Long-short term memory networks (LSTMs) are now frequently used for time series analysis. An LSTM is a special type of neural network that has the ability to learn sequential dependencies between observations in a series — thus making them suitable candidates for time series forecasting.

However, LSTM models have not been without criticism. In particular, there is concern that LSTMs do not actually forecast at all. Instead, they use lagged values in order to make forecasts of the immediately following observation. This might be useful in situations where accuracy at a particular point in time is required. One example could be stock market predictions where an LSTM is used to predict stock price on a particular day, as in this example.

Essentially, an LSTM makes predictions in a stepwise fashion. For instance, an LSTM with a “lookback period” of 5 days would use values from t — 5 to _t — 1 _to forecast the value at time t. Let’s take an example.

Air Passenger Data Example

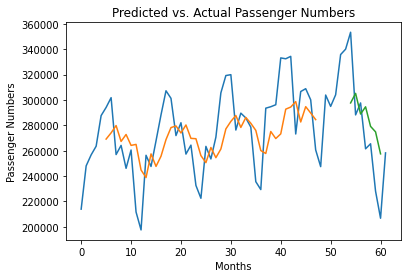

In another article, I described how an LSTM model could be used to forecast monthly air passenger numbers.

The data is sourced from San Francisco Open Data: Air Traffic Passenger Statistics. The below analysis uses a previous example from Machine Learning Mastery as a template in using LSTM models to analyse air passenger data.

Specifically, monthly air passenger data from February 2014 — June 2020 is analysed, with the first 62 months being used for training and validation purposes, and the last 15 months used for test purposes.

#machine-learning #data-science #time-series-analysis #time-series-forecasting #neural-networks #data analysis