What is Bonded Finance (BOND) | What is BOND token

Welcome To Bonded Finance

Decentralized Finance (“DeFi”) Today

In what has become something of an arms race, the open finance/DeFi space, despite its share of copies, forks and fugazis represents something both old and new. From the outside looking in, it may appear to be no different than the proliferation of Bitcoin clones and forks circa 2017 that brought us the likes of Super Bitcoin and the lesser. Do not let the usual suspects rebase us into a bubble mindset because this is very different. To do so would be to miss a great transformatiaon, something akin to what the late Bruce Lee said: “It’s like pointing at the moon. Do not concentrate on the finger, or you will miss all of the heavenly glory.”

Though it has been somewhat obscured amidst the whirlwind of development, we are witnessing the rapid emergence of a new paradigm that has reclaimed the very essence of crypto. The principle of cooperation and the ethos of open source has been re-established by governance tokens and it appears there will be no slowing down or looking back. With the advent of true cross-chain interoperability coupled with the inspired number of co-opetitive initiatives, we are redefining our world by way of governance-driven-crowd-wise communities. Never has the phrase, “what we can not do alone, we can do together,” been more apropos.

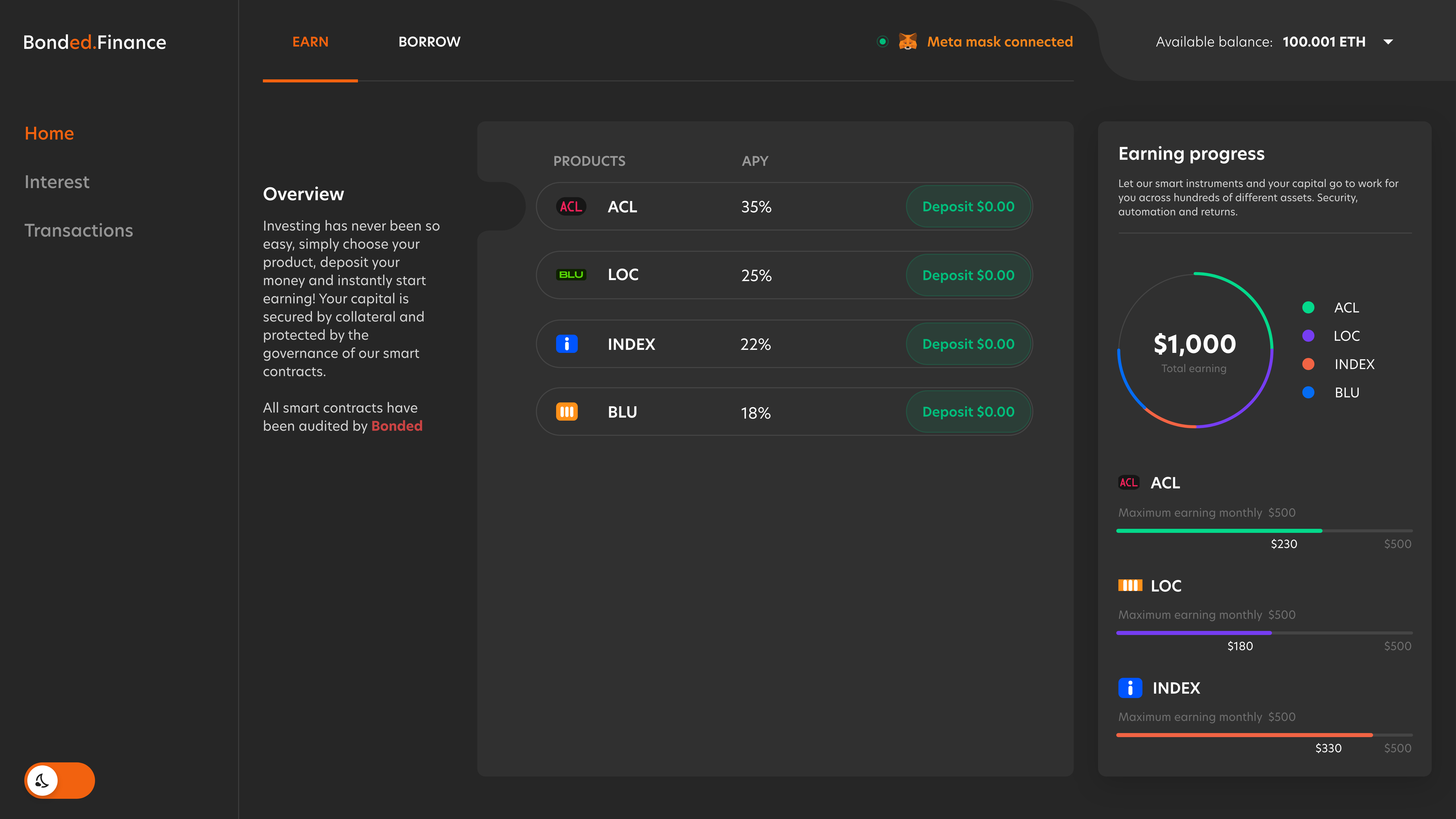

The Bonded platform was created to incubate and deploy experimental, high-yield, smart-contract driven, financial instruments that push the bounds of open finance. Bonding is an algorithmic model that aims to unlock, aggregate and de-risk ~50 billion in dormant value distributed amongst untapped digital assets. Bonded proposes a new fintech solution deploying both permissioned and permission-less high yield exotic financial products in the rapidly growing DEFI sector.

