What is Parallel Finance (PARA) | What is Parallel Finance token | What is PARA token

In this article, we’ll discuss information about the Parallel Finance project and PARA token

Introduction

Parallel Finance is a Decentralized Money Market Protocol that offers lending, staking, and borrowing in the Polkadot ecosystem. Depositors can lend and stake simultaneously to earn double yield on their staked coins,and borrowers can collateralize to borrow. We refer to this feature as “leverage staking,” because users can lever up agains their staking collateral to increase their yield overall. In addition, when a user’s DOT and KSM are staked through Parallel, a reputation-determining algorithm is applied which maximizes staking yield on behalf of the user. In the future, projects and individual users will also be able to source their auction loans through Parallel’s interface–a feature we call “auction loans.” This feature will give users the ability to stay liquid while their DOT/KSM is locked in parachains, an it will give projects direct access to the liquidity they need to win parachain auctions.

Parallel Lending Protocol

Supporting both Kusama and Polkadot assets, Parallel enables token holders and projects to flexibly and borderlessly put their idle capital to earn interests.

Parallel Staking Protocol

Parallel to the Lending Protocol, the foundation introduces a cross-alliance staking derivative to build an interest stacking module for lenders and stakers DOTs - xDOTs

Leverage Staking

Parallel aims to be the go-to lending solution for DOT and KSM stakers. Through Parallel, users will have the ability to stake their DOT and KSM in exchange for tokenized staking derivatives called xDOT and xKSM. These tokens represent the redemption of the underlying DOTs and KSMs in Parallel’s staking pool. As you can see in the graphic below, the user can lend xDOT and xKSM to Parallel to receive an added borrower fee on top of their staking interest, which we refer to as “leverage staking.” After that, the user can create even further leverage by using xDOT and xKSM as collateral for borrowing. These tokens are already natively yield bearing due to the staking yields, which lowers the interest, and increases demand. The graphic below shows the workflow for creating leverage, and as you can see, the borrower can significantly increase their leverage by lending KSM, borrowing xKSM, and lending xKSM. While the user is lending and borrowing, Parallel will algorithmically optimize the users’ staking yields by nominating validator nodes with the strongest reputation, and the lowest number of DOT and KSM staked. When compared to current custodial staking solutions like Kraken’s, Parallel’s algorithmic staking solution outperforms both in security and overall yields.

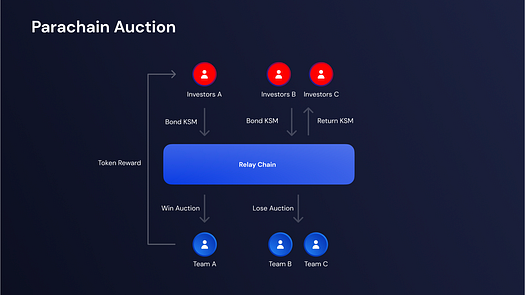

Auction Loans

After retaining its own parachain, Parallel will be able to offer auction loans, a feature that has vast implications for DeFi on Polkadot and Kusama. Users will be able to deposit lending collateral for fixed or floating interest, and parties pursuing parachains will be able to borrow from that collateral to participate in parachain auctions. This means that in addition to incentives offered by projects, users will also earn a fixed rate on their auction loans. This kind of lending mechanism will be attractive for users who want to increase the value of their lent DOT and KSM, but also for projects who want direct access to users with capital to loan.

Ideal projections suggest that 30% of the total DOT and KSM will be locked in parachains, reducing the circulating supply by half, and generating an opening for a symbiotic lending and borrowing market intrinsically by virtue of Kusama’s and Polkadot’s design. Entities to whom Parallel lends DOT or KSM may or may not be successful in their parachain auctions. This means that the parachain auctions will create continuous cash flow on Parallel that is not limited to the total capacity for parachains counted individually, and entities who do win will be able to harness the value of the parachain without the difficult burden of financing it by themselves, or through crowd loans. This, in turn, will make the parachain market much more attainable. It will also maximize the potential utilization of parachains overall, which is an inherent good for the Polkadot ecosystem.

