Picture you and your family ready to take the next step and move to a new home. Wouldn’t it be nice to know in which areas were the home prices expected to rise the most? You could make a more sound investment that way, and strengthen your family’s financial security.

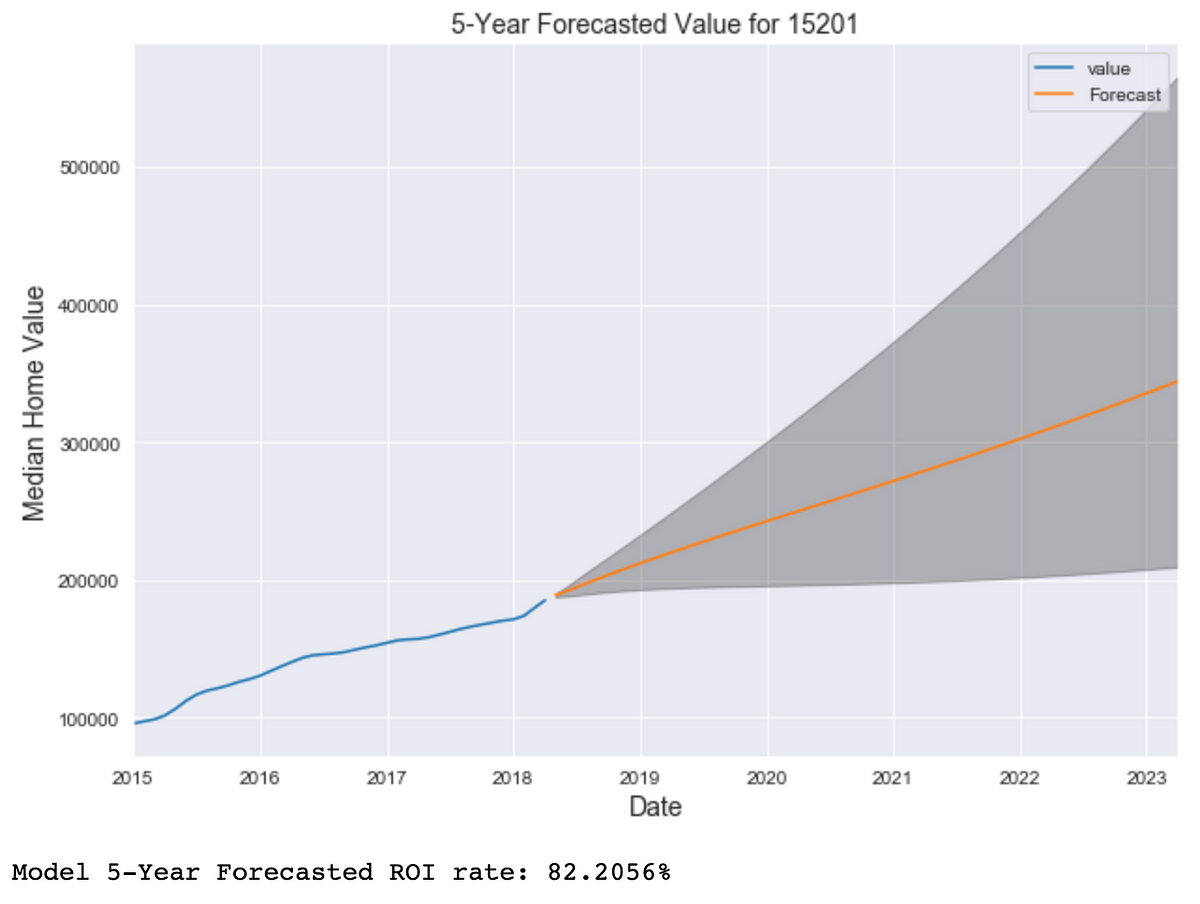

Well in this post, I will be going over how to model, predict and forecast real estate value over time, using time series machine learning methods and getting a little technical. I was initially assigned a project- to pick the Top 5 ZIP codes for a real estate investment firm to make a best investment. To do this I would have to define what our “best” zip code meant, and then use those metrics to narrow down over 14,000 zip codes to 5 fit for a solid investment decision using time series modeling.

Well I’m going to spare you the methods of filtering through 14,000 ZIP codes and just focus on how we were able to forecast our top pick.

