What is StakeWise (SWISE) | What is StakeWise token | What is SWISE token

In this article, we’ll discuss information about the StakeWise project and SWISE token

StakeWise is an Ethereum 2.0 staking service that strives to achieve the highest possible yield for users. We do this by running a secure and stable banking-grade infrastructure, by enabling yield farming and theoretically also compound staking with unique tokenomics, and by charging low fees. Anyone with at least 0.001 ETH can participate.

We welcome you to the latest iteration of StakeWise and hope that you make the most of our product to achieve your staking goals. This documentation will help you along the way.

StakeWise Pool

Tokenized ETH staking pool targeting maximum rewards for stakers

The goal of the StakeWise Pool is to enable holders of ETH to earn maximum staking rewards from participating in the Ethereum 2.0 consensus mechanism and allow them to utilize their stake in various DeFi protocols with help of StakeWise tokens.

We apply a 10% commission on rewards that the Pool generates to compensate for the costs of developing, running, and maintaining the infrastructure and smart contracts that underpin the StakeWise platform. To our knowledge, this is the most competitive offer on the market, which underscores our commitment to helping users maximize their staking returns while maintaining the highest level of service.

Overview

StakeWise Pool is a network of validators created and operated by StakeWise on behalf of stakers using ETH deposited into the Pool. For each new block of 32 ETH collectively deposited by the users, a new validator is created and added to the StakeWise Pool to earn rewards. All rewards and penalties generated by the Pool are distributed among stakers pro-rata according to their share of the Pool. The balance of ETH deposits and rewards is reflected in sETH2 (staking ETH) and rETH2 (reward ETH) minted to stakers in a 1:1 ratio.

Depositing

Anyone can deposit any amount of ETH into the StakeWise Pool. Upon each new deposit in the Pool, StakeWise mints an equal amount of sETH2 (ie 1 ETH = 1 sETH2). Holders of sETH2 will start accruing rETH2 within 24 hours of receiving the sETH2 token.

Deposited ETH first goes to the Pool contract, where it sits with other small deposits until it collects a total of 32 ETH required for a new validator.

Once the Pool contract collects 32 ETH, it sends them to the Validator Registration Contract (VRC). VRC registers a new validator entity on the Beacon Chain. Simultaneously, StakeWise Pool adds the new validator to its network. After progressing through the activation stage in the Beacon Chain, the newly created validator starts earning rewards for stakers in the StakeWise Pool. For every ETH earned as a reward by the Pool, StakeWise mints an equal amount of rETH2. It is accrued to the holders of sETH2 every 24 hours.

Deposit queue

On the occasion that a large amount of ETH is deposited into StakeWise within a short time frame, new deposits may need to enter into the deposit queue to protect the APR of existing stakers from dilution. It means that the minting of sETH2 tokens upon deposit must be triggered manually once the activation period has passed.

Only the largest deposits are required to enter the deposit queue.

The rationale behind the Deposit queue

No user, whether a whale or a small fish, wants to see their APR reduced, yet a large influx of new deposits (or a couple of huge inflows) may force APR down. This is especially likely during long validator activation periods in the Beacon Chain.

To achieve consistently the highest APRs for its stakers, StakeWise introduced the activation queue for new deposits.

How to determine if your deposit will enter the Deposit queue

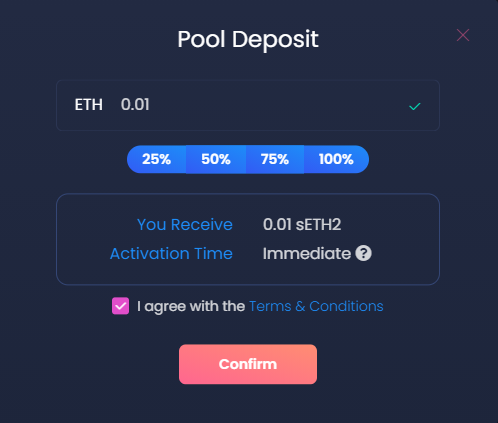

In the vast majority of cases, the deposit is activated immediately and the user receives sETH2 tokens without manually pulling them. If your deposit doesn’t enter the Deposit queue, you will see that the Activation Time is Immediate upon deposit.

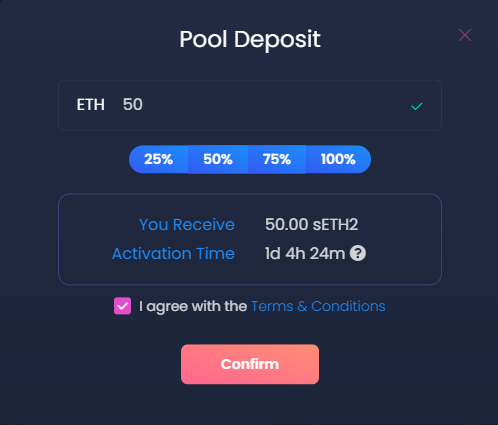

However, the deposit will enter the Deposit queue if:

- The deposited amount exceeds 32 ETH

- The total amount of ETH that is

Activatingin the Pool exceeds 5%

The exact threshold is regulated by the DAO and can be set to any parameter depending on the community’s preferences, the Pool’s TVL, and the gas price.

