What is Futureswap (FST) | What is Futureswap token | What is FST token

In this article, we’ll discuss information about the Futureswap project and FST token

Futureswap is a protocol that can be considered a hybrid between a perpetual platform and Uniswap without the high slippage. It uses automated market making for perpetuals.

Goal

Futureswap aims to provide the best price execution environment for large perpetual trades. Through Futureswap’s series of signatures and meta-transactions traders can place trades on Ethereum layer 1 with near instantaneous execution on Futureswaps layer 1.5.

There are three actors in the system:

1. Liquidity Providers [LP]: LPs add liquidity to the platform in equal value amounts per exchange. For example, if they wanted to add value to an ETH/USDC pool they would add $100 of ETH and $100 of USDC. They are minted liquidity tokens similarly to Uniswap. LPs can redeem liquidity at any time if their liquidity is not in a trade. They will ideally be receiving the trade fees for allowing traders to use their liquidity. They will also be earning FST [Futureswap Token], the native governance token, as an added incentive.

2. Traders: Traders can open long or short positions with a leverage up to 10x.

3. Liquidators: Liquidators monitor the platform for positions that are close to violating margin requirements. They receive an adjustable fee for sending this transaction in. They do not need to include any value with this transaction as they do not have to take over the trade. The trade is just closed.

⏳ Futureswap is a decentralized platform that enables traders to enter into leveraged perpetual contracts at low rates backed by our liquidity pools using automated market making. Futureswap can be viewed as a hybrid between Uniswap and a leveraged trading platform that allows up to 10x leverage.

Our goal is to disrupt the multi-billion dollar leveraged trading market dominated by a centralized services. Our decentralized approach allows us to compete with lower fees, more token pairs, and significant returns for liquidity providers.

Main features

Automated Market Making: Instead of relying on order books, Futureswap uses automated market making by leveraging the assets of liquidity providers, similarly to Uniswap.

Best Price Execution: Once Futureswap hits a critical mass of liquidity (estimated to be around 50m USD) the slippage/price execution on Futureswap should be better than what is offered on current decentralized exchanges.

Incentives: Liquidity providers earn FST and fees from the trading commissions that are generated by traders’ activity.

Position Balancing: To minimize liquidity provider risk, Futureswap maintains symmetry between longs and shorts by using scaled fees that redistribute capital from the in-demand side to incentivize the less in demand side as well as by causing the open/exit price for new trades to the more popular side, to be less favorable. For more info, see the Dynamic Funding Rate section.

How does it work?

For Liquidity Providers

Similar to Uniswap, Futureswap is powered by liquidity providers. Every Futureswap liquidity pool holds two ERC-20 tokens one as a stable token (DAI, USDC, ect…) and another as an asset token (ETH). Liquidity providers are not buying a token like on a traditional exchange; instead, they are contributing to the specific pair’s pool. The assets deposited are added to the larger pool for that pair. An internal token that represents relative ownership to the liquidity pool’s assets is issued to liquidity providers.

Automated market making means that Futureswap’s liquidity providers may initially take the other side of an unmatched perpetual position. This risk of loss is detrimental to Futureswap’s liquidity pools being seen as a safe haven for earning low-risk interest. To mitigate drastic imbalances between position volumes, an increasing fee is charged to the more popular side along with a less favorable entry price. As the disparity between shorts and longs grows the over-represented side is disincentivized by paying an increasing fee to the less popular side. We call this the Dynamic Funding Rate.

Dynamic Funding Rate

Keeping the balance between longs and shorts is important for our system to achieve maximum returns for liquidity providers. In the case of a trade imbalance, liquidity providers are exposed to the over-represented side.

The funding rate changes dynamically based on the balance between the ratio of open shorts and longs. A volume-balanced long and short pool would have a near 0% funding fee while a pool with significantly more long exposure would have a much higher funding fee for the longs and an incentive fee for the underrepresented shorts. The funding fee scales exponentially.

To achieve a dynamic fee, traders do not own a set amount of collateral but rather a relative share of the collateral pool for their trade type. When a trade is initiated the appropriate collateral is transitioned from one collateral pool to the other. This facilitates a dynamic funding fee between all longs and shorts at once.

Example: If the long pool and short pools were both 50% allocated to open trades, the funding fee would roughly 0.03% for both sides. A large trader opens the remaining 50% of the long pool so that the long pool is now 100% allocated while the shorts are still 50%.

