I became frustrated with the numbers not making sense on my Student Loan statements and speculative opinions about why you should not try to pay it off quicker if you are able to. I wanted to gauge my likelihood of paying off the full loan and practice my Data Science skills, so I simulated my earnings using Monte Carlo written in Python. Here I give a walk-through and evaluation of the findings.

Full code available on my GitHub.

Skip to Method and Results if you’re short of time!

Intro

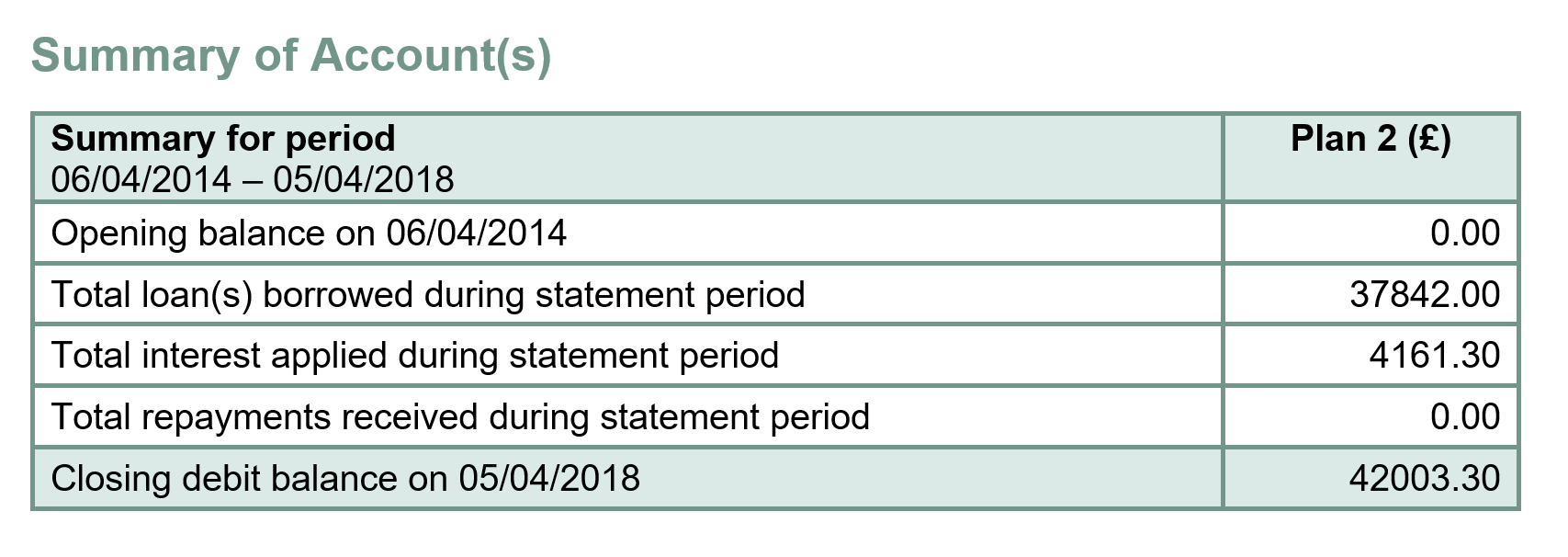

In the UK, students can take out university loans for both tuition fees and living costs with Student Finance England, who provide loans underwritten by the Student Loans Company. Once you enter employment as a graduate, you then begin to pay off your loan on a monthly schedule as part of your tax deductions. Crucially, if you do not pay off your loan, plus interest, in 30 years, your loan is cancelled. They’re also substantial — approximately £42,000 one year after graduating in many cases.

Example of the statement summary graduates receive from the Student Loans Company after graduating. (Image by author).

Rationale

- I found documentation surrounding repayment murky and dense. It’s confusing, and no-one online or in my circle could give me clear answers.

- Conflicting opinions surrounding repayment— _“it comes out of my tax so I don’t even notice it” _and “most students won’t pay it off and it will get cancelled, so paying extra upfront might be wasting your money” — but this paints “most students” with a broad brush, which spans a huge variance in earnings (and therefore amortisation) between subjects, university attended and industry.

- I wanted to cut through the noise and capture the dynamics between the accruing interest and monthly tax repayments to quantify my own probability of paying it off.

Questions

1. How likely am I to pay off my student loan inside of the 30-year payment window, given my probable salary progression?

2. If you manage to save money, or come across a sum of money (e.g. inheritance), should you pay off some or all of your loan in the form of voluntary payments?

Facts

- Students taking out loans since 2012 are on “Plan 2” loans, and they are split up into instalments which you receive throughout your degree.

- Graduates only start paying back towards their loan when they earn more than £2,214 a month or £26,568 a year (pre-tax) as of the date this article was published.

- Loan repayments are deducted from your salary when you are paid by your employer (in the UK, usually the last working day of the month) — these are due the April after graduating if you earn above the threshold.

- You begin accruing interest from the day of your first loan instalment (i.e., shortly after arriving at university).

- Interest accrues daily.

- Plan 2 loans are written off 30 years after the April you were first due to repay if you are still repaying.

Student Loans are not like other loans

- The amount you pay back on your Student Loan is calculated as a percentage of how much you earn above a threshold, so it behaves much more like a tax, rather than regular loan repayments.

- Interest rates are variable, not fixed — they are calculated as the RPI (Retail Price Index) measure of inflation, plus 3%, so rates have been as high as 6.6% in recent years.

- Interest rates change each academic year (September 1st), using the RPI inflation for the financial year ending in the previous March (i.e., March 2019 RPI is used for the rate set on September 1st 2020).

#data-science #programming #monte-carlo #student-loans #personal-finance #python