What is DAO Maker (DAO) | What is DAO Maker token | What is DAO token

Exploring the DAO Maker Token Economy

Yesterday, the first batch of private sale applicants that passed the whitelist received the DAO Maker whitepaper and the DAO Token Economics Papers.

This article explores the token economics paper, as a summary of key aspects. There are three key aspects that add utility to the token:

- Payments to Stakers

- Holder Incentives

- Lending Sponsorship

- Token Support Activities

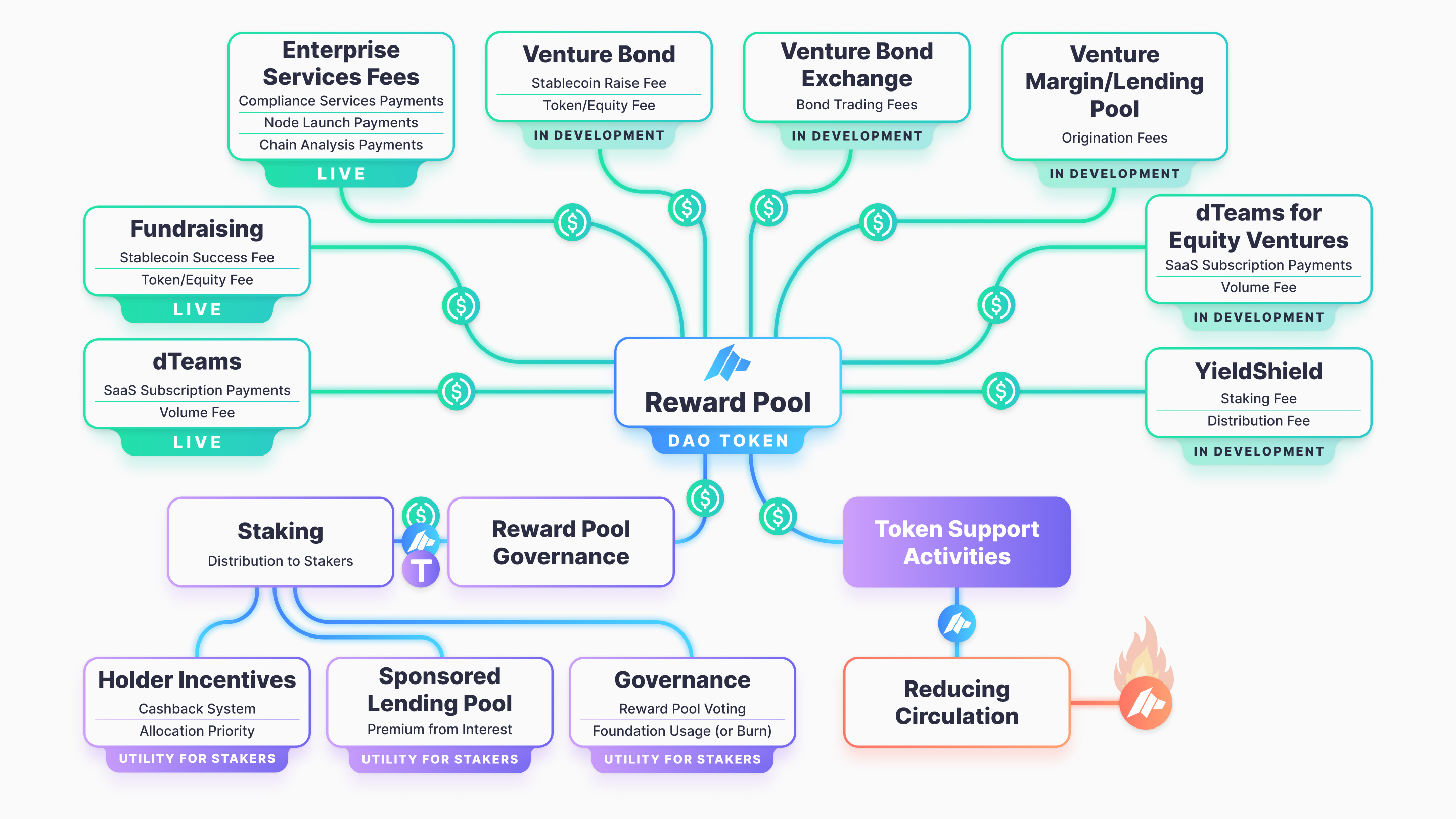

Utility Set 1: Payments to Stakers

First and foremost, this is not an inflationary staking system. Staking payments are not based on just unlocking more DAO tokens. They are only based on platform fees.

