What is Polymath Network (POLY) | What is Polymath Network token | What is POLY token

About Polymath

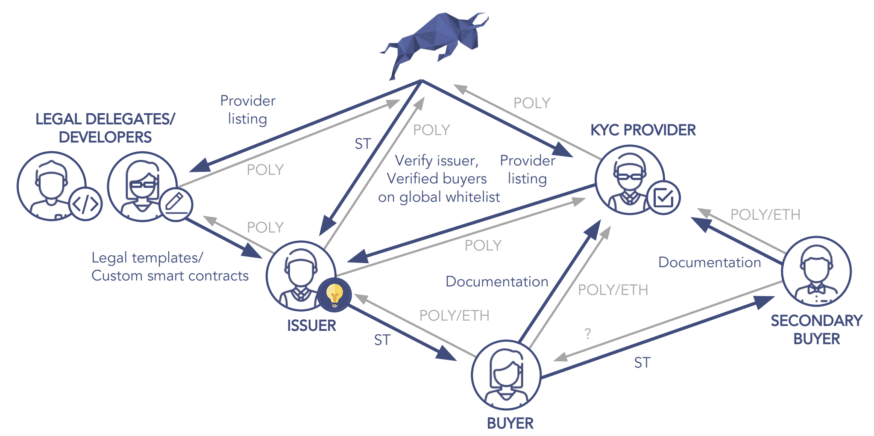

Polymath (POLY) is creating a global platform for issuing and investing in securities tokens. Polymath’s standard for blockchain security tokens aims to integrate the necessary regulatory requirements into smart contracts and comply with regulations. The project simplifies the legal process of creating and selling security tokens. It establishes a new token standard (ST20) and enforces compliance by whitelisting authorized investors and their Ethereum wallet addresses. The POLY token is used for payments on the platform, which facilitates exchanges between issuers, investors, service providers, and developers.

Polymath simplifies the legal process of creating and selling security tokens. It makes a new token standard, the ST20, and enforces government compliance. Only a “list of authorized investors and their Ethereum wallet addresses” can hold ST20 tokens. Therefore, token issuers don’t need to worry about the legal implications of their security falling into the wrong hands.

In order to launch a legally compliant token, the Polymath platform brings together issuers, legal delegates, smart contract developers, KYC verification, and a decentralized exchange. All transactions on the Polymath platform take place using the native POLY token. Due to the continuing government crackdown on initial coin offerings, Polymath hopes to instead provide legal Security Token Offerings.

Polymesh, a blockchain built for security tokens, will be going live in March 2021. Get a behind-the-scenes look at the brand-new Token Studio in this quick 3-minute demo.

Driving efficient capital markets

We relentlessly focus on thetechnological backbone for security tokens. Whether configuring tokens using the Polymath Token Studio or integrating our broker-dealer toolkit into your offering, Polymath’s technology brings efficiency and transparency to security token management.

Open source.

Transparency is at the core of all Polymath products.

Standardized.

ERC1400 standard ensures the token’s code meets specific requirements in order to minimize technical due diligence.

Modular.

Build tokens your way, for your jurisdictions. Polymath modules let you customize your offering, manage your token, and provide corporate actions.

Automated.

Polymath lets issuers set rules around who can hold their token, how it can be transferred and other jurisdictional requirements. From there, the system will automate rule enforcement.

End-to-end.

Polymath’s self-serve token creation and management technology integrates smoothly with a large ecosystem of custodians, broker-dealers, legal firms, cap table management providers, token sale platforms, KYC/AML providers and others so that issuers can create a bespoke end-to-end solution.

Purpose-built.

Polymesh is an institutional-grade blockchain built specifically for security tokens that solves the inherent challenges with public infrastructure around identity, compliance, confidentiality, and governance.

How Does Polymath Work?

Token Supply and Sustainability

Overall, there are one billion POLY tokens that will ever exist. You could have signed up for the Polymath airdrop before January 10th, 2018. Subsequently, airdrop participants received 240 million tokens.