If either of these conditions is met, you will see that the Activation Time exceeds 0.

How to claim your sETH2 once the Deposit queue is over

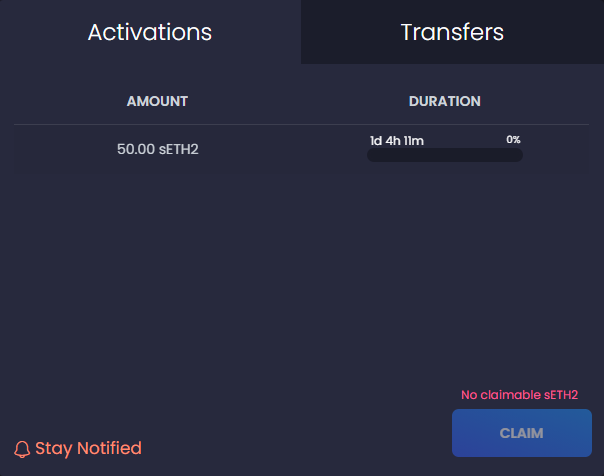

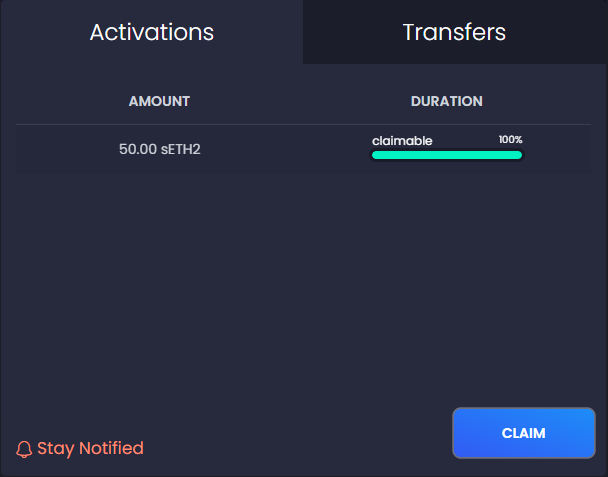

All activating deposits will show up in the Activations tab. For every deposit, you will see how much time there is left until sETH2 can be claimed.

Once the Activation Time has passed, simply press the Claim button and receive your sETH2. You will have now started staking with StakeWise and can be sure of having your APR protected from dilution for the rest of the staking period.

