to be staked or locked into a contract to receive inflation, therefore it can be applied to the full range of DeFi applications while still achieving its distribution target

The FLOW Inflation Schedule

FLOW inflation is governed by Eras. The daily inflation applied to the token supply starts at 1% during the Genesis Era and is halved at the end of every Era.

The first era, called the Genesis Era, lasts for 60 days. After the Genesis Era there are 10 additional Eras, each lasting for 365 days.

Inflation stops upon completion of the final Era and the supply becomes capped.

The initial supply of tokens started at 10,000,000 FLOW. As the daily inflation occurs over a period of 10 years, the supply will increase to just under 700,000,000 FLOW.

You can see the total supply, current inflation rate and the next halving at https://app.flowprotocol.io/dashboard

Flow Token (FLOW)

The FLOW token and its distribution would be governed by Eras. At the end of each Era, it is expected that the inflation rate would be halved, just like how the mining rewards in Bitcoin are always halved after a certain period.

The First Era of the would-be was called the Genesis Era, and it would last for a mere 60 days. Subsequent eras would last for 356 days, and there would only be ten of them.

During the Genesis Era, the daily inflation rate would start at 1%, and at the end, it would be halved.

Benefits of Inflation with FLOW

Inflation occurs in most other cryptocurrencies, including Bitcoin and Ether. However, in almost all other cases the inflation is only paid to miners or stakers. This harms holders of the token by diluting their ownership of the total token supply.

With FLOW, your share of the total supply can **never **be diluted. This means that no dilution occurs as the supply inflates. Even if you are using your tokens for yield farming or any other DeFi application, the inflation will still be applied!

FLOW inflation has several other benefits that help achieve the goal of becoming a widely adopted store of value.

As the token supply inflates, some holders may choose to sell the additional tokens. This helps achieve the wide distribution required to become a robust store of value as inflation decreases and eventually stops. This effect can already be observed by the impressive number of FLOW holders.

Demand for FLOW can also be partially absorbed by inflation rather than just by increasing price alone. This results in a different price action than a typical token, making FLOW more difficult to manipulate based on traditional metrics.

How Does it Work?

Simply put, anyone who holds FLOW tokens can become a liquidity provider on Uniswap by pooling their FLOW tokens combined with an equivalent USD value of ETH.

Upon successfully pooling, the liquidity provider will receive UNI-V2 tokens which represent their stake in the Uniswap liquidity pool.

UNI-V2 tokens can then be staked to earn additional FLOW.

How are Rewards Determined?

There are several factors that determine the amount of FLOW you will receive for staking:

The unlock rate — The total rewards will be unlocked evenly over 90 days.

The amount you have staked — The amount of FLOW rewards you receive over time depends on the percentage of the total staked tokens that belong to you. If you were the only one staking you would receive all of the rewards!

The amount of time you remain staked — The rewards you earn will have a multiplier applied to them the longer you remained staked. To achieve the full multiplier (3x), you need to remain staked for at least 60 days.

How can I participate?

You will need both FLOW and ETH to provide liquidity and earn rewards from The Tap.

For example, if you have 10 ETH total that you want to stake in The Tap, you would buy 5 ETH worth of FLOW and then add liquidity on Uniswap with the resulting ETH/FLOW.

Here are the steps required to participate:

- Buy FLOW: https://app.uniswap.org/#/swap?outputCurrency=0xC6e64729931f60D2c8Bc70A27D66D9E0c28D1BF9

- **Provide Liquidity on Uniswap: ** https://app.uniswap.org/#/add/ETH/0xC6e64729931f60D2c8Bc70A27D66D9E0c28D1BF9

- **Stake your liquidity tokens at The Tap: ** https://app.flowprotocol.io/

Looking for more information…

☞ Website ☞ Explorer ☞ Explorer 2 ☞ Whitepaper ☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Social Channel 3 ☞ Coinmarketcap

Would you like to earn FLOW right now! ☞ CLICK HERE

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ Binance ☞ Bittrex ☞ Poloniex ☞ Bitfinex ☞ Huobi

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

I hope this post will help you. If you liked this, please consider sharing it with others. Thank you!

#bitcoin #crypto #flow protocol #flow