This utility is going to be a key driver in holding and staking DAO tokens. Staking tokens is required to claim payments from a primary reward pool.

The reward pool is built up with payments generated by the platform’s services and products. Many products are already live as we’ve been working on them since 2018. Many more products are in development as we expand the product portfolio to reach our goal of making the DAO Maker platform the center of venture capital opportunity for retail investors across the world.

- Live Fee Streams -

1.1. Fundraising Fees

Most people know us for token launches. Fees are collected from tokens that launch through our platform. We are now in the process of expanding our platform services to equity crowdfunding.

1.2. dTeams Fees

Those who do not know us from token launches, know us from DAOs or Community Hubs powered by our Social Mining technology. A new, more advanced version of Social Mining is now being launched, rebranded as dTeams.

Subscription fees are collected from projects that use the technology. A success fee is claimed based on the transactional volume that takes place on it.

Demand for the product has been great, but we have always kept it permissioned access. We are now shifting towards two variants: (a) a limited _Express _brand, available without permission to any project and (b) a full-featured permissioned _Atlas _brand, available only to a few.

Express will include success fees based on transactional volume on the platform; this is usually in the form of rewards distributed to stakers. Atlas will remain as a combination of subscription fees and success fees.

1.3. Enterprise Service Fees

The DAO Maker platform is a combination of many services, many of which have grown in high demand as legislative pressure grows. Fees are charged when companies use our chain analysis tools to block certain addresses; fees are charged when companies use our KYC/AML service; fees are charged when companies use our node launch system.