Tracking earnings

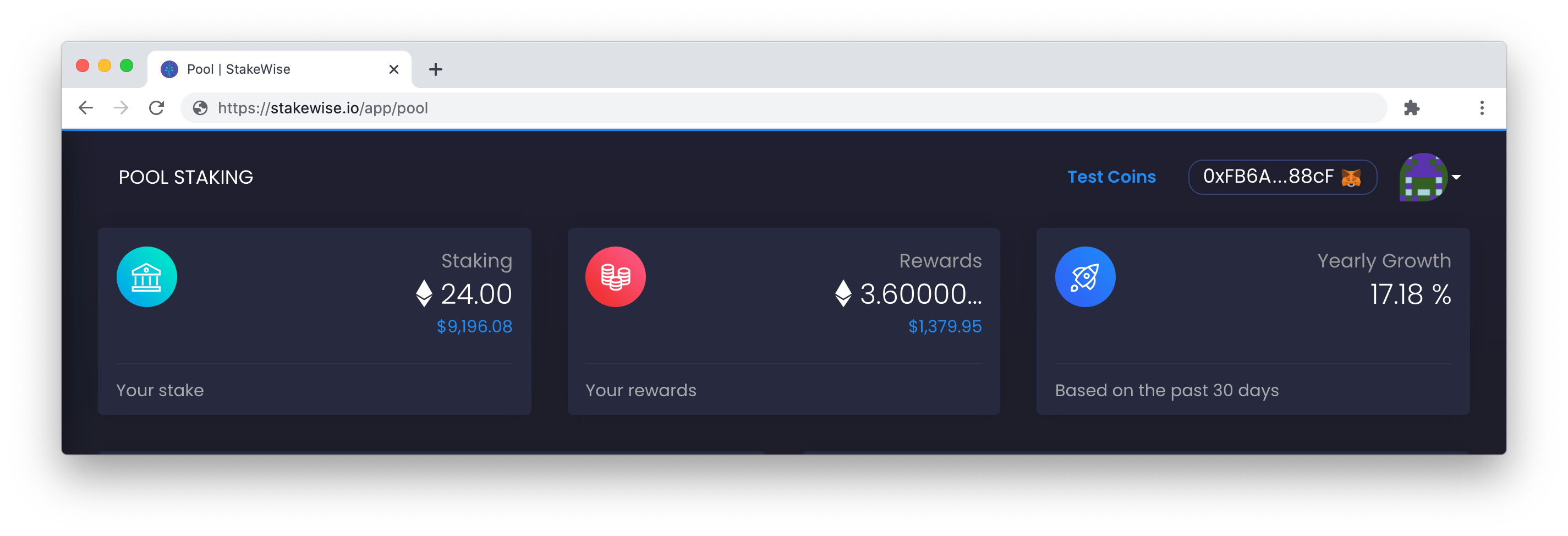

Your earnings from staking in the Pool can be tracked by looking at the amount of accrued rETH2 or by consulting the dashboard within the StakeWise Pool section of the app.

At the later stages, StakeWise will add a dedicated Statistics page to show the most important KPIs for the StakeWise Pool and the Ethereum 2.0 network as a whole.

Withdrawal

Upon arrival of Phase 2, StakeWise users will be able to burn sETH2 and rETH2 within the app and receive ETH in return at a 1:1 ratio.

Stages of deposit utilization

Every deposit into the Pool will pass through the two stages of utilization. These stages are Activating and Staking.

Activating

Newly registered deposits enter the activation queue to start staking in the Ethereum 2.0 network. The length of the activation queue depends on the amount of ETH being simultaneously registered in the network during a certain period. If the amount is large, it can take the network several days or even weeks to activate all queuing ETH.

ETH that is stuck in the activation stage is labeled as Activating in the StakeWise Pool. The amount of Activating ETH can cause a temporary drag on the Pool’s performance, especially at the moment of StakeWise’s and Phase 0 launch.

Staking

Once ETH in the registered validator gets activated by the network, it proceeds to staking and starts earning rewards for the Pool. At this stage, sETH2 backed by deposits waiting in the Deposit queue may be minted manually.

The Horcrux

StakeWise avoids sole custody of the withdrawal key for the Pool’s validators by creating something we call the Horcrux. It is a trustlessly generated withdrawal key that is split into 7 parts, which are held by the widely-recognized figures in the Ethereum community. The withdrawal process will be overseen by these people, ensuring StakeWise processes all withdrawals fairly.

This semi-custodial approach was used for the validators created before the update to non-custodial solution in April 2021.

Creation

The Horcrux is created during an offline ceremony, where the participants (part holders) are required to exchange a series of cryptographically encrypted messages to create their part to the Horcrux and store it on an offline machine. The withdrawal key is never shown to any of the participants and only its public part is revealed. This part is then used by StakeWise to register validators for the Pool.

Generation of the Horcrux happens using an open-source tool developed by StakeWise. Its code has been audited and the tool is available for examination on Github.

Withdrawal

The Horcrux can only be recreated if x of the 7 parts are combined. Recreating the Horcrux is necessary to process the withdrawal of funds from the Pool’s validators in Phase 2. The distribution of funds to the users will be handled by a Smart Contract; however, the release of funds into the Smart Contract (i.e. withdrawal) will need to be approved by the Horcrux holders.

StakeWise Solo

Non-custodial Ethereum validators running on banking-grade infrastructure

The goal of StakeWise Solo is to simplify participation in staking and achieve maximum returns for users that prioritize self-custody of withdrawal key and have at least 32 ETH to stake.