Since the large trade of 50% of the long pool occurred at once, the fee as expected will be significantly greater than 0.03% and could be in the low 0.1 – 0.3% range. Now that the funding fee is likely 1–10x that of other platforms, arbitrageurs will capitalize on the opportunity. They will open shorts on Futureswap to earn the 0.1 – 0.3% funding fee while simultaneously entering longs on other platforms to hedge their exposure. This incentive will return the longs and shorts back to near equilibrium.

The way this fee scales is adjustable. We anticipate that our initial estimation for the funding fee’s scaling ratio to be incorrect, and as such, it can be adjusted via governance mechanisms.

Liquidation

Due to EVM limitations, running consistent logic checks for margin collateralization infractions is not possible. Futureswap, similar to Maker’s CDP liquidation mechanics, allows anyone to send a liquidation transaction to the contract. The contract then checks if the specific trade is in violation of margin collateralization rules and, if so, closes the trade. A 30% liquidation fee is charged to the remaining collateral and paid to the liquidator. 65% is returned to the trade initiator and the remaining 5% is returned to the liquidity pool as an additional fee for bearing the risk of the trade.

For the security of liquidity providers, trades have a set liquidation price saved at trade initiation (updateable via margin addition). This price is what is used for liquidation. This means that if in the case of a black swan event, where the underlying asset is extremely volatile and liquidation transactions cannot or are not feasible to be sent, the trade will still be liquidated at the stored liquidation price upon an eventual liquidation transaction receipt.

Futureswap Token

The Futureswap Governance Token (FST) enables democratic governance of the Futureswap platform. Token holders set Futureswap’s direction for the future. The distribution of FST is structured intentionally to ensure longevity and value add to the platform and gives full control to its users. The development team believes that success comes from being able to run the platform with a long term vision and has repeatedly chosen a long term strategy instead of short term gain (e.g Shutting down the alpha to ensure user safety). Futureswap’s aspiration is to become the best execution environment for perpetuals on any asset. Our community is key in achieving this goal.

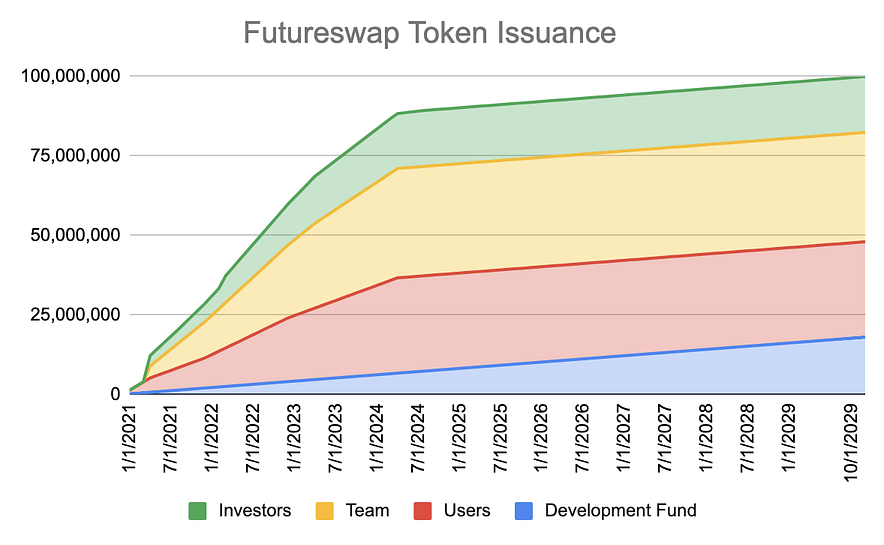

FST enables community members to express their views in an open manner, allowing them to create proposals to bring the best ideas to life that will serve the platform long term. The FST supply is capped at 100 million tokens which will be minted over the next nine years. Here is our release schedule for Futureswap Token (FST).

Futureswap Tokens will be distributed to four groups: Users, Developers, Investors, and Team.

User rewards

Futureswap has three core user groups: Traders, Liquidity Providers, and Referrers.

30 million FST (30% of total) will be allocated to the users of Futureswap to ensure they have a strong voice in governance. User incentives are issued over the course of 3 years with an initial front load (as voted in by the community) in the initial weeks after launch. FST holders can vote to adjust the incentive distribution schedule, exchange weighting, and action weighting.

Development Fund

A development fund will be issued tokens over 9 years to allocate voting power to groups/individuals who bring value to the Futureswap platform. There are a total of 18 million FST (18% of total) reserved for the development fund. The fund will be controlled by token holders. There are many purposes for a development fund, but since FST is non-transferable the development fund acts to give more of a voice to those who receive grants.