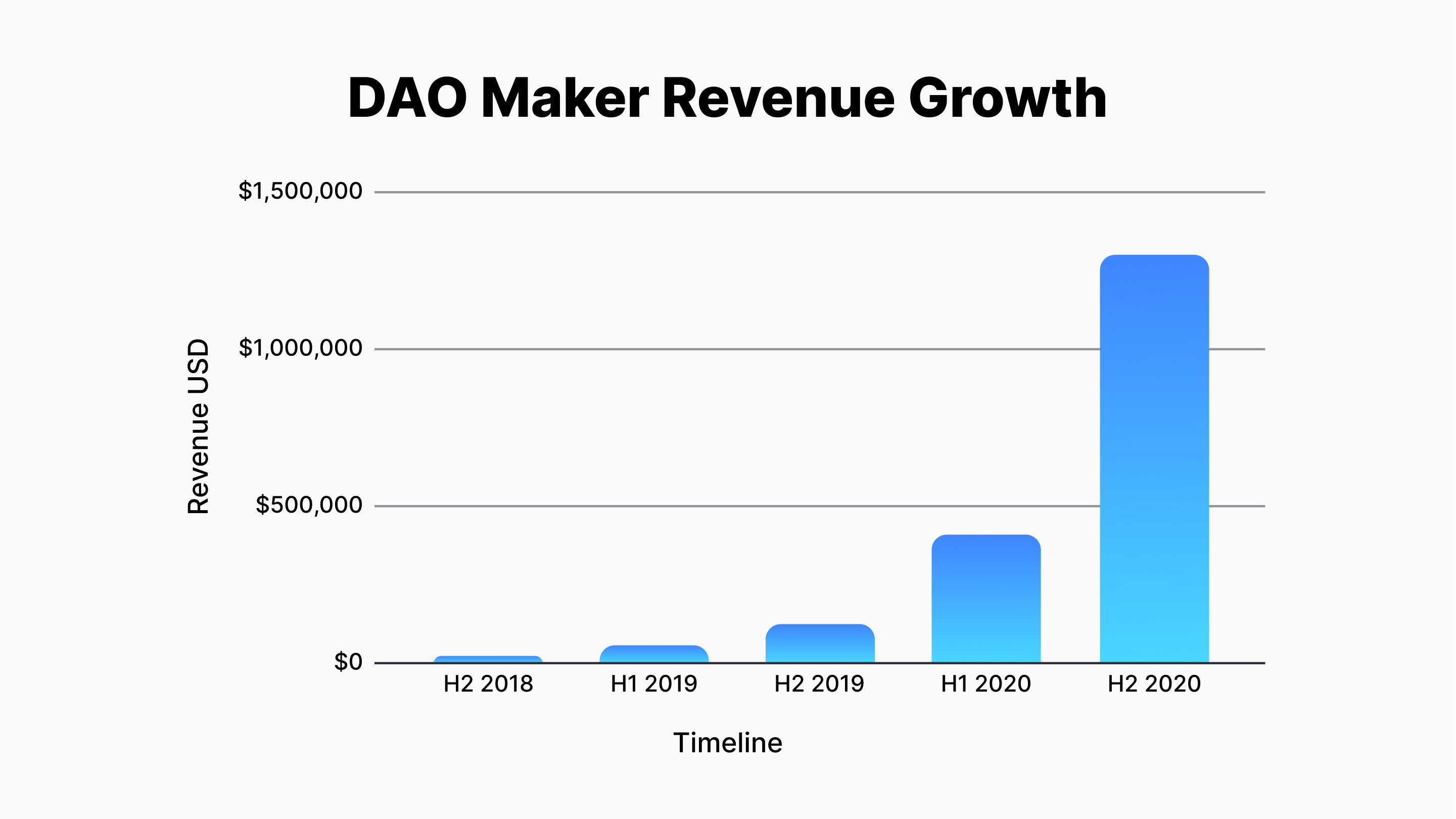

The above services and products that are already live. DAO Maker is a cash flow-positive. It has been a self-funded company since late 2018, and is now on path to cross $1.7M in 2020 revenue.