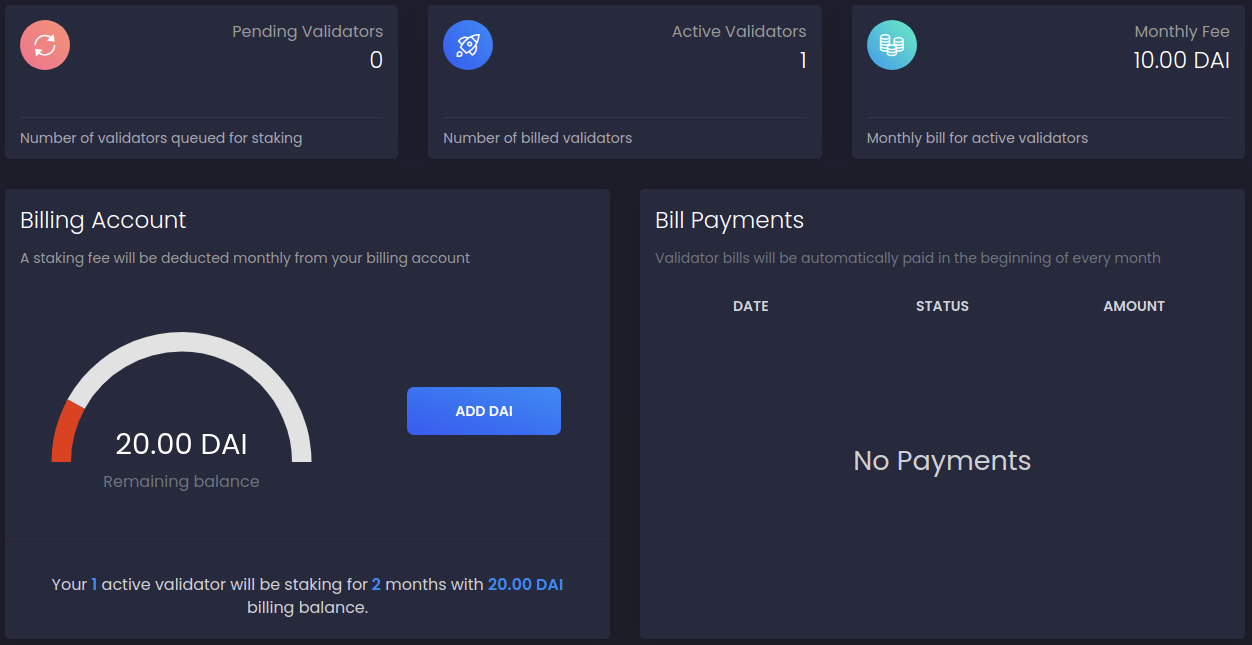

We charge a fee of 10 DAI ($) per validator per month and offer a unique billing method to handle regular payments for your validators without linking a credit card. To our knowledge, our fees are the most competitive on the market, which is consistent with our goal of maximizing profit for stakers.