Team

Futureswap needs to be able to recruit and retain top-tier talent in order to achieve our ambitious long-term goals. As we have seen with other projects, we believe it is crucial to have incentives aligned with the project and its values. 34 million FST (34.4% of total) is reserved for current and future core team members which vests over 3 years. This will ensure that the team actively developing Futureswap will have a voice in its governance and can continue to drive important additions to the platform.

Investors

In total, investors hold 12.58 million FST (12.58% of total) with a 3-year vesting schedule, which started April 20, 2020. Futureswap has reserved an additional 5 million FST (5% of total) for a future round if needed. To attract investors with a long-term mindset all investors without exclusion have a 3-year vesting period. We’ve been fortunate enough to be able to strategically choose investors who are aligned with our values and have helped Futureswap remain long term oriented. Having a strong investor backing with a long term vision has enabled the team to make the right choices when it comes to safety, hiring and overall execution.

Earning FST

40,000 FST are distributed daily:

- 65% (26,000) distributed to traders

- 35% (14,000) distributed to liquidity providers.

Source : https://www.youtube.com/watch?v=2o2zzhqWxvU

Would you like to earn TOKEN right now! ☞ CLICK HERE

How and Where to Buy Futureswap (FST)?

FST has been listed on a number of crypto exchanges, unlike other main cryptocurrencies, it cannot be directly purchased with fiats money. However, You can still easily buy this coin by first buying Bitcoin, ETH, USDT from any large exchanges and then transfer to the exchange that offers to trade this coin, in this guide article we will walk you through in detail the steps to buy FST

You will have to first buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT)…

We will use Binance Exchange here as it is one of the largest crypto exchanges that accept fiat deposits.

Binance is a popular cryptocurrency exchange which was started in China but then moved their headquarters to the crypto-friendly Island of Malta in the EU. Binance is popular for its crypto to crypto exchange services. Binance exploded onto the scene in the mania of 2017 and has since gone on to become the top crypto exchange in the world.

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer, and buy one of the major cryptocurrencies, usually either Bitcoin (BTC), Ethereum (ETH), Tether (USDT)

Step by Step Guide : What is Binance | How to Create an account on Binance (Updated 2021)

Next step - Transfer your cryptos to an Altcoin Exchange

Since FST is an altcoin we need to transfer our coins to an exchange that FST can be traded. Below is a list of exchanges that offers to trade FST in various market pairs, head to their websites and register for an account.

Once finished you will then need to make a BTC/ETH/USDT deposit to the exchange from Binance depending on the available market pairs. After the deposit is confirmed you may then purchase FST from the exchange: Uniswap (V2), and 1inch Exchange

Apart from the exchange(s) above, there are a few popular crypto exchanges where they have decent daily trading volumes and a huge user base. This will ensure you will be able to sell your coins at any time and the fees will usually be lower. It is suggested that you also register on these exchanges since once FST gets listed there it will attract a large amount of trading volumes from the users there, that means you will be having some great trading opportunities!

Top exchanges for token-coin trading. Follow instructions and make unlimited money

☞ https://www.binance.com

☞ https://www.bittrex.com

☞ https://www.poloniex.com

☞ https://www.bitfinex.com

☞ https://www.huobi.com

☞ https://www.mxc.ai

☞ https://www.probit.com

☞ https://www.gate.io

☞ https://www.coinbase.com

Find more information FST

☞ Website ☞ Explorer ☞ Explorer 2 ☞ Social Channel ☞ Social Channel 2 ☞ Social Channel 3 ☞ Documentation ☞ Coinmarketcap

🔺DISCLAIMER: Trading Cryptocurrency is VERY risky. Make sure that you understand these risks if you are a beginner. The Information in the post is my OPINION and not financial advice. You are responsible for what you do with your funds

Learn about Cryptocurrency in this article ☞ What You Should Know Before Investing in Cryptocurrency - For Beginner

Don’t hesitate to let me know if you intend to give a little extra bonus to this article. I highly appreciate your actions!

Wallet address:

BTC: 1FnYrvnEmov2w9fovbDQ4vX8U2dhrEc29c

USDT: 0xfee027e0acfa386809eca0276dab286900d75ad7

DOGE: DSsLMmGTwCnJ48toEyYmEF4gr2VXTa5LiZ

I hope this post will help you. If you liked this, please comments and sharing it with others. Thank you!

#bitcoin #crypto #futureswap #fst