What is Polkacover (CVR) | What is Polkacover token | What is CVR token

Polkacover is working towards creating the world’s leading cryptocurrency-friendly insurance purchase & policy issuance marketplace with the aim to be the one stop-shop for crypto & personal insurance need…

At Polkacover, we will connect users & multi-national insurance providers with all global insurance products such as crypto related protection, health, life, education & family insurance plans to start with and would be working towards adding more products in the longer run. The platform would providing several tokenized incentives making upto 40% cheaper than any traditional insurance channel.

We are developing a frictionless insurance marketplace experience that incorporates next generation blockchain technology based on Web 3.0 framework on Polkadot using sbstrate providing tokenized incentives. By building a state-of-the-art user experience and several cryptocurrency and traditional payment options alongside benefits tied to our proprietary cryptocurrency. our users know they are purchasing through a platform of the future with transparent pricing

Why POLKACOVER?

The vision and mission of POLKACOVER.

Over the years, with giant leaps in technologies in several industries, insurance companies and brokerages seem to be stuck in a time capsule. PolkaCover was created as a solution to beat archaic manual systems and break open the industries from their shells.

Founded in late 2019 by seasoned insurtech, fintech, and blockchain experts, Polkacover believes in creating a well-developed marketplace connecting users and insurance products from around the world. This belief led to a mission to investigate the best options to create next-generation insurance management with a vision to cater to the needs of the growing crypto world.

Polkacover has four main roles it would fulfill within the insurance space.

The platform is developed in four phases:

- Phase 1: Polkacover cryptobased products

- Phase 2: Global insurance marketplace

- Phase 3: Polkacover P2P ( Insurance DAO )

- Phase 4: Autonomous third party administration/claims management for third party insurance companies

The crypto insurance platform aims to develop this dynamic insurance marketplace through the four development phases. The** vision** of the seasoned team is to bring to the crypto ecosystem as a whole, enhanced security, and unparalleled end-user ease of interaction. We want everyone to be safeguarded against the bad actors which plague crypto users.

The team is working hard behind the scene, building up ecosystem partners inside & outside the cryptosphere. Polkacover’s future is definitely a bright and interesting one that everyone is looking forward to!

Why Blockchain for the Polkacover ecosystem

Insurance is traded in traditional ways, often manually and with several layers of intermediaries. The inefficiencies have resulted in most of the major insurance institutions taking a keen interest in blockchain technology with the hope it will provide a modern, more streamlined alternative. The McKinsey Panorama FinTech database currently registers over 200 blockchain-related solutions, of which about 20 provide use cases for insurers that go beyond payment transactions — either as specific applications or as base platforms.

Finally, even traditional insurance companies, such as AXA and Generali, have started to invest in blockchain applications and Allianz has just recently announced its successful pilot of a blockchain-based smart contract solution to automate catastrophe swap transactions. Within Dubai as well, Blockchain startups are being encourage as Dubai aims to be the Blockchain capital of the World by 2020.

The blockchain provide a decentralized ledger which allows data to be permanently stored without the possibility of fraud. With the growing importance data protection, the ability to control the data in this form dramatically affects the type of communication between consumers and businesses.

For us, we found blockchain was able to provide vast improvements over centralized systems in terms of CRM Management, cross-country scaling & payment solutions, data integrity, improved user experience with the option of efficient claims management as well. It gives superpowers to the insurance industry focusing on granular level of customer-segmentation, tailored products, predicting customer behavior, targeted customer service, and an overall enhanced customer journey.

Blockchain’s enablement of increased trust and transparency speaks to the heart of the insurance business

Smart contracts have the ability to be designed to be decision makers on insurance claim settlements (based on pre-underwritten fundamentals).

Groups of participants not individually eligible for the suitable insurance coverage might use the decentralized trust and autonomous processing smart contract capability of blockchains to self-insure the group by sharing risk at a reduced cost.

The secure storage of a policy holder’s information helps in removing the manual processes which are being followed where there is duplication of information (at the broker, insurance company and customer’s end) thus reducing data redundancy and reduce the possibility of misinformation. The public registry (and decentralized nature of blockchain) removes the possibility of loss of data over years.

Reduce administrative cost Blockchain may reduce administrative/operations cost through automated verification of policyholder identity and contract validity, auditable registration of claims and data.

