What is Tenet (TEN) | What is TEN token

Overview

Tenet is a cross-chain Automated Market Maker (AMM) connector that provides a decentralized Liquidity Tap for various tokens. The Liquidity Tap is the powerhouse of the Liquidity Pool, which ensures the fair allocation of mining rewards through the optimization of the algorithms of initial mining incentives and LP token pools. Tenet is developed by DREP Signal Labs and will be launched in 2020 November for all AMM platform layer 2 facilities. In order to address the current pain points such as multi-chain barrier in the Defi sector, Tenet will be released in cross-chain versions based on Ethereum, Polkadot, DREP Chain, BSC, etc. This article will walk you through various features of Tenet.

Tenet’s Unique Advantage

AMM cross-chain connectors

Currently, there is no AMM platform acting as a moat in terms of features and attributes, so liquidity demanders and providers have little loyalty to anyone of them; many typical AMM platforms also are based on different public chains, resulting in cumbersome user experiences and high transfer costs. Thus the industry needs to resolve these road blocks and leverage cross chain technology to realize platform interoperability. If this is solved, internal processes can be simplified, and gas costs can be lowered. Tenet’s cross-chain and cross-platform toolkit protocol, namely AMM cross-chain connector, fills this gap. Tenet’s new “AMM Integration Framework” protocol initiative will enable faster cross-platform, cross-chain exchange of assets and to simplify interactions with different blockchains.

Optimization of the Liquidity Pool Reward and LP Token Pool Reward Algorithms

Tenet hopes that the new mining model of liquidity tap + liquidity pool will better align the incentives between token holders and liquidity demanders, ultimately striking a balance as the agreement evolves, early liquidity contributors won’t lose benefits because of share dilution.

From the perspective of the liquidity provider, they must persistently lockup their funds to earn passive transaction fee benefits. In the long run, later entrants will find it difficult to compete with first movers. Tenet has therefore optimized the algorithm for incentive rewards to motivate liquidity providers.

At the same time, in order to circumvent, in a certain extent, the inflation caused by liquidity mining, Tenet’s embedded algorithm also includes an optimization for LP token rewards; it incentivize more Token holders to deposit assets to the Tenet Liquidity tap, weakening the negative impact of bonus hunters on Token inflation rates.

The incentive loop of Ten

To cement the ecosystem on Tenet protocol, with liquidity taps for governance token trading pair LP token, Tenet gives the right to distribute TEN token reward to liquidity taps created by other projects. The goal is to encourage more liquidity tap creators to trade and add TEN on Uniswap to obtain TEN trading pair LP token. Then, LP token can be added to Tenet’s official liquidity tap and start liquidity mining. As a result, a positive loop is formed to encourage mining among liquidity tap creators, liquidity providers and Tenet.

Mixed Revenue Model

Tenet protocol is unique. Because liquidity tap creators can customize liquidity taps for specific projects, attracting liquidity providers to Uniswap. Liquidity providers deposits its trading pair LP Tokens in Tenet, and then will gain mining rewards from both liquidity tap creators and Tenet.

Fully Customizable Configuration

Tenet’s liquidity tap configuration is fully customizable, from the AMM platform options in the initial phase, native token issuance protocol options, to the mining cycle, initial incentive requirements, mining revenue exercise option, etc., all can be customized according to the respective needs of the DeFi protocols.

Mining model before:

Mining model with Tenet:

