Stablecoins: Things you need to know

What are stablecoins?

Stablecoins are a special type of digital asset that represent the value of another currency or asset found outside of this asset’s blockchain. Investors may think of it almost as a derivative product, in that there is an underlying asset involved. “Stable” references that the outside asset is more constant relative to the value held on this asset’s current blockchain. Major cryptocurrencies, Bitcoin and Ether, are renowned for their volatility — which have been the boon and bane of many investors. The most popular currency that stablecoins represent is the US Dollar, thereby allowing for stable on-and-off ramps for investors, a process that previously involved multiple costly transfers between fiat and cryptocurrencies.

Why use cryptocurrencies?

Cryptocurrencies have several potential advantages over using regular fiat. Fiat requires trust in the central issuing government body. Since all major currencies have decoupled from the gold standard in the latter half of the last century, fiat is no longer backed by a hard asset, meaning that value in a fiat currency is tied to trust in the issuing body. The US Dollar and Euro have a high amount of trust and support, but that’s not the case with other currencies. Zimbabwe’s dollar was effectively abandoned as a national currency in 2009 due to hyperinflation. Cryptocurrencies offer a higher level of transparency since all transactions are stored on an immutable ledger. This detailed record-keeping reduces the need for paid intermediaries to verify if and when transactions occurred. Also, consumers benefit from lower transaction fees with remittances. Cross border transactions no longer have to do multiple hops between intermediary currencies based on what individual banks support. Value can be moved in a single step from one user to another. Certain cryptocurrencies allow for programmable logic to be built into blockchains as well.

Cryptocurrencies aren’t sufficient?

Investors have entered the digital asset ecosystem for a number of reasons. Ethereum¹, with the use of smart contracts², offers a multifunctional protocol that has seen significant application development and financial proofs of concept. Ethereum provides a decentralized network for running resilient, secure, and borderless applications. While Ethereum enables the world computer, the majority of transactions are still tied to the real financial world. Bills, insurance, and everyday expenses are still primarily paid in fiat. Complex financial products and commodities, as well as all domestic transactions, are still denominated in US Dollars. With cryptocurrency volatility persisting, having a solution where one gets fiat price stability and blockchain technology is an essential component in the development of the global digital financial ecosystem.

How do stablecoins solve this problem?

- Stablecoins bridge existing financial markets and crypto-related ones by using the same reference pricing. Users are able to stay in the “digital sphere” while allowing for real-world assets to come online.

- A digital token with price stability gives investors the opportunity to interact with the digital ecosystem while avoiding the middlemen’s costly conversions between fiat and crypto. The investment experience can remain entirely digital.

- Fiat currencies’ inherent benefit also applies to stablecoins: the stability of the US Dollar or another asset/currency to which it is linked. Countries with weaker or volatile fiat currencies could utilize stablecoins similar to embracing the USD to manage risk and participate in global monetary systems.

- Cryptocurrencies’ inherent benefit applies to stablecoins: fast and trustless settlement, frictionless transfer, and use of blockchain technology.