Overview

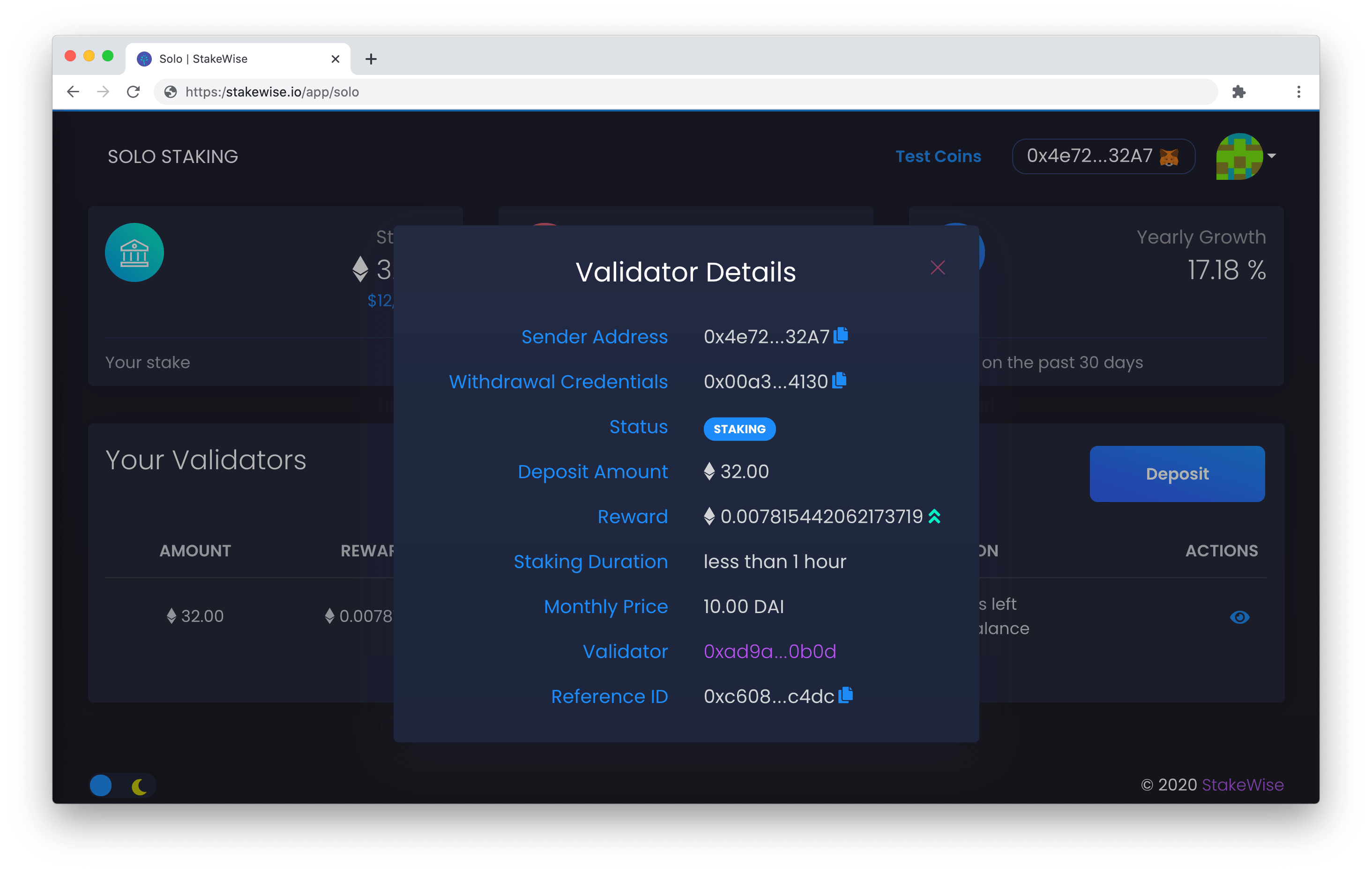

StakeWise Solo is a non-custodial staking service where users provide the public part of their withdrawal key and blocks of 32 ETH for StakeWise to create and manage validators on their behalf. All validators created in this manner run on our infrastructure and benefit from a failover setup, meaning that they are never offline. Their deposit data prevents anyone but the respective private key holders from withdrawing their balance upon Phase 2. Solo validators will keep running for as long as the user is paying a staking fee or until a validator exit from the network is performed. The latter can happen either upon the user’s voluntary in-app request or as a result of two missed validator bills.

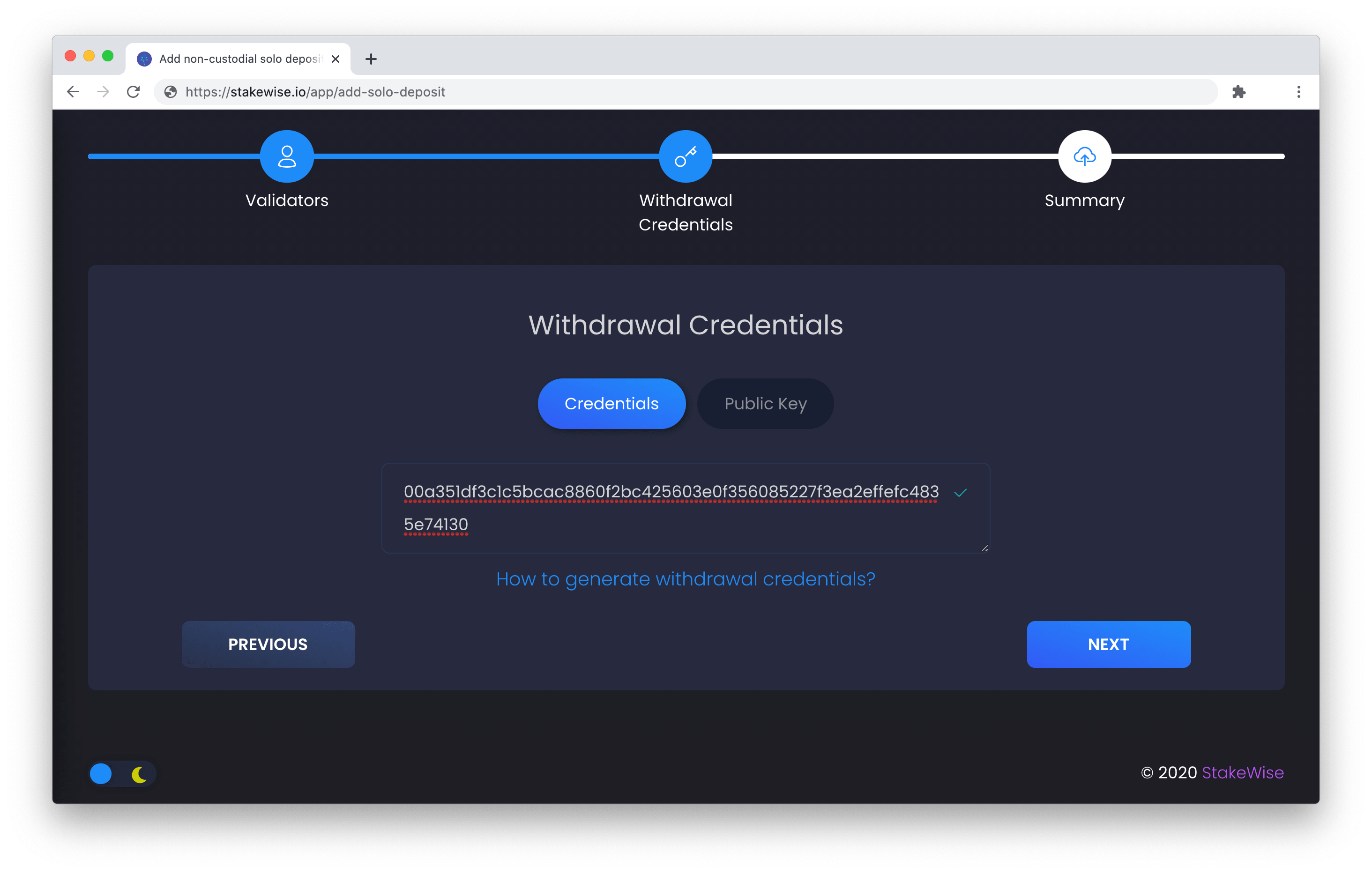

Depositing

To create a Solo validator, you must submit your withdrawal credentials and deposit at least 32 ETH via our Solo Deposit interface in the app. The withdrawal credentials are something that you must generate on your own before creating a validator, or use Ledger Nano X that will create and store the withdrawal key for you. Use our guide on how to do that below.

