People love predicting bitcoin’s price.

PlanB’s Stock-to-Flow model predicts $288k by 2024. Crypto Research Report’s Equation of Exchange model predicts $398k by 2030. John McAfee says it’ll hit $1 million by the end of 2020 while Bob Loukas expects $200k by the end of 2021.

While some people believe these predictions, others think they’re all nonsense.

What do I think? It’s fun to speculate.

More importantly, by speculating, we can get some perspective about what will push prices higher.

When you think things through, you can sometimes get insights that matter more than the actual numbers or statistical projections. After all, up is up, right? We want to know what _drives _the market up.

Bitcoin will not decide how much it’s worth. People will. Instead of focusing on chart projections, mining costs, or bitcoin’s intrinsic value, let’s look at what people will do to make the price of bitcoin go up.

But first, my prediction on bitcoin’s next all-time high — price and timing, and why I believe we will see a massive bull market that will shock everybody.

Price prediction: $350k before the end of 2022

Bitcoin’s price will hit $350,000 before the end of 2022. The market will likely peak around September or October 2022.

If that seems extreme, keep in mind, cryptocurrency is now a global market. We tend to think in terms of US, Europe, and East Asia, but Latin America, Middle East, and Africa have seen a huge uptick in crypto activity according to a report by Formal Verification. If 2017’s boom mostly came from Pacific Rim and European countries, this next boom will come from almost every country on earth.

Also, the world is huge, with over $1 quadrillion in “things” that you can put a price on. All of those things can get recorded on a blockchain and exchanged as cryptocurrency.

On top of that, probably 16–22% of all bitcoins are lost. As a result, bitcoin’s actual scarcity is greater than we think. Inflows will have a much larger impact on price than you might expect.

And, unlike in 2017, many people will buy using investment funds or custodial wallets that use sidechains and batching technology to cut costs. Because they will not hold bitcoin directly, they will not suffer from the high cost of on-chain transactions and routine “real-world” usage.

Yea, but, $350k? Isn’t that a little much?

It’s a bold prediction, yes.

No guts, no glory. When it hits its next market cycle peak, bitcoin will have a market cap of $6.5 trillion.

(Total market cap will top out around $10–12 trillion combined BTC and altcoins, roughly on par with gold’s market cap today and the inflation-adjusted value of the dot-com boom. I’ll write about my altcoin predictions in a separate article.)

How does bitcoin get that big?

You start with a global commodity that has NO barriers to entry, where access is as easy as downloading an app or hopping on a browser.

Then, you add two ingredients: decentralized financial platforms (“DeFi”) and fresh capital from cash in bank accounts.

Boom.

Thanks to DeFi and coordinated government financial stimulus, the next two years will see a speculative boom unlike anything you’ve ever seen — even if the global economy does not recover from COVID-19.

DeFi = Money from nothing

Permissionless, decentralized financial systems will revolutionize finance and redefine the meaning of money.

Eventually.

In the short-term, they just give speculators easy access to cheap money.

As cryptocurrency prices go up, insiders will leverage their gains for stablecoins, which they will use to buy more crypto. Smart money will roll their new crypto into new loans to buy more crypto with. After all, the market’s going up, why cash out and pay taxes when you can re-up and snowball your gains? DeFi loans carry lower interest rates than most other types of debt, anyway.

On top of that, attractive yields will encourage people to keep crypto on lending platforms like Crypto.com, BlockFi, and Celsius. This will essentially lock up their crypto, reducing circulating supply while also giving new borrowers more credit at lower rates.

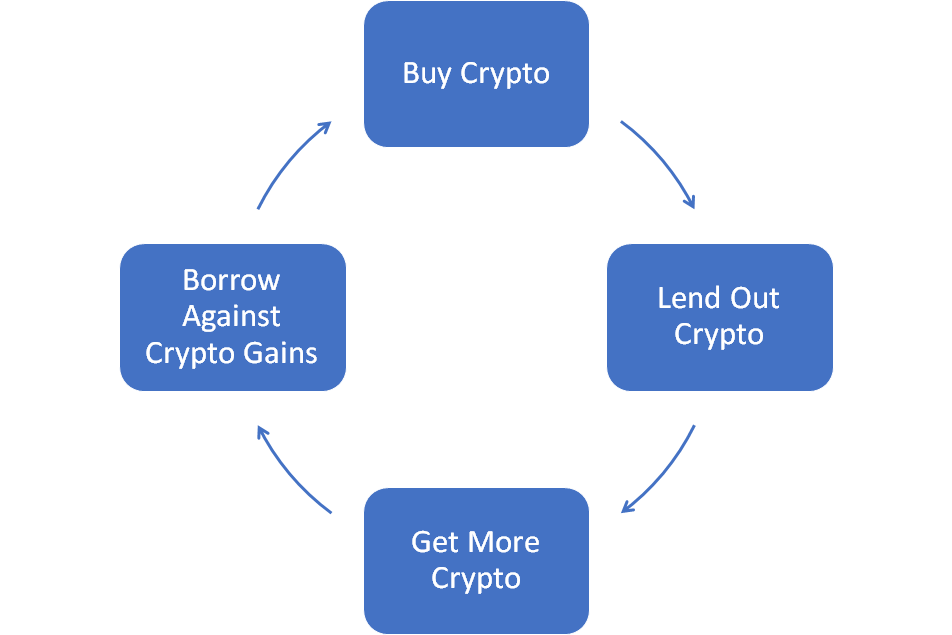

As a result, you will see a cycle emerge: buy crypto, lend it out, get more crypto, borrow against that crypto, buy more crypto, lend it out again, get more crypto again, borrow against that crypto again . . . like so:

This is normal human behavior. If not for credit limits, credit scores, and government regulations, people would do this with money from the banks.

Eventually, you’ll start to see people advertising their “master plan” for using DeFi to make fast money with crypto. You’ll hear stories from friends and strangers about DeFi millionaires and people who got rich from yield farming. That could be you!

How many people do you know will turn down money from nothing?

#investing #cryptocurrency #finance #blockchain #bitcoin