Interest Rate Swaps

In its current state, DeFi is built to gratify short-term bull runs, but for a more competitive and long-term advantage, the excitement of DeFi will need to be exposed to the more practical merits of TradFi. Interest rate swaps are one of the pragmatic tools needed in order for DeFi to break through the glass ceiling. With this functionality, institutional borrowers will be able to extend or reduce their exposure to interest rates depending on their perception of the market and their willingness to undertake further risks. Fixed-rate loans act as an anchor for the variability of floating rates. If a user is currently holding a fixed-rate loan, and they suspect that a bear market is on the horizon, and utilization will decrease in the near future, then they may switch to a floating interest rate in the hopes of paying lower interest. If the opposite is true, and they expect utilization to increase across the board, then they may choose to remain in a fixed-rate position, to capture a lower rate.

Decentralized Credit Scoring

In its initial exploration of blockchain credit scoring, Parallel finance will set out to become the “DefiPulse of credit.” DeFi has a kind of intrinsic reputation system. Sentiment can be tracked qualitatively through social media mentions and quantitatively through factors like market cap, TVL, and dominance. However, in order for DeFi to be able to compete with traditional finance, it needs to be able to transparently rate the quality of borrowers and their debts. The credit reporting system will function like a check against rogue institutional borrowers, and it will also give lenders a second line of defense to negotiate repayment of their loans. If a large DeFi institution is reported as having defaulted on a loan, the negative impact of this reportage will affect the perception of the project’s token, and projects will seek to improve their creditworthiness as a result. The ability of blockchain to act transparently is indeed a valuable asset, and in the future, this ability may in fact help avert crises like the 2008 market crash, which resulted from non-transparent credit scorings.

A Durable Advantage: Why we’re starting in the Polkadot Ecosystem

On a strategic level, there is less infrastructure already developed on Polkadot, and thus more opportunity for beginning there. Polkadot is like the wild west, and the potential for returns is much higher. In particular, the parachain market has the largest extractable value of any untapped market in DeFi, and Parallel has the chance to be the first mover. We expect our auction loans to be very attractive and freeing for founders who want to launch on their own parachain, but don’t want to allocate a large portion of their resources in advance. Parallel can also be the first to offer compound staking to a massively underexposed market of DOT and KSM holders.

In addition, it is important to start our work on Polkadot, because Polkadot is the only blockchain that has created an ethos of collective innovation fundamentally as a consequence of its design. When Polkadot reaches critical mass, the “chain wars” will be ineffectual, because every chain can be routed through Polkadot. This makes building on Polkadot even more important as a hedge against siloed capital. Only by launching on Polkadot can Parallel always front run the hype cycles of being on any chain in particular, by always having access to any chain in general.

We also intend to make our platform available on Ethereum in the future. Currently, however, we are focused on the Polkadot ecosystem. Launching Parallel in the Polkadot ecosystem first, where staking is already widely available, will give us the necessary time and market penetration to take our platform to Ethereum, where the need for leverage staking will soon be much greater as a result of Ethereum 2.0.

Problems and Solutions

Problems:

- The Polkadot ecosystem currently benefits from staking rewards, and while these rewards are very generous, there is currently no way for users to leverage their staking with lending and borrowing. This leaves users with a great deal of dormant capital, and it leaves the circulating supply at large with little utility. In addition, when DOT and KSM tokens are staked with validator nodes by users directly, the user is required to spend a significant amount of time and attention moving their coins from node to node to optimize their staking rewards and prevent slashing.