At this point, the Polymath team retains the rest for future use. If you missed the airdrop, then you’ll need to trade for POLY on an exchange.

Polymath Securities Token Platform

The token platform involves three layers: an application layer, a legal layer, and the protocol layer to ensure your token is compliant and stays compliant. These layers aim to reduce the legal complexity and ambiguity surrounding securities while also minimizing fees and improving the liquidity of assets.

Launching a Security Token

Polymath asks for the following information to instantly create your ST20 standard security token.

- Legal Name:

- Legal Entity Type:

- Type of Security:

- Project Description:

- Logo:

- TOKEN CHARACTERISTICS

- Voting Rights:

- Dividend:

- Dividend Frequency:

- Corporate Governance:

- Governance Integration Partner:

- Additional Features:

- TOKEN ALLOCATION

- Tokens to Create:

- Percentage of Tokens Held by Company:

- Percentage of Company Equity Distributed With Tokens:

- Price per Token in USD:

- LEGAL DETAILS

- Issuing Jurisdiction:

- Offering Security To:

- Investors Must be Accredited:

- Investor KYC Needed:

- KYC Integration Partner:

- Tokens Freely Tradable:

- CONTACT DETAILS

- Contact Name:

- Position at Company:

- Contact Phone Number:

- Contact Email:

- Permit Contact from Polymath:

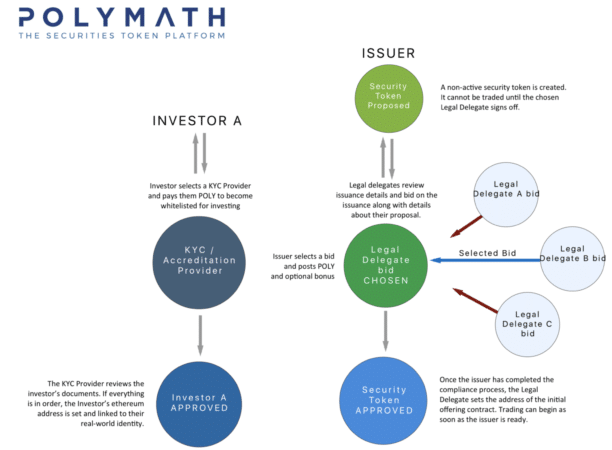

Choosing a Legal Delegate

After creating your new token, it’s still non-transferrable until a legal delegate confirms “that the steps have been completed for the token to be issued.”

You’ll receive several bids from legal delegates, lawyers, but it’s up to you to perform due diligence and compare their fees. Once you choose a legal delegate, you send POLY for their fee to a smart contract and begin working together on the Polymath platform by securely sending necessary documents and working through the compliance process.

Part of the process entails delegates working with developers to build a smart contract specifically for your token. Then, the smart contract enforces investor requirements such as jurisdiction of investors, type of offering, hold time before tokens can be resold etc. After the necessary documents are sent and the smart contract completed, the legal delegate will set the address of your initial offering contract. You’re finally ready to start trading.

Becoming an Investor

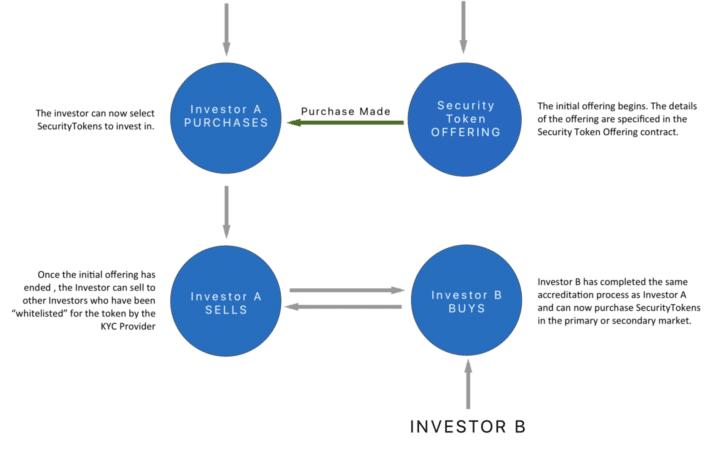

If you’d like to purchase a token on Polymath’s platform, you first need to have your identity and accreditation status confirmed by a KYC (know your customer) provider. You can search and choose a KYC provider on the Polymath network. Next, you’d send the required number of POLY tokens to escrow until your KYC process is completed. After submitting the necessary documents, the KYC provider can send information to a Polymath smart contract specifying details on your ability to buy securities. The information stored in the smart contract will also determine the amount of money you can invest in securities and where you can trade them.