Philosophy

As yet another entree into the fray, Bonded Finance diverged from old guard business tenets which typically ask, “what can we capture,” and replaced it with “what can we contribute?” We believe that the pathway to success for the crypto economy is through collaboration. This mindset is not just a belief system but is fundamentally built into our operational model and the very mechanics of our smart contract financial products.

The Name

When unstable atoms share, transfer and manage electrons to fill their outer shell, it is known as covalent bonding while ionic bonding is when bonds are formed by two oppositely charged ions. These principles inspired the architecture of our smart instruments. A well-managed, shared basket of volatile assets can create a stable ecosystem while bonding lenders and borrowers, despite their opposite agendas, allows for a sharing of resources and creates lasting, sustainable growth and value.

The Opportunity

Our desire to add value and contribute has been laborious as we experimented with lending products while watching the space crawl, walk and occasionally stumble. After months of pivoting and market observation, it became clear that there is a gaping hole in DeFi. As more and more assets are being put to work, there is an inordinate and truly inefficient amount of untapped liquidity and resources in altcoins. Certainly, Uniswap and AMMs have breathed much needed life into many early stage projects, however, the ability to aggregate and earn for many, has been absent. Providing a way to put alternative coins to work is the essence of Bonded Finance.

In crypto today, there is roughly fifty billion USD in dormant value and some thirty billion in under-utilised liquidity locked in altcoins. This is by no means in total either. These estimates are taken from a large sample of verifiable projects that have price and volume history. Currently, crypto lenders support only a handful of select assets and though this number is slowly growing, the volatile and unrefined altcoin space remains rife with opportunity and risk in need of amelioration. In the most general of terms, why would a supporter of a given project not be able to earn while having her long bag in tow? Again, we are entering a phase of great growth where competition is outstripped by cooperation. Previously, projects were continually at each other’s throats and held hostage by traders. Liquidity came at a great premium and essentially, the success of one project created the failings of another. A finite amount of liquidity playing the equivalent of musical chairs.

Through an educated lens, we can identify distributed pools of both capital and liquidity from the community rich demographic in the altcoin markets. It is the mission of Bonded Finance to harvest this hidden, unchallenged capital.

To that end, we have created smart instruments that generate incentives, can reduce downside exposure and effectively realize value in a vast but largely untargeted market.

Our pioneering innovation and contribution leverages the untapped altcoin market place, in order to create theoretically unlimited total value locked or TVL. Given the proliferation of new projects, we believe that a suite of smart contract instruments could go a long way in securing value. Though we have some four products in the pipeline, we are open to share our first: a simple crypto loan accelerator that offers a rather unique feature-set.

Bonded Accelerated Crypto Loan (“ACL”):

· Allows loans against traditionally dormant assets

· Creates low-risk yield for liquidity providers (“LPs”) on those same assets

· High-yield, interest-bearing product

· Variable APY balanced by a price elasticity of demand algorithm

· Upside exposure of the collateral used to secure your investment

· Aggressive loan-to-value ratios to guard against volatility

· Dynamic loan to value (“LTV”) ratios and interest-automating algorithm

To simply describe the Accelerated Crypto Loan:

Unlike a traditional loan, the issuer of the ACL is not a person, bank or lending institution but a pool of shared liquidity supported by makers looking to put their crypto to work. This ensures liquidity for borrowers, instant click and borrow solutions, elimination of third-party intermediaries and also allows for compounded returns for the LP.

Let’s take a closer look at how this works:

· A borrower moves funds from an exchange wallet to the Bonded platform

· The Bonded interface determines the current loan-to-value ratio, the dynamic interest rate and the general risk profile

· Borrower deposits collateral then withdraws the loan from the LP pool

The loan amount will depend on a variety of factors:

· The specific coin deposited and the amount

· Current and post-deposit state of the liquidity pool

· Various other health factors related to pool size and volatility

Over the life of the loan, Bonded LPs will benefit from their participation in a number of ways:

1. All generated fees and interest related to the loan will be returned to the liquidity pool, (hence to the LPs) with the added benefit of a more secure pool and additional liquidity.

2. If applicable, borrowers in the Bonded protocol agree to “upside-redistribution*,” at the end of the loan term.

*Upside-redistribution takes place when the price of the asset at the end of term is greater than at the time of loan issuance.

3. A percentage of that gain is returned to the Liquidity Pool, and LP token holders are further compensated for their participation.

What you end up with is a positive feedback loop, for both lender and borrower, that supports higher yield generation on less liquid assets while growing the liquidity that determines rewards.

Would you like to earn token right now! ☞ CLICK HERE

☞ Public Sale Details

☞ Token Distribution

Looking for more information…

☞ Website

☞ Announcement

☞ Source Code

☞ Social Channel

☞ Documentation

☞ Coinmarketcap

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#blockchain #bitcoin #cryptocurrency #bonded finance #bond