- The parachain infrastructure of Polkadot and Kusama is the beating heart of interoperability, as well as the largest reservoir and primary use case of DOT and KSM. In its current state, for a project to participate in a parachain auction, they would need to acquire seed investments, or crowdfund loans, usually in exchange for a pro-rata portion of the project’s native tokens. The bare bones of the parachain infrastructure exists to execute parachain auctions, but they do not accommodate more nuanced economic parameters for individual projects. Without lending and borrowing solutions, this model would be cost preventative for projects to launch on their own parachain. An additional problem for individual users is that parachain auctions requires users to give up their staking rewards for the duration of the parachain lease.

Solutions:

- Leverage Staking: Users who participate in Polkadot’s network validation to earn rewards can also lend their staked tokens in our liquidity pool, thereby earning double yield, or in other words, high-interest yields. Users can continue to add leverage as they desire, to fit their risk profile, and they should always remain cautious of the risk of being liquidated.

- Algorithmic Staking: Parallel’s staking system uses a formula to determine the reputation of DOT or KSM nodes, and staking to the most promising nodes on the users behalf. While governance may have some say in the total nodes that are available, the selection will ultimately be up to the algorithm.

- Auction Loans: Parallel will extend its borrowing interface to parachain auctions, offering competitive rates for projects who want to source parachain loans directly, and for users who are seeking incentives through crowdloans.

- Parashares: When users use Parallel to participate in crowdloans, they will receive a token in return that entitles them to the redemption of the DOT or KSM they have locked in the selected parachain. These “shares” can be borrowed or lent, allowing users to stay liquid while their coins are locked.

Token Economics

PARA Token is the native token of Parallel Finance on Polkadot Deployment, distributed among key actors and partnerships in the ecosystem. This paper also details the economic designs of our token, and plans for parachain auctions.

PARA Token Utility Overview

- Token Governance

- PARA token holders are delegated with voting rights and the ability to propose governance action, referenda, network upgrades, council elections, and other parameter adjustments.

- Network Utility

- PARA is a native fee token that is required to execute the functionalities and security of the protocol. The native token is also utilized to incentivize collators and validators, which is the mechanism that powers the decentralized node infrastructure of the network.

- Staking and Security Module

- PARA token is also utilized to hedge risks, incentivize rewards, and share profits. The insurance parameters are determined by PARA token governance in the emergency of slash.

PARA Token Allocation

The total supply of Parallel Token will be minted at the initial mainnet launch. The token will be funneled in the Parallel Reserve Fund and distributed to ensure network security, stability, decentralization, and parachain slot auction/maintenance. More details to be determined in the coming months.

How and Where to Buy PARA token?

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Binance is a popular cryptocurrency exchange which was started in China but then moved their headquarters to the crypto-friendly Island of Malta in the EU. Binance is popular for its crypto to crypto exchange services. Binance exploded onto the scene in the mania of 2017 and has since gone on to become the top crypto exchange in the world.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance (BNB)…

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step - Transfer your cryptos to an Altcoin Exchange

Once finished you will then need to make a BTC/ETH/USDT/BNB deposit to the exchange from Binance depending on the available market pairs. After the deposit is confirmed you may then purchase PARA from the Website: https://parallel.fi.

The top exchange for trading in PARA token is currently …

Find more information PARA

☞ Website ☞ Whitepaper ☞ Source Code ☞ Social Channel ☞ Social Channel 2 ☞ Message Board ☞ Documentation

🔺DISCLAIMER: The Information in the post isn’t financial advice, is intended FOR GENERAL INFORMATION PURPOSES ONLY. Trading Cryptocurrency is VERY risky. Make sure you understand these risks and that you are responsible for what you do with your money.

🔥 If you’re a beginner. I believe the article below will be useful to you ☞ What You Should Know Before Investing in Cryptocurrency - For Beginner

⭐ ⭐ ⭐The project is of interest to the community. Join to Get free ‘GEEK coin’ (GEEKCASH coin)!

☞ **-----https://geekcash.org-----**⭐ ⭐ ⭐

I hope this post will help you. Don’t forget to leave a like, comment and sharing it with others. Thank you!

#blockchain #bitcoin #para #parallel finance