Note from Towards Data Science’s editors:_ While we allow independent authors to publish articles in accordance with our rules and guidelines, we do not endorse each author’s contribution. You should not rely on an author’s works without seeking professional advice. See our Reader Terms for details._

A lot of definitions and formulations of entropy are available. What in general is true is that entropy is used to measure information, surprise, or _uncertainty _regarding experiments’ possible outcomes. In particular, Shannon entropy is the one that is used most frequently in statistics and machine learning. For this reason, it’s the focus of our attention here.

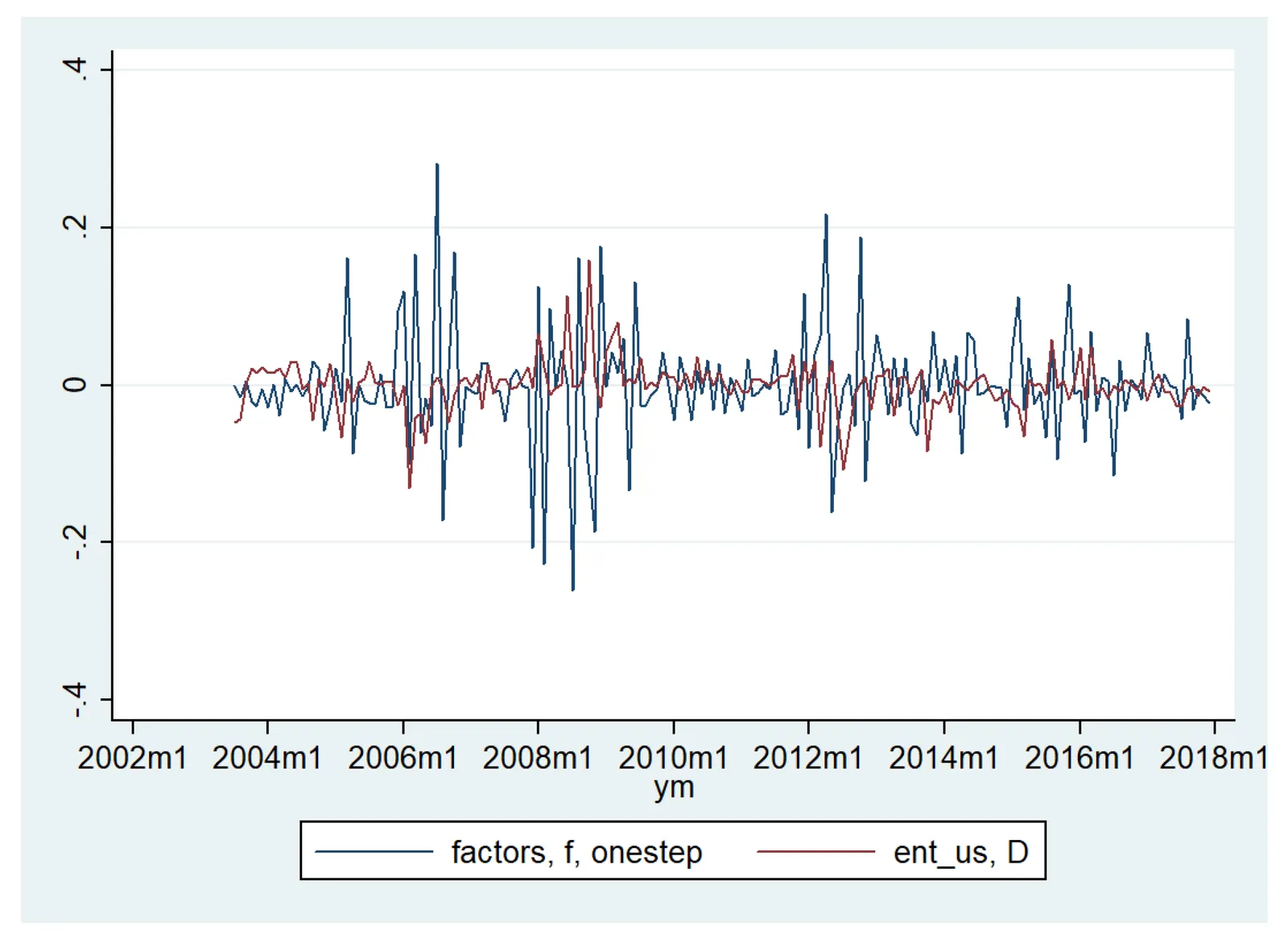

Surprise and uncertainty are daily concepts in the financial market. So using the entropy as an instrument to explore the market sounds like a very spicy idea. What we expect is to reveal a remarkable pattern between the new measure and the volatility of the assets’ prices over time.

Considering our aims, I think it’s valuable to introduce the standard approach and considerations provided in this work. The authors introduced the concept of **Structural Entropy **and used it to monitor a correlation-based network over time with application to financial markets.

#entropy #finance #machine-learning #data-science #editors-pick