TEN Token’s Economic and Utility Model

Marginal diminishing returns distribution model

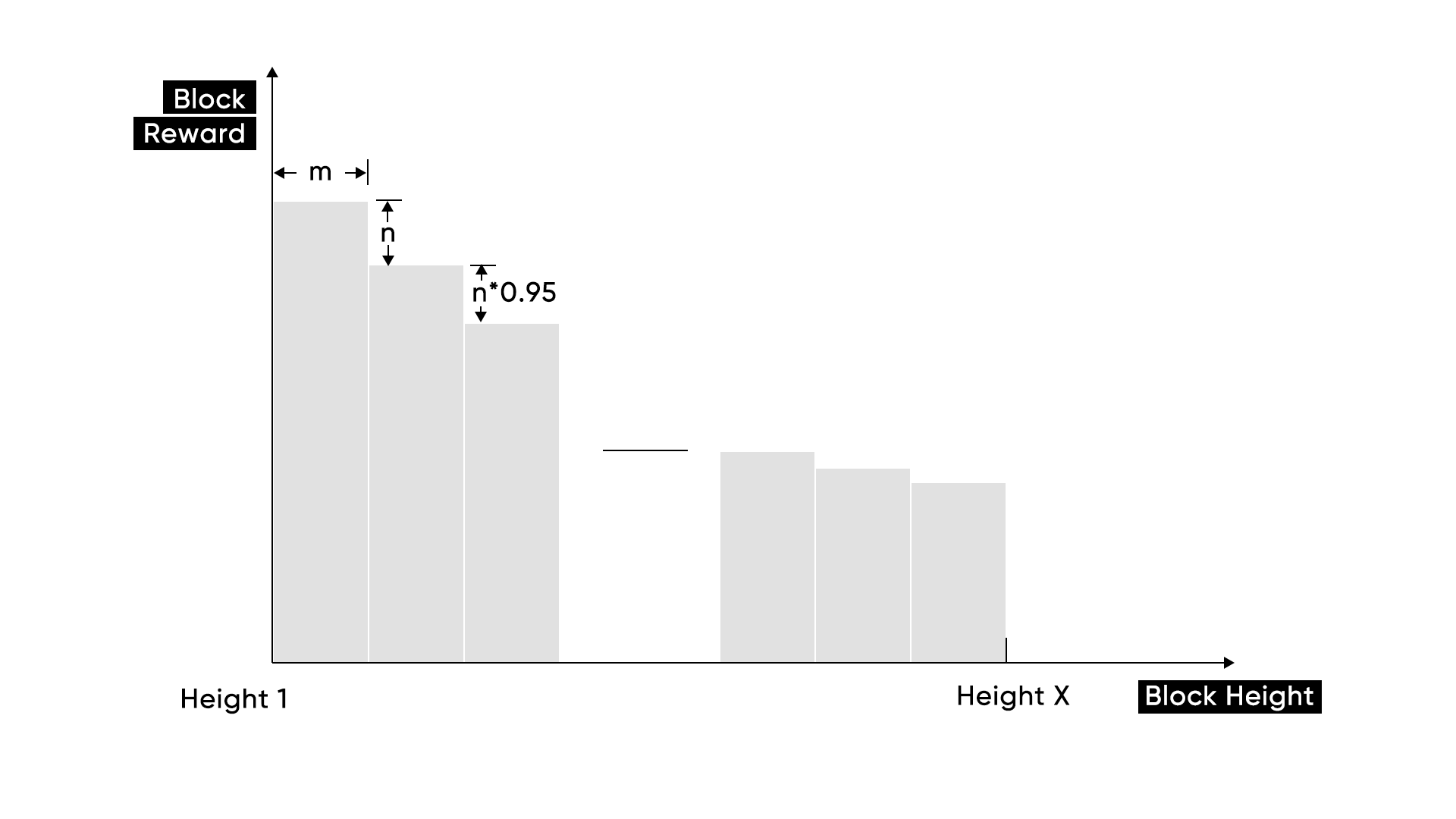

Tenet’s token is TEN. TEN employs a deflation model, and the maximum circulation is 4,317,400. The initial block reward is 10, which lasts for 20,000 blocks. After that, the block reward is adjusted to 5, and decreases by 5% for every 40,000 blocks (one cycle). Mining is expected to conclude after 50 cycles.

Dynamic ratio of liquidity distribution

Tenet adjusts the liquidity distribution ratio between liquidity providers and liquidity tap creators through cyclical rebalancing. Factors such as their share of LP token to investment portfolio are considered so as to ensure risk is controllable and help the long-term development of Tenet protocol.

After a certain period, Tenet protocol will monitor the amount of TEN trading pair LP tokens in liquidity tap and calculate the latest ratio. To smooth the curve, the dynamic ratio in the next cycle will be an average value. As a result, the dynamic ratio will stay at a reasonable level. Moreover, Tenet protocol adjusts temporary factors to optimize the distribution of tokens.

Functions and Utility Scenarios of TEN

Tenet enables the community to govern the protocol of Tenet. Holders of Tenet tokens and their representatives debate, propose and vote on all changes to the protocol. By placing Tenet tokens directly in the hands of users and applications, an increasingly large ecosystem will form and will be empowered to collectively manage the protocol into the future.

The Symbiosis of TEN and DREP

All DREP Token Holders will have the privilege to mine Ten reward first during the initial launch phase. We believe that by connecting the ecosystem together, DREP Chain and Tenet protocol will enrich each other and add important value to the economy.

In the second half of the Defi craze, community users will cease to jump into insecure and random projects with nothing but yolo. From now on, only those with real value infrastructure and long term development can stand out and win the appraise of the market. The Tenet protocol, by its cross chain connector, layer 2 solutions, customizable design, deep liquidity generator, is clearly such a choice.

Tenet Public Sale FAQ

The TEN token will be based on a deflationary model. Maximum amount of TEN to be issued will be 7,650,000, of which 5,720,000 (75%) TEN tokens will be on Ethereum and 1,930,000 (25%) TEN will be on Binance Smart Chain. The token distribution will be allocated as the following:

Initial Dex/Farm Offering 15%

Mining 60%

Initial Liquidity 5%

Ecosystem Fund 20%

A total of 1,500,000 TEN tokens will be allocated for the upcoming public sale. Among them, 500,000 TEN will be sold through Ethereum and 1,000,000 TEN will be sold through Binance Smart Chain.

To participate in the public sale of TEN, you can either:

1. Via Initial Farm Offering (IFO) on PancakeSwap, supported by Binance Smart Chain

OR

2. Via another cooperated platform for Ethereum Users (to be announced soon)

More About IFO On PancakeSwap

Total Amount to Be Raised: $1,000,000 USD in CAKE-BNB LP tokens (via IFO)

Tokens to Be Sold: 1,000,000 TEN via PancakeSwap (13% of total TEN supply)

IFO Token Price: 1 TEN = 1 USD

Unsold Tokens: All unsold token during the sale will be burned after the sale is completed.

Contract Address: 0x74159651A992952e2bF340D7628459aA4593fc05 (BSC)

Would you like to earn TEN token right now! ☞ CLICK HERE

Looking for more information…

☞ Website

☞ Explorer

☞ Source Code

☞ Social Channel

☞ Message Board

☞ Documentation

☞ Coinmarketcap

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#blockchain #bitcoin #crypto #tenet #ten