- Fee Streams in Development -

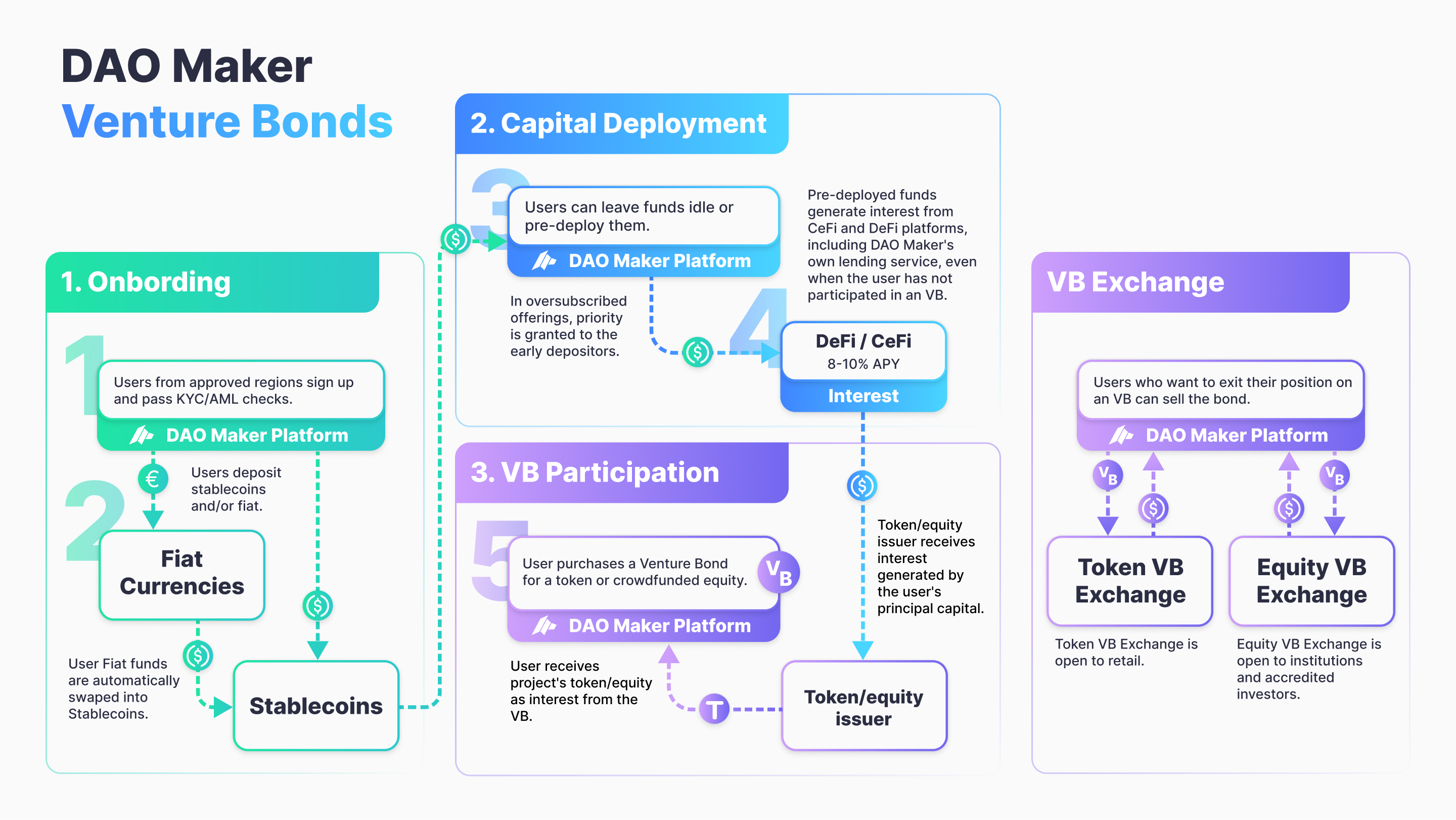

1.4. Venture Bond

The Venture Bond is a product we are launching to create nearly zero-risk venture investments. First, startups issue bonds, then retail purchases these bonds, and then the principal money collected from retail generates interest on insured and overcollateralized margin lending.

The generated interest is given to startups, who in return give equity or tokens. At bond maturity, the principal funds are returned to retail. So retail ends up with their initial money back, plus tokens or equity in a startup.

The complete details on how a Venture Bond operates are available in the whitepaper. Fees will be collected from a portion of funding generated by startups, and from a portion of tokens or equity received by Venture Bond holders.

1.5. Venture Bond Exchange

The Venture Bond is an asset class native to the DAO Maker platform. It will need liquidity, and the platform will also facilitate that.

To clarify, a Venture Bond, like any bond, locks funds and returns them after a maturity date (like an expiry date). Only at maturity date, the funds are unlocked from the Venture Bond. It’s likely that some (or many) people may want to exit their position before a Venture Bond’s expiry date. The Venture Bond Exchange facilitates this demand.

There will be trading fees.

The VB Exchange will be open to all for trading Bonds of tokens. Bonds of equity, even though it is crowd equity, will be open to only accredited investors, due to legal requirements.

1.6. Lending Pool for Venture Margin

As just mentioned, the Venture Bond generates funding for startups by using money generated by retail in margin funding activities, insured and over collateralized.

Margin funding isn’t a new concept. There’s almost $800 billion in margin funding in traditional markets. Margin funding isn’t new to crypto either. Exchanges companies like BlockFi and Celsius have been providing this for a while. It has now taken center stage with the DeFi surge.

There is an instant market tap worth billions of dollars.

Margin funding is essentially money used by traders for leverage. To do so, traders have to provide over collateralization, with the standard being 200%. While at the initiation of the Venture Bond we will work with industry providers that are insured and overcollateralized, we will launch our own platform to internalize the margin supply Venture Bond creates; this will be in the form of a lending platform.

Origination fees will be collected, per industry standards, and added to the reward pool. Origination fees are the costs charged upon interest, to borrowers.

- Claiming Payments -

The above revenue streams, whether they are live or in development, will feed a reward pool.

0.5% of the daily pool value will be rewarded per day to stakers. Stakers will have to participate in platform governance, be it creation of proposals or voting in them.