Once you submit the withdrawal credentials and confirm the deposit transaction, the operator running in a cluster will provision validator keys, start a validator node, and submit the deposit data through the Solos smart contract. There is no way for StakeWise to replace the withdrawal credentials you have submitted with something different as the validator registration transaction would then be rejected. You can examine the Solos and Validator Registration contracts yourself to confirm this before making a deposit.

Once the Validator Registration contract (VRC) receives the deposit data, it registers a new validator in the Beacon Chain. Following an obligatory activation stage, this validator starts participating in the consensus mechanism and earns staking rewards for you.

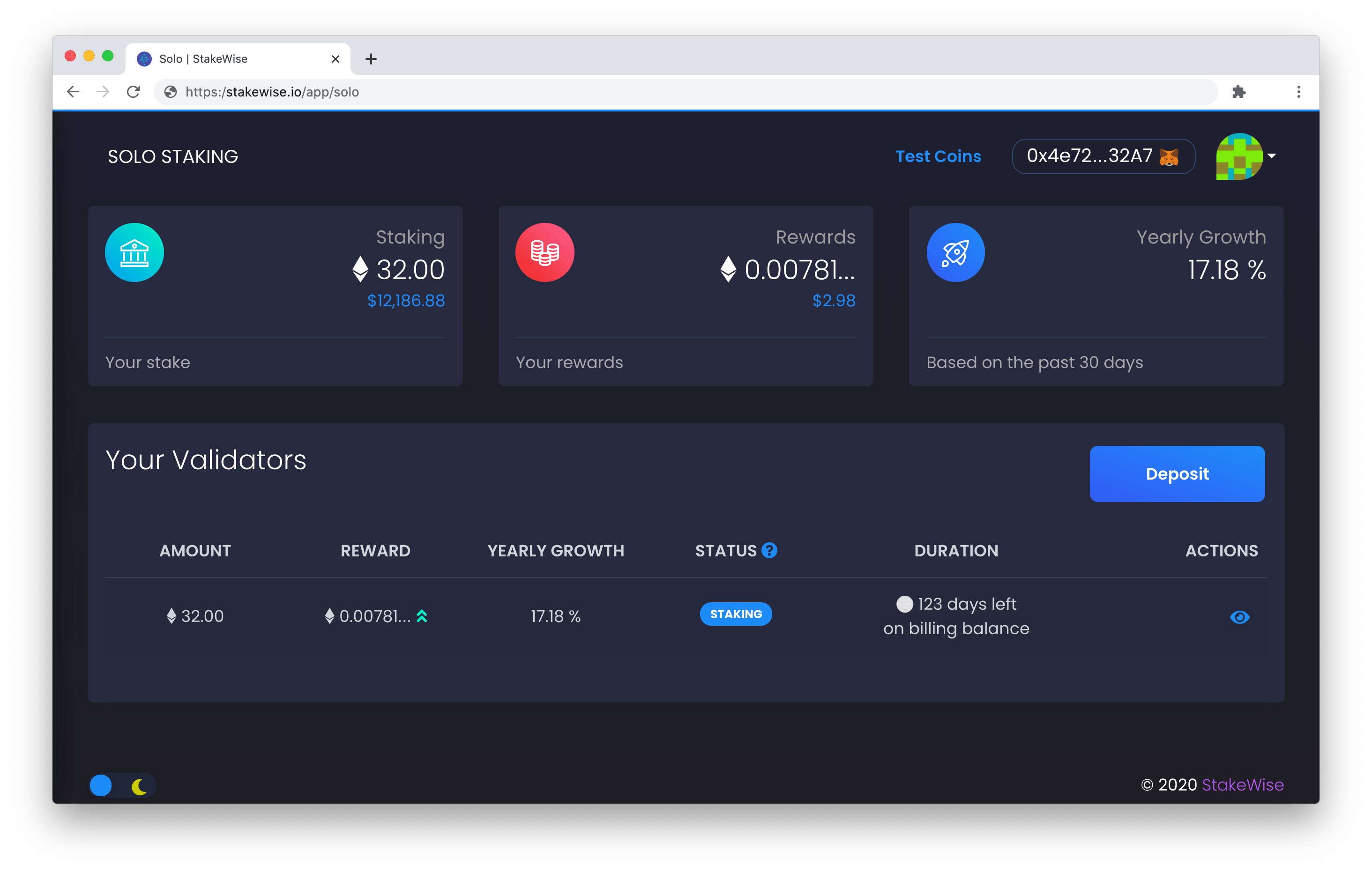

Tracking earnings

Your earnings are tracked within a dedicated dashboard in the Validators section of our app.

