This earnings season promises to be a wild ride across the tech sector as initial impact from the coronavirus will be reported while a few outliers will seem impervious. Ad-tech stocks are especially vulnerable to other sectors with Google expected to have its first decline year-over-year in company history. Facebook boycotts that came late in June could affect future quarters. We’ve seen Twitter report 23% lower revenue and entertain new methods of monetization. However, these well-known risks will be rivaled if not exceeded by the effects of the lesser-known announcement from Applelast month in regards to the required opt-in for the ID for Advertisers (IDFA).

The IDFA is a number tied to the device that allows ad exchanges to track user interactions and behavior. The primary function is very similar to cookies in that it helps ad companies store data profiles and preferences for personalized messaging, regardless of which device you are logged into. In addition to targeting, the IDFA also helps with attribution and measurement.

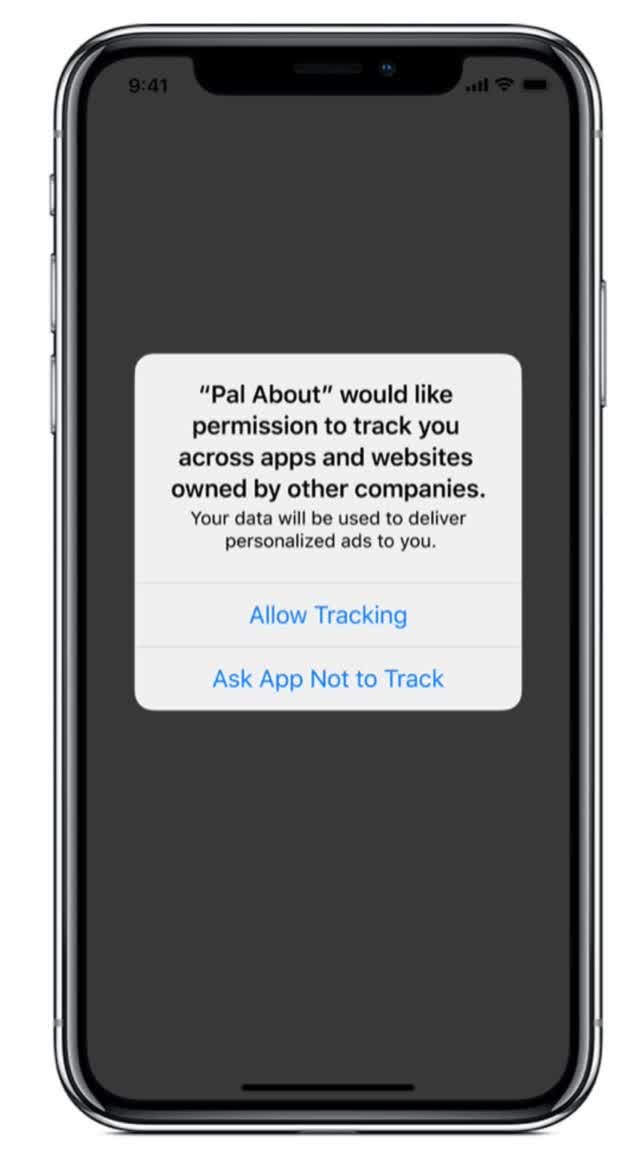

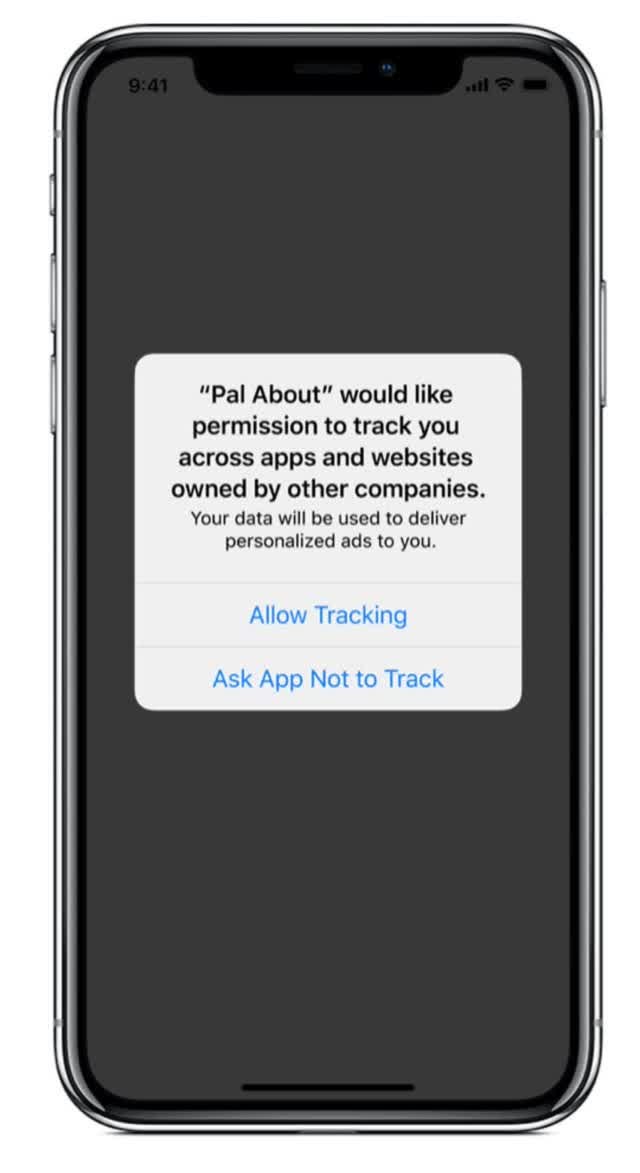

If you’ve never heard of the IDFA or are not aware that a number is assigned to your iOS device to help track you, it’s because this has been opt-out in the past and been hidden inconspicuously in your Settings. In the upcoming release of iOS 14 in September, Apple will make this an opt-in for every single application. This means a message will appear for every application using a mobile device ID asking for permission.

Pictured above:_ Apple will require opt-in permission to track for displaying targeted ads, sharing device location, sharing a list of emails, ad IDs or other IDs used to retarget and/or placing a third-party SDK in the app that combines user data from your app with user data to target advertising. See the full list here on _Developer.Apple.Com

Below, I go over the background that led to Apple’s decision and the public companies this might affect. As noted below, this should affect companies who offer mobile targeting, such as Google, Facebook, Twitter/MoPub and The Trade Desk. In the interim, it could also affect any applications that use aggressive growth tactics. This list is harder to identify, but Uber and Lyft, for example, are known for spending heavily on user acquisition to drive installs.