Security Tokens

While most tokens are easily tradable on exchanges, security tokens follow different rules due to numerous legal implications. It’s important to know who owns a security token at all times due to securities potentially providing voting rights, dividends, or other income with tax implications. Exchanges currently avoid listing any token potentially considered a security to avoid security regulators.

However, with a token created through Polymath, the smart contracts verify who can buy and sell the token. Only investors authorized under Polymath’s KYC providers will be able to hold the token. This could, in theory, eliminate the fees associated with centralized exchanges that ensure security compliance.

The Polymath investment process

The Polymath investment process

Learn more about Polymesh Testnet II

Today marks the release of Polymesh Testnet II: Alcyone. Much like it’s predecessor Aldebaran, Alcyone is the name of a star within the Taurus constellation, a nice nod to our Polymath brand bull.

Whereas Testnet I was predominantly user-facing, much of what Alcyone brings to life is under the hood of Polymesh, with new enterprise features to help institutional users clear the roadblocks found on public, permissionless blockchains.

Here’s what you can expect from Alcyone:

Confidential Assets Infrastructure

On public chains, anyone can see the contents of a public address. While users can easily make transactions and balances confidential with layer-2 solutions, they come with an unworkable compromise — to add confidentiality, they must sacrifice compliance. Polymesh enables users to issue confidential assets while still adhering to compliance criteria in an automated way. The Alcyone release is simply the first step to implementing confidentiality with much more on the way — look forward to a technical white paper on the specifics of how Polymesh manages confidentiality later in the fall.

Portfolios

Portfolios help users group assets in a way that makes sense for them, letting them organize large numbers of assets in a functional and reportable way. Alcyone testers can start using portfolios right away and can look forward to dashboarding capabilities in Q4.

Permissions

With the Alcyone testnet, users will be able to define granular permissions for who can perform which actions on the blockchain. When combined with the portfolios function, users are able to segment responsibilities and efficiently control access to assets.

Attestation Management SDK Documentation

Attestations are the feature that ties user identity and compliance together, allowing the issuer to automate the compliance framework for their security token. More specifically, they are the on-chain confirmation that an attribute of a user’s identity is true. Sometimes attestations are based on the token (e.g. buy or sell lockups tied to when a token was issued). Other times, they’re based on the unique identity of the user and need to be verified through third-party service providers (e.g. residency; accreditation). SDK documentation makes it simple for enterprise users and attestation providers to implement this feature.

Importantly, the move from testnet I to II marks a reset of the chain — unless absolutely necessary, it’s the only one we plan to do. For us, testnet is as much about refining our internal processes as it is about ironing out bugs in the code. We know that it’s important to quickly get new features into the hands of users, but we need to be able to do this through smooth network upgrades. From here on out, we plan to conduct regular upgrades to the chain rather than doing another full reset (of course, we’ll be launching a brand new chain for mainnet). This helps us ensure that we can deliver a seamless upgrade process once we get to mainnet, and it gives users more immediate access to new features as they’re developed.

Look out for regular new feature releases as we head towards mainnet in Q1 2021.

Looking for more information…

☞ Website ☞ Explorer ☞ Explorer 2 ☞ Whitepaper ☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Message Board ☞ Message Board 2 ☞ Coinmarketcap

Would you like to earn POLY right now! ☞ CLICK HERE

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ Binance ☞ Bittrex ☞ Poloniex ☞ Bitfinex ☞ Huobi

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#blockchain #bitcoin #polymath network #poly