It is also possible to check attestation/proposal performance for each validator individually by pressing on the Details button and clicking on the Validator link. The link leads to the beaconcha.in stats page for your validator.

Withdrawal

Withdrawal of the validator balance will be natively allowed by the ETH2 specs upon Phase 2.

Solo validator owners will use their withdrawal key to request withdrawals to the address that they specify.

Voluntary Exit

The voluntary exit is an action that stops the validator attesting duties and exits it from staking. A validator that exits from the network will stop earning staking rewards but also will not incur penalties for being offline. There may be different good reasons for exiting a validator, but the downside to exiting it before Phase 2 is the inability to access the validator balance (i.e. withdraw funds) due to ETH2 specs. The specs also do not allow exited validators to re-enter staking before Phase 2.

Before requesting a voluntary validator exit, please consider the implications of exiting your validator before Phase 2.

In the mainnet, Solo users will be able to request an exit for their validator(s) within the Validator dashboard in the Solo app once this functionality is enabled. The staking fee will continue accruing until the validator has exited from the network, which may take a few days from the moment of submitting an exit request.

Users of StakeWise Solo must also remember that if a bill for their validator(s) is not paid within two months, StakeWise will automatically request an exit for their validators. Therefore, we advise you to always keep your billing balance topped up with DAI.

Validator Keys

At the moment, there is no safe way to hand over the validator keys of Solo users if they wish to migrate their validator(s) from StakeWise to elsewhere. Therefore, you must consider that by depositing in StakeWise Solo, you will be bound to use our service until Phase 2.

You can be certain that whenever a solution for the safe handover of validator keys emerges, StakeWise will implement it as a new feature.

Billing

Billing for Solo staking begins as soon as your validator(s) start earning rewards and continues until your validator exits the network or two consequent monthly staking bills are missed. We advise you to keep your DAI billing balance topped-up for as long as you are using the Solo service to avoid not paying the bills. You can top-up your DAI balance at any time, even before you create your first Solo validator.

Automatic payment system

StakeWise uses a payment system that simplifies and automates the process of paying for one’s validators without the need to create an account on our website or link a credit card. This system is based on DAI deposits into a special account, which is charged monthly to pay for your validators.

Each Solo user has a dedicated deposit account. It works akin to a pay-as-you-go SIM card, where you top-up a certain sum on your card and use this balance to pay for the services over time. With a DAI deposit account, users can deposit any amount of DAI - this amount will become their billing balance. StakeWise will charge the staking fee for Solo validators from the billing balance of their owner. The charge will be deducted once per month meaning that the 10 DAI fee per validator is charged as one sum on a certain day every month.

Payment terms

To improve customer experience, StakeWise provides generous payment terms to Solo stakers - from the moment of receiving their bill, users have 2 months to pay it. If a user fails to pay for the service within the 2-month term, StakeWise will automatically request an exit for that user’s validator(s).

Balance of the validators that exit from the network before Phase 2 gets frozen until its release. Therefore, it makes sense to top-up your billing account instead of avoiding the payment of the staking fee. See our guide on how to do it below.

SWISE Tokens

sETH2 token contract: 0xFe2e637202056d30016725477c5da089Ab0A043A

rETH2 token contract: 0x20bc832ca081b91433ff6c17f85701b6e92486c5

sETH2 (staking ETH) and rETH2 (reward ETH) are tokens that are issued to stakers in StakeWise Pool. Built on the ERC-20 standard, these tokens represent the growth of one’s stake when they’re held and can be transferred or exchanged for other tokens to exit from staking or utilize yield opportunities in DeFi protocols.

One of the main advantages of StakeWise tokens is that they reflect deposits and rewards separately, which allows users to separate their holdings into different risk classes, avoid impermanent loss when providing liquidity and potentially compound their returns.

Minting

sETH2 (staking ETH) is a token that represents users’ deposits in StakeWise Pool in a 1:1 ratio. Hence, sETH2 is always backed by ETH that has entered our Pool contract. With every new ETH deposit into the Pool, StakedETHToken contract updates totalSupply and mints an equal amount of sETH2 to the depositor.

rETH2 (reward ETH) is a token that represents users’ ETH rewards in StakeWise Pool in a 1:1 ratio. These rewards do not physically exist, but their record is stored in the Beacon Chain, so they can be measured and used to back rETH2 in a 1:1 ratio. The record about the Pool’s rewards specifically is calculated from the balances of StakeWise validators. The balances are measured from the Beacon Chain and submitted to the RewardETHToken contract using Oracles.