Source CMC

Collateralized Stablecoins

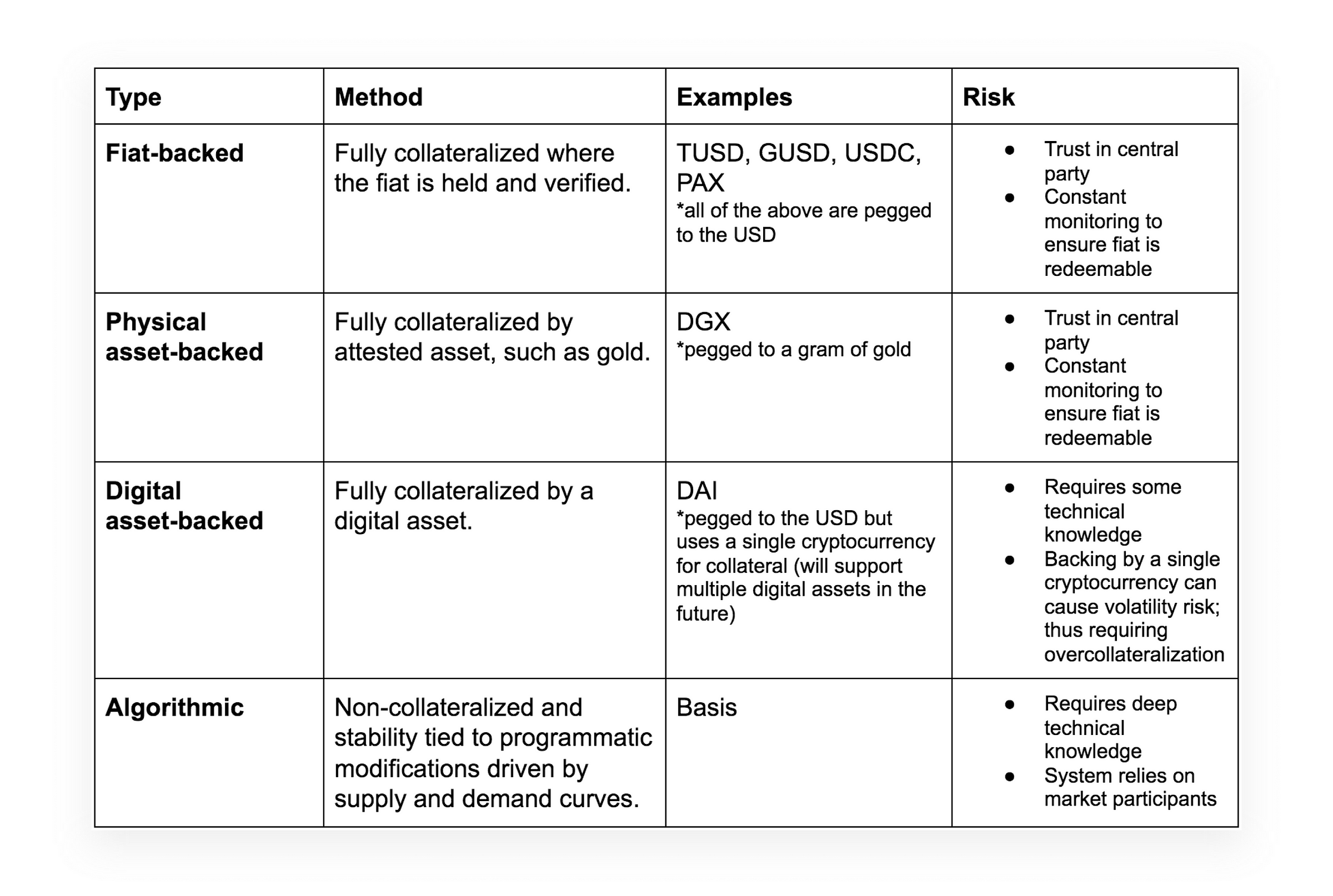

Fiat-backed

Example: TUSD, GUSD, USDC, PAX, USDT

- Fiat-backed stablecoins are issued in accordance to a set ratio pegged to fiat currency. The total amount of tokens issued must be 1:1 with the total cash in the bank or vault. For example, the USD Coin (USDC) is pegged 1:1 to the US Dollar. This stabilization method presents risks around the trust of centralized third parties. These fiat custodians are audited frequently to prove that the digital tokens are fully backed by fiat deposits.

Asset-backed

Example: Digix

- The structure of asset-backed stablecoins is similar to fiat-backed, however, the digital coin is pegged to the value of a hard asset instead of a fiat currency. For example, Digix offers a token, DGX, where one token is equal to one gram of gold. This gold is stored in a vault in Singapore and is audited quarterly to ensure the gold reserves correlate to the total market cap of the token.

- The risks associated with asset-backed stablecoins are similar to the risks of fiat-backed stablecoins in that third parties must be trusted with audits to ensure the peg ratio holds true.

