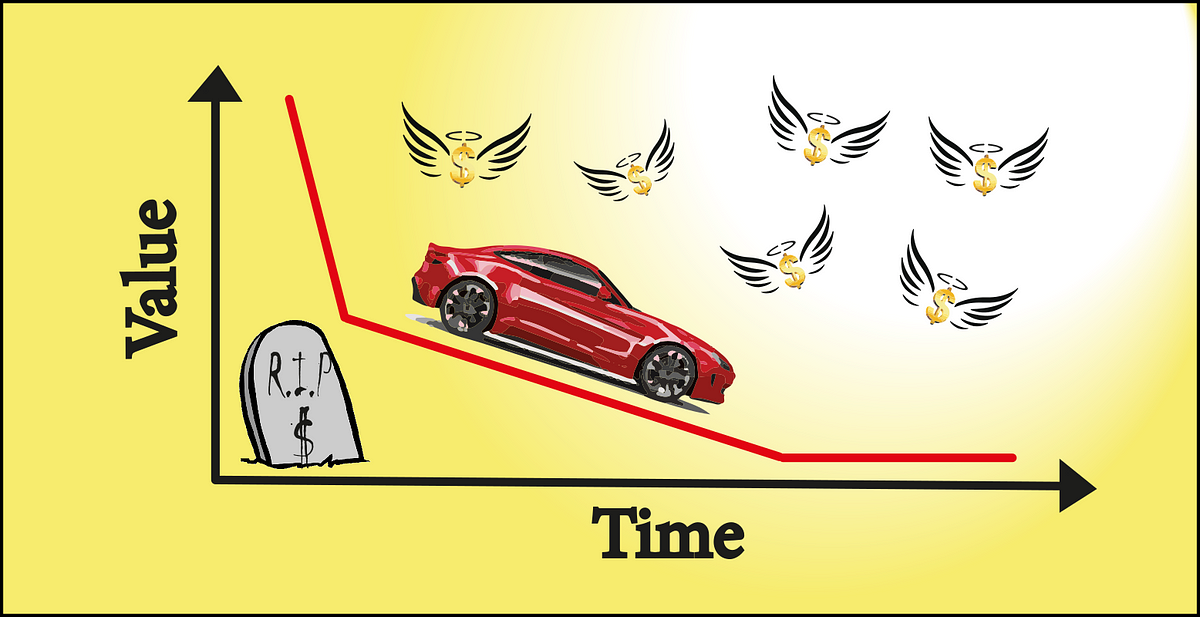

Cars: A means of commuting, travelling, shopping and according to the Department for Transport, the leading mode of transport in the UK. In 2018, 83% of the total kilometres travelled were done so by car. (Transport Statistics GB, 2019 [1]). Car adverts conjure up feelings of freedom, power and independence. Combine their continuously declining real price [2] (nominal price divided by inflation) with the seemingly unlimited finance options available it’s no wonder that the average number of cars per household was recorded as 1.2 in 2018 (1.3 excluding London). Everyone, it seems, can see the benefits of owning a car, however it does beg the question of whether buying a new car is financially wise, or if purchasing a used car is a sounder investment (tip: it is the latter).

To demonstrate this hypothesis a total of 85,000 new and used car records were scraped from a popular car marketplace using python’s beautiful soup. The scraped data include models with a mean price ranging from £8,700 (Dacia Sanderos) to £101,000 (Audi RS 7s). However, in this study the comparison of new car versus old will be focused on hatchbacks as this car types make up 35% of the total market as seen in the following figure. The data were visualized using Tableau. The data for the rest of the categories/models, along with additional information such as average price per model and market share can be found online at tableau public.

New/old car market share across different car types. Types comprising less than 0.1% were removed to avoid visual cluttering.

To depict the magnitude of depreciation in value, six models were selected and are shown in the figure below. These make up approximately 17.4% of the hatchback category with prices for a new car averaging between £16,700 (Renault Clio) and £21,500 (Peugeot 208). The figure clearly demonstrates that the price of a new car falls by an average of 30% after just one year. The biggest decrease in value, a staggering 50%, can be seen for the Peugeot 208 and the Vauxhall Corsa (also known as Opel Corsa) within the first year. This downward trend continues until year 7 with the price drop of a new car averaging 65%. The Volkswagen Polo seems to be the winner, its value depreciating by only 10% after one year and 60% after seven years. It is also interesting to note the level of heteroskedasticity in the data. The width of depreciation ranges between 10% and 52% in the first year, narrowing to 60% and 70% after seven years, demonstrating that irrespective of the losses experienced in the early years of owning their car (a Polo owner for example), after some time they all decrease to the same result.

#data-visualization #cars #insurance #analytics #data-science #data analysis