Utility Set 2: Holder Incentives

There’s a large stream of products within the DAO Maker. Some are B2B, some are B2C, and some are B2B2C.

The token will provide the end-user focused products to host incentives for holders. This is in line with boosting platform loyalty. The incentives are focused on the funding products.

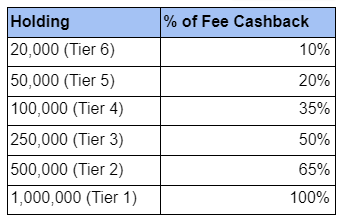

2.1. Cashback System

The first form with which loyalty will be rewarded is a cashback system. Stakers will not only receive a portion of platform fees, but they will also receive somewhat of a discount on venture investments they make on the platform.

As mentioned earlier, there are platform fees taken from projects that launch a funding campaign. The fee is not applied to the buyer; it’s applied to the startup.

If a person is staking enough tokens, he/she will get a cashback. The funds for the cashback come from the fees taken from the startups on the platform. It’s similar to a credit card cashback system: when you spend money at a store, the store pays a bit to the card provider, and the card provider gives you some of that money.

Example of possible Cashback system; this can be adjusted in the future.

2.2. Allocation Priority

DAO Maker’s DYCO and rSHOs have seen great demand, especially in the small public rounds. The DAO token will give its holders priority in our offerings.

Tokens in the SHO ecosystem will continue to play a role in allocation priority, but the larger portion of allocation will be based on holding/staking status of DAO tokens.

Utility Set 3: Lending Sponsorship

This utility set is complex so it is recommended that the whitepaper is referred for a thorough explanation. The article will offer only a topical insight.

As mentioned earlier, to internalize the margin lending market generated by Venture Bonds, the platform will host its own lending market, tailored for margin lenders. The industry standard is that margin collateral is only accepted in the form of handful of cryptocurrencies. These are the notably high market cap and extremely liquid assets, like Bitcoin and Ethereum.

This means that a significant portion of the market is cut out from access to lending. Given that the DAO token has a very diverse stream of fees creating its support, it creates an opportunity to use the DAO token as a sponsorship token to insure the launch of low-cap tokens as collateral. This will allow them to earn additional fees from the interest being paid to borrow the tokens in sponsored lending pool.

DAO token stakers, who are earning reward pool distribution and enjoying platform incentives like cashbacks, will have the opportunity to voluntarily sponsor lending pools of tokens they like. There’s significant detail on the parameters placed to ensure the operational security of the system.

Utility Set 4: Token Support Activities

There are three primary token support activities. These are designed to boost token distribution, holding, and community involvement.

4.1. Reducing Circulation

Adding all platform fees into the reward pool is not the best approach. Instead, the fees will be split: (a) added to reward pool and (b) used for reducing token circulation.

While the reward pool growth increases staking, reducing circulation boosts token liquidity confidence. It also has a permanent benefit on the token.

4.2. Decentralized Accelerator

The Strong Holder Offering is being turned into the refundable Strong Holder Offering. This framework will be only for projects that have already raised in a private round but now need a public sale mainly to build a community.

The SHO resources will be used to locate a community, but with an added feature.

People will have the right to refund their SHO tokens. However, if tokens are not refunded (meaning token is doing well), a fee will be charged on the non-refunded amount to buy back tokens of that project.

These will then be distributed to the stakers. This was not mentioned above in the reward pool because this distribution has a skew. Those who helped the project that conducted the rSHO will get a bigger amount of tokens. So it creates an incentive system for the community seeded by the rSHO to make help the token do well.

The reward pool described in the beginning of the project distributes payments evenly to all stakers. The Decentralized Accelerator payments are not even: those who helped the rSHO client will get a higher reward.

4.3. Reward Pool Governance

Platform fees are collected in a combination of stablecoins and tokens (of many different projects).

Fee collection that is being added to the reward pool will be up for votes on a monthly basis. This vote will allow DAO stakers to decide which ecosystem token should the stablecoins buy. This means a portion of platform fees will be used to support projects that join the DAO Maker ecosystem. This creates a good incentive system for projects to join.

