Throughout the years I’ve read a lot of papers regarding insurers and upcoming changes driven by both business and technological innovations, commonly known as InsurTech. These insurtech companies use technology to develop a more analytics-based approach to improve existing processes, therefore gaining competitive advantages, compared to the traditional insurance business model. Insurers are warned to keep up or perish …

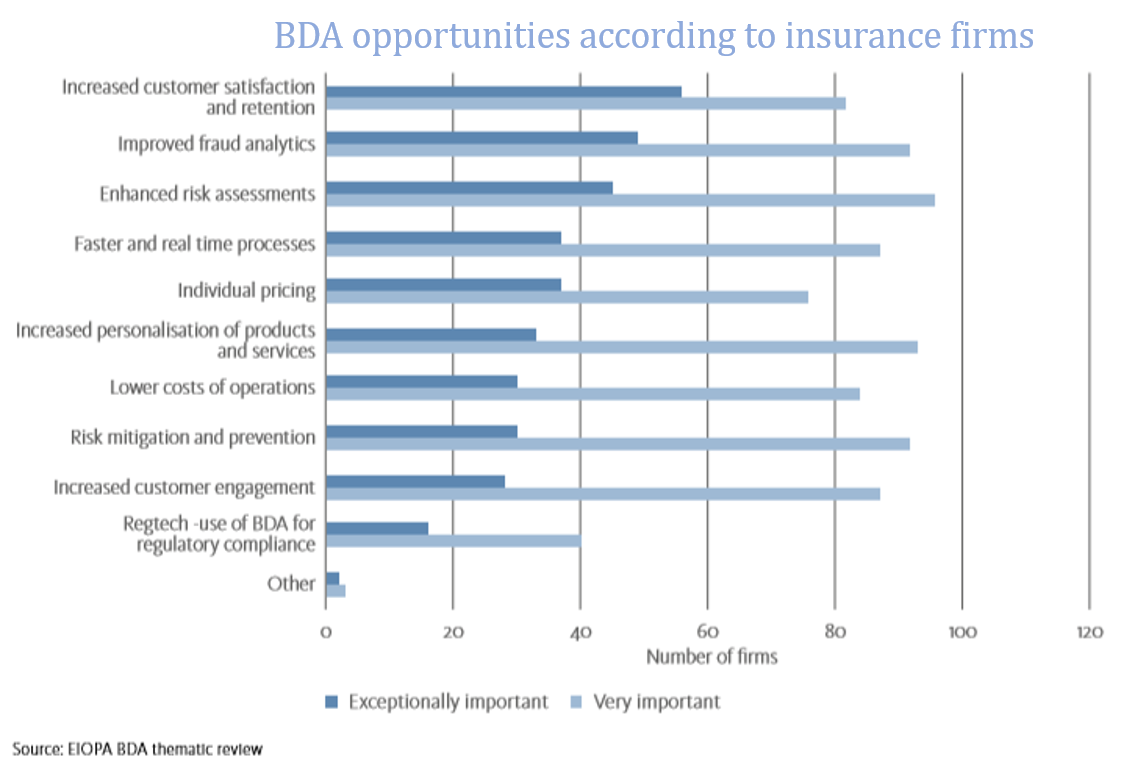

Given the competitive landscape and evaporating margins, traditional insurers are advised to evolve and become a** data-driven enterprise** powered by machine learning (ML) and artificial intelligence (AI). There are several of use cases for these advanced models at insurers. The benefits of big data analytics (BDA) for insurers are listed below:

Source: EIOPA — European Insurance and Occupational Pensions Authority, https://www.eiopa.europa.eu/, thematic review

Insurers have made some progress in the adoption of ML and AI. Some have set up a data science center of excellence to define and implement use cases in their business. Furthermore, some insurers are investing in organically building their internal knowledge by providing data science and big data courses to their employees.

To further accelerate digital innovation, some insurers are teaming up with startups through in-house incubators, accelerators and innovation labs. This is beneficial for both parties as the startups benefit from established technical support, guidance, and connections to industry experts, whereas the insurer gains access to new technologies.

On the other hand, some insurers are putting their capital to use by forming corporate venture capital arms to invest in InsurTech firms. Investing relatively small amounts in multiple startups gives insurers access to potential breakthroughs in numerous areas of interest to them.

Despite the numbing buzz around advanced models, these innovative solutions have yet to gain noteworthy traction. Instead of the intended rapid disruption, insurers are slowly assimilating to these changes. As a result, I would like to shed some light into the slow adoption of advanced models at insurers.

