Stock market prediction has been one of the most widely used applications of Deep Learning next to computer vision. These will be used in various hedge funds to generate maximum returns on investments. The problem we are addressing is that the lack of data for future dates i.e we will not have the real time data for future dates. We will be generating predictions for future dates for which we don’t have data. This can be implemented for any of the stock prices given we give related industries as our inputs.

In this blog, I will demonstrate the prediction for AMD by taking few other company stock price data. Please note that for future dates we will not get any data related to news polarity(.i.e fundamental data) we will only make predictions by using technical data.

Data:

We consider training data from 01/01/2010 to 05/31/2020, all the data has been acquired from Tingo API. Please consider the as of date is 05/31/2020. This is because as of writing this blog we could get the data till 10/11/2020, but we want some ground truth data to compare with.

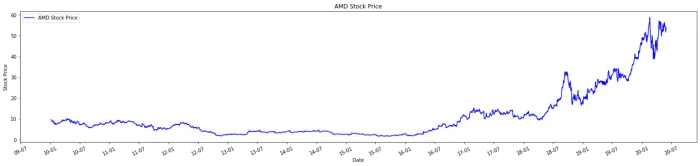

Let’s look at the data from 2010.

We can see as usual the stock has been on since 2007 financial crisis and since 2017 its been improved by quite a lot due to the announcement of Ryzen line up of CPUs. For this model, we are going to consider various other company data as well. We can’t consider that AMD is the only company, in the financial world all companies are related to each other.

Ex: AMD and Intel are rival companies and most the days the movements are inversely proportional.

So we will consider the stock closing price for companies like Intel(INTC), Nvidia(NVDA), Microsoft(MSFT), Qualcomm(QCOM), TSMC(TSM), S&P ETF(SPY).

#machine-learning #deep-learning #stock-market #data-science