Oracle nodes

The Beacon Chain exists separately from Eth1, so information about the rewards is not accessible on-chain. Hence, communication about the amount of rewards between the Beacon Chain and the RewardETHToken contract is done using Oracles. totalSupply in the contract is updated every 24 hours. This should pose no problems to stakers who utilize their rETH2 in DeFi protocols since even during periods of high yield in Ethereum 2.0 rewards earned in a single 24-hour period are minuscule (6/10^4 %). This makes potentially missing out on them inconsequential for one’s long-term earnings.

The Oracle nodes are distributed geographically and they read balances of all the Pool validators from the Beacon Chain and submit them on-chain simultaneously but independently. As soon as 3 out of 4 Oracle nodes submit the same data about the rewards, the total supply of RewardETHToken contract is updated. The update happens every 24 hours.

Withdrawal

Upon Phase 2, holders of sETH2 and rETH2 will be able to exchange their tokens for ETH from the StakeWise Pool by burning their tokens. The exchange will happen at a 1:1 ratio, where sETH2 and rETH2 can be exchanged for 1 ETH each.

Whitelisting

sETH2 can be transferred to any address on the Ethereum network, including a contract, where it will continue accruing rETH2. However, the design of some contracts may not allow withdrawing accrued rETH2, forcing one to forego the rewards for the period that sETH2 is stored in such a contract. Typically, these are contracts that issue tokens to represent your share of the total value locked in them.

To avoid this challenge, StakeWise whitelists the most popular of such contracts and allows stakers to continue earning rewards even when their sETH2 is assigned to the whitelisted contract address. This is done by staking the tokens minted for the sETH2 holder by the whitelisted contract. Once sETH2 migrates from the whitelisted contract to another address, rETH2 automatically starts accruing to that address, by the same logic as before.

Example

- Staker wants to provide liquidity for sETH2/ETH pool in Uniswap, so requests StakeWise to whitelist that specific contract

- StakeWise whitelists the contract and creates

holder contractthat accrues rETH2 from sETH2 stored in the Uniswap contract - Staker adds liquidity to the sETH2/ETH Uniswap pool and receives LP tokens

- He/she stakes LP tokens in the

holder contractand continues to earn rETH2 while providing liquidity - When someone exchanges ETH for sETH2 in the Uniswap pool, they will accrue rETH2 to their address as normal.

How and Where to Buy SWISE token ?

SWISE token is now live on the Ethereum mainnet. The token address for SWISE is 0x48c3399719b582dd63eb5aadf12a40b4c3f52fa2. Be cautious not to purchase any other token with a smart contract different from this one (as this can be easily faked). We strongly advise to be vigilant and stay safe throughout the launch. Don’t let the excitement get the best of you.

SWISE has been listed on a number of crypto exchanges, unlike other main cryptocurrencies, it cannot be directly purchased with fiats money. However, You can still easily buy this coin by first buying Bitcoin, ETH, USDT, BNB from any large exchanges and then transfer to the exchange that offers to trade this coin, in this guide article we will walk you through in detail the steps to buy SWISE.

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Binance is a popular cryptocurrency exchange which was started in China but then moved their headquarters to the crypto-friendly Island of Malta in the EU. Binance is popular for its crypto to crypto exchange services. Binance exploded onto the scene in the mania of 2017 and has since gone on to become the top crypto exchange in the world.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step - Transfer your cryptos to an Altcoin Exchange

Since SWISE is an altcoin we need to transfer our coins to an exchange that SWISE can be traded. Below is a list of exchanges that offers to trade SWISE in various market pairs, head to their websites and register for an account.

Once finished you will then need to make a BTC/ETH/USDT/BNB deposit to the exchange from Binance depending on the available market pairs. After the deposit is confirmed you may then purchase SWISE from the exchange.

The top exchange for trading in SWISE token is currently **** 1inch Liquidity Protocol****

Find more information SWISE

☞ Website ☞ Explorer☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Social Channel 3 ☞ Message Board ☞ Message Board 2 ☞ Documentation ☞ Coinmarketcap

🔺DISCLAIMER: The Information in the post isn’t financial advice, is intended FOR GENERAL INFORMATION PURPOSES ONLY. Trading Cryptocurrency is VERY risky. Make sure you understand these risks and that you are responsible for what you do with your money.

🔥 If you’re a beginner. I believe the article below will be useful to you ☞ What You Should Know Before Investing in Cryptocurrency - For Beginner

⭐ ⭐ ⭐The project is of interest to the community. Join to Get free ‘GEEK coin’ (GEEKCASH coin)!

☞ **-----https://geekcash.org-----**⭐ ⭐ ⭐

I hope this post will help you. Don’t forget to leave a like, comment and sharing it with others. Thank you!

#blockchain #bitcoin #swise #stakewise