In today’s world the credit card frauds are very vulnerable to each one of us. In a day all around the world millions of transactions get carried out. It is very much possible that the person doesn’t carry out the transaction still the credit is done from his/her account.

There are many ways to detect whether the transaction is a fraud or not.

In our project we detect the transaction on basis of behavior of the transaction.

The detection of fraud transactions can be used by banking companies and other Money transaction applications to inform their customers if a fraud transaction occurs and strict measures can be then taken.

It can be also considered as a safety measure taken to avoid fraud transaction.

If a fraud transaction occurs the company can immediately inform its customers and verify with them.

We are basically going to use 2 different models to optimize our output thereby maintaining our accuracy high.

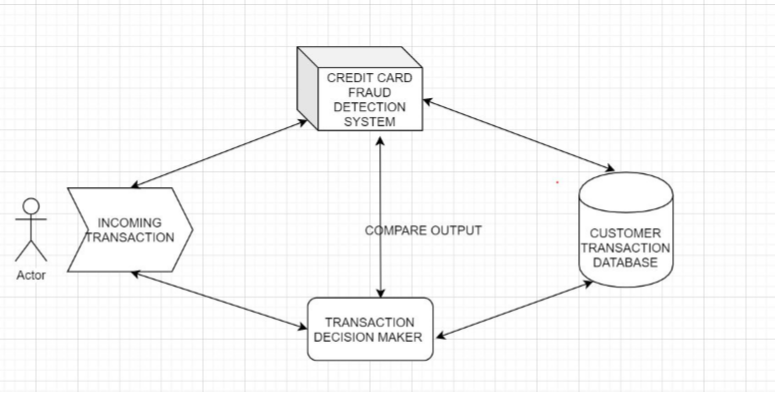

**Architecture **of our System.

OUTLINE

Module 1:

OCR- a font, a font created specifically to aid Optical Character Recognition algorithms. We’ll then devise a computer vision and image processing algorithm that can localize the four groupings of four digits on a credit card, Extract each of these four groupings followed by segmenting each of the sixteen numbers individually, Recognize each of the sixteen credit card digits by using template matching and the OCR- a font.

So this is how Module 1 works:

1. Takes a reference image and extracts the digits.

2. Stores the digit templates in a dictionary.

3. Localizes the four credit card number groups, each holding four digits (for a total of 16 digits).

4. Extracts the digits to be “matched”.

5. Performs template matching on each digit, comparing each individual ROI to each of the digit templates 0–9, whilst storing a score for each attempted match.

6. Finds the highest score for each candidate digit, and builds a list called output which contains the credit card number.

7. Outputs the credit card number and credit card type to our terminal and displays the output image to our screen with database details .

8. Comparing with Luhn algorithm it tells whether it is valid or invalid card.

Retrieval of Customer details from the database by OCR technique.

#fraud-detection #credit-cards #data-mining #data analysis