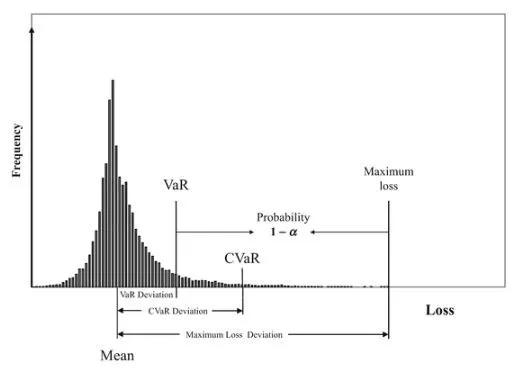

In recent years alone, Wall Street titans, such as JP Morgan and Goldman Sachs, generated a cumulative revenue of half a trillion dollars. Quantitative analysts — or “quants” — have been instrumental to this tremendous success. Not only can they predict the expected payoff of financial derivatives using classical algorithms, “quants” are also able to estimate the level of financial risk.

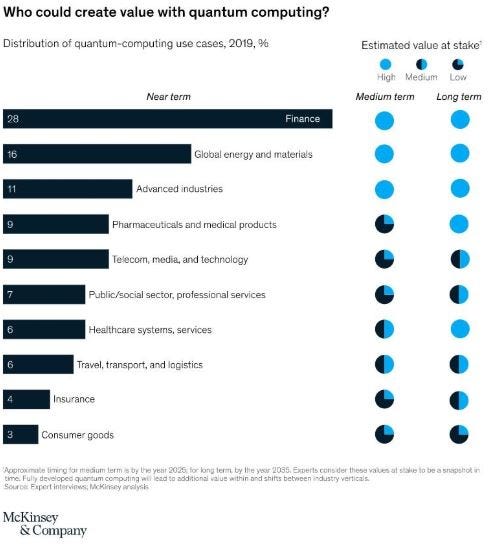

According to McKinsey & Company, the finance sector is the most likely industry to significantly reap the rewards from quantum computing in the near-term. As seen below, even in the medium to long-term, there is a reasonable chance that quantum computing may revolutionise processes within quantitative finance.

Figure 1: The finance sector is 14% more likely than the global energy and materials sector to benefit from quantum computing in the near term

Earlier in our Quantum Finance series, we outlined key quantum amplitude estimation algorithms. In this blog, we apply these algorithms to solve problems in financial mathematics such as credit risk analysis and option pricing. Finally, we conclude the series by briefly discussing our elementary toy quantum-model for forward contracts.

For a reminder of these quantum algorithms, please refer to our previous blog, Exploring the Mechanics of Quantum Computing Algorithms.

#credit-risk-analysis #ai #machine-learning #quantum-machine-learning #financial-planning