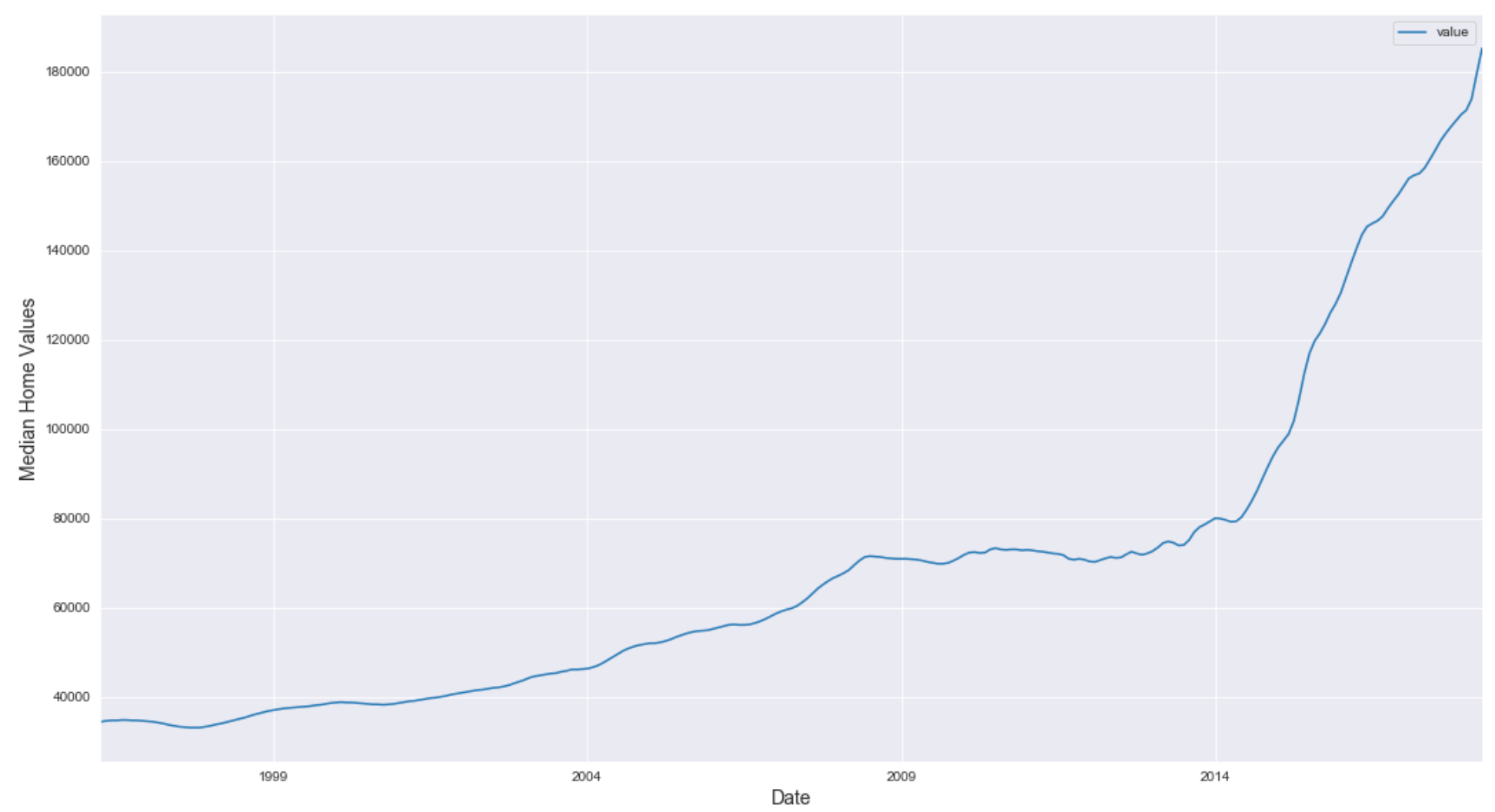

Plot for our top pick, 15201 using Zillow Research Data, 1996–2018.

A extremely quick summary of time series modeling:

Time series modeling can be a bit tricky and confusing, so I’m going to try and sum it up quickly. The goal in time series modeling, among other common assumptions for machine learning (normal distribution, etc.) is to make your trend stationary. As that is how time series models interpret variance, you will need to de-trend your time series. There are a handful of methods for de-trending. For example, subtracting the rolling mean takes the average of however many past values you want, and subtracts that from the current observation. You will end up with spikes of values that hover around a constant mean. Another commonly used technique is called ‘differencing’, which subtracts past actual value, from a specified period of time (also called lag), by the current value.

Trends are essentially reduced until they have a constant mean, and constant variance. Essentially it boils down to ‘noise’- randomness over time.

The statsmodels SARIMA model is a very effective combination of multiple models: Auto-Regressive (AR) modeling, Moving Average (MA) modeling, and Integration (I).

#timeseries #machine-learning #time-series-forecasting #investment #real-estate