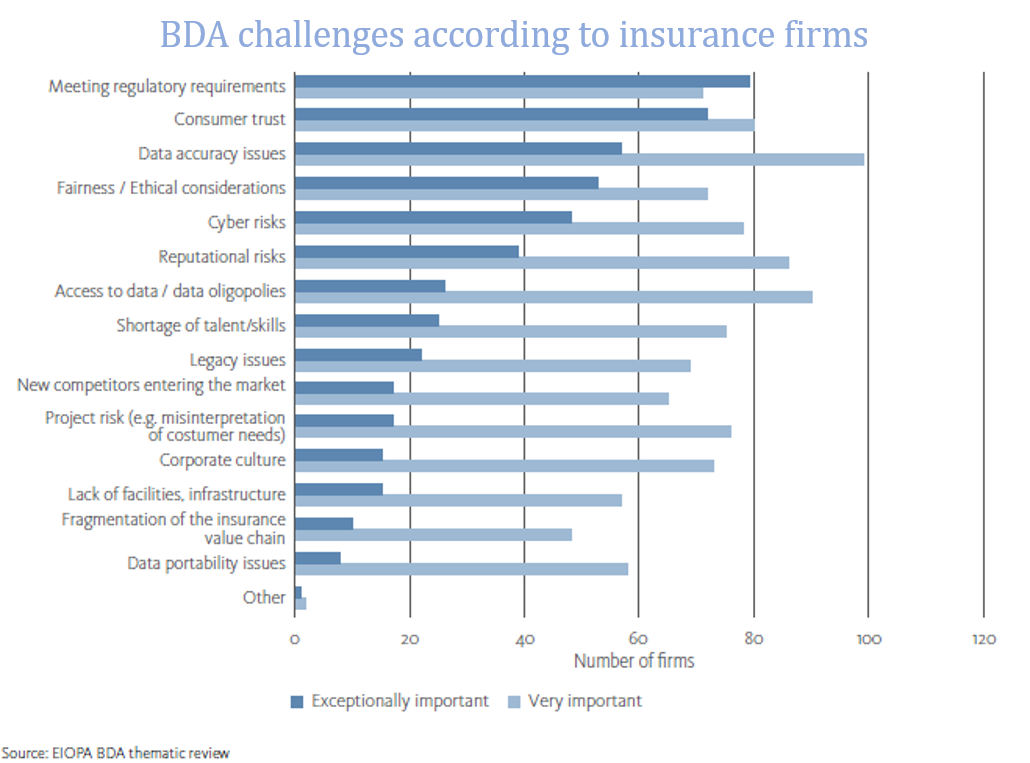

The chart below summarizes the challenges of big data analytics (BDA) for insurers.

Source: EIOPA — European Insurance and Occupational Pensions Authority, https://www.eiopa.europa.eu/, thematic review

There are quite some challenges that insurers are facing with responsibly implementing ML and AI. I’d like to consider some of these challenges and provide additional context. First, insurers believe that the primary risks lie in dealing with consumers, this entails maintaining consumer trust, using AI ethically and identifying potential risks that jeopardize the reputation of an insurer and the insurance sector.

Innovation is an agenda item for insurers, however it is almost impossible to predict the return on investment of a machine learning project. It’s not easy to plan or budget such projects, as funding may vary during the project, based on findings. As a result, this item gets overlooked, especially compared to more pressing items, such as compliance with new and upcoming (regulatory) standards or the profitability of the insurer given the current low interest rate environment.

Every data scientist knows of GIGO “Garbage In, Garbage Out”. This is another reason that ML has not gained traction at insurers, the data quality. The availability of high-quality and varied input data is a precondition for applying advanced models. Currently, the quality of data at insurers is subpar, thus minimizing the added value of ML and AI.

A favorable development for AI and ML at insurers is the increased data requirements for new and upcoming regulations. To elaborate, the new reporting standard (IFRS 17) requires more data granularity, as result insurers are overhauling their IT systems and architecture to handle the increase in data volume and quality.

Lastly, insurers are also aware of their need to ‘stay in control’, especially in the pricing and reserving domains. ML and AI models are often associated with the term black box models. As a result, it is unclear for insurers how AI can be used without overstepping the legal and regulatory requirements. As a result, the challenge for insurers is to construct a compliant and interpretable framework of advances models within the regulatory space.

#insurance #innovation #machine-learning #data-science #fintech