Crypto-backed

Example: DAI

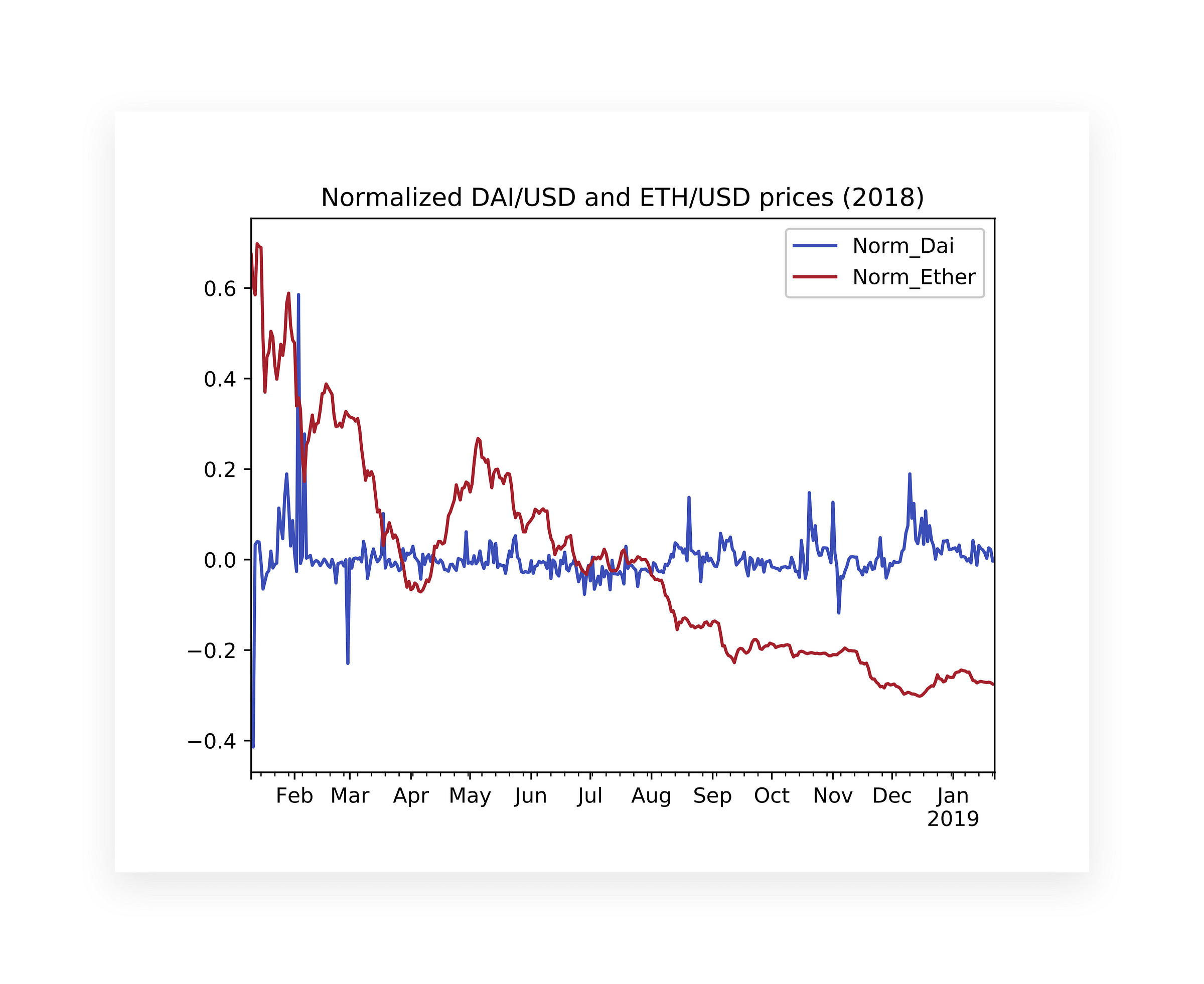

- Crypto-backed stablecoins are digital tokens that are backed by the value of another digital asset like Bitcoin or ETH. This structure is a bit more complicated as the price of cryptocurrencies can swing wildly; thus simply pegging the two assets, Ether and the stablecoin, 1:1 will not serve to stabilize the price. Thus, more creative solutions, like that of MakerDAO and their stablecoin DAI, have been introduced. Maker uses collateral debt positions (CDP) which operate similar to a bank. Smart contracts on Ethereum hold collateral in ETH and in return give a “loan” of 66% of DAI. If the value of ETH goes below a certain threshold, the user either pays back the CDP, or the position is auctioned to the highest bidder.

- Currency risk exists in this initial deployment of CDPs due to lack of diversification of a single digital asset, ETH, held as collateral. Future developments of the CDP functionality will allow the smart contracts to hold multiple asset types thereby increasing diversification and reducing volatility.

Non-collateralized Stablecoins

Algorithmic

Example: Basis

- Algorithmic stablecoins are not backed by a hard asset, but instead automated logic modifies the token supply based on supply and demand. Think of this as an automated central bank that enacts monetary policy through programmatic capital controls.

- User adoption is one risk faced by algorithmic stablecoins, like Basis, since the functionality of the system required participation for stability.

What do stablecoins enable?

- Growth of applications using blockchain technology by serving as an intermediary between the digital and fiat world.

- Greater access to the global financial system: anyone with internet access can gain exposure to stablecoins.

- Stablecoins are poised to be a powerful vehicle for fundamental long-term changes in the global economy: decentralized stablecoins transcend economic controls and policies.

- Intersection of stablecoins and tokenized securities: investments and dividends become practical.

- Programmability: payments via stablecoin are not subject to the volatility of cryptocurrencies.

What comes next?

The next generation of currency, payment, and settlement will undoubtedly occur in digital form. The composition of the initial attempts gives us an idea of where this technology can go. Fiat-backed currencies offer familiarity and ideological comfort of 1:1 backing of the underlying pegged currency. Although introducing centralized risk, they serve an important function to familiarize and build trust with newcomers to the digital ecosystem.

The next generation of currency should allow alternative pegging so that they can be shielded from extraordinary events. Ideally, it should be backed by a diversified uncorrelated basket of assets to avoid effects of such events. Additionally, an ideal stablecoin would execute smart contract logic on-chain and be backed by decentralized assets. Each of the first attempts highlighted above successfully accomplish essential tasks in this development. With certainty, the next evolution in stablecoins is coming.

Thanks for reading ...

#bitcoin #blockchain #cryptocurrency #altcoins #geek-cash