For instance, Snap beat on revenue recently yet some of this beat came from direct response ads, such as TikTok driving user acquisition on mobile. In this case, there will be less information about who is taking an action if Snap users do not opt-in on the warning screen. Twitter, as well, pointed towards direct response ads holding up revenue during the pandemic while brand ads have weakened. Yet again, direct response has a new and very serious obstacle.

The silence on this topic from financial analysts on Twitter’s earnings call when many ad-tech companies including two of the world’s most valuable companies rely on the IDFA for a sizable chunk of revenue is odd to say the least. AppsFlyer places mobile app install spend at $80 billion in 2020 and estimates this will reach $118 billion by 2022. This is compared to the total mobile advertising industry worth $241 billion in 2019 and $368 billion in 2022.

The changes will not take effect until September with most devices running the iOS update by October, so no financial impact will be seen until Q4. However, if brand ad spend remains low from the pandemic, and direct response campaigns will now be blind due to an aggressive move against mobile ad targeting, then investors should expect a significant shift in the ad industry by the latter part of the year.

I first covered this in October for MarketWatch with the article, “Governments can’t stop Google and Facebook but Apple can.” The changes to the IDFA are being done under a privacy guise, however, it could be an attempt for Apple to reclaim valuable revenue streams from its ecosystem as iPhone penetration is maxed out. How this would work is not evident right now but its unlikely that a $118 billion market in iOS app install spend has gone unnoticed.

Apple and its operating system is the most important governor in the mobile industry with two-thirds of mobile acquisition spend compared to Android’s one-third. If Apple is playing the long-game on reclaiming iOS attribution and measurement to generate revenue, then Google, Facebook, Twitter, Snap and The Trade Desk have plenty to worry about as Apple can undeniably claim this turf.

#tech-stocks #stocks #apple #apple-ios-14