The voting system also adds an additional network utility to the DAO stakers, giving them increased responsibility in the ecosystem.

DAO Maker’s Direction

- Till recently, only projects we accelerate are allowed to use our sale platform

- Our accelerator is highly exclusive, and only a couple projects qualify per year; the cause is the extreme cost of time and capital needed for proper acceleration

—

- Compliance is in high demand, and we have spent years building a platform that offers a fully compliant token sale

- We want to use the high demand for such a service to offer our community access to otherwise sold-out sales

- Such projects, though, won’t operate like the ones we accelerate as we have no influence on them; just providing compliance

- From now on, we will give a warning if a launch is not accelerated by us; such projects would also be mandated to agree to down-side protection (refunds) to the community sale

Full Article starts here.

Over the past three years, we have acquired a reputation of accelerating some of the best projects in the space, some of which have defied the bear market of 2019.

Behind the doors, we’ve actively advanced our ‘launchpad.’ We are based, registered, and licensed in the EU and hence we comply with the most up to date KYC, AML, and data protection compliance requirements.

Many projects have and continue to approach us to host compliant public sales for retail. Unlike private rounds for VCs, public rounds for retail require more stringent compliance requirements. Moreso now than ever, since regulatory throwback has brewed to a point where revitable exchanges like BitMEX and OKEx are facing legal hurdles.

Projects seek communities, and community raises need to be done in a manner that covers a wide range of requirements: provable efforts to cut off the US and China, ALMD5-compliant (and soon ALM6) KYC and AML checks, GDPR-compliant data protection, and provable efforts to cut off any sanctioned countries.

We offered and continue to offer Compliance as a Service to projects that are both sold out and have been actively building something that furthers the crypto ecosystem. However, this does not mean that DAO Maker actively endorses or advises these companies.

We will continue to incubate & accelerate projects

Up until we recognized that there is a surging demand (need) for compliant token sales, we only raised for projects that were incubated/accelerated by us. When we incubate a project, we invest in it and then take a very active role in the project. We may even take a board seat to ensure that the actions we feel are going to drive success are implemented.

Our incubation process involves us working on the project’s product to ensure it has a strong market fit and a greater integration of the project’s token. If the underlying technology allows, we work to strategize additional products that could be added to the development, to ensure a diversified product portfolio for the company. We may even work to improve the UX and UI design, alongside game theory in project economics and business development. This is resource, labor, and capital intensive and that is why we only incubate a few projects per year.

We will take a different approach to non-accelerated sales.

We are now fulfilling a rising industry necessity: safe and compliant token sale offerings, even for projects that are not incubated by us.

We will clarify from now on whether a token sale launched on our platform is just a project seeking a compliant token sale, or that it is a sale of a development fully incubated by DAO Maker. Users should only invest in these projects if they have had a pre-established interest in the specific companies as we have little to do with them, outside of the compliance of the token sale.

For projects that want to grow their community using the ecosystem, in a compliant manner, DAO Maker hosts safe Token Sales that will offer participants partial or full refunds if the token goes below ICO price in the first 2 months. The first one being PlotX, which offers the participants of the DAO Maker-operated Community Offering a 50% refund if they do not participate in the app to claim the second batch of tokens.

TOKEN SALE: 18 JAN – 18 JAN

Ticker: DAO

Token type: ERC20

ICO Token Price: 1 DAO = 0.1 USD

Fundraising Goal: $300,000

Total Tokens: 312,000,000

Available for Token Sale: 25%

Please add our communication channel to keep you up to date! Looking for more information…

☞ Website ☞ Whitepaper ☞ Social Channel ☞ Message Board ☞ Documentation

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ Binance ☞ Bittrex ☞ Poloniex ☞ Bitfinex ☞ Huobi

What You Should Know Before Investing in Cryptocurrency - For Beginner

⭐ ⭐ ⭐ Join to Get free ‘GEEK coin’ (GEEKCASH coin)! ☞ CLICK HERE⭐ ⭐ ⭐

(There is no limit to the amount of credit you can earn through referrals)

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#blockchain #bitcoin #dao maker #dao