Customer engagement. An important lever for improving customer engagement through blockchain lies in the area of personal data. Customers’ fears about losing control of personal data as soon as it is handed over to a company and their frustration with the need to repeat data entry processes can be addressed by a customer-controlled blockchain for identity verification (see KYC use case) or medical/health data. Personal data does not need to be stored on the blockchain; it remains on the user’s personal device.

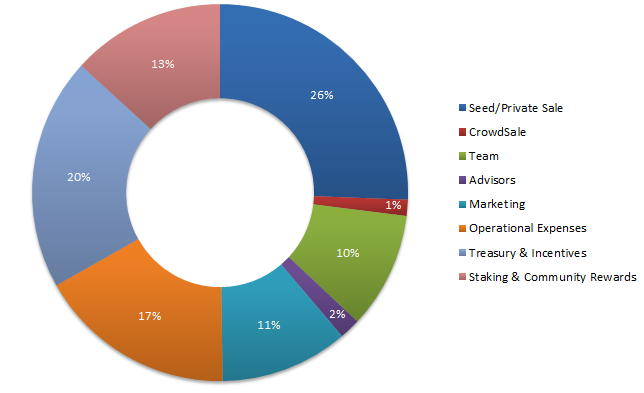

PolkaCover Updated Tokenomics

Over the last month, we have had a few changes on our Tokenomics structure. Please find below the updated Tokenomics details & Schedule for the PolkaCover project. The information below supersedes the information provided in the whitepaper as of 7th January 2021

TOKEN DETAILS

TOKEN ALLOCATION

TEAM

CVR tokens reserved for the CVR Founding team. Team tokens are locked and vested to demonstrate long-term commitment.

- Tokens locked for 24 months

- After lockup, tokens are vested over 6 months

ADVISORS

CVR tokens reserved for the PolkaCover advisory board. These tokens are vested to demonstrate long-term commitment.

MARKETING & OPERATIONAL EXPENSES

PolkaCover has the funds needed to manage its costs for running its operations for a period of 12–18months. These CVR tokens reserved for future objectives like immediate operational expansion requirement, broad marketing initiative, regulatory & compliance clearances, business expanis exchange listings etc.

- Operational Tokens — Locked for 12 months followed by 12 month vesting

- Marketing Tokens — Locked for 6 months followed by 18 month vesting

TREASURY & INCENTIVES

CVR tokens are reserved to fuel the growth of the covercompared.com platform being developed by the PolkaCover team. The tokens will be used to build token adoption within the platform once it goes live.

- Tokens are locked for 3 months

- After lockup, tokens are released equally over 36 months.

STAKING & COMMUNITY REWARDS

This is a “Go-To-Market” FUND which would be required to build the community involvement within the platform. The CVR tokens will be used to

- Provide liquidity at launch at UniSwap

- Provide Staking rewards/allocations for early adopters, governance & risk assessment members

- Bug bounty programs & early testers of the platform

- Governance & Risk Assessment rewards within the P2P platform

- Tokens are released equally over 24 months.

All the reserved allocation would be unlocked as per schedule but this does not mean it will necessary be in circulation. The PolkaCover team would be distributed at the discretion of the board. Distribution is primarily used to fuel the growth and expansion of the project over the years to come and may hold/delay the release of the tokens if the need does not arise.

CIRCULATING SUPPLY

USE OF FUNDS

Funds raised through the Private and Crowdsale round will be used to develop and to support the liquidity of the CVR token & platform. The PolkaCover is well funded to manage the growth & expenses for a period of 12–18 months

This includes:

1. Liquidity, tech and product development. CVR anticipates launching its Web 3.0 Insurance marketplace platform in 6 months after the crowdsale completed. To prepare our future ecosystem, will devote significant resources for risk liquidity and market expansion as required.

2. General marketing and development expenses such as website development, advertising materials, outreach, community, partnership and customer development.

Looking for more information…

☞ Website ☞ Explorer ☞ Explorer 2 ☞ Whitepaper ☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Message Board ☞ Coinmarketcap

Would you like to earn CVR right now! ☞ CLICK HERE

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ Binance ☞ Bittrex ☞ Poloniex ☞ Bitfinex ☞ Huobi

Thank for visiting and reading this article! I’m highly appreciate your actions! Please share if you liked it!

#blockchain #bitcoin #polkacover #cvr